Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

==========================================================================================================================================

One might think reducing the charity tax deduction punishes rich. Nonsense. The rich will continue to give the same net (gross donation – tax deduction) dollars. Sadly, a greater share of those dollars will go to the federal government.

A billionaire giving ten million dollars, and paying the highest marginal tax rate, receives a $3.5 million tax deduction. It’s the net contribution of $6.5 million that actually comes out of his pocket. The rich know what their net outflow will be and what they will have left after making their contributions. They have people who keep track of those things.

Reduce the tax deduction, and the rich won’t absorb the loss. They simply will give less and the government will receive more. The charities would absorb the loss. So President Obama’s desire to reduce the charitable tax deduction for the rich, merely will reduce net contributions to charities.

And to whom do charities give: The poor, the needy, the 99.9%.

So while some of the 99.9% might exult at seeing the charitable reduction reduced for the rich ($250 thousand a year is “rich”???), in fact this means nothing to the rich. It is the middle and lower classes that will suffer.

Thus, we have another in a long string of Obama initiatives to widen he income gap between the rich and the rest.

But there is a fundamental question that never seems to be addressed. What has been the historical purpose of the charitable tax deduction? The answer: To encourage private charitable giving.

Those who hate “big government,” and who believe the private sector is best equipped to determine which charities are most beneficial to the nation, logically should want the charitable deduction to be even bigger. But even the conservatives don’t understand what’s happening.

There are only three alternatives:

1. More help from the private sector

2. More help from the federal government

3. Less help for the needy.

By reducing the charitable deduction, and cutting federal spending, which direction will we go? No rocket science necessary.

Washington Post

White House, nonprofit groups battle over charitable deductions

By Jerry Markon and Peter Wallsten, Thursday, December 13, 11:06 AM

The White House and the nation’s most prominent charities are embroiled in a tense, behind-the-scenes debate over President Obama’s push to scale back the nearly century-old tax deduction on donations that the charities say is crucial for their financial health.

In a series of recent meetings and calls, top White House aides have pressed nonprofit groups to line up behind the president’s plan for reducing the federal deficit and averting the year-end “fiscal cliff,” according to people familiar with the talks.

In part, the White House is seeking to win the support of nonprofit groups for Obama’s central demand that income tax rates rise for upper-end taxpayers. There are early signs that several charities, whose boards often include the wealthy, are willing to endorse this change.

Why would any charities endorse deficit reduction? It’s in the last sentence: “. . . boards often include the wealthy.” Yes, as we have seen in previous posts, deficit reduction (austerity) widens the income gap between the rich and the rest.

But the White House is also looking to limit the charitable deduction for high-income earners, and that has prompted frustration and resistance, with leaders of major nonprofit organizations, such as the United Way, the American Red Cross and Lutheran Services of America, closing ranks in opposing any change to the deduction.

Studies have shown that people would donate less if the deduction were reduced but estimates of the effect vary widely

“It would be devastating,’’ said Jatrice Martel Gaiter, executive vice president for external affairs at Volunteers of America, which has paid Patton Boggs — Washington’s most lucrative lobby shop — nearly $200,000 to lobby on the charitable deduction and other issues in the past year. “Of course people want to say they are giving out of the goodness of their hearts, and of course they are, but the tax deduction makes our heart larger and our goodness even better.’’

Many people would continue to give the same – mostly members of the lower 99.9% income groups. They still would drop a dollar into the Salvation Army kettle; they still would give $100 to the church. But unquestionably, the big donations would shrink.

Obama has proposed capping the value of deductions for individuals earning more than $200,000 ($250,000 for families) at 28 percent, regardless of their tax bracket. This would include deductions for mortgage interest and state and local taxes, along with charitable contributions.

Currently, the tax code allows people who itemize deductions to deduct their charitable contributions at their maximum marginal tax rate. So, for example, if someone in the highest tax bracket — now a 35 percent tax rate — gives $100 to charity, the donor saves $35 in taxes. If the deduction were capped at 28 percent, the donor would save only $28 dollars.

Ultimately, people are concerned with what they have left in their own pockets, after all expenses and contributions. Tax them more for contributions and they’ll contribute less.

Capping deductions at 28 percent — including those for charitable contributions, mortgage interest and state and local taxes — would raise $574 billion in new federal tax revenue over 10 years, according to White House estimates.

This transfers $574 billion out of the private sector, most of it coming from charities and their beneficiaries, the poor.

Obama has dismissed the charities’ contention that his plan would substantially damage their fundraising. White House officials, including Chief of Staff Jacob Lew and senior adviser Valerie Jarrett, have recently been telling nonprofit leaders they would face far graver danger under Republican deficit-reduction plans.

“You see, our plan only cuts off one of your feet, unnecessarily; the Republicans would cut off both of your feet, unnecessarily. So you should be happy with our plan.

Obama aides this week also signaled a willingness to overhaul corporate taxes as an enticement for the chief executives of major U.S. companies to speak out in favor of raising individual income taxes, and a number of prominent executives have begun backing the tax plan in recent days.

Can you believe it? “Prominent executives” like the idea of reducing corporate taxes while increasing individual taxes. Who’d a thunk?

Frustration stems in part from what some nonprofit leaders describe as a philosophical disagreement between Obama and the non-profit sector. The president has framed the tax deduction as a benefit for the wealthy, they say, while in their view the deduction is a benefit for charities that use the money to help the needy.

Reduce the tax deduction, and the rich will give less. No harm to the rich. All the harm is to the charities and ultimately to the people who need service from charities. Once again, Obama, the great liberal, works to widen the gap between rich and poor.

“Obama said. “Well, if you eliminated charitable deductions, that means every hospital and university and not-for-profit agency across the country would suddenly find themselves on the verge of collapse.”

A flat-out admission that reducing the charitable deduction will impact charities and as a result, impact those who need charities. But wait, here’s Obama making the opposite claim:

When the president proposed reducing the charitable deduction in 2009, initially to help pay for his health-care overhaul initiative, he said there was “very little evidence” that the change would significantly affect giving. Speaking at a press conference, he said the deduction “shouldn’t be a determining factor as to whether you’re given that $100 to the homeless shelter down the street.’’

So, according to Obama, charitable deductions are vital but not very important. Got it?

And finally, there is the Bill and Melinda Gates Foundation, to which Warren Buffett has contributed massively:

“Buffett’s gift came with three conditions for the Gates foundation: Bill or Melinda Gates must be alive and active in its administration; it must continue to qualify as a charity; and each year it must give away an amount equal to the previous year’s Berkshire gift, plus another 5 percent of net assets.

Do you think tax considerations aren’t important to charitable givers? Warren Buffett sure thinks they are.

Bottom line: The greater the tax deduction, the more the private sector will determine charitable giving. Reducing the charitable tax deduction will not hurt the rich. It will hurt the middle an lower classes, who benefit from charities. It will increase the gap between rich and poor. Federal bureaucrats will have greater power over charities. America will be diminished.

Yet another needless casualty of austerity.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

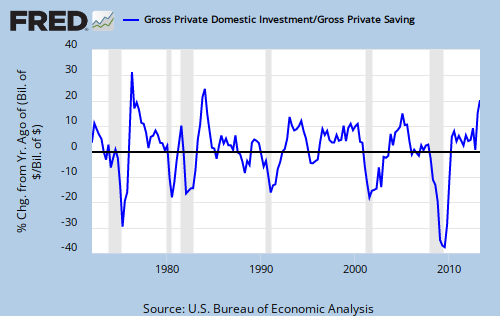

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY