Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

In case you didn’t know it, “deficit reduction” is identical with“austerity.” Here is what austerity, aka deficit reduction, has brought to Spain:

Excerpts from the New York Times

Spain Recoils as Its Hungry Forage Trash Bins for a Next MealMADRID — On a recent evening, a hip-looking young woman was sorting through a stack of crates outside a fruit and vegetable store here in the working-class neighborhood of Vallecas as it shut down for the night.

The woman, 33, said that she had once worked at the post office but that her unemployment benefits had run out and she was living now on 400 euros a month, about $520. She was squatting with some friends in a building that still had water and electricity, while collecting “a little of everything” from the garbage after stores closed and the streets were dark and quiet.

She is one of the people the U.S. religious right wing disparages as lazy, free loaders – people who have adopted what wealthy Mitt Romney sneeringly calls “the culture of dependency.” It’s the rich guy’s way to blame the victim.

As Spain tries desperately to meet its budget targets, it has been forced to embark on the same path as Greece, introducing one austerity measure after another, cutting jobs, salaries, pensions and benefits, even as the economy continues to shrink.

Sound familiar? This is exactly what the budget cutters in the U.S. are doing. The difference – and a major difference it is: The U.S. is Monetarily Sovereign. It controls its sovereign currency the dollar. So we do not need to cut spending.

Spain is monetarily non-sovereign — like our states and cities. Spain has no sovereign currency. So it needs to live within its ability to tax, just as you, being monetarily non-sovereign, need to live within your ability to earn.

Most recently, the government raised the value-added tax three percentage points, to 21 percent, on most goods, and two percentage points on many food items, making life just that much harder for those on the edge.

The value added (VA) tax is a consumption tax. It is designed to punish the poor, those people who spend a greater percentage of their income on taxable items. The rich, like Romney, don’t worry about a tax on consumables; the rich spend most of their money on investments. No tax there.

At the huge wholesale fruit and vegetable market on the outskirts of this city, men and women furtively collect items that had rolled into the gutter.

“It’s against the dignity of these people to have to look for food in this manner,” said Eduardo Berloso, an official in Girona, the city that padlocked its supermarket trash bins. Mr. Berloso proposed the measure last month after hearing from social workers and seeing for himself one evening “the humiliating gesture of a mother with children looking around before digging into the bins.”

Mr. Berloso prefers that people starve rather than be humiliated.

The Caritas report also found that 22 percent of Spanish households were living in poverty and that about 600,000 had no income whatsoever. All these numbers are expected to continue to get worse in the coming months.

Last fall, the U.S. Census Bureau, reported the percentage of Americans living below the poverty line last year, 15.1 percent, was the highest level since 1993. (The poverty line in 2010 for a family of four was $22,314.)

The report also said, “The past decade was also marked by a growing gap between the very top and very bottom of the income ladder. This year is not likely to be any better. Stimulus money has largely ended, and state and local governments have made deep cuts to staff and to budgets for social programs, both likely to move economically fragile families closer to poverty.”

Yes, these lazy people have adopted a “culture of dependency.”

In Girona, Mr. Berloso said his aim in locking down the bins was to keep people healthy and push them to get food at licensed pantries and soup kitchens. He said 80 to 100 people had been regularly sorting through the bins before he took action, with a strong likelihood that many more were relying on thrown-away food to get by.

But Mr. Berloso’s locks created something of an uproar across Spain, where the economic crisis is fueling more and more protests highlighting hunger. A group of mayors and unionists in southern Spain, where unemployment rates are far above the average, recently staged Robin Hood raids on two supermarkets, loading carts with basic foods and pressing them to donate more food to the needy.

The dumpster locks help keep people from that “culture of dependency,” and move them toward the self-sufficiency of starvation.

Some politicians say Girona’s locks are really all about protecting Girona’s image. The city of about 100,000 derives most of its income from tourism.

“The social workers or civil agents could refer people to the food distribution center without having to lock bins,” said Pia Bosch, a Socialist councilor in Girona. “It’s like killing a fly with a cannonball.”

But referring people to food distribution centers, where they can obtain free food, just fosters that dreaded “culture of dependency.”

The unemployment rate is still relatively low in Girona — 14 percent over all, compared with 25 percent for the country as a whole. But more and more families have no income. Of the 7,700 unemployed in Girona, Mr. Berloso said, 40 percent have now run out of benefits.

Many, he said, were “people who never expected to find themselves in this position.”

On a recent morning, Juan Javier, 29, who had come to collect milk, pasta, vegetables and eggs from one of the distribution centers, was one of the few clients who would discuss his circumstances. A former printer, he has been out of work for two years. “I would like to have a job,” he said, “and not be here.”

In a nearby soup kitchen, Toni López, 36, waited quietly for a free lunch with his girlfriend, Monica Vargas, 46, a beautician. The couple recently became homeless when they fell two months behind on their rent. “All our lives we have been working people,” Mr. Lopez said. “We are only here because we are decent people. The landlord was knocking on the door demanding the rent, so we said, ‘Here, here are the keys.’”

Think this can’t happen to you, in America? It shouldn’t, but it can. Our politicians, funded by the richest 1%, are determined to cut federal spending: Fire federal workers (that already has begun). Cut Social Security benefits and tax the ones that remain. (That too, already has begun.)

Cut Medicare. (Romney vowed to do that.) Reduce the military (The vast majority of its expenses are for salaries).

Deficit reduction, wherever it is implemented, always, always, always causes a downward economic helix, in which suffering is in inverse relationship to money. Those with the least suffer the most.

The richest 1%, with the help of the politicians, the media and the compliant economists, have brainwashed the 99% into believing federal financing is like personal, kitchen-table financing, where affordability is an ever-present issue. But for the Monetarily Sovereign U.S. government — unlike the governments of Spain, Italy, Illinois, Chicago et al — affordability never is an issue.

For the U.S. government, there is no amount of spending that is “unsustainable.” The U.S. government does not need to “live within its means.” These are concepts appropriate to you and me — we don’t have a sovereign currency — but not appropriate to a government having a currency over which it is sovereign.

The federal deficit is not too high; it is too low. Economic growth requires a growing federal deficit. One of the most basic equations in economics is:

Gross Domestic Product = Federal Spending + Non-federal Spending – Net Imports.

To grow GDP we always must increase Federal Spending and/or increase Non-federal Spending. That requires increasing the deficit. Straightforward mathematics the 1% hopes you never understand.

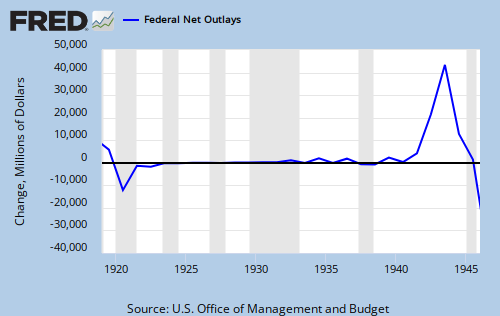

Every depression in U.S. history began with a reduction in deficit spending.

From 1919 to 1929, the U.S. ran either a surplus or a balanced budget. During that time, we had 3 recessions, culminating in the Great Depression — cured by spending for World War II:

Today, the politicians, the media and the old line economists, all under the thumb of the 1%, want us to take more of that bitter, deficit-reduction medicine — the medicine that already has destroyed so many lives all over the world.

And like sheep, marching into the slaughterhouse, we willingly and without question, place our necks on the chopping block. In fact, some will fight angrily against any who dare to warn of our coming doom. You can page through this blog to see the outraged rebuttals.

It’s happening in Spain and Greece and other euro (monetarily non-sovereign) nations. The Spanish and Greeks are not victims of a “culture of dependency.” They are victims of their own governments. Before their leaders recklessly adopted the euro and became monetarily non-sovereign, which forced them into deficit reduction, these people were not eating out of dumpsters.

What happened was simple: They were told they needed to cut their government’s deficit spending. And they believed. And this belief has led to their downfall.

And it will happen here, if we naively accept the deficit reduction lie so willingly adopted by our fellow sheep, and if we demand to lay our own heads on the 1%’s chopping block.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Medicare — parts A, B & D — for everyone

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Long-term nursing care for everyone

5. Free education (including post-grad) for everyone

6. Salary for attending school (Click here)

7. Eliminate corporate taxes

8. Increase the standard income tax deduction annually

9. Increase federal spending on the myriad initiatives that benefit America’s 99%

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY