Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

======================================================================================================================================================================================================================================================================

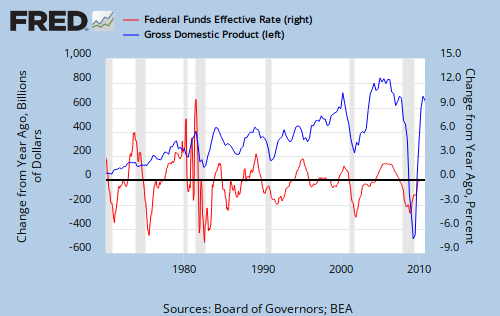

It looks like Congress and the President, with the approval of the media, old-line economists and the voting public, are determined to reduce the deficit. Historically, deficit reduction has resulted in recessions and depressions. Federal deficits are the government’s method for adding money to the economy, and economic growth requires money growth.

So, we will cause ourselves a recession or a depression. I’m resigned to the fact that the vast majority doesn’t believe this, so I suppose I should enjoy the pleasant irony of seeing all the fact doubters lose their money, their jobs and their homes in the years to come.

But I don’t, partly because my own children and grandchildren will be hurt by the mess Congress is creating. I’ll be hurt, too – unless I can think of some recession-proof investments. While it seems nothing can prevent the out-of-control freight train known as “Congress” from destroying America, I’d like to protect my own family as best I can.

Many of you are investors. Some may know far more about stocks, bonds etc than I do. So I ask you this:

Given that we will have deficit reduction, which absolutely, positively will cause a recession or a depression (depending on how big the deficit reduction will be), what are the best investments to make today? Cash may be safest, but there’s no income. Treasuries are safe too, but again, there is scant income. Its a dilemma. What do you suggest?

Thank you for your help.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY

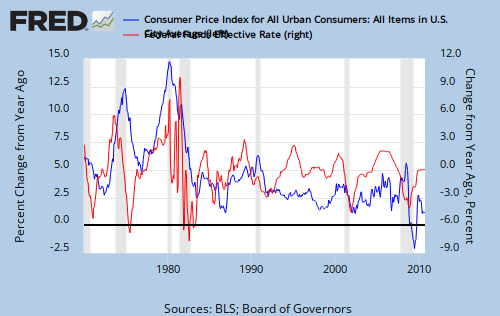

that seems to indicate interest rate increases are followed about one year later by inflation decreases.

that seems to indicate interest rate increases are followed about one year later by inflation decreases.