The debt hawks are to economics as the creationists are to biology.

John Mauldin responded to my comment on his post, “Pushing on a String”

“I don’t know why you think I would not respond. Just happened to see this on Google alerts.

I have been quite clear on what is too much debt. I have done whole e-letters on it. It is debt growth above nominal GDP on a consistent basis, which ends up in a Greece like state. In fact, I will have a book out in January called The Endgame which goes into hundreds of pages of detail about the problems with debt and debt crises.

Now, I do not want private businesses or people borrowing beyond their own means or banks lending if they do not think there is reason to believe they will be repaid. And there is a limit to how much countires can borrow. To assert that the US can borrow without limit is rather absurd. You write:

‘And here is the government, which can service a debt of any size, and functionally is incapable of bankruptcy, and the debt hawks want to restrict debt.’Go read Rogoff and Reinhart. 266 crises in 60 countries over the last few hundred years, from countries that can print their own money to gold standard currencies. Everything was fine until the last moment. There are more than one ways to default on debt, and one way is to print the money and debase the money supply. Inflation ruins pensioners and savers. If that is your ideal future, then by all means, run up that debt!

John”

First John, you have my apology. You responded, and did so without name-calling, which not only is commendable, but a rarity in the debt hawk world. Unfortunately, you didn’t offer any facts, so I will supply one.

Again, you said,“I have been quite clear on what is too much debt . . . It is debt growth above nominal GDP on a consistent basis, which ends up in a Greece like state.”

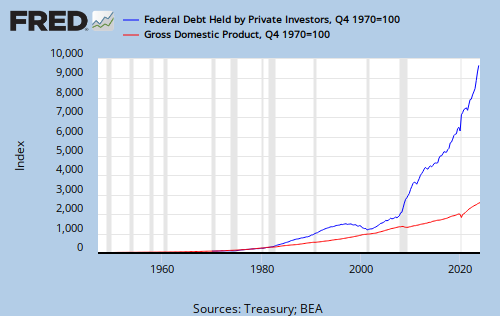

Here is a graph you might find interesting:

It shows that in the past 40 years GDP has risen less than 1,400% while federal debt has risen 3,500% — well more than double the rate. I would call that “debt growth above nominal GDP on a consistent basis,” wouldn’t you? Yet, where is the inflation?

The last big inflation was in 1979, at a time when debt growth did not exceed GDP growth.

Also, ” . . . ends up in a Greece like state . . .” makes no sense, whatsoever. The U.S. is monetarily sovereign. Greece is not. It functionally is impossible for a monetarily sovereign nation magically to transform itself into a “Greece like state.”

The debt hawk inflation bogeyman emerges every time deficit spending is mentioned. I’m surprised you didn’t offer pre-war Germany or Zimbabwe as examples. But that bogeyman has hurt the lives of real people. It has prevented universal health care. It has restricted Social Security and Medicare benefits. It has given us a monster, wasteful, unnecessary federal tax system. And all because the debt hawks tell us that eventually — eventually — we will have inflation.

Yet, money debasement is not related only to money supply, but more importantly to money demand (interest rates), which is why in the past 40 years, there has been no relationship between federal deficits and inflation.

Again, I do appreciate your comments and your courage, but because you do not understand monetary sovereignty, you simply are wrong.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity.