An alternative to popular faith

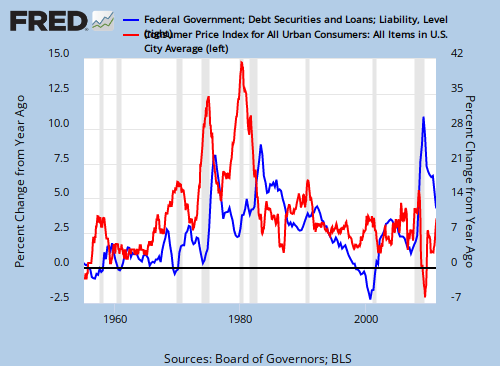

Next year, the Fed may be faced with stagflation, the simultaneous occurrence of economic stagnation and inflation. Sadly, the Fed cannot cure stagflation.

You’ll find a more complete discussion of this phenomenon at http://rodgermitchell.com/inflation.html, but here is a quick overview:

Money is the lifeblood of an economy. During a recession, an economy suffers from “anemia,” a shortage of money. The treatment for anemia is to increase the blood supply. But typically, the Fed tries to cure recession by cutting interest rates and tries to cure inflation by doing the opposite, i.e. increasing interest rates. Since recession is not the opposite of inflation, doing the opposite doesn’t work, and changing interest rates does not fix the money shortage.

To cure inflation it is necessary to raise interest rates. To cure stagnation it is necessary to treat the anemia, i.e to deficit spend. The former is the task of the Fed. The later is the task of Congress. That’s why the Fed alone cannot cure stagflation.

Unfortunately, the Fed wrongly believes high interest rates slow the economy, so when stagflation appears, the Fed will urge a reduction in deficit spending (bleeding the anemic), which they consider “fiscally prudent,” while only reluctantly and incrementally raising interest rates.

This will continue the Greenspan and Bernanke policies, which will extend or worsen the recession.

Rodger Malcolm Mitchell