The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

==================================================================================================================================

I know this is a strange time to talk about fighting inflation. Recently we struggled up from a minus inflation (aka “deflation”) and now are at a puny 1% level. But too often, when I say that federal deficit spending should increase, a debt-hysteric concern expressed to me, is not just inflation, but the typical debt-hawk exaggeration: hyperinflation!

The debt-hawks seem to be the kind of folks who, upon seeing a starving child, would not feed that child for fear the food would cause obesity. Today, our economy is starved for money, but the debt hawks fear monetary obesity (aka “inflation”) and they warn us of wheelbarrows full of money. They give silly speeches about what they term “fiscal prudence” and what I term, “starving the baby.”

So as long as we must face debt hysteria, and the hysteria has to do with a non-existent though dreaded inflation, we might as well talk about preventing and curing inflation. Inflation is the loss in value of money compared to the value of goods and services.

So, there are two fundamental methods for curing inflation: Reduce the supply of money or increase the demand for money. Both methods increase the value of money vs the value of goods and services. (In theory, increasing the supply of goods and services or decreasing the demand for goods and services also would work, but there is no known method for accomplishing this without changing the money supply.)

Ideally, any anti-inflationary activity should be effective, quick to activate, quick to take effect, incremental, easy to rescind and not damaging to the economy. But while tax increases remove money from the economy, and so can be effective, they fail all the other tests. They are highly political; They are slow to pass through Congress. They take effect slowly, because taxes are collected slowly. They cannot be passed and implemented incrementally. They are difficult to undo. And they damage the economy. The require answers to difficult questions: Exactly which taxes should be increased? By how much? Should we have a tax increase during a stagflation? How do we calibrate an incremental tax increase?

Compare this approach with another approach: Interest rate increases. Interestingly, interest rate increases have both pro-inflation and anti-inflation effects. Pro inflation: Increase in business costs and increase in the money supply due to increased federal interest payments. Anti-inflation: Increase in the demand for money vs the demand for non-money.

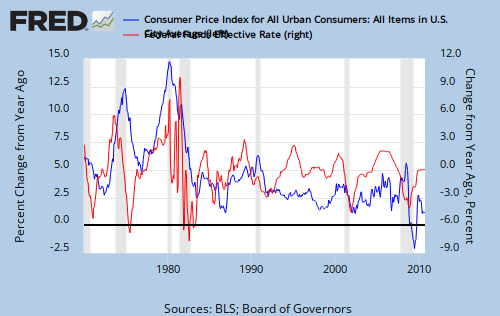

On balance, the anti-inflation effects are stronger. One hint is this graph:  that seems to indicate interest rate increases are followed about one year later by inflation decreases.

that seems to indicate interest rate increases are followed about one year later by inflation decreases.

The other hint is the Fed’s ongoing success in controlling inflation despite massive increases in the money supply. Interest rate increases actually work.

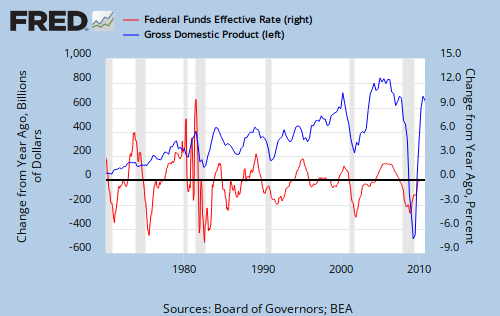

Interest rate increases can be done quickly and in small or large increments — just what is needed for inflation control. And contrary to popular faith, high interest rates do not negatively affect GDP growth. See:

In summary:

–We are nowhere near inflation

–We can control inflation by raising interest rates

–High interest rates do not negatively affect GDP growth

We can and should feed the starving economy without letting unfounded worries about our ability to prevent or cure the economy’s obesity, prevent us from saving the child.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”