We have discussed this for many, many years. But because of the new, ultra-partisan, endlessly repeated efforts led by the right wing to reduce any benefits to the non-rich, the truth must be repeated so it can fight through the fog of lies to be remembered.

No rational person would take dollars from the economy and give them to a federal government that has the infinite ability to create new dollars.

Yet, that same rational person approves collecting tax dollars from the private sector and giving them to the federal government.

It is illogical to the extreme, yet it is universally countenanced. So much for human mental superiority.

Economics is a combination of mathematics and psychology. Economists lose their place during attempts to blend the two, for instance, when they claim that something must happen when historically it seldom or never happens.

The most important problems in economics involve just two issues:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Insolvency, the phony issue: Cutting SS and Medicare is again being touted as the “only” way to avoid national insolvency. It is a lie.

The federal government, being Monetarily Sovereign, has infinite money to support all its agencies. No federal agency becomes insolvent unless Congress and the President want that.

The notion that funds for Medicare and Social Security — and no other federal agency — are limited by a tax on the lower side of the income scale — FICA — is absurd. Billionaire Donald Trump doesn’t pay that tax; you do.

The fact that the so-called “debt ceiling” has arbitrarily been raised 94 times should give any thinking person pause to consider the idiocy of the ceiling itself.

An astounding 94 increases, the sky hasn’t fallen, and still we debate it.

Ask your neighbor why we have a debt ceiling that we have increased 94 times. I promise he will give you an ignorant answer. Why?

Because the sole purpose of the debt ceiling is to take advantage of the ignorant.

Your neighbors believe they understand economics. They don’t. They think federal financing resembles personal financing. It doesn’t.

If you try to explain it to them, they will resist understanding it. In their ignorance, they will laugh at what they perceive as your ignorance.

Their ignorance is akin to flat-earth believers, who assure you that ships sailing west eventually will fall over the edge. No amount of evidence can convince a flat-earther or a federal debt worrier. They are beyond the evidence.

How do I know? I’ve been doing this for nearly 30 years. Why do I keep doing it? Every so seldom, I meet someone open to learning, which requires changing one’s beliefs.

So despite meeting thousands of learning-resistant people, the relatively few who use their brains give me hope.

In that sense, I am an Ignaz Semmelweis of economics.

I hope I don’t meet his fate.

Federal Taxes: They do not fund federal spending. The U.S. Treasury destroys all dollars it receives and creates new dollars every time it pays a creditor.

To pay an invoice, the federal government sends instructions as a check or wires (not dollars) to the creditor’s bank, telling the bank to raise the balance in the creditor’s checking account.

New dollars are added to the M2 money supply when the bank does as instructed.

At no point are federal tax dollars involved.

When you send your M2 tax dollars to the Treasury, those dollars immediately disappear from any money supply measure. The reason: Our Monetarily Sovereign government has the infinite ability to create dollars from thin air, so trying to measure its supply of dollars would make no sense.

Adding dollars to infinite dollars yields infinite dollars. No change.

The sole purposes of federal taxes are:

- To discourage what the government doesn’t like and to give tax breaks to what the goverment likes

- To create demand for the dollar by requiring taxes to be paid in dollars.

That’s it. Taxes do not provide the federal government with spending money.

The sole purpose of the debt ceiling is to sell the lower-income groups the false idea that the government cannot afford to give them benefits.

In short, the debt ceiling has no financial purpose other than to widen the income/wealth/power Gap between the rich and the rest. It is a program designed to make the rich richer.

Period.

There is a political purpose, however: To give the party that is out of power leverage over the party that is in power.

Federal finances are nothing like personal finances.

The useless and misleading “debt limit” should be eliminated. The so-called “debt” is the net total of deposits into T-security accounts (T-bills, T-notes, T=bonds). These deposits are:

- Like the contents of safe deposit boxes: Owned by the depositors, not by the federal government

- Not used by the federal government

- Not borrowed by the federal government. The federal government never borrows dollars.

- Not touched by the federal government

- Not a debt of the federal government

- Paid back simply by returning the dollars in the accounts.

The useless and misleading Social Security “trust funds” are:

- Not trust funds, but simply bookkeeping notations

- Not recipients of FICA tax dollars, which are destroyed upon receipt by the Treasury.

- Not paying for Social Security or Medicare, which are funded by new dollar creation like all federal programs.

- Illusions, established by President Franklin D. Roosevelt, in a (failed) psychological attempt to keep Congress from cutting Social Security.

And contrary to popular myth, federal deficit spending never has caused inflation. There is no historical relationship between federal spending and inflation.

Rather than causing inflation, federal deficit spending prevents and cures recessions.

Federal “debt” reduction caused every depression in U.S. history.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. A recession began 2001.

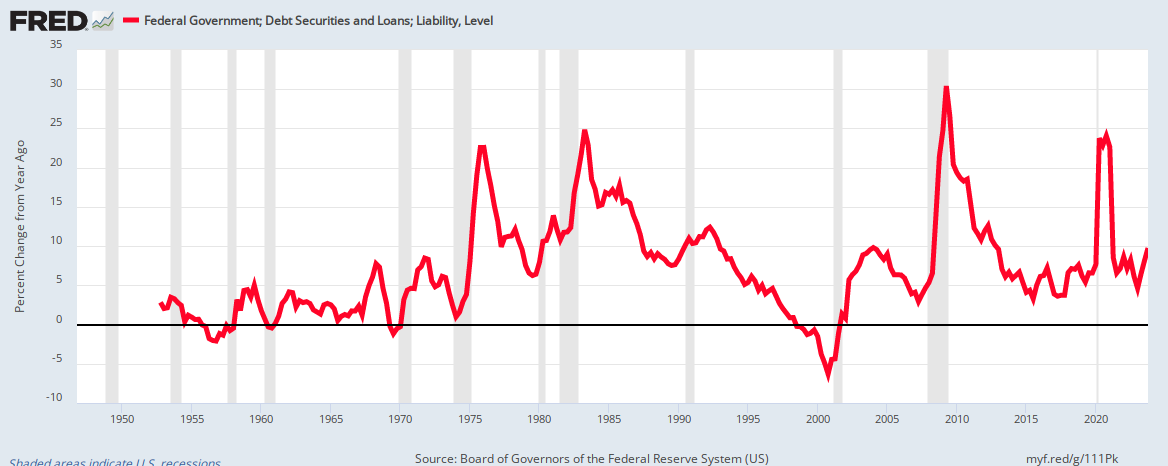

All inflations in history have been caused by the scarcity of critical goods and services, mainly oil and food. This is demonstrated by the graph below:

As we said, this has been discussed before on this site.

But past Republican parties, though heavily favoring the rich over the poor, were not led by demonic, psychopathic dictator wannabe who would burn down your house and our entire nation for the chance to rule the ashes.

IN SUMMARY

The federal government is uniquely Monetarily Sovereign. It cannot unintentionally run short of dollars.

When you are told that Medicare and Social Security benefits must be decreased and FICA taxes must be increased, that is a lie, and the person saying it is a liar, ignorant, or both.

The federal “debt” is not a problem, not even a debt, not paid for by your grandchildren, and is necessary for economic growth.

Efforts to decrease the federal “debt” are, in reality, efforts to make the rich richer by widening the Gap between the rich and the rest. The wider the Gap, the richer they are.

Unfortunately, when you try to explain this to your friends, their previous indoctrination will prevent them from believing what is in their self-interest.

So they naively will continue approving and justifying federal tax increases and federal benefit decreases, much to the amusement of the rich, who have blessed themselves with tax loopholes and income not subject to FICA taxes.

All you can do is to keep fighting, and forgive them, for they know not what they do.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

:max_bytes(150000):strip_icc()/oasis-with-palm-trees-in-the-middle-of-desert-157192238-bc7670d8152441aca329a8b94410ed2a.jpg)