Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================================================================================================

There is an old saying, “Long after the price is forgotten, the quality and service are remembered.” Though some American businesses complain about the Chinese (or is it the Indians, the Vietnamese, the Mexicans et al?) taking business away due to low prices, many American businesses thrive with quality and service.

Even the mighty Walmart, which grew on the basis of low prices and no service, recently learned there is a limit to what Americans will endure. The chain began to remove slow selling items, and suddenly, sales took a hit. Americans wanted that minuscule amount of service at least – the ability to find their favorite products.

While numerous exceptions to this generalization can be found, I suspect American businesses will do better long-term, by focusing on quality and service than on price. Here are brief accounts of my experiences at two businesses. You be the judge about which has the better future:

Rooms to Go: This chain of furniture stores, selling moderately priced pieces assembled into groupings, has a store in Boca Raton, from which I made a purchase. Their advertised deal was: Buy now and pay monthly over two years, at no interest. The amount I bought was small – about $2,000 – but what the heck. Two years of no interest is worth something.

The month after I made the purchase, my credit card was charged the full amount. I called the store manager, who said there is nothing she could do, because the salesperson had quit, and note had been sold to a bank. I (not she) would have to call the bank. I tried, but after 20 minutes on hold, I gave up. I mean, we’re not talking about big money. I twice wrote to a guy named Stephen Buckley, who not only is company president but CEO – a real big shot. No response from the big shot.

What they could have done:Rather than putting the onus on me to spend my time trying to solve their mistake, they at least could have given me the interest I would have earned, had I invested my money. What would that have been? Forty dollars? A mere pittance, to be sure, but a gesture of concern for a customer. After all, it was their advertised deal, and they screwed up.

Needless to say, I never will buy from that chain again, and I tell this story every chance I get. So they saved $40, and cost themselves lots of business, as I am just now furnishing a new apartment in Boca Raton, as are some of my friends.

Wildfire Restaurants This chain is part of the Lettuce Entertain You group, that became big and famous for good food and good service. Their staff is well trained. Within two minutes after you are seated, a waiter must come to your table. Your water glass never is empty. You don’t need to find a waiter; they know how to anticipate your needs.

They send out “secret shoppers” to test the service and quality. These people are trained and given a long list of criteria to measure. Reports are made daily to home office. I mean, Lettuce Entertain You is dedicated to quality and service. Their prices are not low; in fact, they lean toward the higher side. Virtually all the restaurants nearby charge more, but Lettuce grows.

Recently I made an reservation for eight people. When we arrived, our table wasn’t ready and we had to wait 15 minutes. That may be normal for some restaurants, but for Wildfire that was unacceptable.

What they did: Immediately after we were seated, a waiter apologized and told us they were “comping” all appetizers, which eventually totaled about $60.

Will I go back to Wildfire? Darn right I will, as will the others who were with me. What could have been a grumpy meal, suddenly became great, as we snarfed down those free appetizers.

So that is the tale of two businesses, one providing me crap service from top to bottom, and one providing great service. Would Rooms to Go do better if it provided better service? You decide.

I believe American business can compete with the sweatshop nations, if not on price, then on quality and service. We have little to fear from competition; we have much more to fear from incompetent management. Once dominant General Motors learned that harsh lesson, but I doubt Rooms to Go will be bailed out by the federal government as GM was.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

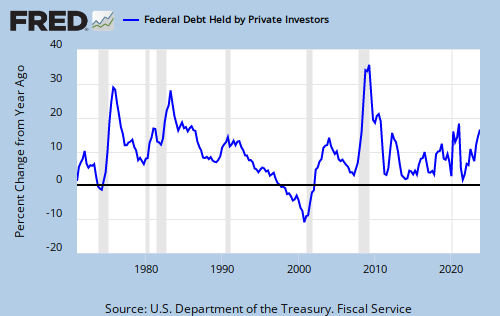

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY