Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

================================================================================================================================================================================================================================================================

President Obama is operating under the confusing myth that while deficit spending is stimulative, deficit spending should be reduced or even eliminated. So he has advocated a “grand bargain” to cut deficits, a plan which will lead us first to recession, then to depression. Guaranteed.

Washington Post, By Alec MacGillis and Lori Montgomery, July 16, 2011.

Even as President Obama and congressional leaders focus on a fallback plan to lift the nation’s debt ceiling, top Democrats and Republicans have begun to map a new way to craft the same sort of ambitious deficit-cutting plan they abandoned last week.

As part of the deal being discussed to raise the debt ceiling, leaders on Capitol Hill are forming an especially powerful congressional committee that would be charged with drawing up a new “grand bargain,” possibly by the end of the year.

Key elements for a big deal remain in place. Obama has been clear that he wants one and has started making the case to skeptical factions of his own party that getting the nation’s fiscal house in order is in their best interest. House Speaker John A. Boehner (R-Ohio) also remains committed to an ambitious plan, having told his troops that he didn’t become speaker to do small things. And, perhaps most critically, the markets are demanding it. The credit rating agency Standard & Poor’s says Washington must agree to reduce the debt by $4 trillion over 10 years to avert a downgrade.

The Democrats want it. The Republicans demand it. The Tea Party insists on it. The credit agencies advocate it. What possibly could go wrong?

“We cannot as a country fail to deal with the debt threat,” said Senate Budget Committee Chairman Kent Conrad (D-N.D.), one of the bipartisan “Gang of Six” senators who tried to reach an agreement in recent months. “Every serious economic analysis tells us we’ve reached the danger zone. And just kicking the can down the road? That can’t be. We’re better than that. We’ve got to be better than that.”

Er . . . ah . . . exactly what is the “debt threat”? Is it that the government will be unable to pay its bills? No, the government has the unlimited ability to pay its bills. That was the reason we went off the gold standard.

Is it that taxes will need to be raised? No, the government does not use tax money to pay its bills. In fact if taxes were reduced to $0 or increased to $100 trillion, neither event would affect the government’s ability to pay its bills.

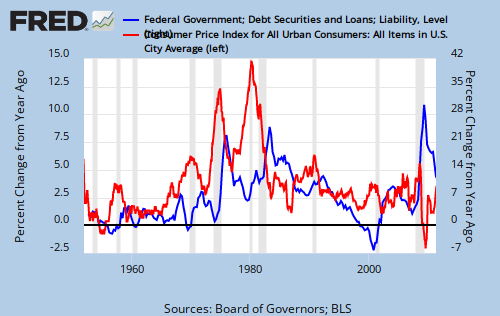

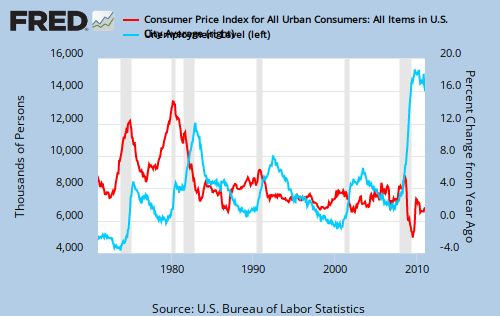

Is it that federal deficit spending will cause inflation? No, contrary to what the Tea Party tells you, there has been no relationship between federal deficits and inflation. See: Cause of Inflation

Is it that foreign countries will stop lending to us? No, since we went off the gold standard in 1971, the federal government has had no need to borrow the dollars it can create without limit. If the Treasury stopped issuing T-securities, this would have no effect on the government’s ability to pay its bills. We could “pay off”China tomorrow at the press of a computer key.

Is it that “future generations” will pay for the debt? No, the debt merely is the total of outstanding T-securities, which the government services by crediting the bank accounts of T-security holders. It can do this endlessly. Nobody pays, not today’s generation, nor tomorrow’s. But future generations will pay by receiving less Social Security, less Medicare, less Medicaid — in short, our children and grandchildren will lead worse lives because of deficit cutting today.

So what is the “debt threat.” No one knows, and no one specifically says, but by heaven, we simply must deal with it somehow, even if we destroy the economy.

But hopes for a grand resolution in coming months face the same question that hangs over the current crisis: whether tea-party-aligned conservatives in Congress who forced the debt-ceiling showdown will provide the necessary votes for an eventual major deal, even if it includes new taxes.

Well, if it has Tea Party support, it must be good. We all know what brilliant economists those folks are.

The Gang of Six — which tried to come up with its own plan — disbanded last week after failing to reach agreement on how to cut spending and raise taxes. Meanwhile, the big deal pursued by Obama and Boehner faltered amid criticism from congressional Republicans opposed to additional revenue.

House Majority Leader Eric Cantor (R-Va.), who has emerged as the leader of this contingent, has argued against such a deal. But his views may be shifting along with those of some rank-and-file House Republicans whose imaginations have been captivated by the idea of slicing as much as $5 trillion out of the federal budget over the next decade.

In a caucus meeting last week, some freshmen wanted to know whether they could slice that much out of the budget in the next two years, GOP aides said. (Answer: no. The entire federal government is expected to spend about $3.6 trillion this year.)

Ah, those freshmen. They have proved they have no idea what they are talking about, but they sure are loud. So I guess we should respect their opinions.

In public at least, conservatives are maintaining that the answer is to “cut, cap and balance” — passing a balanced-budget amendment that would cap federal spending at 18 percent of the nation’s gross domestic product, down from its current 24 percent.

I can’t think of a better way to assure an ongoing recession or even a depression than to limit the amount of money the federal government can add to the economy.

The House is expected to vote Tuesday on such an amendment, but it has scant odds of getting the needed supermajority in the Senate. Democrats say an 18 percent cap in a country with an aging population and rising health-care costs would lead to ruinous cuts.

But conservatives said Saturday that they are holding out for the amendment and are not ready to accept a stopgap measure being put together by Senate leaders Mitch McConnell (R-Ky.) and Harry M. Reid (D-Nev.) that would raise the debt ceiling before the nation hits its borrowing limit Aug. 2.

“I didn’t get elected to punt this problem down the road another six months,” said Rep. Jason Chaffetz (R-Utah). “We are the body, we are the commission to make these tough decisions. . . . Guys like me are not coming along. We’re not going along just to get along.”

Translation: “We don’t care about ruinous cuts. We don’t care about the economy. We just want to do what the Tea Party tells us to do, so we can get elected, again. We have our priorities.

Under the stopgap plan, Congress would allow Obama to raise the debt ceiling in three increments totalling $2.5 trillion over the next year. Each time, Congress would vote on a resolution of disapproval, allowing Republicans to blame the increases on Obama.

Can anyone take these guys seriously. They propose a complex, convoluted plan that allows them to avoid all responsibility for the disastrous results. Our brave Congress at work.

The commission recommended saving $3.8 trillion by raising the retirement age for Social Security, slashing spending across government and wiping out more than $100 billion a year in popular tax breaks, including the tax deduction for mortgage interest and the tax-free treatment of employer-provided health insurance. It recommended larger Pentagon cuts and revenue increases than the White House sought this month.

Obama countered last week that Democrats should want a major fiscal deal, because it would make it easier to win approval for spending on their priorities in the next few years.

“If you care about making investments in our kids and making investments in our infrastructure and making investments in basic research,” he said, “then you should want our fiscal house in order so that every time we propose a new initiative somebody doesn’t just throw up their hands and say, ‘Ah, more big spending, more government.’ ”

Let’s see. You want to cut Medicare and health coverage, but you also want to increase investments in research, infrastructure and “our kids.” So you want the elderly and the sick to pay for roads and research. Great plan, Mr. President.

Here is the bottom line. Money is the lifeblood of an economy. A growing economy requires a growing supply of money. Federal deficit spending is the method by which the federal government adds this “lifeblood” to the economy. Today’s economy is starved for money. Cutting federal deficit spending is like applying leeches to cure anemia.

Whichever deficit-cutting plan is being debated in Congress, I absolutely, positively guarantee it will cause a recession that will make the last recession look like a walk in the park. The public has been sold a bill of goods about the so-called dangers of deficits, and we all will pay the price of ignorance.

Be careful what you wish for, Mr. President. If you get what you want, it will come back to bite you in the butt. You will take your place in history, right beside Herbert Hoover, as the guy who through ignorance caused the next Great Depression. That will be your legacy.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

MONETARY SOVEREIGNTY

![]()