The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

========================================================================================================================

Here are a few results from a survey I ran, recently. The results demonstrate the confusion even educated people have about our economy:

All respondents agreed “the U.S. government has the power to print all the money it wants to” and half thought the federal deficit was too low. But, only half thought high taxes were a big problem. There was a logical disconnect between the government’s unlimited ability to spend money and the need for taxes.

Nearly everyone thought a “continuation or resumption of the recession” was a big problem, and only a handful thought the federal deficit was a big problem.

The majority wanted more spending on Retirement, Medical care, Education, Infrastructure, The environment and Unemployment. I was surprised that the majority wanted less spending on The military and Homeland security.

Perhaps the most interesting parts of the survey were the answers to “If I were President of the United States, this is what I would do to improve the economy.”

One person wanted to “cut the budget by 1% across all departments each year for 3 years and eliminate earmarks.” But that same person wanted more spending on medical care, education and the environment, with no change in spending on retirement, housing, business, infrastructure and unemployment.

One person wanted to end all federal taxing and borrowing, and to cut the size of the federal government to 20% of the size it is today. That person wanted less spending in all listed categories, while feeling the following problems were big: recession, state deficits, unemployment, mortgages, medical costs.

Several people wanted to end FICA along with other taxes, but some felt the federal deficit was too high.

Obviously, the results are skewed by the fact that most respondents read this blog. I was encouraged by the unanimous knowledge that the federal government has the unlimited ability to create money. So I was surprised by the common belief that taxes are necessary, especially since very few people felt inflation was a problem. (If the government can create money, and inflation is no problem, why the need for taxes?)

As I read through the comments, I was struck by one theme: Even those, who generally understand federal financing, tend to have some elements of anthropomorphic economics disease – the intuition that the federal government is like you and me. There was some“Tea Partyism” – wanting more federal spending on most projects, while wanting less government.

The debt hawks have a simple, highly intuitive model: Our own personal experience. Those who understand monetary sovereignty haven’t found such a model. So even among readers of this blog, whom one might expect to understand monetary sovereignty, the intuitive pull of personal experience is quite strong.

You can see it best while watching Congress try to stimulate the economy while limiting the only thing that can stimulate the economy: money creation.

========================================================================================================================

Response Summary

Chart1. I believe the federal deficit is:

Too low 57.7%

Too high 15.4%

About right 26.9%

Chart2. My belief about the size of the federal deficit is based on: (Indicate all that apply)

My own research 66.7%

What I learned in school 11.1%

What I hear and read in the media 33.3%

What the experts say 37.0%

What my friends say 7.4%

Other 14.8%

Chart3. Do you believe the U.S. government has the power to print all the money it wants to?

Yes, it has that power 100.0%

Chart4. How big are these problems facing the American economy.

Extremely big—–Fairly big—–Moderate or Not sure—–Not very big—–Not at all big

Continuation or resumption of the recession

63.0% 29.6% 7.4%Federal deficit too high

7.4% 7.4% 14.8% 14.8% 51.9%State deficits too high

37.0% 37.0% 18.5% 0.0% 7.4%Unemployment

85.2% 14.8%The economy has too little money

30.8% 26.9% 34.6%Federal taxes are too high

26.9% 26.9% 15.4% 3.8% 26.9%Too little support for the poor

38.5% 30.8% 23.1% 3.8% 3.8%The gap between rich and poor

63.0% 14.8% 11.1% 7.4% 3.7%Mortgages

26.9% 53.8% 15.4% 3.8%Bank lending

15.4% 30.8% 42.3% 11.5%Medical costs

51.9% 29.6% 11.1% 7.4%Inflation

0.0% 7.7% 19.2% 11.5% 61.5%

Chart5. The federal government should spend on:

More than it currently spends—–About what it currently spends—– Less than it currently spends

The military

7.7% 26.9% 65.4%Homeland security

15.4% 34.6% 50.0%Retirement

63.0% 29.6% 7.4%Medical care

53.8% 26.9% 19.2%Housing

38.5% 46.2% 15.4%Business support

30.8% 42.3% 26.9%Education

74.1% 22.2% 3.7%Infrastructure

85.2% 11.1% 3.7%The environment

53.8% 30.8% 15.4%Unemployment

74.1% 18.5% 7.4%

========================================================================================================================

If I were President of the United States, this is what I would do to improve the economy. [Selected responses]

1. suspend FICA collection

2. put people to work on infrastructure projects.

bring our troops home from all over the world.

build an network of wind-power projects, and feed them into a much upgraded national electrical grid.

facilitate a truly high-speed internet.

build a very high-speed maglev train network.

enable a national network of college-level courses that anyone could take over the internet.

3. Hugely increase spending in job creation, infrastructure, education, health care, energy R&D, heath care R&D, health and safety regulations and environmental clean up and protection.

4. First, I would institute a full payroll tax holiday, a per capita disbursement to the states, and an ELR program. Then hopefully we can begin to turn our economy around and start to reap the benifits of our real terms of trade.

5. Cut the budget by 1% across all departments each year for 3 years. Eliminate earmarks.

6. remove/eliminate payroll/FICA/medicare taxes & fund them from the general fund like everything else (great idea you have)… spend/hire billions more on DARPA, National Insitutte of Health, Medical Corps, QUADRUPLE medical schools/nursing schools/PA schools, etc to increase supply of medical personnel for increased medical demand of baby boomers & lower prices by increasing supply of medical services

and $1 TRILLION (like China is doing) on 250mph bullet trains between L.A. & Vegas, Chicago & Detroit, DC & NY, etc

7. Eliminate the payroll tax.

8. FICA holiday forever, Per capital state support, Work program.

9. End the Income Tax, Social Security Tax, and Medicare Tax. Stop borrowing our own currency. And cut the size of government to 20% of the size it is today.

10. Not too sure. Support green jobs and green infrastructure – this reduces unemployment, strengthens our infrastructure, and increases national security (moreso than a war in the Middle East would anyway). I would reduce some of the corporate welfare and unnecessary defense projects (and probably pay our soldiers more). Spend more overall, however, until the private sector picks back up.

11. Cut taxes for everyone. Fix health care, dump the current law

12. go back to the barter system.

13. Eliminate the payroll taxes

14. No taxes (including FICA) on 1st 100K of income (all sources), graduated marginal rates going up to 90% on all else. Guarantee job to anyone wanting one. Raise social security payouts by 50%. Really regulate financial sector and introduce transaction taxes

15. Cut military spending, eliminate tax cuts for rich, and dedicate more resources to meaningful stimulus packages.

16. cut taxes, increase the stimulus packages because I believe that the current stimulus is barely helping people pay off their debt and willing not increase their spending. I would seek reform of the IRS tax code(So it is not so complicated and the average American can do their own taxes), Audit and Tax the federal reserve on their income. Eliminate congressional spending to what they bring in only.

17. I would aim to catch up and overtake the Chinese in infrastructure and education. The US has to spend and tax the rich whatever it takes to achieve this. I would tell the American people that the US is in an economic war with China and is currently losing and is going to lose unless it changes course.

18. Dismantle the Tax code, make it a simple structure, a % of earnings at 4 or 5 stages (say 0% for under 30,000; 8% over 30K and under 50K; 15% over 50K and 150K; 25% over 150K and 250K & 32% over 250K. No loopholes, no deductions, no credits on anything.

19. Learn about how the govt’s role in providing money to the economy. They dont’ know how things work.

20. Tax all offshore tax haven corporate sales in USA at a higher rate than sales from US based corps and corps based in countries we have trade agreements with.

– Bring taxes on top 3% into line with Reagan or Clinton rates.

– Pass a War Tax which would go into effect automatically whenever US troops enter a foreign country for military engagement. Progressive tax, no exceptions. Exempt special ops from this tax.

– Pass a 1 trillion dollar stimulus bill.

– Disengage as quickly as possible from Afghanistan.

– Withdraw as many troops as possible from Muslim countries.

– Emphasize special ops in any future engagement, avoid ground troops. Retire most generals. keep number of generals to a smaller number.

– Increase veteran benefits, cut back on military budget by 30%.

– Fully support Head Start programs.

– Encourage savings by giving 10-20 year US bonds to all families below a certain income, add 50% on every dollar in savings accounts first year for low income people, 20% afterwards, 10% after 5 years.

– Create a federally funded, independent bond and equities rating agency. Prosecute executives and CEOs at any financial company who provides this agency with deceptive information.

21. Direct hiring program, single-payer health-care, increased taxes on rich.

========================================================================================================================

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”

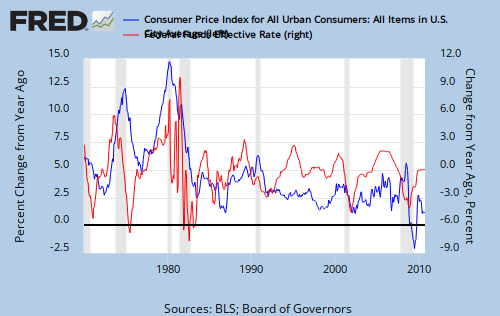

that seems to indicate interest rate increases are followed about one year later by inflation decreases.

that seems to indicate interest rate increases are followed about one year later by inflation decreases.