The author of the following article, Veronique de Rugy, may need help understanding federal government finance, for she has written several articles in the same misleading vein.

The question: Is it ignorance or is it an agenda? Perhaps she needs to be more knowledgeable about federal finance. No problem. Most laypeople, and even many economists, suffer from that form of ignorance.

I suspect, however, that Ms. de Rugy is feigning ignorance and has an agenda, a pro-rich, pro-right, anti-poor agenda. You decide. Here are excerpts from her article:

The U.S. Credit Rating Just Dropped. It’s Time for Radical Budget Reform. The lack of oversight and the general absence of a long-term vision is creating inefficiency, waste, and red ink as far as the eye can see. By, Veronique de Rugy | 8.10.2023

Fitch Ratings just downgraded the U.S. government’s credit rating due in part to Congress’ erosion in governance.

Indeed, year after year, we see the same political theater unfold: last-minute deals, deficits, and, all too often, the passage of gigantic omnibus spending bills without proper scrutiny, repeated debt ceiling fights and threats of shutdown.

We say “mistakenly termed debt” because it is unlike private debt. Federal “debt” is the total of deposits into privately owned, T-security accounts.

When you invest in a T-bill, T-note, or T-bond, you deposit your dollars into your T-security account at the U.S. Treasury.

This account is similar to your safe deposit box, where you deposit valuables. The bank does not touch the box’s contents, and they are not considered bank “debt,” though the bank owes you those contents in one minor sense.

Similarly, the federal government never touches the dollars held in your T-security account. Although some mistakenly refer to the dollars as borrowing, the federal government never borrows dollars.

Why would it? Given the federal government’s infinite power to create dollars at the touch of a computer key, borrowing dollars would be a ridiculous exercise:

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

Alan Greenspan: “The United States can pay any debt it has because we can always print the money to do that.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Statement from the St. Louis Fed:

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

“Not dependent on credit markets” is Fed-speak meaning, “We don’t borrow.”

So what is the purpose of T-securities, the total of which erroneously is called “debt”? T-security accounts”

- They allow holders of unused dollars to store them in a safe, interest-paying account, which stabilizes the dollar

- They help the Fed control interest rates.

That’s it. The purpose is not to provide the federal government with spending dollars. The government creates all it needs. All federal spending is done with newly created dollars. No spending uses the dollars in T-security accounts.

For this reason, the size of the misnamed “debt” is irrelevant. Whether total deposits equal $100 or $100 TRILLION, the government has the same real ability to return them to depositors.

That is why the debt ceiling is so outrageously foolish. Why limit the amount of deposits that will be accepted if the dollars neither are used nor scarce to the government?

The confusion comes with the word “debt.” Federal “debt” differs from personal debt as an ink pen is a pig pen. Different meanings for the identically spelled and pronounced word “pen.”

If someone thought they could write with a pig pen, that would be equivalent to someone thinking the federal government was burdened by its federal debt.

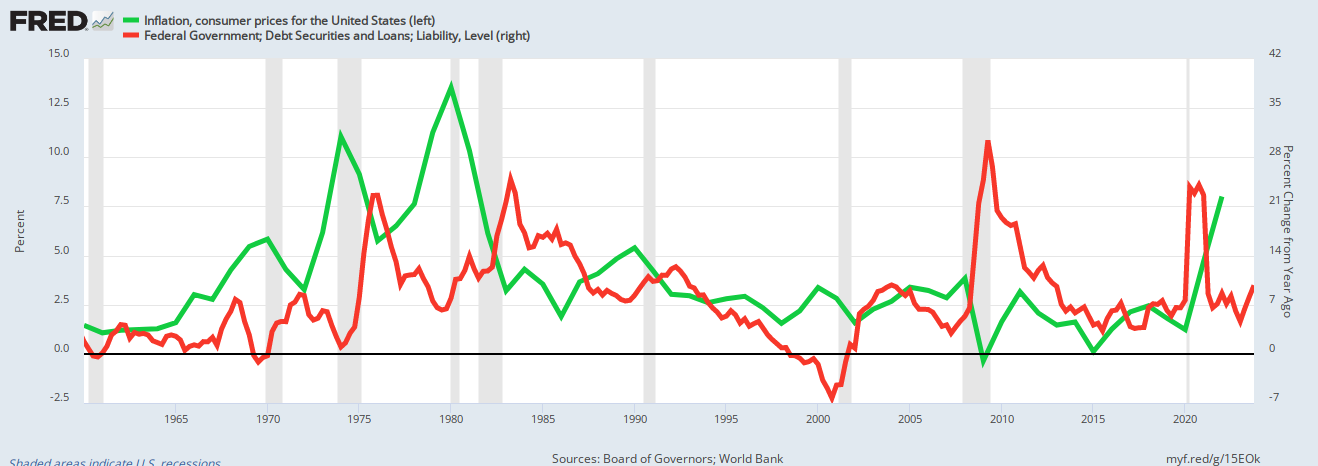

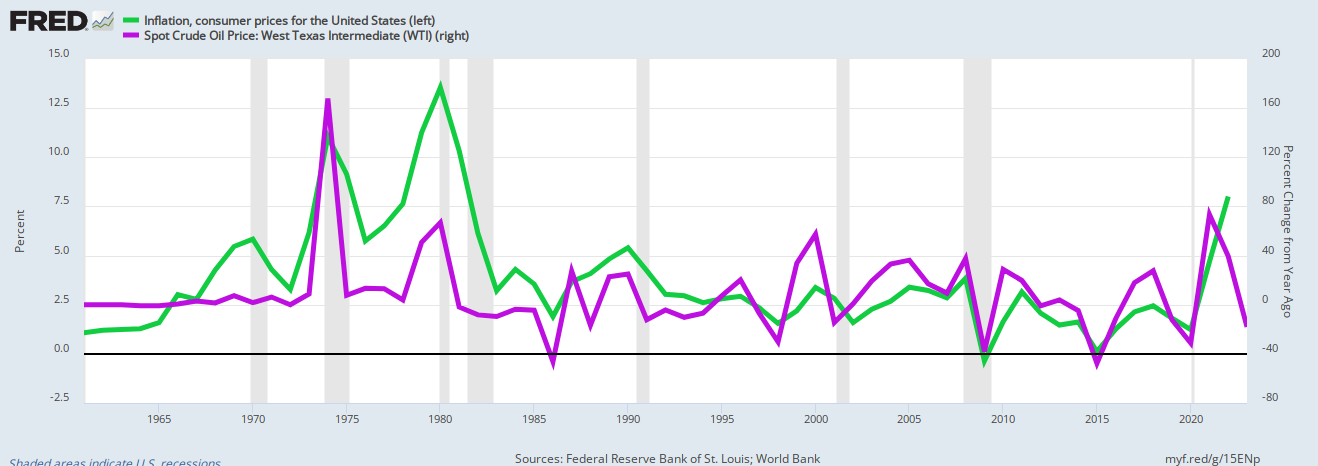

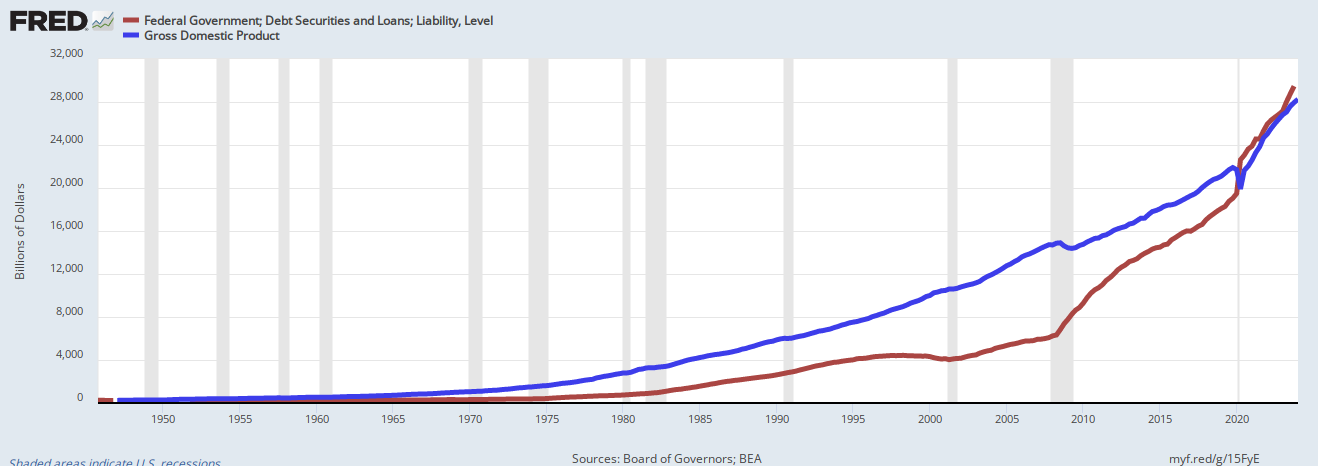

Since 1940, there never has been a time when the government has not had Ms. de Rugy’s “red ink.” The lines essentially parallel, which should be no surprise to anyone because the formula for GDP is:

GDP = Federal Spending + Nonfederal Spending + Net Exports.

Federal Spending adds dollars to the economy, as do Net Exports, and those added dollars stimulate Nonfederal Spending. The three terms work in concert to create economic growth.

Sadly, “debt” confuses some economists, who wrongly equate it with private sector or state/local government debt.

But while the private sector and state/local governments are monetarily non-sovereign (i.e. they do not have the infinite ability to create U.S. dollars), the federal government is Monetarily Sovereign (it does have that limitless ability).

The difference is that the private sector and state/local governments unintentionally can run short of dollars, the federal government cannot unintentionally run short. That is a huge difference.

Imagine you had the federal government’s ability to create dollars at will. Why would you ever worry about debt? You wouldn’t.

A billion dollars in debt. No problem. A trillion? Still fine. A trillion trillion. Again, no problem.

So why is Ms. de Rugy worried about the “debt” if it’s no problem for the federal government? Does she understand that the federal government pays all its debts by creating dollars? Here is what she wrote:

Fitch Ratings just downgraded the U.S. government’s credit rating due in part to Congress’ erosion in governance.

Indeed, year after year, we see the same political theater unfold: last-minute deals, deficits, and, all too often, the passage of gigantic omnibus spending bills without proper scrutiny, repeated debt ceiling fights and threats of shutdown.

In the above two paragraphs, Ms. de Rugy properly explains the reason for the rating downgrade: Political theater, debt ceiling fights and threats of shutdown.

It isn’t that the federal “debt” is too high. The reason for the downgrade is the political theater, the debt ceiling fights, and the shutdown threats. The federal government politically has become an unreliable payer.

It always can pay, but it might not choose to pay.

But, having expressed the truth, Ms. de Rugy goes off the rails.

But these are just symptoms of a budget-making process that desperately needs reform. In a world where politicians are rarely told no when it comes to creating or expanding programs, most simply refuse to have their hands tied or behave as responsible stewards of your dollars.

The lack of oversight and the general absence of a long-term vision is creating inefficiency, waste, and red ink as far as the eye can see. Without fundamental reform, no one can stop it. So, let’s have some real reform.

Inefficiency, waste, and red ink have nothing to do with the federal government’s ability to pay. I suspect Ms. de Rugy knows this because here comes what I believe to be her agenda.

We need a comprehensive budget process under which programs like Social Security, Medicare, and Medicaid can no longer grow without meaningful oversight.

Combined with other mandatory, more-or-less automatic spending items, they comprise over 70 percent of the budget.

Thus, they must be included in the regular budget process and subjected to periodic review.

Only then will our elected representatives be forced to stop ignoring the side of the budget that requires their attention the most.

Her solution to the federal credit rating cut is to cut Social Security, Medicare, and other spending items (like Medicaid and anti-poverty initiatives).

In this, she has become a shill for the Republican Party, which is a shill for the rich people of America.

The GOP has tried to eliminate the popular ACA (aka Obamacare) for many years, but it’s a program that helps the less affluent, a significant voting bloc.

This is the party that gave massive tax cuts to the rich, falsely complains about the Social Security and Medicare “trust funds” supposedly running short of dollars, and consistently votes against anything that would help the poor (whom they deem “lazy takers.”)

Federal “trust funds” differ from private trust funds as federal debt differs from personal debt.

WHAT ARE FEDERAL TRUST FUNDS?

Sep 20, 2016, Peter G. Peterson Foundation

A federal trust fund is an accounting mechanism the federal government uses to track earmarked receipts (money designated for a specific purpose or program) and corresponding expenditures.

The largest and best-known funds finance Social Security, Medicare, highways and mass transit, and pensions for government employees.

Federal trust funds bear little resemblance to their private-sector counterparts.

In private-sector trust funds, receipts are deposited and assets are held and invested by trustees on behalf of the stated beneficiaries.

In federal trust funds, the federal government does not set aside the receipts or invest them in private assets.

Again, the public and many economists are confused about the words “trust fund.” A federal trust fund is not a real trust fund and cannot run short of dollars unless Congress and the President want it to.

So all the bleating about the Social Security and Medicare trust funds running short of money is nonsense. Congress and the President could add $100 trillion to those trust funds or eliminate them completely at the touch of a computer key.

Medicare and Social Security could be funded directly like the military, Congress, SCOTUS, and the White House, none of which are burdened with fake trust funds.

This would also help deal with the fact that entitlement spending is, as every serious observer knows, unsustainable. Unless reformed, these programs will drain wealth from the government and the economy.

Ensuring their sustainability must be part of any serious budget process reform.

The above statements to too wrong to be accidental. They are outright lies. The government has proved it has the infinite ability to pay for things. It has been sustaining federal deficit spending since 1940, and the economy has continues to grow.

And federal spending, which adds dollars to the economy, certainly does not “drain wealth” from the economy, nor does it drain wealth from a government with infinite dollars.

See the article: Remember that “ticking time bomb”? After 83 years it’s still ticking and still a scam

Since 1940, people like Ms. de Rugy have complained that the federal “debt” is an unsustainable, ticking time bomb. Year after year, the same complaint and the lies are proven wrong year after year.

But the de Rugys of the world never stop.

Enter a “Base Closure and Realignment Commission (BRAC)”-style fiscal commission, an idea promoted by the Cato Institute’s Romina Boccia.

This commission would be “tasked with a clear and attainable objective, such as stabilizing the growth in the debt at no more than the GDP of the country, and empowered with fast-track authority, such that its recommendations become self-executing upon presidential approval, without Congress having to affirmatively vote on their enactment,” Boccia explains.

Go to the Cato Institute’s website and you’ll be greeted with more misinformation like the above.

Besides the fact that the economy has grown faster than the “debt” (see the graph above), what is the purpose of this objective?

The federal government cannot run short of dollars. And think of the reality: CATO and de Rugy want a group of unelected political bureaucrats to determine how much Social Security and Medicare should be cut.

It’s unimaginably ignorant.

And think of the result. By formula, cutting federal spending cuts GDP, so we would enter an endless spiral of spending cuts, GDP cuts, spending cuts, GDP cuts ad infinitum.

The euro nations, Greece, Italy, and France tried this. It’s called “austerity,” a process that dooms a nation to recessions, to borrow Ms. de Rugy’s phrase, as far as the eye can see.

Cutting federal spending cuts GDP, and cuts to GDP are, by definition, a recession. Why do the rich-loving Republicans want recessions?

Because recessions actually make the rich richer. Here is how that works.

- “Rich” is a comparative. A person with $100 is rich if everyone else has $1, but that person is poor if everyone else has $1,000—the Gap between the richer and the poorer measures how wealthy a person is.

- Recessions widen the Gap between the rich and the rest. During recessions, desperate people will accept menial, low-paying, demanding jobs, while wealthy business owners continue to profit by paying low salaries.

Here is what happens to an economy when the federal “debt” doesn’t increase substantially:

Not just reduced debt but reduced deficits cause recessions. Imagine what would happen to the economy if de Rugy’s bureaucrats started making cuts. The idea is so screwball that even de Rugy is unsure about it:

I’m uneasy about delegating the president’s power to appoint “experts.” But, Congress would retain some veto power.

If they disapprove of the proposal, the House and Senate can reject it through a joint resolution within a specified period. Whether it’s the best solution to address our fiscal problems remains to be seen, but it’s worth considering.

No, Ms. de Rugy, it’s not “worth considering” any more than economic suicide is worth considering.

There are many more budget reform ideas out there. I’ll leave you with one more. For years, Congress has failed to pass a budget, bringing the country to the brink of a government shutdown by fighting over the need for a continuing resolution.

This temporary measure extends previous funding levels for a few months.

Making continuing appropriations automatic in case of a lapse could remove the threat of shutdowns.

As explained in one senator’s proposal, if appropriations work isn’t done, “implement an automatic continuing resolution (CR), on rolling 14-day periods, based on the most current spending levels enacted in the previous fiscal year.”

Further, to avoid over-relying on CRs, “all Members of Congress must stay in Washington, D.C., and work until the spending bills are completed.”

The problem is the nutty debt limit law. Just eliminate that law and Congress could not easily bring the economy to its knees.

It’s time to completely rethink how we approach the federal budget, grounding our efforts in transparency, accountability, and fiscal responsibility.

Yes, it is time to rethink how we approach the federal budget. First, learn Monetary Sovereignty. By learning how federal financing works, we could help our poor, retired, sick, homeless, and hungry.

But, of course, that is not what the rich want.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the People’s Lives.

MONETARY SOVEREIGNTY