An alternative to popular faith

Fundamental to debt hawk beliefs is the idea that monetarily sovereign nations are like you and me. Thus, debt hawks practice “anthropomorphic economics.”

A monetarily sovereign nation is the monopoly supplier of its currency, which currency is not tied to any asset (like gold) or to a foreign currency. A monetarily sovereign nation has the unlimited ability, and the monopoly power, to create its currency.

The U.S., Canada, Australia, China and India are monetarily sovereign. The EU nations are not. That is why so many of the comparisons between Greece and the U.S. are false.

Specifically, here are a few of the assumptions debt hawks have about the U.S. — assumptions that might be correct for individuals, but not for the U.S.

1. The U.S. government must borrow or tax in order to spend.

You and I must obtain money, either by borrowing or by income, before we spend. The reverse is true for the U.S. government. U.S. spending creates money. So-called federal “borrowing” is not like personal borrowing. The U.S. creates T-securities from thin air, then exchanges them for dollars it previously created from thin air. Then it destroys the dollars. When the government repays its ‘debt,” the situation is reversed. It creates dollars, which are exchanged for T-securities, and the T-securities are destroyed. The whole process became obsolete in 1971.

2. Servicing the federal debt is a burden on the U.S.

Because the U.S. pays all its bills by creating money ad hoc, paying its debts never is a burden. Unlike you and me, the government simply credits the bank accounts of its creditors and debits its own balance sheet, which it can do endlessly. The “debt” carried on the government balance sheet is an accounting of the T-securities created by the government. Rather than “debt,” this balance sheet entry should be called “T-securities open.”

3. Federal debt is a burden on future taxpayers

Unlike you and me, the government does neither needs nor uses income in order to spend. There is no relationship between federal taxes and spending. Even were taxes dropped to zero or raised to $100 trillion, neither event would affect the federal government’s ability to spend by one penny. In fact, tax money is destroyed upon receipt, as a credit in a government balance sheet. The government does not spend tax money.

4. Federal surpluses are more prudent than deficits

For you and me, net income is more prudent than net outgo. Not so for the U.S. government. Federal taxes destroy money; federal spending creates money. To grow, an economy must have a growing supply of money. Federal spending is the most reliable, controllable source of money. Federal surpluses are imprudent, because by destroying money, they create recessions and depressions.

5. If U.S. debt is “too big,” nations will refuse to lend to us.

A credit rating is based on the past and future ability and willingness to service debt. You and I need a good credit rating in order to borrow. But, the federal debt has grown 1500% in only 30 years, and no nation has refused to buy our T-securities (not that it would matter, because we no longer need to sell T-securities).

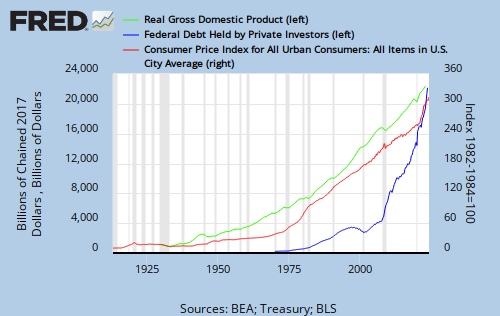

Debt hawks have made the intuitive argument that federal debt is like personal debt – anthropomorphic economics – but are unable to supply data to substantiate their intuition. One person told me the proof is that costs have risen (inflation) and the federal debt also has risen, therefore federal debt must cause inflation. The problem with this cause-effect conclusion is that through time, many things in addition to debt have risen: population, real GDP, the miles of paved roads, satellites in orbit, M3, the number of schools in the Big Ten, the number of cell phones and the years since the Cubs won the World Series. For example:

GRAPH

GRAPH

If federal debt caused inflation, we would expect to see greater inflation when deficits are greater and less inflation when deficits are smaller. But, as we have seen at INFLATION there is no historical relationship between deficits and inflation.

In short, debt hawks suffer from anthropomorphic economic disease, the unsubstantiated intuition that the federal government’s finances are like personal finances, where debt must be minimized and spending must follow the acquisition of money.

As I have so often in the past, I again suggest you write to one of the debt hawk web sites – Concord Coalition, the Committee For A Responsible Federal Budget et al – and ask for data to substantiate their claim that federal debt has an adverse effect on our economy. In the unlikely event they answer you, they will supply data showing the debt is large and growing, but no data showing it hurts then economy. The reason: No such data exists. Growing federal debt is economically necessary.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

No nation can tax itself into prosperity