- The Republicans who support rich, white, Christian, NRA men born in America, but claim too much money is given to everyone else.

- The semi-Republicans (aka “Libertarians) who also claim the government spends too much helping the poor and middle-income people but support tax breaks for the rich.

- The Dems who claim to love ordinary people but still yield to fairy tales about excessive federal deficits and debt.

- There’s a fourth category: All those groups that claim to support a specific issue but, in reality, are designed to take votes from one of the major parties.

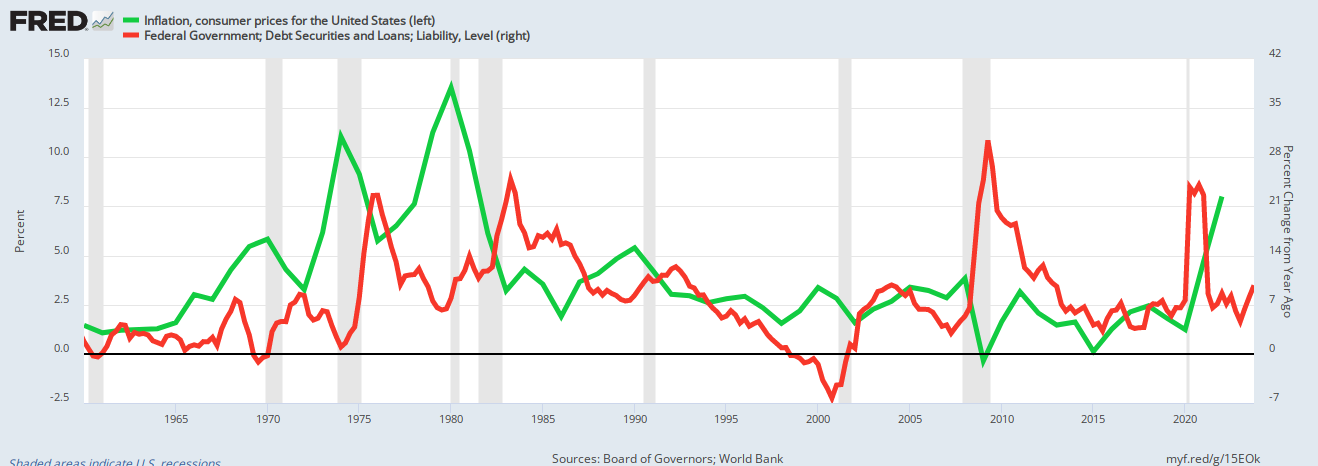

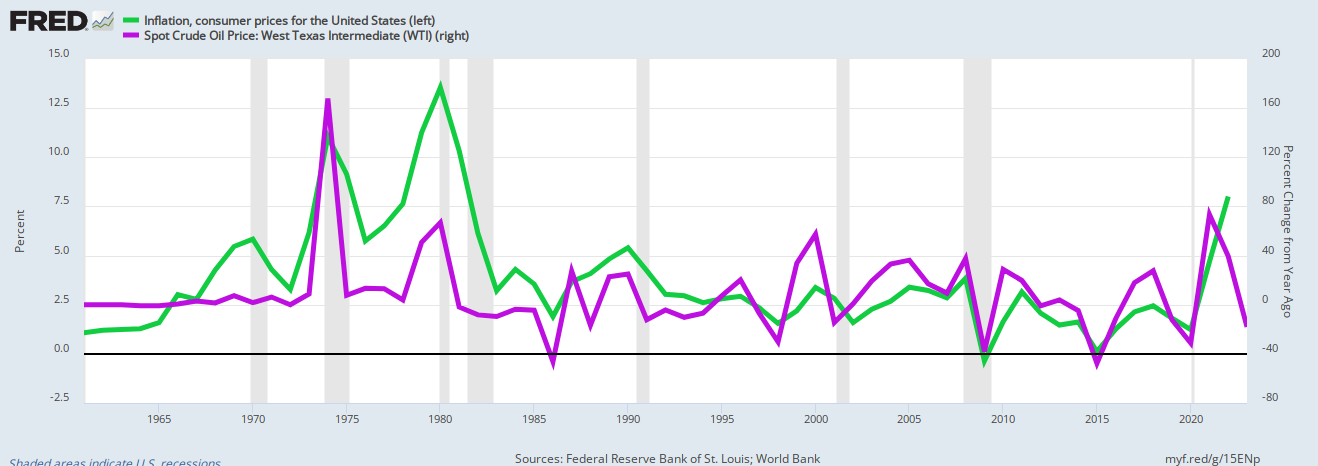

We’ve shown you data (here, here, here, here, and elsewhere) that demonstrate why even massive federal spending does not cause inflation. All inflations are caused by shortages of critical goods and services. When anything is in short supply, its price rises. When critical goods like oil and food are in short supply, prices generally increase. This general increase is called inflation. These shortages can be cured by federal spending to obtain and disseminate the scarce goods and services. The U.S. government spent massively for many years, and we experienced meager inflation. Only when COVID, the Russian/Ukraine war, immigration restrictions, and Saudi greed caused shortages of oil, food, computer chips, lumber, metals, labor, and other Gross Domestic Product necessities did we have the general increase in prices known as “inflation.” GRAPH I.‘Bidenomics’ Is Failing Everyday Americans The big spending has fueled higher inflation, resulted in larger-than-projected deficits, and contributed to a record level of debt.

By Veronique de Rugy, 9/21/2023

De Rugy forgets she admitted we’re at full employment. This has nothing to do with employment growth. “Full” means “full.” She makes the strange claim that because we lost jobs during COVID, today’s full employment was a natural result. Sorry, but that right-wing naysaying won’t fly. Federal spending helped create those jobs. We have a labor shortage, partly because right-wingers falsely claim that undocumented immigrants bring crime and drugs to America.Ordinary Americans aren’t feeling the so-called success of “Bidenomics.”

Superficially, the economy looks solid. Real gross domestic product (GDP) increased at an annual rate of 2.1 percent in the second quarter of 2023.

While August’s unemployment rate rose to 3.8 percent, that’s still considered full employment by economists.

Wages are rising, and we are often told we’re in a manufacturing boom.

But these numbers need perspective. Employment growth was inevitable because we lost millions of jobs during the pandemic.

Comparing Crime Rates Between Undocumented Immigrants, Legal Immigrants, and Native-born US Citizens in Texas

This study used uniquely comprehensive arrest data from the Texas Department of Public Safety to compare the criminality of undocumented immigrants to legal immigrants and native-born U.S. citizens between 2012 and 2018.

Cocaine seizures on U.S. borders, for instance, regularly measure in tons, making it impractical to have individual migrants ferry it across. Instead, dealers prefer to smuggle drugs into the country via legal ports of entry, which allow them to bring in high-value substances that are more easily hidden.

“The majority of the illegal drugs that enter the United States through the U.S.-Mexico border cross through formal Points of Entry,” said Joel Martinez, a Mexico research associate for the Center for American Progress

“The drugs that cross in between are very minimal and non-expensive products like marijuana. All the cocaine, fentanyl and methamphetamine — they cross through formal ports because they’re easier to hide […in] freight comp and assorted vehicles.”

So, right-wing bigotry against foreigners, especially those of color, make it almost impossible for those people to gain citizenship.De Rugy, desperate to minimize Biden’s success, unknowingly admits that federal spending reduces unemployment. Then, strangely, she declares that in some unknown way, federal spending “closes people out of the labor force.” It is not unusual for people to take both sides of an issue when they have no facts.Unemployment is low, but only because the economy is drunk on spending, simultaneously closing many people out of the labor force.

This problem is not caused by federal spending but rather by the greed of the rich. Plenty of profits reward shareholders via stock price growth and stock by-backs. Companies have plenty of money to reward executives with excessive pay increases, many multiples higher than average workers’. Now, we see the inevitable result: Strikes.Moreover, inflation-adjusted median household income has declined—from $76,330 in 2021 to $74,580 in 2022. Labor tensions and strikes are also intensifying.

No, the average worker is not making more inflation-measured dollars, which is why Biden (but not the Libertarians and the GOP) favors the strikers. They are striking to narrow the income/wealth/power Gap between the rich and the rest. This is anathema to the Republicans and the faux Republicans (Libertarians), who always favor cutting benefits to the not-rich (while cutting taxes on the rich.)With all this in mind, is the average American becoming better off?

Excluding food and energy from the measure of inflation and calling the balance “core inflation” makes no sense. It’s like excluding all home runs, triples, and doubles from a baseball player’s statistics and calling singles his “core” batting average. Scarities of energy and/or food are the most common and most important reasons for inflation. The Fed is so focused on money it has lost sight of reality. The reason: The Fed is tasked with curing inflation, and its only tool is interest rates. So, the Fed ignores the scarcity of energy and food and proclaims these products are not “core,” when that is precisely what they are. (“Move on, folks. Nothing to see here.”)These troubles are partly caused by inflation, which continues to take its toll. Per the Consumer Price Index (CPI), year-over-year inflation rose to 3.7 percent in August, nudging back up after peaking at 9.1 percent not long ago.

“Core” CPI (excluding food and energy) is down slightly to 4.3 percent. Although these numbers are an improvement after we experienced their highest levels since 1982, they remain disturbingly high.

The federal government can make all of the above less expensive to Americans. Consumers could receive federal benefits for housing, transportation, and food. FICA could be eliminated; being a federal tax, it pays for nothing. (The federal government pays for everything by creating new dollars ad hoc. Federal tax dollars are destroyed upon receipt.) The right-wing opposes all these solutions to the fallen standard of living.This is bad news for Americans whose standard of living has fallen since early 2021.

The Bureau of Labor Statistics (BLS) reported real average hourly earnings declining in 2021 and 2022, meaning Americans can afford less with their hard-earned dollars.

More than three-quarters of people’s income is devoted to living expenses like housing, transportation, and food—all of which have become more expensive.

Inflation would not take its toll on Americans if the federal government increased spending to:Food prices, for instance, rose by 19.3 percent. Shelter rose by 16.5 percent since 2021. Gasoline prices are up, too.

Inflation is a tax on every American’s standard of living. It’s also a regressive tax. Low-income workers tend to experience higher-than-average levels of household inflation.

- Provide free healthcare insurance to every man, woman, and child in America, regardless of wealth and income.

- Provide Social Security benefits to every man, woman, and child in America, regardless of wealth and income.

- Reduce energy prices by supporting renewable energy and oil drilling/refining.

Both inflation and high-interest rates take money from the pockets of average Americans. But both inflation and high-interest rates are unnecessary and totally within the control of the government. High rates do not “result” from anything. They are the Fed’s primary inflation-fighting tool. Inflation can be cured by federal spending to cure the shortages that cause inflation. And interest rates are determined by the Fed. Raising interest rates not only does nothing to cure inflation but also exacerbates inflation by increasing the price of nearly everything: Real estate, cars and trucks, food, clothing, all imported goods, construction materials. The Fed feeds the patient salt tables to cure high blood pressure. Why does the Fed do it? Because the Fed focuses on money, raising interest rates increases the demand for the dollar. The Fed ignores the obvious fact that adding interest payments to the price of everything increases the purchase price of everything.Making matters worse, high-interest rates resulting from the Federal Reserve’s fight against inflation also hit lower-income Americans the hardest.

These tend to consume a higher proportion of such incomes and take money from the pockets of people who hold assets in cash or low-yielding bank deposits.

In other words, inflation creates the opposite of an equitable economy.

Simple example: You buy a $50,000 car and finance the purchase with a 5-year, 3% loan. The total of your 60 monthly payments is $53,852.13.

Alternatively, say you finance that $50,000 car with a 5-year 6% loan. Now, the total of your monthly payments is $57,776.95

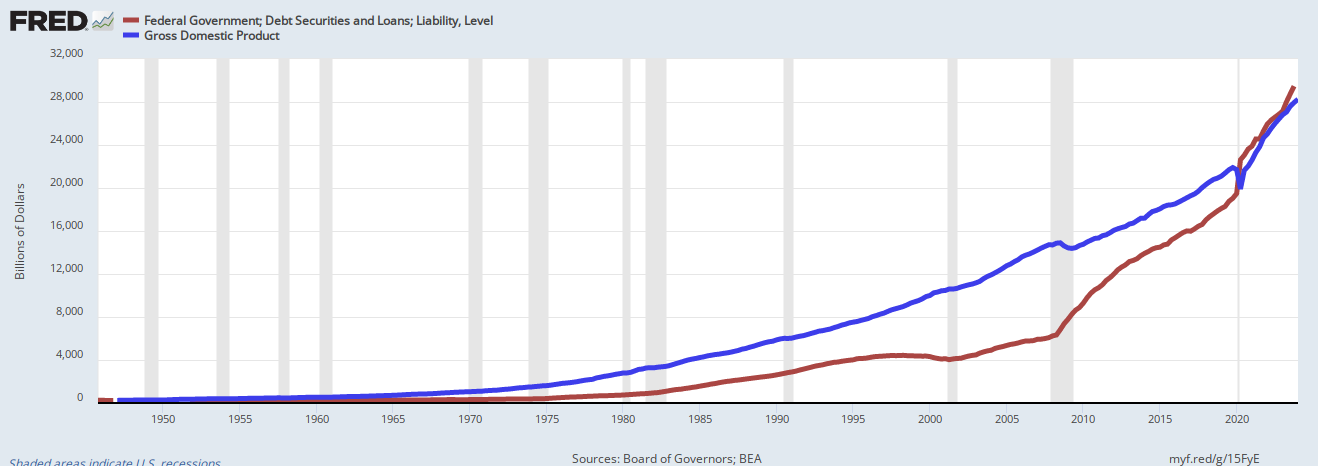

That $50,000 car cost you an additional $3,924.82, courtesy of the Federal Reserve. That is the very definition of inflation.It may be “well-known” that federal spending causes inflation, but what’s “well-known” often contradicts the facts. It once was “well-known” that the earth was the center of the universe, emotional stress was the primary cause of stomach ulcers, and drinking water during exercise causes cramps (Yes, really. When I was young, that was common knowledge.) As GRAPH I and GRAPH II (above) demonstrate, there is no relationship between federal spending and inflation. Nor is there a relationship between federal deficit spending and inflation. There is, however, a robust relationship between oil price increases (which are strongly related to oil scarcity) and inflation. As for de Rugy’s concern about federal debt and deficits, she displays widespread ignorance about Monetarily Sovereign governments. The U.S. federal government’s finances are nothing like those of monetarily non-sovereign governments such as state, county, city, and the euro governments. Monetarily, Sovereign government cannot run short of their own sovereign currency.By now, it’s well-known that Bidenomics’ big spending has fueled higher inflation, resulted in larger-than-projected deficits, and contributed to a record level of government debt.

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

“Federal debt” is not a debt of the federal government. It is deposited into T-security accounts that are owned not by the government but by the depositor. The government never touches those deposits other than to add interest money, and upon maturity, the money in those accounts is returned to the depository. The two purposes of T-accounts (T-bills, T-notes, T-bonds) are to:- Provide the public with a safe storage place for unused dollars.

- To assist the Fed in setting interest rates.

Fitch Ratings did not downgrade Treasury debt because of the size of the debt or deficits. It downgraded the debt because of the uncertainty regarding one of the most ignorance-based laws in American history: The debt ceiling. This harmful law is based on the false premise that federal debt and deficits burden the government and taxpayers. The law threatens to force the federal government to renege on its promise to return the money in T-security accounts to depositors or to fail to pay past obligations to creditors.The most recent estimate of the full-year deficit for 2023 is $1.5 trillion, up from $946 billion last year. Total federal debt is more than $33 trillion, an increase from $28.5 trillion in 2021. Budget tensions led the credit agency Fitch Ratings to downgrade Treasury debt based on prospects of further fiscal deterioration.

The federal government never borrows dollars. It creates all the dollars it needs and uses ad hoc.This is not great; federal borrowing is projected to be $120 trillion in the next 30 years.

Statement from the St. Louis Fed: “As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

Knowledgeable investors are aware that the size of federal deficits does not, in any way, affect the federal government’s ability to pay its bills.The prospect of gigantic, never-ending deficits during good times makes investors nervous.

Here, Ms. de Rugy mixes two errors.Borrowing costs like mortgage and car loan rates are rising, as are yields on benchmark 10-year treasury notes. They’re above 4.3 percent, their highest level since 2007—weighty burdens on lower-income Americans.

- Mortgage rates are whatever the Fed wishes them to be. Sadly, the Fed believes raising rates is the way to fight inflation, while it causes more inflation.

Finally, while America may be experiencing a hike in real construction spending, that’s a far cry from a manufacturing boom.

According to the Institute for Supply Management Report on Business, economic activity in the manufacturing sector in August contracted for the tenth consecutive month following 28 months of growth.

Moreover, manufacturing only accounts for 11 percent of GDP. Even if this sector grew, the benefits wouldn’t be widely shared.

It’s not clear why Ms. de Rugy believes manufacturing subsidies won’t help workers with college degrees. And as for projects that “likely” would be taken on without benefits, one wonders where she came up with that bit of fakery.Nor will Bidenomics’ manufacturing subsidies help workers with college degrees. These handouts, often extensive and rich, benefit companies for projects they would have likely taken on anyway.

Meaning that half were announced after it was passed. That’s an excellent result.Take the Inflation Reduction Act, for example. About half of all projects included in the Act were announced before it was passed.

Ms. de Rugy’s complaint seems ever more desperate. The private green market may or may not have been “booming,” but is that a reason not to invest in green? She objects to government aid for anti-global warming electric vehicles because rich people own them (though average workers build them).The private green market was booming even before the subsidies. The remainder of those subsidies overwhelmingly benefit affluent consumers of electric cars and other Biden-favored products.

The president’s low approval rates are not related to reality but more to the relentless naysaying from extreme right-wingers like Ms. de Rugy. When you keep pounding people with the message that things are awful, they tend to believe it.Taken together, these facts can help explain the president’s low approval ratings and the American people’s overall pessimism about the economy’s direction.

With so many working people feeling pinched, who can blame them?

JUST SOME OF BIDEN’S ACCOMPLISHMENTS DESPITE THE EFFORTS OF THE GOP

1) $1.2 trillion infrastructure package 2) $1.9 trillion COVID relief deal 3) Highest appointment of federal judges since Reagan 4) Halt on federal executions 5) Rejoined the international Paris Climate Accord 6) Mandated converting the federal fleet to zero-emission vehicles. 7) Support for transgender service members. 8) Reduced unemployment. 9) Strengthened QUAD alliance with the U.S., India, Australia, and Japan. 10) Student loan debt relief 11) Used the Russia/Ukraine war to strengthen NATO, which Trump tried to weaken. 12) Imposed crippling sanctions on Russia 13) Fought Saudi’s oil price increases by releasing 180 million barrels of oil from the country’s Strategic Oil Reserves. 14) Pardoned people convicted of a federal marijuana charge 15) Respect for Marriage Act 16) Prevented the rail strike and gave workers a significant raise. 17) Passed Government Funding Bill 18) Got us out of Afghanistan, ending years of American deaths. 19) Expanded healthcare. 20) Defended Obamacare 21) Negotiated lifting the debt limit to prevent an economic disaster 22) Rejoined UNESCO 23) Lowest unemployment in years 24) Massive job creation 25) COVID-caused inflation dropping

Considering that unemployment is at historic lows and GDP is at historic highs, consumers’ biggest problem is the COVID-caused shortages causing in inflation. Without the obstinacy of the right-wing, Biden could have passed even more consumer benefit programs to “unpinch” working people. And yes, that would have increased federal spending, a good thing. It would have grown GDP further.Federal Spending + Nonfederal Spending + Net Exports = GDP

Those T-securities don’t cover anything. The government never touches the dollars that purchase T-bills, T-notes, and T-bonds. Though Sen. Durbin has been in Congress for over 26 years, he still does not comprehend the difference between federal and personal finance.September 22, 2023, Dear Mr. Mitchell,

Thank you for contacting me about the Fiscal Responsibility Act (P.L. 118-5). I appreciate hearing from you.

The debt limit is a statutory limit on the amount of debt the federal government may incur. When government expenditures outpace revenues, the Treasury may issue debt to cover the shortfall.

Why would an entity having the infinite ability to create dollars ever “need to borrow money?” It doesn’t.Government spending and revenues vary by month, and even if the government has a surplus for the year, it may need to borrow money to cover a shortfall at some point during the year.

The federal government never needs to default. Only foolish actions by Congress and the President can force the government to default.On May 26, 2023, Treasury Secretary Janet Yellen projected that without action from Congress, the federal government would be unable to meet its obligations and subsequently default on June 5, 2023.

Default would have crashed the economy and impeded the government’s ability to make payments to Social Security and Medicare recipients, military personnel, veterans, federal employees, defense contractors, state governments, and our bondholders.

Notice that Congress can raise the meaningless debt limit merely by deciding to do so.On May 27, 2023, President Biden and Speaker Kevin McCarthy reached an agreement. The Fiscal Responsibility Act avoids default by raising the debt limit through January 1, 2025.

Alan Greenspan: “There is nothing to prevent the federal government from creating as much money as it wants and paying it to somebody.”

There is no reason for the U.S. government to “claw back” anything or to expand work requirements. The government has infinite money. There is no reason, but there is a purpose: To make the rich richer by widening the income/wealth/power Gap between the rich and the rich. The wider the Gap, the richer and more powerful are the rich.This agreement was a good-faith compromise between President Biden and Speaker McCarthy, and it included some provisions that alter several important federal programs, which includes clawing back unspent pandemic relief funding and expanding work requirements for some beneficiaries of the Supplemental Nutrition Assistance Program (SNAP). On June 5, 2023, President Biden signed the Bipartisan Budget Agreement into law.

And, of course, there was no economic reason for the reallocation.This agreement did not include everything I wanted. I am incredibly disappointed in any reallocation of funding to medical research or the National Institutes of Health. However, this agreement is what was required to avoid default.

The whole thing is an exercise in stupidity. If, for some strange reason, Congress and the President wished to reduce spending (a reduction that mathematically would force a recession or depression), Congress and the President merely could stop spending. Period.I also have joined Representative Brendan Boyle of Pennsylvania to introduce the Debt Ceiling Reform Act (S. 1882), which would take the threat of default off of the table in the future. This bill would permanently end the weaponization of the debt ceiling by giving the Treasury Department the authority to continue paying the nation’s bills unless Congress submits a resolution of disapproval, which would need to be signed by the president.

The full faith and credit of the United States is not a bargaining chip, and it should not be used to enact any party’s extreme agenda. The Debt Ceiling Reform Act has been referred to the Senate Committee on Finance.

If he wants to “protect and enhance federal programs, he should learn Monetary Sovereignty. After 26 years, it’s about time he learned at least this fundamental truth: The federal government cannot unintentionally run short of U.S. dollars. It has infinite dollars.Now that we have avoided the default crisis, we must look to passing our twelve regular spending bills through regular order. I will be sure to keep your views in mind as we develop these spending priorities, and I will continue working to protect and enhance the federal programs on which American families rely.

That didn’t work for Stephanie Kelton; I wonder whether it would work for me. Rodger Malcolm Mitchell Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm MitchellThank you again for contacting me. Please feel free to stay in touch.

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY