The debt hawks are to economics as the creationists are to biology. Those, who do not understand monetary sovereignty, do not understand economics. Cutting the federal deficit is the most ignorant and damaging step the federal government could take. It ranks ahead of the Hawley-Smoot Tariff.

======================================================================================================================================================

Some states are so deep in debt, it is all but impossible for them to extricate themselves. Illinois, for instance, has proposed a massive tax increase on individuals and on business. The result will be that individuals and business will flee the state, making even more tax increases “necessary.”

As I’ve posted earlier, it is arithmetically impossible for a monetarily non-sovereign government (as are all the U.S. states and the euro countries) to survive long-term, on taxes alone. (See: Why the states are in financial trouble) They need money coming in from outside their borders, either from exports, tourism or federal subsidy.

Since all states can’t be net exporters or tourist Meccas, they need money from the federal government, which being Monetarily Sovereign, has no difficulty supplying.

Now read an excerpt from an article posted in the “naked capitalism” blog:

(From) an article today in Pensions & Investments: Former House Speaker and possible GOP presidential contender Newt Gingrich is pushing for federal legislation giving financially strapped states the right to file for bankruptcy and renege on pension and other benefit promises made to state employees…

So rather than assist the states by, for instance, giving each state $1,000 per resident, which would stimulate the entire U.S. economy, and which the federal government easily can do, a leading politician wants to solve the problem by destroying the retirement plans of state employees.

I’ve been at this for more than 15 years, and this idea, in addition to being unconstitutional, ranks near the top of the “Clueless-Heartless” scale.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

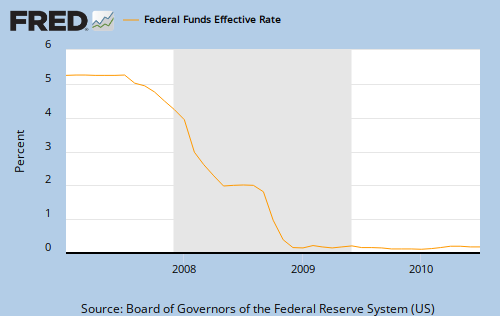

No nation can tax itself into prosperity. Those who say the stimulus “didn’t work” remind me of the guy whose house is on fire. A neighbor runs with a garden hose and starts spraying, but the fire continues. The neighbor wants to call the fire department, which would bring the big hoses, but the guy says, “Don’t call. As you can see, water doesn’t put out fires.”