As the terrified woman attempted to get away, AS SHE WAS ORDERED TO DO, first, in panic, she backed off to get a better turning angle. Then she turned her wheels to go down the street, not at the ICE agent. She was trying to leave.

That is exactly what you would do if you are trying to get away from a crazed, armed, screaming man trying to wrench your door open.

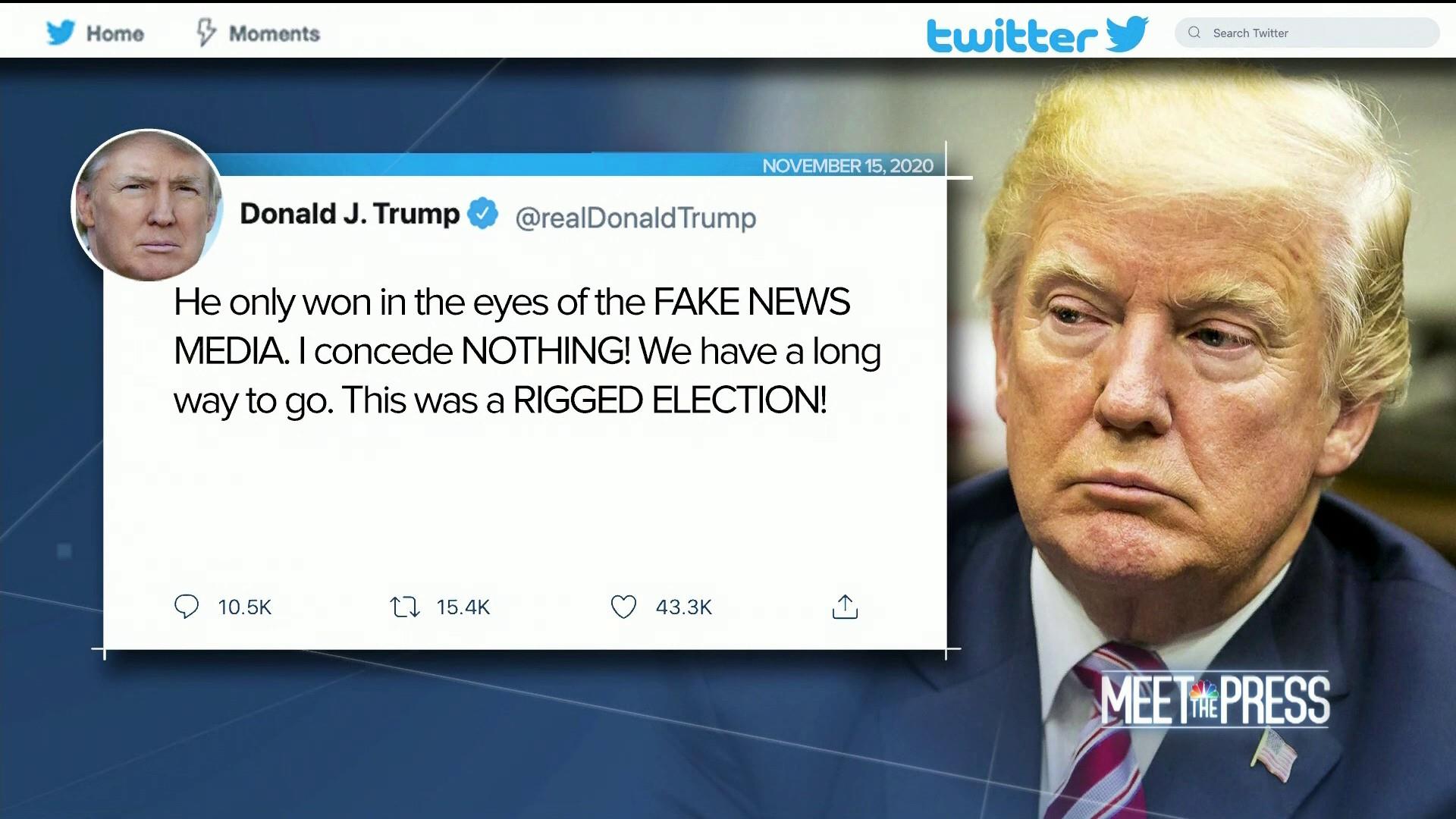

Lying Donald Trump, before any investigation, immediately called the victim a “terrorist” — the usual Trump bullshit. Idiot Noem did the same.

An out-of-control ICE predictably gunned her down. If the agent thought he was in danger, wouldn’t he have moved sideways to avoid contact? He didn’t, because he knew he was safe.

So, he stood his ground, and as the car went by, he shot into it, a clear violation of the law.

And then, they left her there to die, rather than trying to treat her.

This is not the first, nor will it be the last, innocent American arrested, brutalized, and/or murdered by Trump’s Gestapo.

These agents have been told they have “absolute immunity” to do anything they wish, and Trump will pardon them as he did with the 1/6 convicted criminals.

One wonders how many ICE agents are former Proud Boys.

Here are just a few of the thousands of comments made after seeing the video of Trump’s Gestapo murder an innocent American woman. You can see the full list here: Comments on the differing accounts of the incident between the ICE agent and Renee Nicole Good as described in the article:

Highlights

The comments overwhelmingly express outrage and disbelief at the incident involving the ICE agent and Renee Nicole Good, with many asserting that the video evidence clearly shows an unjustified shooting, contradicting official accounts from President Trump and Homeland Security…Show more

You say the video “raises questions” about the government’s account of what happened. No, the video utterly disproves it.

It’s weird how you never hear about the Proud Boys anymore. It’s almost like they all got jobs working for ICE.

Frame by Frame MURDER of an unarmed civilian.

There’s no question now. ICE murdered an American citizen.

She wasn’t trying to kill the agent. Propaganda is one thing but when you just straight up lie about a video everyone can see….

A frame-by-frame analysis of video footage raises questions about claims by President Donald Trump and Homeland Security Secretary Kristi L. Noem.

No, it shows no such thing. It does not ‘raise questions.’ Instead, it shows that the ICE officer is a MURDERER, and that both Noem & Trump are blatant LIARS.

This is a regime run by liars, of course they lie.

Manslaughter murder. IT IS ILLEGAL to fire on a fleeing vehicle, though whether it was actually fleeing or trying to follow confusing directives is yet to be known. Either way there was no legal justification for her death. Period. It is murder.

“The Party told you to reject the evidence of your eyes and ears. It was their final, most essential command.”

I have observed these videos at least 10 times! These ICE goons attempted to pull this woman out of her SUV. She backed up her SUV and turned the wheels in an attempt to go down the road! The ICE goon then fired three point blank shots with his 9mm Glock pistol killing the driver! A physician in the crowd tried to administer aid to this poor woman and the same ICE agents blocked him for providing aid to the woman! It was murder!!!

Cruelty is always the common thread that unites the people behind this madness… Blow up unarmed injured people clinging to boat wreckage, then blame the victims for their fate. Murder a fleeing unarmed protester, then blame and defame her afterwards. Never mind these victims have families and loved ones. Just blame the victims and accept zero accountability.

Clearly the agent was not on front if the shooting was from the side.

The ICE guy will get off criminally. But let’s hope he is sued for everything he has and his life is miserable. This guy assassinated this lady. We all know it.

The fact that they banned a Doctor to tend to Renee is inhumane.

The ICE agent should have shot the car tires.

The government is lying to us.

Where is the killer?

“Raises questions?” It’s more than obvious that the ICE agent was not in harm’s way, and that he was poorly trained. Get the license plate number and stop and question later.

Cold-blooded murder.

“““““““““““““

Gee now who would have thought that both of them lied and immediately went into spin mode and labeling it as a riot and domestic terrorism.

Second degree homicide. Victim was attempting to leave the scene not ram the agent. But the impulsive use of deadly force is what happens when you hire J6 insurrectionists and give them impunity. It is called a militia.

What is the agent’s name and when will he be arrested? That’s all we need to know. Find that out for us.

But Trump said the agent was RUN OV-ah!

If YOU voted for Trump, YOU share the blame.

🍊——-“You KNEW I was a snake, when you took me in”.

The Kristi Noem cowboy hat press conference was repulsive. I can see why native tribes banned her from tribal lands in South Dakota. She’s a national disgrace.

An obvious act of murder to me as a Brit thousands of miles away.

We are living in a police state. It took less than a year for Trump and Miller to accomplish their goal. We are moving closer and closer to a dictatorship.

It’s called murder. He murdered her. The video is indisputable. He needs to be arrested and charged. Just awful. Having a badge does not give you permission to go after someone and shoot them when they are leaving a scene. His life was not in jeopardy at all. He is a cold blooded killer. When we learn more about him we will learn he is unfit.

The video does not “raise questions” about the Trump administration’s account, it completely refutes it. Furthermore, photographs show that there’s only one bullet hole in the windshield–that’s because the second and third shots were fired through the open driver’s window. That is only possible if she was already past the shooting agent, whom Trump claims she “ran over.”

This administration lies about everything, as a way of flexing their authority, and…

Show more

A frame-by-frame analysis of video footage, however, raises questions about those accounts.

Why is the Post afraid to call it what it is? Kristi Noem LIED when she said this was an act of “domestic terrorism.” Donald Trump LIED when he said the victim “violently, willfully and viciously ran over the ICE officer.”

Why can’t the Post say quite simply: the President lied when he said… The Secretary of…

Show more

The shooting was completely unnecessary. The driver was murdered.

So Ashley Babbit was a heroic patriot for being shot while attacking Congress on Jan 6 2021 and this American citizen, mother of 3 is a “deranged agitator” for driving AWAY from ICE agent after lawful exercise of 1st Amendment rights? Trump, Noem and Miller are horrid people and we need to be rid of them ASAP!

“When fascism comes to America, it will be wrapped in the flag and carrying a cross”

— Sinclair Lewis

This doesn’t raise questions, it answers them. The clarity of a murder is undeniable.

Impeach Kkkristi ASAP…………

Straight up, Cold blooded Murder of an American citizen. No doubt about it.

Even if she was trying to hit the officer with her car (she clearly wasn’t), why did he need to shoot her? He had moved out of the way.

ICE is completely out of control, a federal agency that thinks it’s above the law.

The diagrammed videos are helpful. But please fix your headline. Tell the uncoated truth: their claims are outright lies. And they didn’t even pretend to conduct an investigation first.

Despite what a few loud, indoctrinated voices might claim, the vast, vast majority of this country is grieving and raging, and you have a responsibility to tell the precise truth.

This is state sponsored murder and thecage t should be prosecuted.

Kristi Noem needs to be fired. Not only is she creating terror in the streets of our cities, she is a liar. She is a sociopath seeming to enjoy the cruelty. Other presidents were far more effective at removing criminals and undocumented immigrants. But they did it legally, going through the courts, giving people due process before they were sent back to their home countries. They didn’t grab people off the street and deport even US citizens or send people to gulags where they could be…

Show more

Why is the Executive assumed to be an expert in law enforcement analysis ?

He has absolutely no training or education in these matters

How does this administration find so many willing liars? Oh, right. They weren’t hired for their character but because they have none.

Pam Bondi will investigate… OK she’s done.

The Post is actively helping Trump push false accounts of this and other incidents. I was proud to be a Post carrier during Watergate. You lie now. Your management are bad people.

This murder is on you, Mitch McConnell.

Because you failed to do the right thing in 2021, Renee Nicole Good is dead, and her three children will grow up without their mother.

There is not a question by anyone who has watched the murder video. Ice are the domestic

terrorists.

The ICE agent who shot her emerged from the ICE vehicle, walked resolutely up to the woman’s SUV; she yelled, “No! No!” and tried to pull out around another vehicle, whereupon the ICE agent put his hand in her windows & quickly fired three shots in rapic succession. She was killed instantly. When a surgeon walked up & asked to check the woman for vital signs, the ICE agent clearly says, “No.” The surgeon tries again to help the woman, but the agent clearly says, “I don’t care.” Even…

Show more

If you showed the video to Trump and told him the guys with guns were Antifa, he would blast THEM as cold-blooded domestic terrorists. This administration is just a national nightmare that we cannot wake up from, and gets worse every day.

Mrs. Good was an ICE watcher. ICE knew this, and from their tactics in other cities its pretty plain to see that they coordinate their response to those who would film them.

I believe, but cannot prove, that this “agent” wanted the action. He wanted to go home and tell is buddies about how he owned the libs.

It was murder, and this coward can spend the rest of his life with Derek Chauvin.

None of them ran to her car to help her or to get her aid after shooting her three times. They just walked away to make their phone calls and do whatever.

They murdered an American

Their leaders are lying to us as if we were blind

The “domestic terrorists” are Trump and Noem themselves.

Proof positive the are responsible for state sponsored murder. Now, three kids have no parents.

Would it kill the Post to do a journalism and just say the President of the United States lied about the murder of an American citizen?

Last night I watched FOX new reporting on this. Everybody and their brother that was on was shouting about the radical left, how the driver did this to herself by not following “orders”, how the agent was right in opening fire as he was obviously in fear of his life (even as the vehicle passed him, he continued to fire), how these poor thugs (agents) are bullied every day and on and on and on. I could only sit and wonder how so much hate and lies fill our media and how so many people…

Show more

50K sign up bonuses. 100K + salaries. 25K Christmas bonuses.

They all look the like January 6 types. Overfed and lawless.

As a retired federal agent with 30 years of service including the investigation of agent involved shootings, my opinion is as follows. The woman may have made mistakes. But the video shows she did not have an apparent intent to hit anyone and was not accelerating at a high rate. The agent could and did avoid being hit by the car. His training at FLETC would NOT support firing his weapon in this situation. Instead, in the hyped up militaristic atmosphere that prevails around the…

Show more

Why would anyone be surprised by Trump’s claim that her car “ran over” an ICE agent when the video shows the car barely touching him, if at all, and the wheels are pointed away from him to avoid contact? This is the same guy who watched the January 6 insurrection unfold live on national television and then told us it never happened. With a straight face.

At what point does the pattern become obvious to his supporters? What do they see that the rest of America doesn’t? He lies…

Show more

Why are ICE always masked up, this is what government agents do in fascist countries, it should be prohibited also shooting women in the face.

A police officer does not simply get to execute you because they are unhappy.

If the victim had truly been a domestic terrorist, Trump would have pardoned her.

Trump and Noem lied — ICE murdered an innocent woman and orphaned a child.

These fascists may be able to act with impunity today but the Republicans won’t always be in power. Justice will come.

Praying for the victim’s loved ones. Heartbreaking.

Just say they lied. What is wrong with you? Why can’t you just say they lied?

The “ICE agent and Renee Nicole Good” video clearly shows an unmarked gray SUV driving up to the SUV of an unarmed woman in a black SUV, and a uniformed man with a gun — who does not show his official credentials — jumps out of the unmarked SUV and at gunpoint orders an unarmed US Citizen who just dropped her 6-year-old child off at daycare to get out of her SUV. When the 37-year-old mother of three does not obey the unidentified gunman but instead tries to drive away to safety the…

Show more

Let’s be honest. ICE is / has become a rogue paramilitary force comprised of barely trained, heavily armed maga adherents. They have been unleashed on the populations of “blue” states and cities to cause chaos, sow fear, and intimidate. They have become the Trump administration’s version of Iran’s “Revolutionary Guard.” We must disband ICE now. None of us is safe until ICE is abolished.

Next thing we know Crusty and company will doctor the video.

It’s almost like Naz-is are famous for killing innocent people, or something like that.

There is no question that Noem and Trump et al lied. They all deserve to be thrown in jail and be tried for murder.

Raises questions about their claims??? No, it shows they’re outright lying and trying to gaslight the country.

Ms. Good was not a criminal, not illegally here, and not a threat. The only threat seen is this administration. She was killed in cold blood and they also delayed her help. God help us all, because we all will be next. On top of this administration being at fault, every single donor and supporter have blood on their hands too. This is on all of them.

It’s about time we know who ICE are. OUR tax dollars are paying their salaries and benefits. It’s disgusting!

Republican-controlled government results in the murder of Americans in cold blood. They follow-up with lies and propaganda to hide their culpability. Very unsurprising. Very expected. Very Republican.

“Raises questions.” Just say it – Trump lied. Noem lied.

She was legally filming agents. She lived in that neighborhood. She was trying to go home and avoid possible violence. Her vehicle did not strike the man. Her front wheels were veered to the right. The agent was in no legitimate danger. He initiated the violence. This was a cold blooded killing of an innocent person. He must be punished. The Trump Administration is lying. The agent did not need or seek medical treatment. He walked away and showed no remorse.

The ICE agent appears to have been neither hit by the SUV nor was, quite obviously, ever in any danger. He fired the moment the car started moving. The vehicle wasn’t even traveling at walking speed at that point, and two simple steps to the side were enough for him to then fire two more shots from the side. These were therefore by no means defensive shots, but cold-blooded murder of a mother of three.

First–if you truly believe the person driving a car is a threat, you would never walk/stand in front of the running vehicle.

Second–if the driver of the car pulls away and you were mistakenly standing in front of it, it is easy to avoid the vehicle by stepping aside (which is what the ICE agent did.)

Third–once out ot the way of the vehicle, you note the license plate number and contact the “real” police to follow up

Absolutely no…

Show more

That wasn’t self-defense. That was murder. Charge that ICE officer.

The victim was ordered to get out of the car. Instead she attempted to drive away. The ice officer was on the left of the car and was moving toward the front of it to stop the victim from driving away. The victim attempted to turn her car to the right to avoid the officer and drive away. If she were trying to hit the officer with her car, she would have turned to the left. The officer was not in any danger. This was not self defense.

I am hoping that this incident is Trump’s version of the Kent State murders at a Vietnam War protest. This administration is going to face a huge backlash over this. I hope we haven’t given up yet.

this is what happens when you recruit gun obsessed cosplayers as a private army

The Testerone Administration. Inevitable and yet heartbreaking.

A frame-by-frame analysis of video footage raises questions about claims by President Donald Trump and Homeland Security Secretary Kristi L. Noem.

Raises questions??? They lied. Plain and simple.

Nothing stops the State of Minnesota from arresting those involved and charging them with murder. They should do do quickly.

This was awful to see. The reality that ICE is out of control is quite obvious. The government claiming she was the aggressor, once again tells “US” to believe what they say. Do Not believe what you see with your own eyes. Not to worry our MSM will soon be State TV and tell us what to think.

Having practiced as a criminal defense attorney for 20 years I can say with confidence that if a civilian killed someone in this manner they would be charged and almost certainly convicted of first degree murder.

The local police should be investigating this as a homicide if they are not already.

A voice can be heard saying to “get out” of the car at least two times. Hmm – that is not an accurate quote. ‘Get out of the f-ing car’ was what was said. We have eyes AND ears. Hard to say the shooter was run over when he was on his feet and moving before, during and after. He was also able to tug up his mask to hide more of his face when witnesses shout ‘shame’ as his as he walks away and does not render aid. Let’s be truthful.

No WAPO, there are no questions; the video shows Trump and his cronies are outright lying. WAPO has become a Trump administration mouthpiece.

What I want to know is where is the shooter this morning? Why was he not placed under custody yesterday?

The NYT lead article says the video “contradicts” claims by the Trump administration. This WP article says the video “raises questions” about the administration’s account. One represents responsible journalism; the other, pathetic cowardice.

I’m anticipating Karoline Leavitt’s press conference where she says the officer was obviously run over and the video is a Democrat hoax.

“I watched the one woman screaming, the one woman in the car before she got shot I heard was unbelievably bad, badly behaved,” Trump told the reporters. “You’re supposed to listen to law enforcement.”

Like JANUARY 6??????????

Murdered while merely getting out of the way.

This sequence is heart wrenching. This “officer” appears to have no hesitation in killing a citizen. He is pulling his gun, it appears, before the vehicle moves, and the movement is to turn away from him. If ICE hides him and his identity and refuses to allow his prosecution in Minnesota, it will be proof beyond doubt that Trump-Noem consider their thugs above any law. ICE must be abolished.

The NYT has a much more detailed analysis of the videos. See for yourself whether the federal agent was justified in shooting Ms Good.

This is what Orwell warned about in 1984. Don’t believe what you see with your own eyes. Only believe what the government tells you happened.

I remember when the Washington Post used to actually call trump’s lies lies.

When the first shot is fired, it is clearly visible that both feet of the shooter are to the left of the front fender.

The SUV could not have been headed toward the killer when the first shot was fired.

However, facts are not relevant to true Trump believers. They will believe whatever they are told by their great leader.

More brutish action by the bully Brown Shirts.

This is murder. Pure and simple.

It’s very clear. This was a murder by a goon masquerading in law enforcement gear. Anyone who supports Trump sending armed thugs to assault and kill Americans does not understand what it means to be an American half as well as the average Somali immigrant does.

donald trump is murdering people in multiple locations including our own cities. What will it take for congress to step up and defend us?

In the aftermath, Homeland Security Secretary Kristi L. Noem said the woman had committed an act of “domestic terrorism,”

Noem is a domestic terrorist. All ICE agents, to a man, are terrorists. It’s a domestic terrorist organization and they summarily executed an innocent mother of three in the streets yesterday.

The dangerous evil poet and mother of 3 that a hundred ICE agents could barely stop…right. This is why our 2nd amendment is a farce. It allows so called officers of the law to kill us with impunity. The ICE agent is definitely without question a murderer

Differing accounts? ICE agents murdered a woman. They were not in danger, her intent was not to harm, but to escape the gestapo like tactics.

As the SUV passes the ICEstazi, it is turning to the right. Obviously there was no attempt to injure anyone.

Except by the shooter.

This ICE monster needlessly murdered this poor woman . Full Stop . Anyone with eyes can clearly see it. Trump and Noem’s gaslighting and lies about what happened is grotesque and is just another reminder on how despicable these people are . If they can lie and gas light in the open like this, can you imagine what they are doing behind closed doors ??? It’s Trump first and America last . Wake up people . Don’t ignore the facts over your loyalty to these heartless and corrupt people in the…

Show more

None of the ICE agents appeared to be bothered that they had just killed someone.

Seventy seven million Americans. Seventy seven million! Watched the first go round. Saw the Capitol breached. Saw a Confederate flag fly in the Rotunda. Saw police officers being beaten with the American flag.

And voted for this. Voted for THIS!

The country in which I was born, the one I loved despite its many flaws, is gone. Dead. If one of you reading this is among the 77 million – this blood is on your hands. It should be on…

Show more

Murder………………….

Has the ICE agent been arrested and charged with murder? He should be.

If they had been dressed as law enforcement, this never happens. If they were actually police, she would have gotten out of her car. No question.

There is no way I would obey masked men in body armor in an unmarked vehicle. No rational person would. I would escape and find a real cop.

This was murder, designed to take the nation’s mind off Epstein. It did not work….release the files.

A frame-by-frame analysis of video footage raises questions about claims by President Donald Trump and Homeland Security Secretary Kristi L. Noem.

Does it raise questions or does it show that they lied??????

After listening to Kristi Noem speak with the indifference and depravity she has toward human beings, it’s now easy to understand how easy it was for her to shoot her dog.

This is murder, plain and simple! It should be very clear to everyone that orange king’s Gestapo is not just a threat to immigrants but US citizens as well. Hiring standards have been lowered to get in more Gestapo agents, thanks to the big ugly bill which will lead to more racists, neo-Nazis, proud boys etc joining the ranks. I will not be surprised if there are more incidents like this in the future.

Trump and Noem are complicit in murder.

…Noem said the woman had committed an act of “domestic terrorism,” first disobeying officers’ commands and then weaponizing her SUV…

This administration uses the words ‘terrorism’ and ‘weaponizing’ as get out of jail free cards. They those words to justify any action they want and brook no argument. They think it’s magic. It’s not.

The video doesn’t “raise questions” about the government’s account of the shooting. More wishy-washy language from WaPo. It shows that Trump, Noem and ICE were willing to jump in with bald-faced lies to the public before they had all the facts.

The officer makes no apparent attempt at jumping out of the way, suggesting he felt no personal threat. Does anyone trust the FBI to investigate without prejudice? Our Federal Government is lying about the shooting. They have become tyranny.

A freeze frame in the New York Times clearly shows this murderer had his gun drawn before the victim started pulling forward. His intent is undeniable. However, the claim will be he “thought” his life was in danger. Isn’t that always what law enforcement says? But we all can see that is bogus nonsense.