Are you safer now? Have Trump’s efforts to rid America of immigrants made you feel better about your country and your own life?

Do you agree with the current deportation efforts?

I’ve been wondering why immigrants are seen as a threat.

1 They are less likely to commit crimes than are citizens

Research has consistently found that undocumented immigrants tend to have lower crime and incarceration rates than U.S.-born citizens.

Immigrants are 30 percent less likely to be incarcerated than are U.S.-born individuals who are white, the study finds. And when the analysis is expanded to include Black Americans — whose prison rates are higher than the general population — the likelihood of an immigrant being incarcerated is 60 percent lower than of people born in the United States.

Analyses of arrest and incarceration data show native born citizens have higher rates of arrest and incarceration for violent, drug, and property crimes than immigrants, including undocumented immigrants.

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Most of that amount, $59.4 billion, was paid to the federal government while the remaining $37.3 billion was paid to state and local governments.

Undocumented immigrants paid federal, state, and local taxes of $8,889 per person in 2022. In other words, for every 1 million undocumented immigrants who reside in the country, public services receive $8.9 billion in additional tax revenue.

More than a third of the tax dollars paid by undocumented immigrants go toward payroll taxes dedicated to funding programs that these workers are barred from accessing. Undocumented immigrants paid $25.7 billion in Social Security taxes, $6.4 billion in Medicare taxes, and $1.8 billion in unemployment insurance taxes in 2022.

At the state and local levels, slightly less than half (46 percent, or $15.1 billion) of the tax payments made by undocumented immigrants are through sales and excise taxes levied on their purchases. Most other payments are made through property taxes, such as those levied on homeowners and renters (31 percent, or $10.4 billion), or through personal and business income taxes (21 percent, or $7.0 billion).

Six states raised more than $1 billion each in tax revenue from undocumented immigrants living within their borders. Those states are California ($8.5 billion), Texas ($4.9 billion), New York ($3.1 billion), Florida ($1.8 billion), Illinois ($1.5 billion), and New Jersey ($1.3 billion).

In a large majority of states (40), undocumented immigrants pay higher state and local tax rates than the top 1 percent of households living within their borders.

Income tax payments by undocumented immigrants are affected by laws that require them to pay more than similarly situated U.S. citizens. Undocumented immigrants are often barred from receiving meaningful tax credits and sometimes do not claim refunds they are owed due to a lack of awareness, concern about their immigration status, or insufficient access to tax preparation assistance.

Providing work authorization to undocumented immigrants would increase their tax contributions, both because their wages would rise and because their tax compliance rates would increase.

Under a scenario in which work authorization is provided to all current undocumented immigrants, their tax contributions would rise from $ 96.7 billion to $136.9 billion per year. Most of the new revenue raised in this scenario ($33.1 billion) would flow to the federal government while the remainder ($7.1 billion) would flow to states and localities.

3 They do not receive the benefits (Social Security, Medicare, etc.) of paying those taxes

Most people who pay into the tax system also get access to various government programs and tax benefits.

However, undocumented immigrants who pay taxes are often not eligible for the same tax benefits as US citizens. Undocumented immigrants are not eligible for Social Security retirement benefits or health insurance through Medicare (PDF), for example, even though they contribute billions of dollars to the federal payroll taxes that fund these benefits.

Though most undocumented immigrants are employed, they are more likely to have lower household incomes.

In theory, this means they’d be more likely to qualify for the federal earned income tax credit (EITC), which helps families with low incomes get a tax break.

However, to claim the EITC, the tax filer, their spouse, and their qualifying children must each have a valid SSN.

If an undocumented immigrant with children who are US citizens files their taxes with an ITIN, the entire family cannot claim the EITC.

Compared with native-born Americans, documented and undocumented immigrants combined pay more in taxes than they use in government benefits.

Over her lifetime, an immigrant who arrived in the US at age 25 and did not graduate high school will pay net $200,000 more in taxes than what she will receive in government benefits.

4 They do the least appealing, drudgery jobs (field labor, maids, dangerous, etc.)

The major occupations with the highest shares of unauthorized immigrants were farming (24%), construction (19%) and service occupations (9%).

5 They command the lowest wages

The unadjusted hourly wage gap between undocumented workers and natives is very large — around 40 % lower on average. After adjusting for factors like education and experience, a significant portion of that gap remains, indicating a wage penalty associated with undocumented status.

A government-reviewed summary (Federal Register) reports studies estimating that: Undocumented workers earn on average 4–6 % less than otherwise similar documented noncitizens.

Another government study shows wage penalties of 12–24 % in occupations where legal documentation matters.

6 They can’t vote.

Despite President Trump’s wild, unsupported claims of a “stolen” election, with undocumented aliens as one group of culprits, the facts tell otherwise.

18 U.S. Code § 611 — Voting by aliens “It shall be unlawful for any alien to vote in any election held solely or in part for the purpose of electing a candidate for the office of President, Vice President, Presidential elector, Member of the Senate, Member of the House of Representatives… unless…” (very limited exception).

Any person who violates this section “shall be fined under this title, imprisoned not more than one year, or both.”

A review by the Brennan Center for Justice examined cases over many elections (e.g., review of 23.5 million votes in 42 jurisdictions in 2016) and found only about 30 incidents of suspected noncitizen voting — about 0.0001 % of ballots cast.

In states with systematic checks, such as Georgia, audits found no confirmed cases of noncitizens voting despite years of investigation.

After the 2024 election in Iowa, a certified review found that 35 noncitizens voted out of the 1.6 million ballots cast — a tiny fraction of the total.

If widespread deportation were about economics, it would be insane. From a cold, spreadsheet-only view, undocumented immigrants are extremely useful to the U.S. economy:

They work disproportionately hard, dangerous, and undesirable jobs. They accept lower wages, which lowers agricultural costs. construction, food processing, elder care, and hospitality. They pay billions in taxes (sales, property via rent, payroll via ITINs).

They consume goods and services, boosting GDP. They don’t vote. They don’t qualify for most benefits. They commit fewer crimes than citizens.

If immigrants were “robots,” they’d be the most efficient robots capitalism could invent: productive, cheap, compliant, and politically powerless.

So, economics does not explain deportation drives.

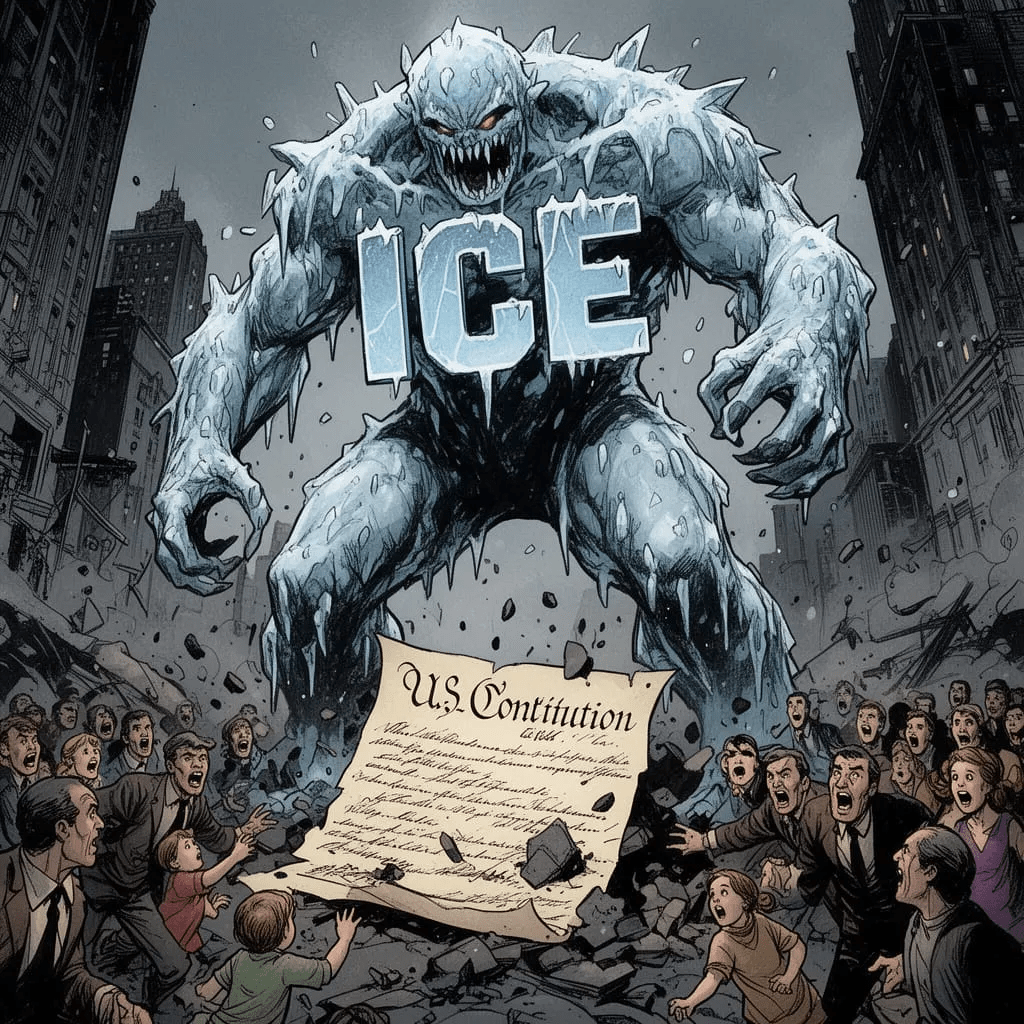

Mass deportation exists because immigration is one of the most effective fear-based political levers ever discovered.

It works because immigrants are visible; they often don’t speak perfect English; they can’t defend themselves politically; they’re easy to portray as an invading “other.”

They serve as convenient scapegoats for various bigoted narratives. Throughout history, every dictator has blamed scapegoats during his rise to power, promising to eliminate them from the land.

Undocumented immigrants trigger fears like:

“People like me are being replaced.”

“My culture is being diluted.”

“I followed the rules; they didn’t.”

“They’re getting something I’m not.”

A dictatorship requires four groups:

I. The unscrupulous leader who is shameless, comfortable with cruelty-by-proxy, indifferent to inconsistency, doesn’t care whether followers believe his lies — only to repeat them.

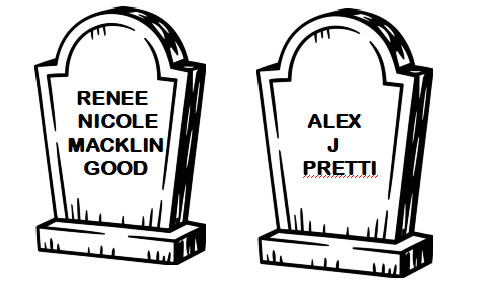

II. A politically powerless group that cannot vote or organize effectively. lacks institutional defenders and can be punished without political cost. (Historically: Jews, intellectuals, gays, “counter-revolutionaries,” etc., depending on time and place.) Powerlessness is more important than difference. Any difference just makes the targeting easier to sell.

III. Fearful, anxious, status-threatened followers. Fear collapses moral nuance and makes blame righteous. Once fear is engaged, evidence becomes irrelevant. Loyalty becomes the currency.

“Gap Psychology” is the key: people don’t just want security; they want relative position. They wish to distance themselves from those below (“At least I’m not them”) and identify upward (“I’m closer to the winners than the losers”)

Authoritarian leaders exploit this by offering symbolic elevation: “You may be struggling — but you are better than they are.” People will vote against their own economic interest if it preserves perceived rank.

That is why cruelty becomes performative; punishment becomes satisfying; humiliation of the out-group becomes entertainment.

IV. Weakened guardrails: Courts that can be stacked, ignored or manipulated, gerrymandering, election fraud, media that can be discredited, norms that can be mocked, and laws enforced selectively.

Do you recognize all of the above in America? Do you recognize it in anyone you know?

Rodger Malcolm Mitchell

Twitter: @rodgermitchell

Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell;

MUCK RACK: https://muckrack.com/rodger-malcolm-mitchell;

……………………………………………………………………..

A Government’s Sole Purpose is to Improve and Protect The People’s Lives.

MONETARY SOVEREIGNTY