An alternative to popular faith

Popular faith holds that the federal debt is a ticking “time bomb,” ready to explode into inflation and high interest rates, and destroy our economy. Here are a few references, beginning 70 years ago. Note that the language remains the same, down through the years — repeated predictions of a disaster that never seems to come.

Even with the end of the gold standard in 1971, arguably the most significant economic event since the Great Depression, the debt-hawk language never changes — as though 1971 were a non-event.

Sept 26, 1940, New York Times: Deficit Financing is Hit by Hanes: ” . . . unless an end is put to deficit financing, to profligate spending and to indifference as to the nature and extent of governmental borrowing, the nation will surely take the road to dictatorship, Robert M. Hanes, president of the American Bankers Association asserted today. He said, “insolvency is the time-bomb which can eventually destroy the American system . . . the Federal debt . . . threatens the solvency of the entire economy.”

Feb 11, 1960, New York Times: Mueller Assails Rise in Spending: The enormous cost of various Federal programs is a time bomb, threatening the country’s fiscal future, Secretary of Commerce, Frederick H. Mueller warned here today “. . . the accrued liability is a ticking time bomb. Some day someone will have to pay.”

Oct 4, 1983 Evening Independent – The United States and the developed world face a “ticking time bomb” because of the huge foreign debt involving loans to Third World nations

Oct 26, 1983, David Ibata: “ . . . home-building officials called for a commission to propose ways to trim the $200 billion federal deficit. The deficit is a ‘ticking time bomb‘ that probably will explode in the third quarter of 1984,’ said Fred Napolitano, former president of the National Association of Home Builders.

Feb 21, 1984, James Warren: “‘We now hear from them (the Reagan administration) that deficits don’t cause high interest rates and inflation,’ AFL-CIO President Lane Kirkland said. ‘If that’s the case, we’ve suddenly discovered the horn of plenty and should stop worrying and keep borrowing and spending. But I don’t believe it. It’s a time bomb ticking away.”

January 12, 1985, Lexington Herald-Leader (KY):The federal deficit is “a ticking time bomb, and it’s about to blow up,” U.S. Sen. Mitch McConnell, a Louisville Republican, said yesterday.

Feb 17, 1985, Los Angeles Times: We labeled the deficit a `ticking time bomb‘ that threatens to permanently undermine the strength and vitality of the American economy.”

Jan 5, 1987, Richmond Times – Dispatch – Richmond, VA: 100TH CONGRESS FACING U.S. DEFICIT ‘TIME BOMB‘

November 28, 1987, The Dallas Morning News: THE TICKING TIME BOMB OF LONG-TERM HEALTH CARE COSTS A fiscal time bomb is slowly ticking that, if not defused, could explode into a financial crisis within the next few years for the federal government and our nation’s elderly. The ticking bomb is the growing cost of long-term care.

October 23, 1989, FORTUNE Magazine: A TIME BOMB FOR U.S. TAXPAYERS The government guarantees millions of mortgages, bonds, deposits, and student loans. These liabilities, now twice the national debt, are growing fast.

May 1, 1992, The Pantagraph – Bloomington, Illinois: I have seen where politicians in Washington have expressed little or no concern about this ticking time bomb they have helped to create, that being the enormous federal budget deficit, approaching $4 trillion and growing now at an annual rate of $400 billion per year.

October 28, 1992: Ross Perot: “Our great nation is sitting right on top of a ticking time bomb. We have a national debt of $4 trillion. Seventy-five percent of this debt is due and payable in the next five years. This is a bomb that’s set to go off and devastate our economy and destroy thousands of jobs.

Dec 3, 1995, Kansas City Star: Deficit is sapping America’s strength. Concerned citizens. . . regard the national debt as a ticking time bomb poised to explode with devastating consequences at some future date.

April 14, 2003: Porter Stansberry, for the Daily Reckoning: The baby boomers are heading into retirement with no savings and no productive companies to support them in old age. Generation debt is a ticking time bomb…with about ten years left on the clock.

October 1, 2004, Bradenton Herald: A NATION AT RISK: TWIN DEFICIT A TICKING TIME BOMB: Lawmakers approved Bush’s request without cutting federal spending by a penny, thereby fattening the country’s projected record deficit of $422 billion by another $145 billion next year.

May 31, 2005, Providence Journal, Defusing the Medicare time bomb, Some lawmakers see the Medicare drug benefit for what it is: a ticking time bomb, set to wreak havoc on the budget and shoot future tax rates sky-high.

April 5, 2006, NewsMax.com, “We have to worry about the deficit . . . when we combine it with the trade deficit we have a real ticking time bomb in our economy,” said Mrs. Clinton.

Dec 3, 2007, USA Today: US debt: $30,000 per American. WASHINGTON (AP): Like a ticking time bomb, the national debt is an explosion waiting to happen.

*September 24, 2010, Email from the Reason Alert: ” . . . the time bomb that’s ticking under the federal budget like a Guy Fawkes’ powder keg.”

*July 7, 2011, Washington Post, Lori Montgomery: ” . . . defuse the biggest budgetary time bombs that are set to explode as the cost of health care rises and the nation’s population ages.

[*Added subsequently]

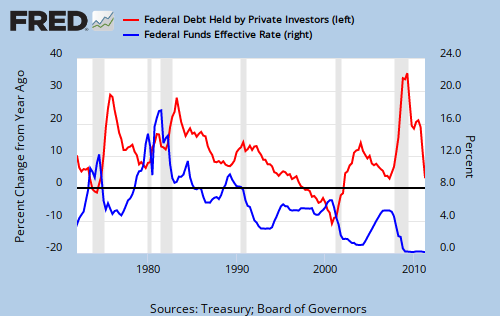

And on and on and on. You get the idea. That time bomb has been on the verge of explosion at least since 1940. Even today, the media, the politicians and sensationalist economists refer to the debt as a ticking time bomb. Please look at the following graph and see if you can find any relationship between deficit spending vs inflation and/or interest rates.

This graph shows there is no predictable relationship between federal deficits vs. inflation and or interest rates.

If the debt is a time bomb, it surely has the slowest fuse in history. The pundits have been wrong, wrong, wrong, all these years. We should understand federal deficits, even large federal deficits, have not caused inflation or any other negative economic effect, and the debt is not a ticking time bomb? It’s an economic necessity. Let us turn away from faith and start to rely on facts.

The faith healers* are killing our economy by restricting money growth. See: The damage done by deficit cuts.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

*Faith is belief without evidence. Science is belief from evidence.