You know what inflation is. Higher prices. That’s simple. So, why do the media, the politicians, and even the economists seem confused by it?

According to my friendly Artificial Intelligence site:

“Inflation describes the general increase in prices of goods and services over time. It can be measured by the average price increase of a basket of selected goods and services over time.”

Measuring is where things get tricky.

The most commonly used inflation indexes are the Consumer Price Index (CPI) and the Wholesale Price Index (WPI). The CPI measures the average change in prices paid by consumers for goods and services, while the WPI measures the average change in prices paid by businesses for goods and services.

According to Investopedia:

“While it is easy to measure the price changes of individual products over time, human needs extend beyond just one or two products. Individuals need an extensive, diversified set of products and services to live comfortably.

They include commodities like food, grains, metal, fuel, utilities like electricity and transportation; and services like healthcare, entertainment, and labor.

Inflation aims to measure the overall impact of price changes for a diversified set of products and services. It allows for a single value representation of the increase in the price level of goods and services over time.

Each person in America has a different set of purchases. A rich man might spend money on a yacht, fine wines, travel, expensive meats, high-end clothing, restaurants, an expensive home, and furnishings.

A poor woman’s purchases will be the opposite. Similarly, a family with young children will spend on different things from a single individual, an old person will spend differently from a young person, and a person with health problems will spend differently from a person with perfect health.

There is no “average person” with average spending.

And then, there is the issue of time. Products change. All electronic products — phones, TVs, music players, etc. have changed significantly. You cannot compare five-year-old phones and TVs with today’s versions. If the price of a phone or a TV changes, is that inflation? Or is it just the price of a different product.

Production systems change. Computerization of production has become more standard. Three-dimensional printing replaces hand-made. Even some homes are being three-dimensionally printed, not to mention the vast differences in home pricing.

Tastes change. Natural fur has been replaced by artificial fur and other materials. Steel yields to composites. Farming methods change. New seeds are more productive than old ones.

In myriad ways, obsolescence affects prices.

If you drive to work while I work from home, you may feel changes in gas prices, car prices, car repair prices, work-clothing prices, and restaurant prices far more than I do.

To distill all those changes — among people, products, and production methods — into one number can be a fool’s errand. Your inflation is different from my inflation.

Inflation is a comparison between the prices of things and the prices of dollars. While determining the costs of what people use is impossible, the money price is even less accurate.

Money can’t be viewed in a vacuum. Its price is mainly related to something else, while the costs of things relate to supply and demand. In one sense, the demand for money is infinite, and the pool is infinite for the federal government but constrained for the economy.

And all that is the source of confusion.

The Fed treats inflations as though they are money supply and demand problems. The reason: It’s all the Fed can control. This reminds one of the old saying, “To a hammer, every problem is a nail.”

To the Fed, every problem involves money supply and demand. Thus, to fight inflation, the Fed increases the demand by raising interest rates, while other Libertarian economists see money supply as the problem. They criticize “excessive federal spending” as causing inflation.

The consensus view among economists is that sustained inflation occurs when a nation’s money supply growth outpaces economic growth.

The Fed and the economists are wrong. Data does not support the intuition that federal spending causes inflation.

Similarly, data does not support the notion that “excessive” money supply causes inflation.

Examples often are given of hyperinflations — Zimbabwe, Germany, Argentina, et al. Massive money creation by the central government provided a cause/effect illusion.

However, in every case, it was shortages of key goods — mostly food and energy — that created the hyperinflations, with the money-creation being a useless government reaction.

Had those governments used their financial powers to obtain or encourage the production of the scarce goods, the hyperinflations would have ended.

Raising interest rates increases the demand for dollars, T-securities, and private debt, both of which are money. This increased demand for dollars increases the dollar’s value, which fights inflation.

Meanwhile, raising interest rates increases the amount of interest the federal government pays, which increases the supply of dollars, an inflationary effect.

Yet contrarily, raising interest rates reduces the demand for private borrowing — mortgages and business borrowing, and is recessive, reducing the demand for dollars. However, the government’s added interest spending increases the economy’s supply of production dollars, an anti-inflationary effect.

In short, the Fed’s myopic focus on interest rates causes numerous opposing effects, which are slight individually but almost non-existent together.

It’s as though the Fed is rowing backward with one oar and rowing forward with the other.

The Effects of Raising Interest Rates

- Increases the demand for dollars by increasing the reward for owning dollars. This makes dollars more valuable and is anti-inflationary.

- Increases the supply of dollars by requiring the Treasury to pay more for its T-securities. This is presumed to reduce the value of a dollar, which is inflationary.

- The added dollars increase the supply of production dollars, which is anti-inflationary.

- Increases the costs of doing business. These costs resemble taxes in that they are passed on to consumers, which is inflationary.

- Increasing business costs lead to recessionary and deflationary profit losses.

- With cost increases, many businesses tend to cut Research & Development, which reduces GDP growth and is recessionary but not anti-inflationary.

The Fed’s focus on interest rates causes numerous offsetting effects; on balance, they are recessionary but not anti-inflationary because none of them address the fundamental cause of inflation: Shortages of critical goods and services.

You don’t need a degree in economics to know that when something is in short supply — i.e., demand exceeds supply — its price will go up. And when many things are in short supply, many prices will increase.

And the word for that is “inflation.”

So, the question becomes, what shortages can cause many prices to rise?

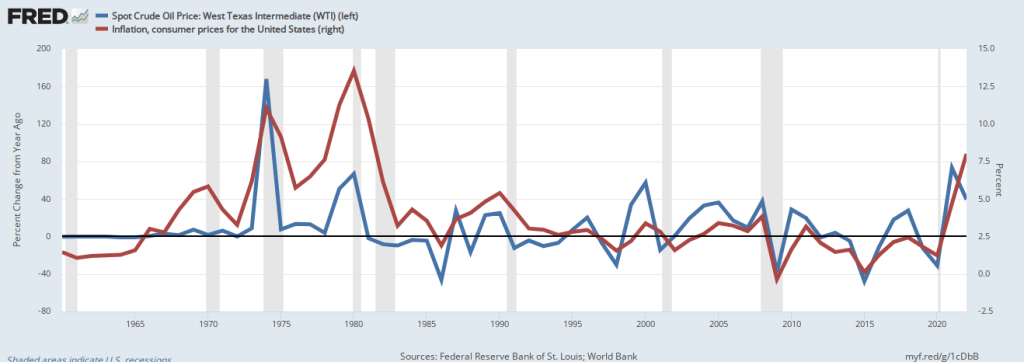

In today’s economy, the one shortage that affects nearly all other products is energy, specifically oil. The cause of most inflations is an oil shortage, and the cure is increased oil production.

The price of oil is reflected in the price of nearly every product and directly reflects the oil supply. Increased prices mean reduced supply and decreasing prices mean increased supply.

Thus, inflation parallels oil prices, which are inverse to oil supply.

Oil shortages are the most critical cause of inflation. Second to oil in price importance is food, a universal need. Food prices reflect weather, oil prices, labor costs, shipping costs, and other production costs. When food prices rise, we have inflation.

Food prices (green) parallel inflation (red).

Ironically, economists use a “core” inflation measure, which omits food and oil prices. I see that as baking a cake without flour and sugar. “Core” inflation misses the two most essential inflation ingredients.

CURING INFLATION

Today’s inflation rightly should be called “the COVID inflation.” It was caused by shortages of oil, food, shipping, lumber, steel, computer chips, labor, and other needs related to COVID-19.

The cure for COVID-caused inflation is to cure COVID and the resultant oil, food, shipping, computer chip, metal, lumber, labor, etc., shortages, all of which is happening now.

Cure the shortages, and you cure the inflation. Period

So, while the Fed will pat itself on the back for curing inflation without a recession, the cure has come from additional oil, food etc., etc. production. The Fed’s interest rate manipulations accomplished very little if anything.

Though the Fed claims among its missions: “To promote maximum employment, stable prices, and moderate long-term interest rates in the U.S. economy,” it can do only one of those. It can “moderate” (whatever that means) long-term interest rates.

The Fed cannot promote maximum employment or stable prices. Those are the jobs of Congress.

We often have compared the Fed to a child sitting in the back seat of a car, spinning a toy steering wheel, and thinking he is steering the car.

Because the Fed cannot control the availability of oil, food, computer chips, shipping, metals, lumber, and labor, it cannot control inflation. Only Congress can.

The false perception persists because the Fed likes the illusory power, and Congress likes avoiding the responsibility.

IN SUMMARY

- Inflation is caused by shortages of key goods and services, most notably oil and food.

- Inflation is not caused by “excessive” federal spending or “excessive” money creation.

- Curing inflation requires curing the shortages that caused the inflation.

- The Fed cannot control the shortages that cause inflation.

- The Fed cannot control inflation via interest rate manipulation.

- Today’s inflation was caused by COVID-related shortages.

- Today’s inflation is being cured by curing the COVID-related shortages.

- Only Congress and the President can control inflation.

Rodger Malcolm Mitchell

Monetary Sovereignty

Twitter: @rodgermitchell Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

……………………………………………………………………..

The Sole Purpose of Government Is to Improve and Protect the Lives of the People.

MONETARY SOVEREIGNTY

This is how I explain inflation.

I have described inflation as the result of those with the power to set and raise prices to impose liabilities on society. Members of society then transfer assets to those with the power to impose liabilities. Those with power to raise prices also have the same liabilities to meet but have more of society’s assets to do so.

Central banks allegedly trying to reduce inflation impose additional liabilities on society covertly through the banking sector by raising credit costs. Again more of society’s assets are transferred to the banksters.

With the declining bargaining ability of non-unionized workers — the neoliberal agenda again — the balance sheets of workers and those with the power to change prices both change.

Assets minus liabilities equal equity (wealth) or

Money minus debt equals wealth.

So inflation and the means of fighting it cause many of us to have less equity and the few with power to have greater equity.

Some of us borrow more money thereby causing a slight increase in the money supply as the banks create more credit from the demand by those of us borrowing. Throughout society that increase in the money supply makes it look like it is a cause of inflation but it is a result of inflation.

Yet we whinge and wring our hands trying to explain inflation and inequality. They are both a result of power and wealth.

These comments were inspired by Peter Radford’s article on RWER about wealth and power.

Herb Wiseman

From Hansard

Q. Would you admit that anything physically possible and desirable, can be made financially possible? Mr. Towers: Certainly. (p. 771) Graham Towers, First Governor of the Bank of Canada.

LikeLike

https://fiscaldata.treasury.gov/datasets/gift-contributions-reduce-debt-held-by-public/gift-contributions-to-reduce-the-public-debt

Charitable donations are greatest at the end of the year. Republicans worried about their grandchildren having to repay the debt could put some money where their mouth is:

How do you make a contribution to reduce the debt?

There are two ways for you to make a contribution to reduce the debt:

At Pay.gov, you can contribute online by credit card, debit card, PayPal, checking account, or savings account.

You can write a check payable to the Bureau of the Fiscal Service, and, in the memo section, notate that it’s a gift to reduce the debt held by the public. Mail your check to:

Attn Dept G

Bureau of the Fiscal Service

P. O. Box 2188

Parkersburg, WV 26106-2188

LikeLike

Reducing the federal “debt” is a reduction in the US money supply, which causes depressions and recessions. Every U.S. depression has come on the heels of a federal surplus.

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

LikeLike

https://www.federalreservehistory.org/essays/treasury-fed-accord seven decades of believing their own BS

What was so terrible about a non-independent Central Bank?

Sometime at a library I will have to try to pull up some news articles from early 1951 about why they thought that they had to do this.

LikeLike

https://fraser.stlouisfed.org/title/federal-reserve-bank-new-york-circulars-466/3665-joint-announcement-secretary-treasury-chairman-board-governors-federal-open-market-committee-federal-reserve-system-11144

“and, at the same time, to minimize monetization of the public debt’.

The “debt” that is not really debt was is and always has been money right?

LikeLike

The so-called “debt” is two things, neither of which are federal debt:

1. It’s the total of deposits into T-security accounts wholly owned by the depositors. The government does not owe that money. It merely holds it for safe keeping. (Think of the deposits into bank safe deposit boxes. The bank doesn’t owe those deposits.) The government does not touch those dollars or use them for anything. Upon maturity, the government simply returns the dollars to the owners.

2. It’s the net total of federal deficits, the difference between federal taxes and federal spending. The government does not owe anyone for that difference. It’s just an arithmetic record-keeping figure. No one owes anyone anything for federal deficits. The government pays all its bills on time and in full.

LikeLike

I still don’t quite understand why they thought they had to do what they did in 1951.

It is all just credits and debits on balance sheets… every integer positive and negative is money right from inception. None of it was ever not monetized.

LikeLike