Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

In June, we published Government/media disinformation. You won’t learn this from your morning paper.

The article quotes Reuters “news” service. You know Reuters, that climate-change-denying, terrorism denying, owned-by-the-rich “news” source.

I you read the Reuters article, you’ll see that it claims the government’s purchase of General Motors stock stimulated the economy (by adding dollars to the economy), while the government’s subsequent sale of GM stock benefited taxpayers (by taking dollars from the economy).

Apparently, there is no difference between federal purchases and sales of private sector stocks, an amazing duality of benefit in which no matter what the federal government does, it’s good.

Now today, Time published:

U.S. Treasury Sells Final Shares in General Motors

The U.S. helped bail GM out with $49.5 billion in investments in exchange for an ownership stake

By Anita HamiltonThe United States Treasury has sold off the last bit of the 912 million shares in General Motors it received when it bailed out the automaker in 2009 under the Troubled Asset Relief Program (TARP).

General Motors said in a press release that the bailout saved 1.2 million jobs. However, taxpayers wound up paying approximately $10 billion to save GM, according to the Detroit News.

Translation: The federal government pumped $10 billion into the economy, which saved 1.2 million jobs. Taxpayers payed an additional $10 billion although no new taxes were levied. No one can explain this.

President Barack Obama also released a statement on the sale.

“Today, we’re closing the book by selling the remaining shares of the federal government’s investment in General Motors. GM has now repaid every taxpayer dollar my Administration committed to its rescue.”

The government’s total recovery from all TARP investments is about $432.7 billion.

Translation: The government has benefited taxpayers by taking $432.7 from the private sector. The fewer dollars taxpayers have, the better off they are.

The government will continue to benefit taxpayers by reducing the federal deficit. This will require adding fewer dollars to the private sector, while taking more tax dollars from the private sector.

Since taxpayers constitute the private sector, adding fewer dollars together with taking more dollars, impoverishes the private sector, which somehow benefits taxpayers.

And this is good for the economy.

Please do not ask for an explanation from Time or Reuters, or from the wealthy people who own these “news” services or from the bought-and-paid-for politicians and main stream economists.

And by the way, just because austerity impoverishes the poor far more than the rich, this all has nothing much to do with widening the gap between the rich and the rest. Nothing at all.

If you need an explanation, ask George Orwell.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

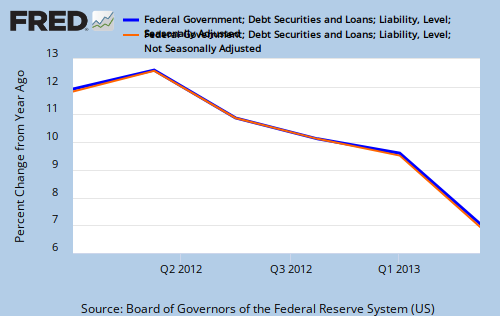

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY