Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive.

======================================================================================================================================================================================

Some frightened folk fret that their guns will be taken from them, so they won’t be able to kill innocent animals or strangers or friends or family members.

Some deluded folk fret that the American government will run short of money, while the American people have too much money, so the people should send more money to the government and the government should send less money to the people (aka “deficit reduction”).

Some befuddled folk believe the federal government must “live within its means,” despite it having no means – or that the growing (misnamed) “debt” will cause a Weimar-like hyper-inflation, which never has happened in the history of America, not even during world wars or depressions, and despite the so-called “debt” not even being a debt, but rather a deposit.

Some generous folk believe the poor are selfish “takers” who happily and unfairly enjoy surviving on food stamps and living in crime-ridden, filthy squalor, rather than work.

Some vengeful folk fret that impoverished women will evade their rightful punishment for being poor and pregnant, by aborting future impoverished “takers.”

Some confused folk believe their federal taxes pay for unfair and excessive benefits to the poor, despite the fact that federal taxes pay for nothing.

Some conned folk believe Fed Chairman Bernanke, when he tells them Quantitative Easing (QE) stimulates the economy, despite the undeniable fact that it reduces the dollars the government pays into the economy via T-security interest, thus depressing the economy.

Some brainwashed folk believe the few rich are the “makers,” who provide jobs, when in fact, they are America’s worst takers — themselves overpaid employees of corporations that underpay millions of other employees.

Those same innocent folk believe the Supreme Court, when it tells them that money is speech, so the more money one has, the more speech to which that rich person is entitled. And corporations are American people, entitled to the same rights as the American people themselves.

Some illiterate folk believe Obama is a liberal who really wants to help the “little man,” and the Republicans really want to grow the economy, and the Tea Party really wants to keep the government solvent, despite the clear fact that the opposite is true in all three cases.

Some innocent folk believe that unless a politician is caught actually stealing money, that politician is unbribed, honest, and truth-telling, despite the fact that what the politicians are stealing is our power and our freedom.

And God help anyone who tries to tell those absolutely certain folk anything different because, they will respond in invective, attached to such lines as “I’m not an economist, but I know . . . [insert nonsense here, to be followed by more nonsense].” Uneducated in a science, they know all there is to know about that science.

And sadly, some of us Quixotic folk keep trying to educate the above-mentioned folk, when we could be engaged in far more productive enterprises – like watching TV game shows, drinking beer or snoozing on the couch.

But having learned nothing from failure, here we go, again:

TruthDig

Judge Blasts Feds for Failure to Go After Wall Street FraudstersU.S. District Court Judge Jed S. Rakoff has written a scathing indictment of the federal government’s approach to prosecuting Wall Street finance and banking executives, concluding that timidity, lack of resources, and a desire by individual prosecutors to pluck the low hanging fruit of fraud cases has left the country’s top financial wheeler-dealers unscathed by the likely crimes that seized up the world economy.

An accused corporation can negotiate a settlement, pay a fine, promise not to sin again, then pass along the costs to consumers and shareholders and maybe fire a subordinate executive or two for public relations value.

Meanwhile, the individuals responsible—or who most benefited from willful ignorance—pay no penalty for their crimes.

No, Judge Rakoff, it isn’t timidity. It isn’t lack of resources. And it isn’t a desire to pluck low-hanging fruit. If President Obama wanted prosecutions, there would be prosecutions.

So why doesn’t Obama want prosecutions?

Because he has been bribed by campaign contributions and promises of lucrative employment for him and his family, after he leaves office. (Call it the “Clinton” syndrome.)

The rich do not want prosecutions of the rich. They want prosecutions of the poor, for far lesser crimes, to keep the poor in line.

Finally, consider that hoped-for, big Obama Presidential Library for which billionaire Penny Pritzker undoubtedly will raise funds, and for which she has been pre-rewarded with the title, Secretary of Commerce.

Obama’s entire Chicago history has been to toady up to the mega-wealthy and allow them to lift him to glory.

That has been the source of success for a man who essentially has accomplished nothing — nothing in the private sector, nothing as a Senator and nothing as a President — nothing that is except to stump for reductions in Social Security, Medicare and other social programs — nothing but the ironically named “Obamacare,” for which he did little to create, even less to pass, and nothing to supervise.

Progressives on the Take

Robert Scheer(Obama) he warns us that sharply rising income inequality “is the defining challenge of our time” and pledges to reverse “a dangerous and growing inequality and lack of upward mobility. …” But then he once again turns to the same hacks in the Democratic Party who helped create this problem to fix it.

His tough speech on income inequality earlier this month was delivered at the Center for American Progress, founded by John Podesta. As chief of staff to Bill Clinton, Podesta helped lead the charge to deregulate Wall Street.

(There was) the appointment of Lawrence Summers and Timothy Geithner, two former Clinton officials responsible for the banking meltdown, to repair it.

The pattern was set by Obama when, in his successful race for the presidency, he decided to shun public financing and instead shamefully courted the Wall Street fat cats who bankrolled him handsomely. It is not surprising then that in his major speech on income inequality, there was no mention of the role of the big banks in fostering this inequality.

(Obama said), ” . . . in the past, the average CEO made about 20 to 30 times the income of the average worker, today’s CEO now makes 273 times more. And meanwhile, a family in the top 1 percent has a net worth 288 times higher than the typical family, which is a record for this country.”

Big talk, but his “grand bargain” features the budget cuts that have made this deplorable situation possible.

The rich are not winning. It is the middle and the poor who are losing. They are the ones who buy into the Big Lie, and announce that though they are not economists, they are absolutely, positively sure they understand economics, and absolutely, positively will not listen to facts that disagree with their uninformed intuition.

Bottom line: The windmills are winning.

Rodger Malcolm Mitchell

Monetary Sovereignty

====================================================================================================================================================

Nine Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Send every American citizen an annual check for $5,000 or give every state $5,000 per capita (Click here)

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

9. Federal ownership of all banks (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

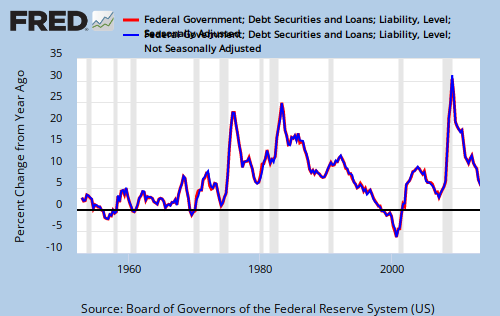

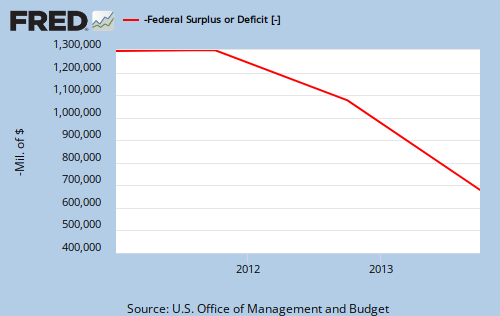

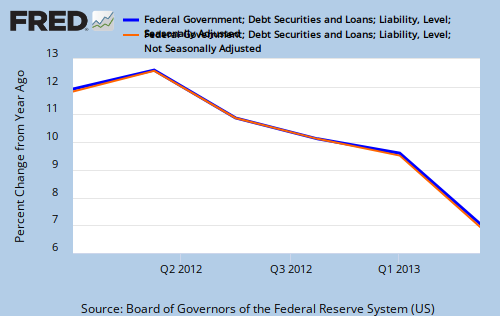

THE RECESSION CLOCK

As the federal deficit growth lines drop, we approach recession, which will be cured only when the lines rise.

#MONETARY SOVEREIGNTY