Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Austerity = poverty and leads to civil disorder.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

In The new paradigm: Disemployment. Less work; more life we discussed the fact that computers are becoming smarter and each year are able to do more of what we’d thought only humans could do.

For example:

SCIENTIFIC AMERICAN

Machines that think for themselves

New techniques for teaching computers how to learn are beating the experts

By Yaser S. Abu-Mostafa | June 20, 2012

Machine learning is a branch of computer science that combs through data sets to make predictions about the future. It is used to identify economic trends, personalize recommendations and build computers that appear to think.

A couple of years ago the directors of a women’s clothing company asked me to help them develop better fashion recommendations for their clients. No one in their right mind would seek my personal advice in an area I know so little about—I am, after all, a male computer scientist—but they were not asking for my personal advice.

They were asking for my machine-learning advice, and I obliged. Based purely on sales figures and client surveys, I was able to recommend to women whom I have never met fashion items I have never seen. My recommendations beat the performance of professional stylists.

Advances in machine learning over the past decade have transformed the field. Indeed, machine-learning techniques are responsible for making computers “smarter” than humans at so many of the tasks we wish to pursue. Witness Watson, the IBM computer system that used machine learning to beat the best Jeopardy players in the world.

The need for professional stylists has just been reduced somewhat.

Then there’s:

My New Scientist

Robots move into the mining business

30 July 2012 by Michael Moore and Michael Reilly

The dirty, back-breaking work of extracting minerals from the Earth is being taken over by machines. Trucks nearly as tall as three-storey buildings are a common sight rumbling through the dusty, red-hued landscape of the Pilbara region in Australia.

But look carefully at some of them: the cabs are empty of human occupants. The trucks are part of mining giant Rio Tinto’s Mine of the Future initiative. The firm is betting $500 million that robots are the future of mining.

South Africa’s famously deep gold and platinum mines are still mostly worked by people. Each day after blasting is complete, a foreman descends into the fresh tunnels, tapping the roof and listening for a hollow thud that could indicate a hanging wall is in danger of collapsing.

But entry inspections are often rushed, because miners’ pay is tied to hitting benchmarks in a timely fashion. Some 14 miners have died already this year in such “ground falls”, according to the country’s Department of Mineral Resources.

To keep miners out of harm’s way, Declan Vogt of the Council for Scientific and Industrial Research in Auckland Park, Johannesburg, South Africa, and colleagues have built a robot that can navigate the 1-metre-high tunnels on tank-like treads and scan rock faces for weaknesses with a thermal camera. “Rock that is firmly attached to its surroundings will cool more slowly than rock that is broken,” says Vogt.

When weaknesses are spotted, the robot can tap on them with a long arm, and use microphones to listen to the sound it makes. On-board neural network software trained by mine inspectors will recognise if the area is safe.

“Our vision is of a fleet of small robots doing various tasks,” including mining and hauling ore, Vogt says.

Swedish firm Sandvik has deployed a mixture of autonomous heavy equipment and robot vehicles in several mines around the world over the last few years. If all goes as planned, within the next decade some mines will be designed not to suit people, but to accommodate the needs and abilities of robots.

Thousands of miners will be safer — but unemployed. Then consider this:

ScienceNews

Paralyzed woman grips, sips coffee with robot arm

Human brain-computer interface enables useful movement

By Rachel Ehrenberg June 16th, 2012;

Directing a robotic arm with her thoughts, a paralyzed woman named Cathy can pick up a bottle of coffee and sip it through a straw, a simple task that she hasn’t done on her own for nearly 15 years. The technology that brought about the feat is a brain-computer interface system: A computer decodes signals from a tiny chip implanted in the woman’s brain, translating her thoughts into actions that are carried out by the robot arm.

Visualize one manager, running an entire robotic factory with her thoughts. She might lounge on a beach, looking at a screen that can show her every inch of the operation.

The factory computers run everything, but on those rare occasions, when the computers encounter a circumstance they’ve not seen, the human supervisor thinks, “Shut down belt #6.” The belt stops

The computers (using machine learning) now know that when this rare circumstance occurs again, they’ll shut down belt #6. If they’re wrong, the human will think of the correct solution, further teaching the computers.

Eventually, computerized machines will do it all. Even that one manager will be unemployed. World unemployment will rise one more tiny notch.

Is this a bad thing or a good thing? I say it’s a good thing.

I am unemployed, but my unemployment is known as “retirement.” I no longer need to work for money, so I don’t. My “work” is this blog, tennis, reading, my family, travel. For me, unemployment is freedom.

How would you like to be able to spend the rest of your years doing whatever pleases you? Given that opportunity, “unemployment” would not be a problem; unemployment would be your goal.

We view unemployment as a problem, because we can’t visualize a world where people don’t work for money. But look around you. Millions of people don’t need to work for money, and most of them lead pretty nice lives.

But, our leaders devise plans to make us all work for money. They want to “cure” our freedom not to be forced to work for money. It’s as though there were some moral imperative that makes working for money good and not working for money bad.

Once, that might have been true. But no more. Our leaders should devise plans to anticipate the future — plans that help us deal with not needing to work for money.

How? By providing either the things we buy for money, or by providing the money itself.

Stretch your imagination and visualize all the things you pay for: Food, clothing, shelter, health care, amusement. What if you were given some of those things and already had the money to pay for others. Wouldn’t your life be better?

What if federally provided computers, programmed with massive data about human afflictions, tested your body, to locate problems. Might you enjoy a healthier life?

What if everyone’s housing cost less, because human labor no longer was need to build houses? Might you enjoy a better home?

What if food and clothing were less expensive, because machines did all the farming, designing, sewing, shipping and selling?

I have just described doctor, carpenter, plumber, roofer, designer, salesperson, shipper and farmer unemployment. Is that a bad thing or a good thing?

Bottom line: I believe the focus on “curing” unemployment is misdirected and harmful. It’s like focusing on the creation of a better horse cart, in the age of automobiles.

Our future is not one of full employment. Our future is one of disemployment — something closer to what I have, now.

Even my Modern Monetary Theory (MMT) friends propose a cure for unemployment called Jobs Guarantee (JG). They are well meaning, but do not consider the future of technology. Better they should propose a QLG (Quality of Life Guarantee).

Our leaders should focus on ways to improve our lives with less mandatory work. Employment, as a basic goal, is becoming obsolete. The basic goal is the improvement of our lives.

We are at a fork in the road. The government can focus on, plan for, and invest in, new technology and appropriate laws. Or it can pretend technology has plateaued, and continue to improve horse carts.

In an ideal world, each of us should be able to do what pleases us most (so long as others are not injured, of course). If working for money pleases you, so be it. But if there are other things that please you more, the ideal world would allow you to do them. Either way, disemployment is coming, whether we like it or not.

When our leaders speak of curing unemployment, your question should be, “What are your plans for making my life and my children’s lives more enjoyable, more comfortable, safer, healthier — better? What are your plans for the coming age of disemployment?“

Rodger Malcolm Mitchell

Monetary Sovereignty

==========================================================================================================================================

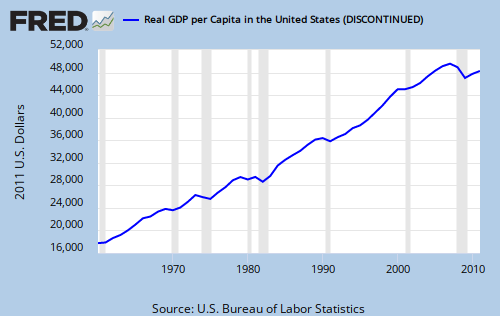

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY

![]()