Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity starves the economy to feed the government, and leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

Have you bribed a politician lately?

The Washington Post published an interesting article titled, When is a campaign contribution a bribe?

By Robert Barnes, Published: August 12

A few excerpts:

Former Alabama governor Don Siegelman heads back to prison next month, contrite about and embarrassed by his bribery conviction. But when he faced resentencing earlier this month, he still was not quite ready to concede that he knowingly broke the law.

“If I had known I was coming close to the line where a campaign contribution becomes a bribe and a crime, I would have stopped,” Siegelman told U.S. District Judge Mark Fuller, who sentenced Siegelman to 6 1/2 years in prison.

Federal law makes it a crime to corruptly solicit or accept money with the intent of being rewarded or influenced in official actions.

In 1991, (the Supreme Court) ruled that a campaign contribution could be a bribe if prosecutors proved a quid pro quo — that the contribution was “made in return for an explicit promise or undertaking by the official to perform or not to perform an official act.”

In a subsequent case, Justice Anthony Kennedy said the quid pro quo need not be expressly stated. But lower courts have differed, since then, on exactly what standards apply.

In Siegelman’s case, the contribution at issue was to his pet project, a lottery referendum measure that would help education. Richard Scrushy, a health-care facility magnate who had been appointed to a state hospital facility planning board by previous Republican governors, gave $500,000 to the referendum campaign. Siegelman, a Democrat, later reappointed him to the board.

Let’s say you understand that the Romney/Ryan ticket is a shill for the upper 1% income group, and intends to slash benefits for the 99% under the guise of “fiscal responsibility.” You are part of the lower 99% who would be hurt by cuts to Medicare and Social Security, so you send in your $25 donation to re-elect Obama.

Later, Obama votes to expand Medicare and Social Security. You keep your benefits. Have you bribed the President?

Let’s say you are one of the Koch brothers who, to quote an article in The New Yorker, “believe in drastically lower personal and corporate taxes, minimal social services for the needy, and much less oversight of industry—especially environmental regulation. These views dovetail with the brothers’ corporate interests.”

So you give $100 million to the campaigns of numerous right-wing politicians, all of whom express their undying gratitude by voting to drill for oil in ecologically sensitive lands, cut taxes on the wealthy and on corporations, and reduce Medicare, Social Security, Medicaid and aid to the poor.

Have you bribed these politicians?

You may try to find an answer, but you will fail. No matter how you twist and turn the semantics of what constitutes a bribe and what merely is free speech, you will not be able to find a boundary.

For instance, you might say a bribe involves a direct quid pro quo, in which something specific is promised in return for something else specific. Does this include giving money to someone who has promised to give you money if elected? Does “direct quid pro quo” include the tax savings right wing politicians have promised to the Kochs?

I submit that everyone, who gives money to a politician, does it for the same reason: They want that politician to do something to benefit someone. There is no bright line difference between the Alabama governor who reappointed a guy to yet another term on a board, the Koch brothers who essentially bribe the entire right wing, the gal who slips a cash-filled envelope to the small town mayor to get a job for her brother. – and you, who gave $25 to the politician who promises not to cut your Medicare.

While there is no clear solution, there may be some partial solutions – some steps in the right direction. And they have to do with money, and with what I consider the false belief that giving money is a form of free speech.

The 1st Amendment says, “Congress shall make no law . . abridging the freedom of speech, or of the press . . . “ That’s it. In my innocense, I would include talking and writing as “speech.” Although money supposedly “talks,” somehow I don’t consider giving a politician money, to be a form of speech – especially when the money is so big it simply cannot be ignored by the recipient.

The Dalberg quote, “Power tends to corrupt, and absolute power corrupts absolutely,” could be refashioned. “Money corrupts, and big time money corrupts big time.” While your $25 contribution to Obama, may not elicit a quid pro quo, is there any doubt that a million dollar contribution to a politician will get that politician to do almost anything?

Sadly, the Supreme Court does not recognize the difference between $25 and $100 million – something like not recognizing the difference between a machine gun and a Nerf gun – so in removing limits from campaign contributions, the Court, in essence said, “Guns are legal, Nerf guns, machine guns, all he same to us.”

Further, while I disagree that giving money is free speech, previous Supreme Courts have held that even some speech can be proscribed. Oliver Wendell Holmes, Jr. famously said, “The most stringent protection of free speech would not protect a man falsely shouting fire in a theater and causing a panic.”

Yes, even “free speech” is not endlessly free. There are limits. Similarly, there can and should be limits on the “free speech” of political donations.

My suggestion: A limit of $10 per person to each candidate. That would level the playing field. A rich man would have no more “free speech” than would a poor man. Not enough to influence a vote, that $10 worth of “free speech” would tell the politician how you feel.

Rather than being a bribe, that $10 would be “free speech” in its purest form — not a total solution, but perhaps a start.

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

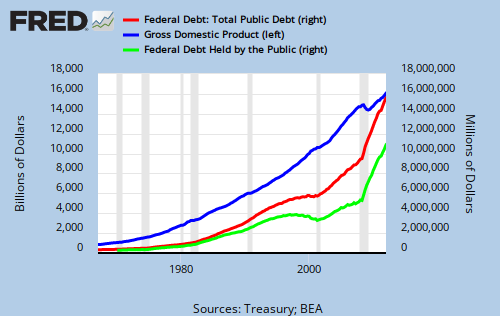

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption + Net exports

#MONETARY SOVEREIGNTY