Mitchell’s laws:

●The more budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity starves the economy to feed the government, and leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

==========================================================================================================================================

Sorry for insulting whores, who work hard for their money, but how do you know when a politician is lying? Aside from “When he’s moving his lips,” he will use certain buzz words that tip you off.

In the post, “No, it’s not your imagination. The upper 1% really are screwing you more,” we listed ten ironic “suggestions” for how the upper income 1% can continue to increase the income gap.

Here are those suggestions, together with examples of how they are being followed. The purpose is to show you the context in which politicians use their buzz words to destroy the 99%. Listen for them the next time you hear a politician open his/her mouth:

1. Raise taxes via a national sales tax or VAT. Poorer people devote a greater percentage of their income on consumption.

April 6, 2010: Speaking at a New York Historical Society event, Obama adviser Volcker said a VAT is “not as toxic an idea” as it has been in the past and concluded: “If at the end of the day we need to raise taxes, we should raise taxes.” (Newsmax)

2. To “save” Social Security, tell the 99% it’s “insolvent”, so you must reduce benefits and continue to increase the SS starting age. Also, continue to tax SS benefits, as these benefits are most important to lower income people. Maintain or even increase the FICA tax. This tax directly punishes lower salaried people.

(Mitt) proposes that Social Security should be adjusted in a couple of commonsense ways that will put it on the path of solvency and ensure that it is preserved for future generations.

First, for future generations of seniors, Mitt believes that the retirement age should be slowly increased to account for increases in longevity.

Second, for future generations of seniors, Mitt believes that benefits should continue to grow but that the growth rate should be lower for those with higher incomes.

3. To “save” Medicare, tell the 99% it’s insolvent, so you must reduce payments to doctors and hospitals. That way, more of the best doctors will opt for “boutique” practices that only the 1% can afford. Don’t pay for expensive procedures (that only the rich can manage). Continue to tax medical expenses based on percentage of income. (Poor people get no benefit at all.)

The Obama administration’s own Medicare actuary, Richard Foster, has explained that the Obamacare Medicare cuts could make unprofitable 15 percent of hospitals serving Medicare patients. “It is doubtful that many [hospitals and other health care providers] will be able to improve their own productivity to the degree” necessary to accommodate the cuts, Foster has written. “Thus, providers for whom Medicare constitutes a substantial portion of their business could find it difficult to remain profitable, and, absent legislative intervention, might end their participation in the program (possibly jeopardizing care for beneficiaries.

4. Cut federal salaries and benefits to “save taxpayers’ money.” Federal agencies employ the 99%. Military equipment production companies hire the 99%. Cut postal and other government employment. Cut domestic spending, as the vast majority of domestic spending benefits the 99%.

As the chief architect of the House Republicans fiscal 2013 budget proposal, (Paul) Ryan proposed extending the current federal pay freeze through 2015, cutting the size of the federal workforce by 10 percent through attrition and increasing employee contributions to retirement plans. Ryan says this would save taxpayers approximately $386 billion over 10 years.

Note: Federal taxpayers do not pay for federal spending.

5. “Broaden the income tax base” (code words for increasing the number of lower income people forced to pay taxes). Continue the Alternative Minimum Tax (AMT); it catches more of the 99% every year, and the 1% know how to avoid it.

The Romney plan would reduce individual marginal income tax rates across the board by 20%, while keeping current low tax rates on dividends and capital gains. In addition, he would broaden the tax base to ensure that tax reform is revenue-neutral.

6. Cut federal spending to “stop spending money we don’t have” and to reduce “big government.” The reason: Most federal spending creates jobs for the 99%. Especially cut food stamps, unemployment compensation, Medicaid, aid to education, job training and all other federal aid programs. The upper 1% don’t use them.

“We need to stop spending money we don’t have,” said Paul Ryan at the Iowa State Fair on Monday. “President Obama has given us four years of trillion dollar-plus deficits. He is making matters worse, and he is spending our children into a diminished future.”

7. Cut financial assistance to the states, Medicaid, food stamps and farmers. Virtually everything the states do benefits the 99%, and since the states are monetarily non-sovereign, they have nowhere to get money except by taxing their own people. The rich know how to avoid this.

The House Agriculture Committee on Thursday unveiled its approach for a long-term farm and food bill that would reduce spending by $3.5 billion a year, almost half of that coming from cuts in the federal food stamp program.

8. Continue to spread the myth that the U.S. government — a government having the unlimited ability to create dollars — is, or soon will be insolvent, like Greece, and that federal taxes pay for federal spending. These false ideas confuse the 99% and give you a good excuse to cut anything that benefits them. Continue the federal debt limit exercise. Pretend federal finances are the same as personal finances.

“Washington isn’t broken — it’s broke.” By EDWIN FEULNER and SEN. JIM DEMINT

“The United States is becoming too much like Greece and could easily end up in the same place.” By Peter Morici, June 15, 2012 FoxNews.com

9. Continue to allow banks to trade for their own accounts, and always bail them out when their investments go sour. Never accuse any banker of criminal activity. Banks are special.

Republican congressmen vented Wednesday that a signature aspect of President Barack Obama’s financial reform has become too costly and complex to enforce. The so-called “Volcker Rule”— named after former Federal Reserve Chairman Paul Volcker — would restrict banks from trading for their own accounts, a move intended to prevent them from making risky bets with deposits insured by the government.

At a joint House Financial Services subcommittee hearing, Rep. Spencer Bachus (R-Ala.) attacked the rule as being a “self-inflicted wound” for the entire economy, warning that Wall Street jobs could migrate abroad to Canada after the rule starts to go into effect in July.

10. Nominate more arch conservatives to the Supreme Court. Scalia, Alito and Thomas are good models, who have turned the Court into a right wing political organization. The “Citizens United” decision was an excellent step forward. This assures that the agenda favoring the 1% over the 99%, will have the reinforcement of Supreme Court decision.

New York Times: The Supreme Court examined the Arizona immigration law in minute detail, but when it came to revisiting the damage caused by its own handiwork in the 2010 Citizens United case, it couldn’t be bothered. In a single dismissive paragraph on Monday, the court’s conservative majority refused to allow Montana or any other state to impose limits on corporate election spending and wouldn’t even entertain arguments on the subject.

It is not as if those five justices could have missed the $300 million in outside spending that deluged the 2010 Congressional elections or the reports showing that more than $1 billion will be spent by outside groups on Republican candidates this year, overwhelming the competition.

They might also have seen that many of the biggest donations are secret, given to tax-free advocacy groups in defiance even of the admonition in Citizens United that independent contributions should be disclosed.

The court’s five conservative justices struck down a Montana law that prohibited corporate spending in elections — a law passed in 1912 not out of some theoretical concern about money corrupting elections but to put an end to actual influence-buying by copper barons.

But the frustration of the dissenters, led by Justice Stephen Breyer, was clear. He said grave doubt had been cast on the majority’s belief, expressed in Citizens United, that independent expenditures do not give rise to corruption or even give the appearance of corruption. But he said the majority had made it plain that it hasn’t the slightest interest in reconsidering or altering its decision.

While the real anti-99% dirty work is done by Republicans, Democrats cannot claim complete innocence. They consistently have failed to disseminate the truth, namely that the federal government easily can support all social programs, without taxes and without borrowing.

Yes, it takes courage to argue against popular wisdom, especially when courting voters. But, think back, Mr. & Ms. politician. Why the heck did you run for office, originally? Do you remember when you hoped to do good for America? Do you feel pride, now that you’ve become a crass, meaningless party servant, who “goes along to get along”?

Is political power really worth becoming a lying whore?

Rodger Malcolm Mitchell

Monetary Sovereignty

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. Two key equations in economics:

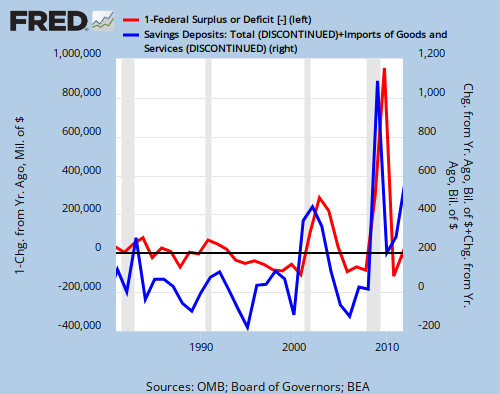

Federal Deficits – Net Imports = Net Private Savings

Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

#MONETARY SOVEREIGNTY