Mitchell’s laws: To survive, a monetarily non-sovereign government must have a positive balance of payments. Economic austerity causes civil disorder. Reduced money growth cannot increase economic growth. Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

========================================================================================================================================================================================================

Washington Post: BERLIN — The economy of Germany, Europe’s headline performer, slowed to a virtual standstill over the past three months . . . The discouraging news came just hours before German Chancellor Angela Merkel and French President Nicolas Sarkozy called for closer European coordination in setting economic policy and new steps to discipline governments whose lax budget practices prompted the debt crisis.

No, the crisis was caused by the euro-zone nations being monetarily non-sovereign. They cannot control the supply of their currency, the euro. I predicted this on June 5, 2005: “Because of the Euro, no euro nation can control its own money supply. The Euro is the worst economic idea since the recession-era, Smoot-Hawley Tariff. The economies of European nations are doomed by the euro.”

. . . Merkel and Sarkozy . . . proposed that countries harmonize their tax policies, adopt a new tax on financial transactions and commit to balancing their budget . . .

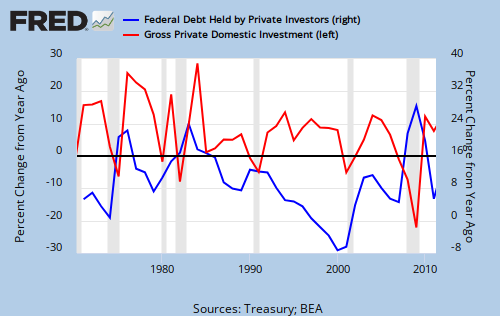

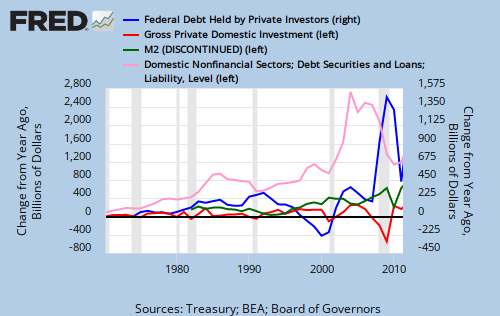

Balancing their budgets assures a recession or depression, by eliminating euro supply growth. A growing economy requires a growing money supply.

The abrupt slowdown in Europe’s largest economy comes at a time when Germany is expected to fund a major portion of the emergency loans extended to struggling neighbors such as Greece, Ireland and Portugal. . . . The new figures call into question whether Germany can remain the economic engine that officials in the United States and elsewhere have been counting on to power Europe’s recovery.

Germany’s economy was strong because it was a net exporter, i.e. a net importer of euros. That was the only way a monetarily non-sovereign nation could increase its money supply.

“Trend growth is not that high,” said Thomas Mayer, chief economist for Deutsche Bank. “It would have been false to think that Germany would turn into a loco-motive for Europe. That is not a viable proposition.”

Right. It’s asking the blind to lead the blind.

According to a release from the Federal Statistical Office of Germany, flagging investment and household consumption were behind the slowdown — particularly disappointing for those, including U.S. officials, who have urged Germany to stoke local demand. . . .

Investment and household consumption “flagged,” because Germany now is short of the euros it formerly had acquired via exports.

Also discouraging were new figures released Tuesday for the entire region that uses the euro. Growth for the second quarter was only 0.2 percent, reflecting government austerity programs and slowing global economic activity.

If you want to kill a nation, austerity is the way to do it. (Hello, Tea/Republicans. Are you watching?)

Although the crisis in Europe is ostensibly driven by high levels of government debt and annual deficits, it is also rooted in slow growth, with nations such as Italy and Spain struggling to expand fast enough that their tax base keeps up with their commitments to citizens and bondholders.

Visualize trying to bail a rowboat having a big hole in the bottom.

Germany’s growth in the past few years offered an example to weaker economies. . . Germany revised its labor and tax rules to become globally competitive. Its stable of large multinationals benefited as China and other fast-growing developing nations snapped up German capital goods and high-end products.

Right. Exports were the key, because they brought in euros.

Figures released last week, however, showed that German exports in June were down significantly from the month before and manufacturing dropped to its lowest level since October 2009.

In a country that has been spared the riots and demonstrations of Greece and Spain, the slowdown may reinforce a public sentiment — reflected in some opinion polls — that Germany should go no further in risking its own financial health to help its weaker neighbors.

Now, visualize bailing your neighbors’ sinking boats, and tossing the water into your own boat.

Merkel and Sarkozy . . . called for what Sar-kozy termed “a true economic government for the euro zone” . . . Compared with some of the more dramatic steps that European officials have taken to address the debt crisis, such as establishing a trillion-dollar bailout fund last year, the proposals offered Tuesday were more evolutionary, Merkel said. By bringing the economic and social policies of the euro nations into sync, the region could “regain confidence step by step,” she said.

The proposals were short on details, and some analysts said they had heard similar ideas before. Over the years, European leaders, particularly from Germany, have offered various ways to control euro-zone spending, but to little effect. National parliaments would still have to approve the proposed measures, such as constitutional amendments to require a balanced budget, and governments would still have to live up to them.

“. . . bringing economic . . . policies into sync . . .” almost sounded like they understood the problem, and were going to combine the euro nations into one Monetarily Sovereign United States of Europe. That would have been one of the two possible solutions (the other being to disband the EU. Unfortunately, they still are talking about non-solutions like balanced budgets. Visualize using leeches to cure anemia.

“They have not given any details on what they feel economic governance should look like,” said Daniela Schwarzer, an expert on European integration at the German Institute for International and Security Affairs. And if the new economic council meetings amounted to no more than the latest in a long series of summits, she said, “that is nothing substantially new.”

They are as clueless as the U.S. Congress and President. Our sole advantage: We are Monetarily Sovereign (though our leaders have not figured that out.) So we can’t go bankrupt, unless our government wants it.

The monetarily non-sovereign euro nations can go bankrupt, and that grim future unnecessarily will drive down the U.S. economy. “Unnecessarily,” because a Monetarily Sovereign nation has complete control over its economic growth, if it is wise enough to use that control.

Recessions are unnecessary in a Monetarily Sovereign nation. Tell that to Congress.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia. The key equation in economics: Federal Deficits – Net Imports = Net Private Savings

MONETARY SOVEREIGNTY