The debt hawks are to economics as the creationists are to biology. Those, who do not understand Monetary Sovereignty, do not understand economics. If you understand the following, simple statement, you are ahead of most economists, politicians and media writers in America: Our government, being Monetarily Sovereign, has the unlimited ability to create the dollars to pay its bills.

============================================================================================================================================

Oil is non-renewable; corn, soybeans and sugar are renewable. One day (Who knows when?), the world will run out of oil. The world never will run out of corn, soybeans and sugar. Based on those simple facts, the decision was made to turn food into oil, otherwise known as biofuel. Yet that decision has been a favorite liberals’ (and to a lesser degree, conservatives’) target.

The underlying facts are not so simple. My friend Warren Mosler, for whom I have great respect, wrote on his blog:

“The reality is very simple, and there is no end in sight. The US is a net exporter of food, and a net importer (directly and indirectly) of motor fuels. So with current high gasoline prices we get a higher price for our food surplus by burning up part of it for fuel.

Even if the energy used in creating the ethanol is somewhat more than the energy produced, the energy used is generally coming from lower cost and domestically produced sources such as coal. And the fuel burned in our cars replaces gasoline- a much higher cost energy that we import.

So, bottom line, burning up part of our surplus crops as motor fuel, which drives up food prices world wide, we reduce imports of motor fuels and we get a higher price for the remaining foods we export. That is, we benefit economically from the global chaos and the likelihood of mass starvation created by this policy.

(We should) outlaw ethanol and biofuels that use up acreage that otherwise produces food.”

I wrote to Warren, “So it is your opinion that the U.S. is short of farming acreage, and that we now have reached the limits of U.S. food output? And it is your opinion that the entire world has reached the limits of food production, which is why the U.S. turning some of its corn into oil raises all food prices, worldwide? Sounds a bit suspicious to me. Do you have any data to support these beliefs?” I’ll let you know what he says.

I saw “A Note on Rising Food Prices” by Donald Mitchell (no relation) of The World Bank Development Prospects Group, 2008. It’s a long paper, but I’d like to show you the featured (bolded) lines from three adjacent paragraphs:

“–Estimates of the contribution of biofuels production to food price increases are difficult, if not impossible to compare.

–Despite all the differences in approach, many studies recognize biofuels production as a major driver of food prices.

–Many other potential drivers of the escalating food prices are mentioned in discussions, but there are few quantitative estimates of their impact.”

To paraphrase, “We have estimates, not data, and we can’t compare those estimates. Some people think biofuels raise food prices, but some do not. Nevertheless, we emotionally, not factually, have adopted the position that biofuels raise food prices.”

The paper goes on to list some of the reasons for higher food prices:

1. The increase in energy prices

2. Increases in prices of fertilizer and chemicals

3. Increases in the costs of transportation

4. Drought in Australia

5. Poor crops in Europe

6. Rapid import demand increases for oilseeds by China to feed its growing livestock and poultry industry

7. Decline of the dollar

8. The increased investment in commodities by institutional investors to hedge against inflation

9. And oh yes, turning corn and soybeans into oil.

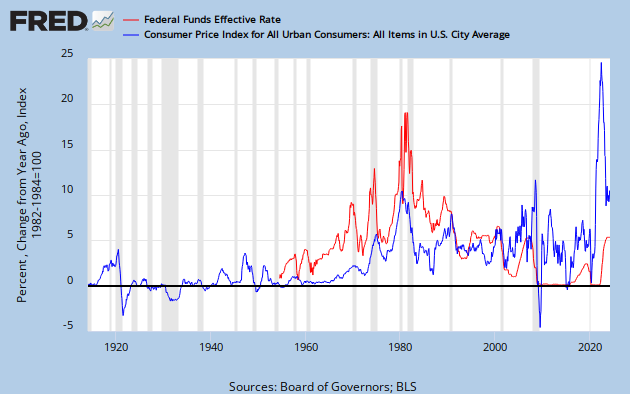

Those of you who have read Inflation/Oil know that inflation has been caused by increased oil prices. So one should assume that creating oil from plants would at least to some degree, mitigate inflation by increasing the supply of oil. Of the nine reasons for higher food prices, five are due to the increased price of oil.

This means, if corn and soybeans were not turned into oil, the price of oil would be higher, inflation would be worse and the price of food would go higher. Of course that is speculation, because despite many absolute opinions, no one really knows the effect of biofuels on food production or food prices.

Consider corn. Oil is made from corn silage. Only a tiny percentage of all corn is used for human consumption. It’s called sweet corn. The vast majority of corn is field corn, which is turned into silage. Only silage is turned into oil. Silage is made from cobs, leaves, stalks, husks and the grain itself.

“In 2009, there were over 86 million acres of corn planted in the United States. In the same year, only a little more than a quarter-million of that was used for growing sweet corn.” ( CompareXY Library) With only 1% of all corn acreage devoted to being eaten by humans, it is difficult to say with any certainty that oil production decreases sweet corn production. A further complexity: Even sweet corn cobs, leaves, stalks and husks are turned into silage.

The above is a bare hint at the massive data surrounding this subject, data that can be turned to any desired meaning. For me, the bottom line is:

1. If the creation of biofuels uses less oil than it creates, the process saves a non-renewable energy source at the cost of a renewable energy source.

2. Creating oil reduces inflation.

3. Inflation has an adverse affect on people’s ability to buy food.

4. The U.S. use of field corn, soybeans and sugar for oil has only a minuscule affect, if any, on the world’s human food supply.

5. The U.S. and the world are capable of producing more food crop than now is produced.

6. A limiting factor in world food production is oil prices, which can be reduced by increasing the supply of biofuels.

There are many other factors and many other considerations, and the above surely is an overly simplified summary, but on balance, I feel biofuels are a worthwhile federal investment. I do not believe biofuel production with cause the mass starvation Warren predicts. Quite the opposite.

I welcome your comments.

Rodger Malcolm Mitchell

http://www.rodgermitchell.com

![]()

==========================================================================================================================================

No nation can tax itself into prosperity, nor grow without money growth. It’s been 40 years since the U.S. became Monetarily Sovereign, and neither Congress, nor the President, nor the Fed, nor the vast majority of economists and economics bloggers, nor the preponderance of the media, nor the most famous educational institutions, nor the Nobel committee, nor the International Monetary Fund have yet acquired even the slightest notion of what that means.

Remember that the next time you’re tempted to ask a dopey teenager, “What were you thinking?” He’s liable to respond, “Pretty much what your generation was thinking when it screwed up the economy.”

MONETARY SOVEREIGNTY