Most economists claim that inflations are caused by “excessive” federal deficit spending.

I suspect the notion is that pumping dollars into the economy puts more dollars into consumers’ pockets, and having more dollars causes consumers to buy more, and these increased purchases cause inflation.

It’s the “too many dollars chasing too few products” mantra.

In her excellent book, The Deficit Myth, Professor Stephanie Kelton wrote:

“The economists behind MMT (Modern Monetary Theory) recognize that there are real limits to spending, and that attempting to push beyond those limits can manifest in excessive inflation.” (p.59)

Professor Kelton devoted an entire chapter to inflation (Chapter 2, “Think of Inflation”) in which she repeatedly claimed that ‘Excessive’ federal spending causes inflation.

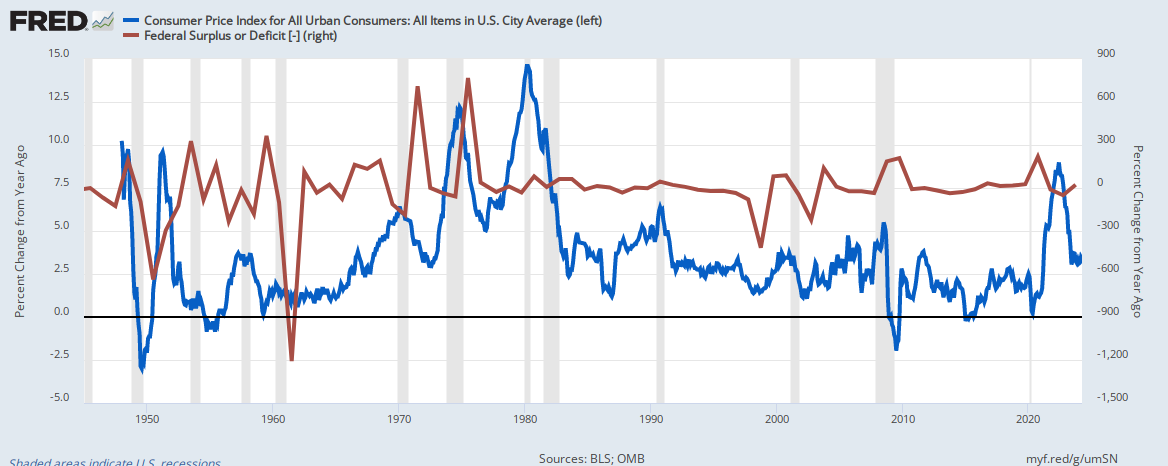

Here is a graph showing federal deficits:

Looking at the above graph, one might assume we had “excessive inflations” in 1948, 1953, 1959, 1971, 1975, and perhaps a blip in 2009.

Here is a graph showing inflations in the U.S.:

For comparison, we put the two graphs together and we see this:

If MMT and the rest of the economics community were correct, we should see a correlation between the peaks and valleys of federal deficit spending and inflation.

But we don’t. We don’t see any relationship at all. It sometimes is up and down together; it sometimes is the reverse. It’s completely random.

Deficits don’t cause inflation.

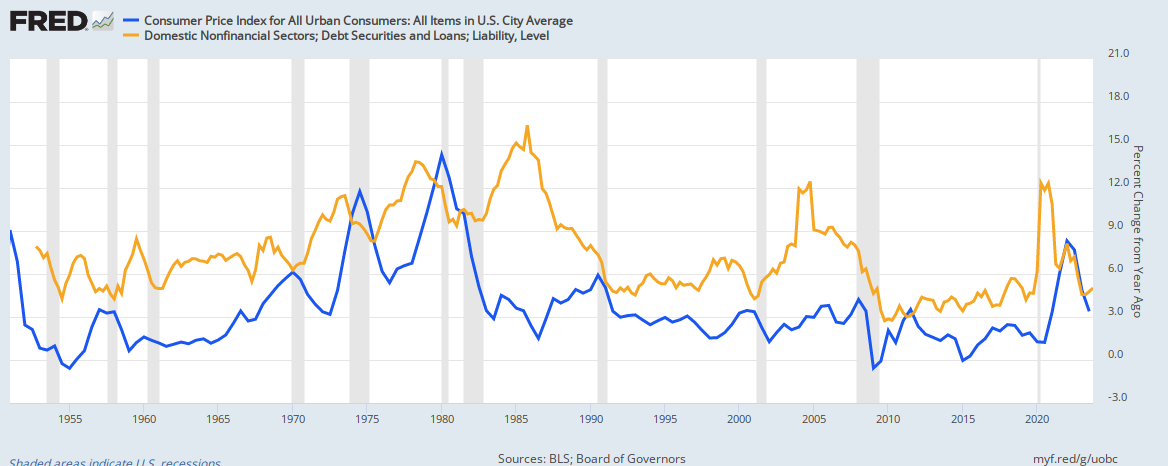

Here’s another graph. It compares changes in the overall money supply (Domestic Nonfinancial Sectors, Debt securities and Loans, Liability Level) to changes in inflation.

Again, no predictable correspondence. Sometimes they move together; sometimes they move in opposite directions. The peaks and valleys sometimes match; sometimes they don’t.

An increased money supply doesn’t cause inflation.

And now finally look at this graph:

While inflations don’t seem to match federal deficit spending, when it comes to oil prices and inflations, the peaks as valleys line up rather nicely.

Oil shortages cause oil prices to rise, which causes inflation.

The philosophy in the blog you’re reading is called Monetary Sovereignty (MS).

MS is in substantial agreement with MMT regarding the federal government’s unlimited ability to spend dollars, the economic need for federal deficit spending, and the fact that the federal “debt” is not a burden on anyone — not on the public, not on future generations, not on lenders or borrowers, and not on the federal government.

Professor Kelton MMT makes quite a point about not believing standard, old economic theories. In fact, she even quotes Mark Twain, “What gets us into trouble is not what we don’t know. It’s what we know for sure that just ain’t so.”,

Ironically, MMT falls into the standard, old “deficits cause inflation” trap.

Not only do federal deficits not cause inflation, but federal deficit spending, properly directed, actually is the best cure for inflations.

Case in point: The infamous Zimbabwe hyperinflation began when the government took land from white farmers and gave it to black non-farmers.

Because the non-farmers didn’t know how to grow food, Zimbabwe suffered from food scarcities, which made the prices of foods rise spectacularly. That leads to the completely obvious truism:

Scarcity makes prices rise.

Had the Zimbabwe government deficit spent to train and otherwise aid the non-farmers to be better farmers, and/or had the government bought food from other countries, and distributed the food to the populace, the scarcity of food would have been eliminated.

There would have been no inflation.

Instead, the government of Zimbabwe’s response to inflation was merely to print more currency, with higher denominations, thus guaranteeing that prices would continue to rise.

Unfortunately, MMT has not been able to completely divorce itself from economic orthodoxy. Most MMT adherents were taught by economists who learned, and then taught, the common dogma about federal deficit spending and inflation.

The myths were passed down the chain.

Sadly, the fear of “excessive” deficit spending has stood in the way of what deficits really do: Federal deficits grow the economy. They grow a healthy economy and cure a sick one.

Warren Mosler, one of the creators of MMT, created “Mosler’s law” which that states, “There is no financial crisis so deep that a sufficiently large fiscal adjustment (federal deficit spending) cannot deal with it.”

That said, I try my utmost to keep an open mind. Though I have looked very hard, I’ve not found an instance of an inflation that was caused by government deficits. Every deficit I’ve researched has been caused by a shortage of some sort, usually a shortage of energy or food.

If you know of any caused by deficit spending, please let me know.

Until then, encourage federal deficit spending to implement programs like the Ten Steps to Prosperity (below).

Rodger Malcolm Mitchell

Monetary Sovereignty Twitter: @rodgermitchell Search #monetarysovereignty Facebook: Rodger Malcolm Mitchell …………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

THE SOLE PURPOSE OF GOVERNMENT IS TO IMPROVE AND PROTECT THE LIVES OF THE PEOPLE.

The most important problems in economics involve:

- Monetary Sovereignty describes money creation and destruction.

- Gap Psychology describes the common desire to distance oneself from those “below” in any socio-economic ranking, and to come nearer those “above.” The socio-economic distance is referred to as “The Gap.”

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics. Implementation of Monetary Sovereignty and The Ten Steps To Prosperity can grow the economy and narrow the Gaps:

Ten Steps To Prosperity:

2. Federally funded Medicare — parts A, B & D, plus long-term care — for everyone

3. Social Security for all or a reverse income tax

4. Free education (including post-grad) for everyone

5. Salary for attending school

6. Eliminate federal taxes on business

7. Increase the standard income tax deduction, annually.

8. Tax the very rich (the “.1%”) more, with higher progressive tax rates on all forms of income.

9. Federal ownership of all banks

10.Increase federal spending on the myriad initiatives that benefit America’s 99.9%

The Ten Steps will grow the economy and narrow the income/wealth/power Gap between the rich and the rest.

MONETARY SOVEREIGNTY

Hi Roger,

Here is a quote from a blogger claiming the great depression and the 1920 depression were the result of government spending.

“The proximate cause of the 1920–21 depression was a deliberate fiscal and monetary retrenchment following World War I.”

“Even with this horrible distortion of the price, investment and capital structure caused by the government, free people were able quite quickly to re-establish prosperity without any significant government involvement. Indeed, it was the lack of such involvement that allowed prosperity to return. This horrible historical chapter inflicted upon the public was caused by “progressive” interference in society and was cured without significant governmental assistance. This is why the episode is virtually unknown to public school graduates and people who get their news from the mainstream media.”

https://bobroddis.blogspot.com/2012/08/daniel-kuehn-provides-factual-basis-for.html

LikeLiked by 1 person

If by “retrenchment,” the blogger means cutting federal debt, the blogger is correct. All depressions begin that way:

1804-1812: U. S. Federal Debt reduced 48%. Depression began 1807.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

1997-2001: U. S. Federal Debt reduced 15%. Recession began 2001.

Prosperity returned because the government started to run defits again, and prosperity came roaring back with the massive deficits of WWII.

A growing economy requires a growing supply of money. Deficit spending adds dollars to the economy.

GDP = Federal Spending + Non-Federal Spending + Net Exports. Adding dollars increases GDP.

LikeLike

Yes but he blames government for the depressions and the free market for the recoveries.

” It is clear that the market did not fail here (as it never does) but that the market quickly repaired a horrendous crisis caused by government, its wars, its violent interventions and its central bank funny money. Further, the distortions that existed prior to the quick repairing of the problem by the market were far worse than anything one would ever find in a free market. This is why this event is and must be suppressed by the statists.”

Also Mises reviewed Kelton’s book https://mises.org/wire/review-stephanie-keltons-deficit-myth

LikeLike

Thank you for calling Mises’s critique to my attention. It provokes me to write a critique of their critique. Essentially, Mises is wrong and Stephanie is wrong — just about different things. The term “funny money” means money not backed by gold, which in itself should tell you Mises is wrong. I already have written about why Kelton’s beliefs about inflation are wrong (as are Mises’s).

Give me a few days to clear some time, and I’ll respond more fully.

LikeLike

Penny, my simplistic model may show the economic difference and preferred way to growth. We have two complete separate economy’s viaing for economic growth.

One uses the “free market” exclusive, no government deficit. In order to pay for those improvements without a return in capital the funds needed are borrowed from private banks. The loans must be paid back with interest, the interest has come from other possible improvements.

The second economy allows the government to pay for the improvements with sovereign funds that are not paid back and don’t remove interest payments from other improvements. The “free market” economy must have a source for additional funds, so they borrow from private banks.

Banks are limited by themselves as to how much capital they have to borrow to others, unless the government allows them to borrow out more then they actually have in excess.

There’s really no “free market” economy, the additional dollars, in the U.S.’s case, needed to recover or expand a economy has to come from a source with a dependable history, the government.

LikeLike

I’m confused. Roger, you state ” Prosperity returned because the government started to run deficits again. ”

But Penny’s quote states ” free people were able quite quickly to re-establish prosperity without any significant government involvement… the lack of such involvement… allowed prosperity to return…. without significant governmental assistance.”

Aren’t these two statements at odds with each other? Was, or wasn’t, the federal government involved in the so-called Roaring 20s comeback? Or was the mass-production stimulus of WW1 enough to do the job?

LikeLiked by 2 people

Prosperity BEGAN to return from the depths of the Great Depression when the government increased deficit spending. It REALLY returned with the massive deficit spending of WWII. Government deficit spending grows economies. Unfortunately, monetarily NON-sovereign governments are limited in the amount of deficit spending they can do. The U.S. no longer is.

LikeLike

“THE GROWTH OF THE FEDERAL

GOVERNMENT IN THE 1920s”

-Randall G. Holcombe

Click to access cj16n2-2.pdf

Cato Institute, (Sorry, I know.)

LikeLiked by 1 person

And the point is??

LikeLike

A resource to question asked to you by tetrahedron720 (#2 above) :”Was, or wasn’t, the federal government involved in the so-called Roaring 20s comeback? Or was the mass-production stimulus of WW1 enough to do the job?”

LikeLike

To quote from Wikipedia: “The Roaring Twenties was a decade of economic growth and widespread prosperity, driven by recovery from wartime devastation and deferred spending, a boom in construction, and the rapid growth of consumer goods such as automobiles and electricity in North America and Western Europe and a few other developed countries such as Australia.”

And then: 1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

LikeLike

Perhaps the “point” is that Cato’s conservative slant upholds the need for business to be free from public sector benefit/control.

On this “point,” it is a fact that the USA’s victory in WW1 and subsequent economic BOOM wouldn’t have been possible without private J.P. Morgan’s billions (not mentioned) which, of couse, had to be paid back to Mr. Morgan in spades.

Thank you very much USA citizens for your money AND your life. Oh those terrible wars we industrialists on both sides of the ocean have to put up with. (wink)

LikeLiked by 1 person

“Free from benefit?” Like no more roads, dams, research grants, government purchases from business?

“Free from control?” Like no laws that prevent businesses from cheating the public?

“Thank you very much USA citizens for your money” which because the USA is Monetarily Sovereign did not go to “industrialists,” but rather were destroyed and paid for nothing at all?

LikeLiked by 1 person

Agreed! Now If Cato people would only read/understand MS

LikeLike

This is one of more nonsensical threads I have encountered here recently. Libertarians are not the most reliable sources of unbiased factual data. Anyone can cherry pick economic data over a narrow time period to prove their ideological point. When you look at government expenditure and economic growth you also have to factor in private debt creation, as well as trade balance, which is absent from any of these arguments (i.e. Sector Balances as Stephanie Kelton covers in her book)

In the 1920’s economic growth was driven by massive amounts of private credit creation that caused three economic bubbles (real estate, stocks, and consumer durables), along with a positive balance of trade. Private credit creation was fueled by FED interest rate cuts to help deleverage from the WWI debts. Private debt can only rise so far before the private sector needs to deleverage, and so the credit expansion of the 1920’s ended with the stock market crash in 1929 and the ensuing Great Depression, which was only reversed through the deficit spending of the New Deal and WWII. As the economist Michael Hudson states ” debts that can’t be paid, won’t be paid”. The 1920’s credit boom also created some of the greatest amounts of wealth inequality due to massive transference of wealth to the finance sector.

In the 1990’s and early 2000’s we also had increasing economic growth and decreasing federal deficits (heck we even ran surpluses); however, that growth was fueled by private debt creation that drove the dot com and housing bubbles, respectively. Both expansions of course ended in recessions (one rather spectacularly so) and were once again only reversed through increasing government deficit spending.

Sustained economic growth requires deficit spending, and there is 232 years worth of evidence in this country that supports that fact. Private debt can certainly result in short term economic expansion but it is unsustainable due to the compounding nature of interest, which causes debts to increase exponentially faster than GDP. This isn’t a theory or hypothesis, it is just math.

LikeLiked by 1 person

I have come around to agree to with you completely that shortages cause inflation in all cases. Even Keynesian demand-pull inflation boils down to shortages in supply relative to demand in the economy. The key point is not whether deficits cause inflation, but rather how deficits are used in response to shortages. As you stated, deficits that simply prop up aggregate demand in the face of shortages will exacerbate inflation (as in the case of hyperinflation), whereas targeted deficits used to increase supply would likely ameliorate inflation.

To be fair to Professor Kelton, I think her arguments are more about political positioning rather than a real belief in deficits causing inflation in the general sense. MMT argues that the only limit to deficit spending is inflation, but doesn’t make any statement as to how much, or what kind of, deficit spending is needed to actually cause inflation, only that it is a possible outcome once “full employment” is reached, of which there is no definition. That’s a lot of hedging in the “deficits cause inflation” argument.

From the MMT perspective, deficit spending would have no correlation to inflation as long as there is sufficient slack in the economy to adjust to demand (i.e. no shortages). The fact that we have never been at “full employment” since WWII is why we should expect to see no recent correlation between inflation and deficits. It is widely understood that the reason the government sold war bonds during WWII was not to raise money, but to defer private sector spending in order to help lower general inflation due to the high demand of labor, raw materials, and capital by the government to support the war effort.

MMT and MS are a hard enough sell to many people, but making an argument that governments can deficit spend without any negative consequence becomes an even harder sell that can be easily dismissed by policy makers. This was a lesson Professor Kelton learned while working in Washington for Bernie Sanders on the Senate Budget Committee, and certainly informs her current messaging.

LikeLiked by 1 person

Good comments.

One of the reasons for war bonds was to give the populace a sense of participation. I lived through WWII (yes, really) and I remember my mother saving cans of fat and turning them in to the butcher. The ostensible purpose was to make bombs with them. That still is widely believed

I also saved bundles of newspapers and lugged them to school, also for the war effort.

It was psychological.

LikeLike

My Mom lived through the war as well (she is 89) and did many of the same things. There definitely was a psychological aspect to get people behind the war effort due to the enormous sacrifice that was being asked; however, many of the initiatives such as war bonds and conservation efforts also had real economic impact in helping to control inflation.

LikeLiked by 1 person

“…saving cans of fat and turning them in to the butcher…..the ostensible purpose was to make bombs..”

Yes they dropped “Fat Boy” on Japan.

LikeLike

😉

LikeLiked by 1 person

One last point(s) on the causes of the Great Depression before this blog ends.

1) In 1926 there came a VERY bad hog market that unleashed a chain of events that had a big impact on banking failure. Many farmers weren’t able to make their loan payments on farm machinery, land and buildings that bankers initially thought were low risk.

2) Then small country banks began foreclosure on farmers, taking away all their property, thinking that they could easily be sold. At this time, during the 20’s, the vast majority of Americans were living/working on farms; not many nonfarmers or city people wanted to be farmers. Meanwhile, real farmers were put out of business, unable to buy back their farms.

3) A year or so later, 1927-28, bigger Midwest city banks were forced to foreclose on their small country banks that had to borrow from them to cover their greatly expanded loans to the farmers. These bigger banks found out they foreclosed on utterly worthless farmhouses, rusting equipment and zero customers.

4) A pecking order developed where bigger banks foreclosed smaller banks. Chicago banks foreclosed on Midwest banks; NYC banks foreclosed Chicago banks. Finally NYC banks had to close due to insolvency, thus precipitating the 1929 Crash.

5) Word was getting around about the foreclosures and small “bank runs” began in 1930, setting up the panic and 1933 bank moratorium.

Could MS have saved the so-called “private” economy despite the gold standard?

LikeLiked by 1 person

Gold standards are nothing but laws. Just as Nixon arbitrarily took us off a gold standard, the President and or Congress could have done the same thing at any other time — and often did.

A gold standard is like the government wearing a pair of handcuffs, for which it has the key.

LikeLike

I’ll attempt to educate you with a little story from the day. Seems back in the day a recent college graduate engineer got his first job in 1933. It was shoveling wheat into a furnace on an Iowa farm because they couldn’t afford coal or oil. Meanwhile, people were standing in line 500 miles East in Chicago, hoping to get some bread to eat. Meanwhile, down in Texas, drums of oil sat on the dock because there were no buyers at 25 cents per drum. All of those people wanted to engage in commerce. It was government and bankers who took the money away, and prohibited any other method of commerce, that created and sustained the “great depression”. They took the gold and revalued it higher immediately, robbing the citizens. They prohibited gold commerce because it would have quickly displaced their paper currency. It was a fiat money scam then and they are running an even worse scam now as the “reserve requirements” are even lower (0). Few can believe the depth of it. Read up on the Worgl Austria Experiment – crushed in its infancy by the central bankers of the day. The common folk were willing and able to work then, as now. It was the central planners, big govt and big banks, restricting any activity that wouldn’t directly be to their benefit, by their control of fiat and credit.

LikeLike

So, the solution is what?

LikeLike

The solution is intuitively obvious, we need an independent currency for the free market. Let the government print/create their currency as they desire. And let them demand it back in payment of the various taxes they can successfully legislate. We will be forced to earn some to render them payments, but we will not be forced to save, and invest, and depend upon for our trade with our fellow man (or nation). And let they and their minions (govt workers, govt programs, defense industry, war makers…) remain dependent upon it and suffer (or benefit!), if and as they abuse their currency creation privileges – as they have done for so long. If they desire to make war, they must convince of its merits (and our peril) such that we deliver more of our currency to them or fund them through issuance of their bonds.

Meanwhile, let the free market blossom and grow on various commodity backed currencies as they may wish to utilize – the wheat unit in Iowa, the oil unit in Texas etc. And let us invite the rest of the world to join in such a system as they wish – so economic and political justice can flourish in our finite world. Inflation is theft, and perpetual inflation is theft and suppression of the poor and the unaffiliated (with bankers/govt or big business). Humanity would already be controlling its numbers if our currency was stable. Perpetual inflation of fiats around the world forces us all to run faster and faster upon the market treadmill, just to keep what we have. It burdens the honorable and unjustly rewards the beggar and the thief. It corrupts our politicians and our political process. And delivers benefit by subsidy, those who procreate with wreckless abandon.

The economic injustice that fiat money exploitation has facilitated is going to rip this world apart if we do not get alternatives ready soon. By war, economic collapse, resource shortage, or government mandate – we will inevitably be thrown into chaos and misery. No government body can possess the wisdom, endurance, or ability to promote honor – of the free market. Watch “I Pencil” from the 1950s and realize why the communist world had such trouble making a decent writing implement.

It is getting from here: monopoly fiat money domination around the world by national governments, and coordinated corruption among central bankers of our political processes etc – and back to a place of stable, honorable existence, with commodity backed money, which is our challenge. Those now in power will not let go of it easily, it has taken many decades of their nefarious manipulations to gain the domination they now have. And no politician who intends to oppose them is likely to endure for long.

Please do constructively critique or extend these thoughts, as getting this right for humanity in the next few decades is going to be a significant challenge.

LikeLike

The solution to inflation is bitcoin??? Or different money for every state, city, and hamlet??? Grapes as a currency??? Hmmm. Really???

LikeLike

MMT doesn’t say federal spending causes inflation, it says it may, if extreme enough cause inflation. These graphs are frequently cited by MMT academics. You’re out of line and chasing shadow rabbits.

LikeLiked by 1 person

“. . . it may, if extreme enough . . .”? Extreme enough for what? To cause inflation?

That is a tautology.

Shortages always are the cause of inflation. Money creation never is — or can you give me a counterexample?

LikeLike

Inflation is a difficult subject. Consider the following example:

When there is more money, prices often go up. A simple example can illustrate this. If two people desperately wanting to buy a house, and only one is for sale, and both have € 50,000, the house may be sold for € 50,000. But if both prospective buyers have € 100,000, the house might be sold for € 100,000. That is unless, a new house can be built for € 70,000. So, if people can get a mortgage, prices of existing homes might go up or more houses may be built or both.

Another situation is that a home is for sale for € 50,000 and two people own € 100,000 but both don’t need a new home. In that case the money they have does not produce inflation or new houses. And if the seller is desperately in need of money, he or she might sell the house for € 30,000 if that is what one of those two others is willing to offer. And so more money doesn’t always produce inflation.

So, apparently, if abundant money printing does create inflation, then we might be in a situation where there is more stuff than we can buy. But there is more going on:

Inflation is low, economists and central bankers say, but people don’t notice it. That may be because of ‘quality adjustments’ in the statistics. For instance, computers have more computing power than a few decades ago, but their price hasn’t risen. So, economists argue that the price of computers has actually gone down. If computers of the 1980s like the Commodore 64 were still built today, they may cost only € 2. But no-one has use for such a computer anymore.

Similarly, regulations might improve a product or reduce its harm done to the environment, and as a consequence the price goes up. Economists might argue that you get better quality so that the higher price is not inflation. And as more and better treatments become available, the price of health-care insurance goes up, but arguably it is not inflation. And so many people experience higher prices and an erosion of purchasing power despite the low inflation in the government statistics.

MMT suggests that there is ‘deficit in the private sector’ that the government has to fix by printing money while in reality there is a capital surplus or too many savings in the private sector (and not a deficit) so that the fix would be negative interest rates to balance savings and investments or consumption versus capital.

But printing money usually produces inflation and causes prices to be higher than they would otherwise be, but other factors are in play, so that it is obscured.

LikeLiked by 1 person

As the graph demonstrates, “printing’ money does not cause inflations. There is no correlation between federal money creation and inflation.

Instead, it is scarcity that causes inflations. When there is a shortage (usually, but not always, a shortage of food and/or energy), prices rise. (See also: https://mythfighter.com/2010/04/06/more-thoughts-on-inflation/)

What you describe in your first two paragraphs, and indeed in your entire comment, is scarcity. Look at your own words: ” . . . only one is for sale . . . ” That is called, scarcity.

Money creation can be a misguided response to hyperinflations, not a cause. And money creation actually can cure inflation. Imagine the U.S. being short of oil. There would be a general increase in all prices, aka “inflation.”

But if the US government created money to buy more oil from abroad, or to drill for more oil, and distributed that new oil domestically, the US price of oil would go down. Money creation would have cured the inflation.

LikeLike

If all other things are equal, money printing does create inflation. But all other things are hardly ever equal, so the relation can’t be seen by simply observing a graph showing the relation between deficits and inflation.

The idea that printing money is the way to lower inflation is a bit daft. Take the oil price example. You might spend this extra money to use scarce resources on oil production capacity so that the oil price goes down while the prices of the scarce rerources you use in the process go up.

Government deficits are not money either, which makes the relation between deficits and inflation remote. But government deficits can be used as a substitute for money as you can sell them for money and then use this money to buy a car or something else.

There are other things to consider. For instance, if the velocity of money. And the US is in a unique position because of the reserve status of the US dollar, so that the relation between government deficits and inflation becomes even more remote because foreign countries keep the dollar in reserve.

In any case, there is a relation between money creation and inflation. In the cases where money creation does not produce inflation, it might have prevented deflation, which is just the same. When people argue otherwise it is just because they don’t see that it is a complicated matter and that many other factors obscure this relationship.

LikeLike

Other than intuition, what data do you have to show that money creation causes inflation?

Creating money to fight inflation is exactly what Zimbabwe should have done to cure its notorious hyperinflation. That government took farmland from farmers and gave it to non-farmers. The resultant food shortage led to hyperinflation. If the government had spent to purchase food from abroad, while helping farmers to grow food, the hyperinflation would have ended.

Instead, it just printed currencies having bigger numbers. That did nothing to reduce the shortages, which were the real cause of hyperinflation.

In your second paragraph, I don’t know which “scarce resources” would see a price increase?

In your third paragraph, you say that deficits aren’t money. That is true, but running deficits are the method by which the federal government creates money.

At the government’s instructions, banks are the ones that create dollars on behalf of the government.

The government does not “print” dollars. It prints Federal Reserve Notes which are titles to dollars. Just as a car title is not a car, and a house title is not a house, a dollar bill is not a dollar. It is a title to a dollar. The dollar itself is just a number on a balance sheet. It has no physical substance which it why it can be transmitted instantly via wire or check.

In any event, I agree that the relationship between deficits and inflations would be remote.

The federal government’s “reserve status” is not an issue. All it means is that major banks keep dollar ON RESERVE to facilitate inter-nation trading. Many other currencies have “reserve status”: The British pound, the euro, the Japanese yen, and in more limited instances, the Australian dollar, the Canadian dollar, the Mexican peso, the Chinese yuan, etc.

Depending on geography, many currencies have “reserve status.” The U.S. dollar is not unique; it is just more often on reserve.

The belief that money creation causes a general increase in prices is base on intuition, not on historical data.

LikeLike

There was a guy, Milton Friedman, who has researched the relationship between quantity of money and price level. And I am not going to argue whether or not this relation exists as there is alwas some guy on the Internet who knows better.

LikeLike

Now, having failed to find and supply data, you turn to supplying a name. How very convincing.

LikeLike

Perhaps you can find cases where your idea appears reasonable, for instance Zimbabwe, but your reasoning is not convincing. The solution in the Zimbambwe case is ‘not destroying production capacity’ rather than ‘printing money’.

It is reasonable to assume that if the production capacity had not been destroyed, and the government had not printed money and instead had taxed farmers to achieve its objectives, the price level would have been lower than in your money printing ‘solution’.

The main reason why the relationship between money printing and inflation is remote, is that the money can be stored (e.g. not used). As long as it isn’t used for spending it doesn’t contribute to inflation. People only store currency if they trust it to keep its value over time. Hyperinflation is when people spend all their money immediately, out of distrust in the currency (velocity of money is key).

You ignore the obvious and that does not bode well for your theory.

LikeLike

I have shown you data indicatingng that money creation does not correspond with inflation. Where is the data to support your beliefs?

You wrote: “It is reasonable to assume that if the production capacity had not been destroyed . . . “ Right, if a shortage had not been created.

” . . . and the government had not printed money and instead had taxed farmers to achieve its objectives,”

If if the government’s objectives were to starve its citizens and create a depression, I assume that taxing farmers during a food shortage would have been a very good start.

So far, you have done nothing but repeat your intuition without providing an ounce of data. In essence, you are lying on your back and stomping your heels on the ground and screaming, “I don’t care what the data say; I know what I believe.”

Come up with the data to support your beliefs. You know the old saying, “Put up or shut up.”

LikeLike

Too bad, I can’t edit my comments, but you can sell government bonds for money (not government deficits).

LikeLike

Deficits are not something one can sell. They merely describe a situation in which spending exceeds taxing. Government deficit spending creates money by adding more money to the economy that it removes.

LikeLike

Government bonds are not money.

LikeLike

Really? Interesting. What is your definition of money?

LikeLike

Investopedia: if the Fed buys government bonds in the open market (selling them for cash), it increases the money supply, so government bonds are not money. I do not have my own definition of money. If you deviate from generally accepted definitions, it will be hard to discuss anything.

LikeLike

Look in your wallet. Your dollar BILLS are labeled, “Federal Reserve NOTE.” NOTES, BILLS, and BONDS all are a form of debt and a form of money. (All money is a form of debt, though all debt is not a form of money.)

See: https://mythfighter.com/2010/02/23/understanding-federal-debt/

A paper dollar BILL (Federal Reserve NOTE) is a receipt for a bearer bond having an infinite maturity date and paying no interest.

A Treasury-BILL is a bond having a less-than-one-year maturity date, and paying interest.

A Treasury-NOTE is a medium-maturity bond that pays interest

A Treasury-BOND is a long-term bond that pays interest.

All four have a variable value prior to maturity, and all are a form of money. The collateral for all four debts is the full faith and credit of the United States government.

Buying a Treasury-BILL with dollar BILLS merely exchanges one form of BILL for another. Buying T-NOTES with Federal Reserve NOTES also exchanges one form of NOTE for another.

Rather than engage further in the “what-is-money? sophistry, stay with the subject. You have drifted away from your initial claim that deficit spending causes inflation.

Is it because you are unable to find data to support that claim, and now wish to argue about something else?

LikeLike

So you do not believe in the free market. You believe government can create money from nothing, merely give it to the “right people”, and more of the desired products will be created, and inflation will be cured! I think you are living in dream land. Governments are very imperfect distributors of purchasing power. And that is what it is – purchasing power, not money but currency, injected into an economy with a scarcity of labor. So instead of doing one thing, more people will be doing what the guy with the govt money says. Without the private sector, there would be very little progress for humanity. Look at what the command economy is doing to communist China of late.

LikeLike

What do you think is the “free market”? If the government can’t create money from nothing, where did the dollar come from? Who says there should be no private sector?

Alan Greenspan: “A government cannot become insolvent with respect to obligations in its own currency.”

Ben Bernanke: “The U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Quote from former Fed Chairman Ben Bernanke when he was on 60 Minutes:

Scott Pelley: Is that tax money that the Fed is spending?

Ben Bernanke: It’s not tax money… We simply use the computer to mark up the size of the account.

Statement from the St. Louis Fed:

“As the sole manufacturer of dollars, whose debt is denominated in dollars, the U.S. government can never become insolvent, i.e., unable to pay its bills. In this sense, the government is not dependent on credit markets to remain operational.”

LikeLike