It takes only two things to keep people in chains: The ignorance of the oppressed and the treachery of their leaders.

………………………………………………………………………………………………………………………………………………………………………………

One simple definition of inflation is the loss in Value of Dollars (Inflation = 1/Value of Dollars).

Increasing the Supply of dollars is inflationary; increasing the Demand for dollars is deflationary. Put the two together and you get:

Value of Dollars = Demand for Dollars/ Supply of Dollars.

/about/what-is-inflation-definition-56a090f45f9b58eba4b19ec9.jpeg)

The Demand for dollars is: Demand = Risk/Reward

The Risk of owning dollars is Inflation. The Reward for owning dollars is Interest. Thus, the Fed limits inflation by increasing interest rates, i.e. increasing the Reward for owning dollars.

Although the Fed can increase the inflation-limiting Reward (interest) endlessly, there are serious functional and political consequences for reducing interest rates below zero. In short, the Fed has more power to reduce inflation than to increase it.

But there is more to inflation than just the Demand and Supply of dollars. Also to be considered are the Demand and Supply of Goods and Services (G&S).

When goods and services are in high Demand or in low Supply, more dollars are needed to buy them. When the price goes up the Value of the dollar is decreased. (Value of the dollar = 1/Price)

This brings the formula for inflation to:

Value of Dollars = (Demand for Dollars/Supply of Dollars) / (Demand for G&S/Supply of G&S)

In plain English, with interest rates held even, we will have inflation (dollar Value declines) if Demand for G&S exceeds Supply. That is called a “shortage,” and a shortage of G&S, not an excess of money, is the usual path to inflations and to hyperinflations.

(Weimar hyperinflation was precipitated by a shortage of gold which caused a shortage of Goods & Services. Zimbabwe’s hyperinflation was precipitated by a shortage of food.)

Consider this excerpt from an article that appeared in Bloomberg:

The Fed can switch gears and see if looser monetary policy can boost productivity growth. The persistently weak inflationary environment offers the perfect opportunity for such an experiment.

Low inflation already vexes the Fed. Core inflation tumbled early in the year and remains well below the Fed’s target.

This alone gives the Fed reason to allow a slower path on rate hikes in an experimental effort to boost productivity growth.

Said another way: The Fed wants to raise inflation to its 2% target rate, so it should cut interest rates to boost productivity growth.

This idea is based on an implied and related set of popular myths:

Myth I. An inflation rate above zero is necessary to encourage consumption, today. If inflation falls below zero, or even close to zero, the public will defer consumption, waiting for lower prices.

Myth II. High interest rates inhibit economic growth because they discourage consumer and business borrowing.

Myth III. The Fed can create and control economic growth by carefully managing interest rates and the money supply.

Let’s examine these myths:

Myth I. Inflation is necessary to encourage consumption, today.

No one accurately can measure inflation, which is defined as a “general increase in prices.” Investopedia says, “As a result of inflation, the purchasing power of a unit of currency falls. For example, if the inflation rate is 2%, then a pack of gum that costs $1 in a given year will cost $1.02 the next year.”

Think about it. Is that what really happens? Each commodity goes up 2%? Gum goes up 2 cents?

Realistically, in any given year, some prices go up, some go down, and most don’t change. I buy gum, and I haven’t seen those annual, fractional price increases. Have you?

To attempt any measurement of inflation, the government uses averages as described in Investopedia:

- (CPI) – A measure of price changes in consumer goods and services such as gasoline, food, clothing, and automobiles. The CPI measures price change from the perspective of the purchaser.

- Producer Price Indexes (PPI) – A family of indexes that measure the average change over time in selling prices by domestic producers of goods and services. PPIs measure price change from the perspective of the seller.

But not only do CPI and PPI prices change over time, but products change. How does the government account for the prices of product improvements — a “better” car, TV, clothing, washing machine, smart phone, paint?

For instance, today’s 60″ TVs cost less than yesterday’s 36″ TVs. Would you consider that to be inflation, deflation or “none-of-the-above”?

Further, the rich use different products and services than do the poor. In fact, different products and services are used by each of many economic, geographic, age, and ethnic groups. There are no “average” purchasers or “average” sellers.

And as for the theory that inflation encourages consumption, did fear of inflation encourage you to buy a car today, a TV, clothing, a washing machine, a smart phone, paint today?

Aside from (maybe) a house, the threat of inflation doesn’t encourage you to buy anything today, does it?

The whole notion of inflation encouraging consumption, today, is based on textbook economic hypotheses and on what happens during hyperinflations, but not on human daily reality.

Myth II. High interest rates inhibit economic growth because they discourage consumer and business borrowing.

Yes, the stock market drops every time the Fed indicates it plans to raise rates. But, there is a saying in the market, “Buy the rumor; sell the fact.” It means stock prices are based on predictions about what other investors will do, not on reality.

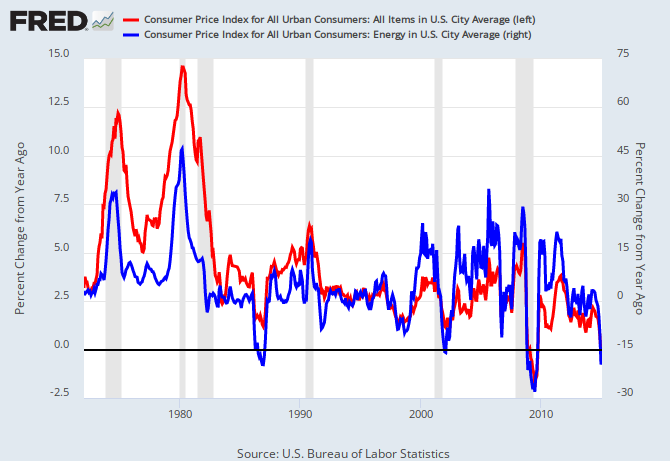

Higher interest rates force the federal government to pay more interest into the economy, which is stimulative. That is why you see a graph like this:

Over the 25-year period, 1955-1980, interest rates averaged higher and trended upward as GDP growth also trended upward. From 1980-2015, interest rates trended lower and while GDP growth also trended downward.

Historically, low interest rates have paralleled slow economic growth.

Myth III: The Fed can create and control economic growth by carefully managing interest rates.

The Fed can reduce and/or prevent unwanted inflation by increasing interest rates, which increases the Demand for dollars. The Fed has unlimited power to increase interest rates, which gives it unlimited power to reduce inflation growth.

The Fed has much less power to prevent unwanted deflation because of the functional and political limits to how low it can take interest rates. Because the Value of a dollar =Demand for dollars/Supply of dollars, Congress has far more power than does the Fed to increase inflation by increasing Supply.

With all of the above considered, the current reality is: The initial influence on inflation in America today is oil prices. Oil prices affect, to some degree, the price of every product and every service.

The price of oil is embedded in all levels of manufacture, all levels of shipping, and every level of service.

The Fed uses its interest rate tool in a constant battle with oil prices and with Congressional budgeting, to control what it believes to be the nation’s optimum level of inflation for optimum economic growth.

Speaking of economic growth, a typical formula is:

Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports

Federal Spending not only is a direct factor, but it also affects Non-federal Spending by providing dollars to businesses.

Federal spending is the primary controllable driver of GDP growth, and this control over Federal Spending primarily is in the hands of Congress and the President, not the Fed.

The Senators and Representatives who claim the Fed is “not doing enough” to grow the economy merely are shifting blame from their own mishandling of the budget. Bottom line:

Congress and the President control economic growth, and the Fed controls inflation.

Contrary to what you repeatedly are told, federal “deficits” (economic surpluses) and federal “debt” (deposits in T-security accounts at the Federal Reserve Bank) are stimulative and infinitely sustainable.

Congress and the President, by pretending that federal deficits and debt are a danger to the economy, are the ones most responsible for low economic growth and a widening Gap between the rich and the rest of us.

In summary, the Federal Reserve has a limited mission: To manage banking and to prevent excessive inflation. Economic growth is the mission of Congress and the President.

Get to it, boys.

Rodger Malcolm Mitchell

Monetary Sovereignty

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

The single most important problems in economics involve the excessive income/wealth/power Gaps between the have-mores and the have-less.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE A MONTHLY ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA (similar to Social Security for All) (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB (Economic Bonus)) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONE Five reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE FEDERAL TAXES ON BUSINESS

Businesses are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the federal government (the later having no use for those dollars). Any tax on businesses reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all business taxes reduce your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and business taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Saying that oils is what drives prices is pretty wild.

Think about this for a minute, oil went from 10 dollars a barrel to 150 dollars a barrel in a relatively short period of time. It stayed there for a while.

While the price of oil based fuel did go up, prices of other prices did not.

Oil then collapsed from 150 dollars a barrel to 30 a barrel. Did inflation collapse? Not one bit.

Most people blame oil for inflation and most are wrong about it.

Additionally, the government chooses items that are benefitial to their numbers, so the inflation numbers are pretty unreliable.

One thing nobody considers is that the natural state of affairs is deflation, as humans strive to increase productivity everyday. We can build more cars today and produce more food thanks to engineering advances.

Yet, we do not have deflation – we have small inflation. What that says is that we indeed have inflation at higher rates – if deflation was running at 10%, a zero to inflation rate represents 10% inflation.

Inflation is not a combination of measurements, that’s like trying to measure the amount of air. It’s impossible and it’s rigged.

Given that the natural state of affairs is deflation, inflation is nothing more than money growth.

LikeLiked by 1 person

Read this: Deficit spending doesn’t cause inflation; oil does

If you have statistics to support your hypotheses, please provide them.

If all you have is your hunches and intuition, not interested.

LikeLiked by 1 person

I dont have stats, I have facts.

Oil went from $10 to $150 dollars. Did inflation go up by 1500%?

Oil went from $150 to $35. Did inflation collapse 500%?

These are facts, you are going by intuition or perhaps political motive.

LikeLike

You don’t have stats; you have facts. Even for you, that is nonsensical.

And your so-called “facts” also are nonsensical.

I gave you an entire link, showing you in detail the parallels between oil prices and inflation.

Instead of reading it, you returned with an undated claim that because inflation didn’t go up and down AS MUCH as oil prices did, this “proves” oil prices don’t cause inflation.

If you had the ability to read and understand the link, you would have seen this:

“The extreme movements of energy prices corresponding with the more modest movement of overall inflation, seem to indicate that energy costs “pull” inflation in either direction.”

It was a mistake for me to think you actually wished to learn and to give you one last chance. Done.

Bye.

LikeLiked by 1 person

Rodger, I agree with you that oil plays a major role in inflation, but you fail to make a convincing case for interest rates controlling inflation.

Interest rates have some link — though a weak link — to housing. Raising interest rates A LOT tends to slow housing, which in turn can slow the economy. That could slow inflation *if* inflation is caused by a “too hot” economy running at 100% capacity.

However, the 70’s economy was not running at 100% capacity. 70’s inflation was caused by Mid Eastern politics. The price of oil final subsided due to the 1976 Doha agreement with Henry Kissinger wherein the Sauds agreed to sell oil in dollars at moderate prices in return for the U.S. military propping up the unpopular Saudi dictatorship.

Then the Iranian revolution caused another spike in inflation, however that spike was short lived. The Sauds were able to ramp up production to make up for the lost Iranian production and then oil prices once again moderated.

Meanwhile Volker tried to take credit. In reality all Volker did was inflict a lot of unnecessary pain.

That’s just the U.S.. In 3rd world countries, it is common for inflation to be highly influenced by the exchange rate and by trade balances.

LikeLike

I’m sorry you disagree with the formulas:

1. Value = Demand/Supply and

2. Demand = Reward/Risk

The Reward for owning dollars is interest.

For the past century, through deficits of different sizes, wars, recessions, depressions, natural disasters, shortages and excesses, the Fed has managed to control inflation to an average of about 2.5% — its target rate.

Sometimes inflation went higher and sometimes lower, but overall it’s been about 2.5%. How did the Fed do it?

By controlling interest rates.

Today, the Fed senses the potential for inflation, so it is raising interest rates, incrementally.

If all of the above is wrong, are you saying the U.S. has no control over inflation?

Or do you believe the MMT idea that somehow Congress controls inflation by intentionally running deficits when inflation is too low, and cutting deficits when inflation is too high?

LikeLike

Milt Friedman might agree with you about Value = Demand/Supply. But the Fed does not control the supply of dollars, private banks do. Demand for money can depend on “animal spirits.”

Lerner’s functional finance theory of inflation applies to a closed economy that is running near full capacity. We do not have a closed economy and we have not run at full capacity since WWII, if even then. I don’t disagree with the operating principles of functional finance, but it’s never been put into practice during my lifetime.

I am saying that the U.S. government, including but not limited to the Fed, has limited control over inflation in a slack economy. If the price of oil goes to $500, there will be a bout of inflation, and interest rates will not change that. Inflation in my adult lifetime has correlated to oil.

Further, all inflation in my lifetime has been synchronized among industrialized economies despite their having independent economic policies. Chart inflation for the U.S., Australia, the UK, Finland, Germany, etc — they all follow the same trend. They all spiked during the 70’s. They all subside after the 1976 Doha agreement. Then they all spike again during the Iranian revolution. It’s the oil.

That’s not to say that other things besides oil cannot influence inflation. Latin America is an interesting study for the student of inflation. War, exchange rates, government dysfunction, Dutch disease, etc..

Like it or not, we live in a global economy. The price of copper in China affects the price of copper in the U.S.. The price of labor in China affects the price of labor in the U.S. (except for doctors, lawyers, and other local service jobs that don’t have to compete with China). The price of oil in the Middle East affects the price of oil in Oklahoma. The Fed cannot control all those things. The Fed is shooting blanks.

LikeLike

“Milt Friedman might agree with you about Value = Demand/Supply . . .”

I know of no economist who disagrees with that equation.

“But the Fed does not control the supply of dollars . . . ”

Correct. The Fed’s control is related to Demand, not to Supply.

In any event, you are correct that the single most important determinant of inflation in America is oil prices.

The Demand for dollars (also known as the “strength” of the dollar) plays a role, especially with regard to exchange rates.

The Fed is not ” dropping atomic bombs, but it definitely is not “shooting blanks.” Their control of interest rates actually is the government’s sole control.

LikeLike