Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Who is America’s single most damaging person? Who is the one person causing the most harm to America as a nation, and to each American, individually?

In a sense, the answer is simple: The President, no matter who he is. He has so much power, that even a casual lift of his little finger can cause major damage.

And when you have a President who is a congenital liar, and who combines a massive ego with a lack of knowledge and a lack of experience, and who surrounds himself with unqualified people, and puts them in charge of agencies whose missions are opposed to their own personal missions, he clearly will cause more damage than anyone, especially if he has a Congress of the same political stripe.

So let’s move beyond the obvious and go to the real question: Who is America’s second most damaging person?

Considering all the possible choices. You could throw a dart at a list of Senators and Representatives, and come up with a candidate. But individually, their power is limited, and most of them focus only on three goals: Be elected, be re-elected and be re-re-elected, regardless of any damage they cause.

True, a Senator can cause trouble for the nation — Joseph McCarthy and Strom Thurmond come to mind — but they need help from an acquiescent Congress, and currently, most are so self-indulgent and short-lived (politically speaking), they haven’t convinced their fellow misfits to follow their lead. So the damage has been limited.

The most (second most after the President) damaging person is one who combines longevity, focus of purpose, access to influential people, a loud “megaphone,” and an agendum that will maximize the damage to the most Americans.

After some thought, I nominate Maya MacGuineas, president of The Committee for a Responsible Federal Budget (CRFB), as the one person, other than America’s Presidents, who has damaged, and continues to damage, the United States of America more than any other individual.

The CRFB was formed in June, 1981. More than 35 years of mischief is plenty of time to do real damage.

The focused purpose of the CRFB is to reduce the federal deficit and debt (aka “austerity”), a process that negatively affects the lives of all Americans — except for the most wealthy among us, the .1%.”

CRFB was formed by Robert Giaimo (D-CT) and Henry Bellmon (R-OK). Mr. Giaimo had served in the House of Representatives for 20 years, including four as Chairman of the House Budget Committee. Mr. Bellmon had served 12 years as a Senator and was the ranking Republican on the Senate Budget Committee from its inception in 1975.

Thus, the organization was born with access to influential people. Further, the CRFB claims it regularly meets with members of Congress and their staff, hosts several policy briefings, and offers practical solutions that can achieve bipartisan support and put the country on a “sustainable fiscal course.”

Additionally, the Board of the CRFB includes a long list of luminaries, wealthy, white people, nearly all men, who personally benefit from austerity, while the rest of America suffers.

We’ve spoken of MacGuineas and the CRFB before:

—More BS from Maya MacGuineas et al

—Stephanie Kelton vs May MacGuineas

—Open letter to May MacGuineas

Fundamentally, the CRFB parrots the Big Lie that federal financing is like personal financing, federal taxes fund federal spending, and the federal government should run a balanced budget.

(The truth: Federal financing is not like personal financing [The federal government is Monetarily sovereign; people are not.], federal taxes do not fund federal spending [Even if all federal tax collections fell to $0, the federal government could continue spending, forever.] and balanced budgets are recessionary [any time the government runs a balanced budget or even reduces deficit growth, we have a recession or a depression.)

Given the economics experience of the CRFB board and its staff, there seems to be no possibility that these facts are unknown to them. The sole conclusion one can draw is that for certain reasons to be discussed later, the CRFB intentionally is trying to cripple America.

Here are examples of their latest “Obamacare reform” efforts that would injure the American economy, and especially punish the “not-rich” (aka the 99.9%).

What’s The Plan to Replace ‘ObamaCare’?, November, 2016

Broadly, the blueprint would repeal most of the Affordable Care Act’s tax and coverage provisions and replace them with a mixture of tax credits, (generally looser) regulations, high risk pools, state flexibility, and other provisions to promote low-cost health insurance coverage.

The focus of the CRFB is on saving money for the federal government while increasing costs to the public. Their underlying belief is that the federal government is short of dollars, but you are not.

Never mind that the federal government, being Monetarily Sovereign, never needs to save money. It has the unlimited ability to create its sovereign currency, the dollar. It never, never, never unintentionally can run short of its own sovereign currency.

The blueprint would also take steps to reform Medicare and Medicaid to slow spending overall growth (though it would repeal some cost-control measures in the Affordable Care Act).

“Reform” is the term the .1% use when promoting a plan to charge the 99.9% more or to provide less benefit to the 99.9%. “Slowing spending” means the government would pay less, but you, the public would pay more — and you would receive less.

Likely, the plan would result in less coverage than current law but more than before the Affordable Care Act. It would also likely encourage economic growth to a small degree.

Reductions in federal spending do not encourage economic growth. Gross Domestic Product = Federal Spending + Non-federal Spending + Net Exports.

And, the CRFB doesn’t care that you would receive “less coverage.” In fact, that is what the want.

Ideally, the final healthcare bill will provide for low-cost insurance coverage for individuals and the government while reducing the deficit and, perhaps most importantly, further slowing the growth of private and public health care spending over the long term.

The plan relies on the beliefs that there are:

- Too many doctors and the doctors earn too much.

- Too many hospitals and the hospitals earn too much.

- Too much research being done on pharmaceuticals and medical methods, and the pharmaceutical companies earn too much.

- The healthcare insurance companies, which merely are middlemen in the process, and do not in themselves provide healthcare, must be protected.

- The federal government is running short of money.

Not one of these beliefs are factual. They are part of one Big Lie.

You can visit the site to see more details, but the overall approach is three-fold.

- Reduce federal government spending.

- Increase your personal spending.

- Reduce your benefits.

This, in fact, seems to be the entire agenda of the CRFB.

Moving on now to the CRFB’s Social Security agenda:

How Old Will You Be When Social Security’s Funds Run Out?

The Social Security Trust Funds are on a path to run out. The Social Security Trust Funds are projected to become insolvent in 2034, according to the program’s trustees.

At that point, revenues coming into the program will be insufficient to cover scheduled benefits, causing all beneficiaries to suffer a 21 percent benefit cut, regardless of their age, income level, or how much they depend on the program.

The program’s trustees are lying and the CRFB is promulgating the lie. Neither the federal government, nor any federal agency, can become insolvent, unless Congress and the President want it.

Note that no other federal agency has “revenues coming in” (aka FICA). The White House is a federal agency. It is not supported by FICA or any other tax. Yet there never is a discussion of a White House “trust fund” running out of funds.

Similarly, Congress is a federal agency, yet we never hear of Congress being insolvent.

The Supreme Court also is a federal agency, not supported by any “trust fund,” yet the Supreme Court is not “on a path to run out” of money.

Do you wonder why?

The facts are these:

- The Social Security “Trust Fund” is an accounting fiction that does not support Social Security.

- The sole purpose of the fictional “Trust Fund” is to provide an excuse for reducing benefits and/or increasing taxes.

- Even if FICA were eliminated, Social Security (and Medicare) could provide increased benefits for all Americans, forever.

Moving on to the CRFB’s comments regarding taxes:

Expanding Medical Deduction Would Add to Debt

Today, the House voted to expand the medical expense deduction by reversing a change used to pay for the Affordable Care Act (ACA). Because this proposal is not offset, CBO estimates it will cost $33 billion over 10 years.

Translation: “Because this proposal is not offset, it will” save us Americans $33 billion and pump $33 billion into the economy over 10 years.

Taxpayers can currently deduct very high out-of-pocket medical costs from their taxable income. Between 1986 and 2013, such costs could be counted as an itemized deduction if they exceeded 7.5 percent of adjusted gross income (AGI).

In order to help finance the costs of the Affordable Care Act and possibly help to slow health care cost growth, Congress changed this threshold to 10 percent of income starting in 2013 for most taxpayers and in 2017 for seniors.

The bill passed in the House (H.R. 3590) would permanently undo the increases of the threshold in the health care law, preventing the increase that is scheduled to take place next year for seniors and rolling back the increase for non-seniors that has been in effect for three years.

To the CRFB, tax savings for sick people and seniors is an anathema. This group of elites would much prefer that sick people and the elderly pay more, and the federal government, which can afford anything, pay less.

Notice that the 7.5% threshold limit does not apply to corporations, but only to individuals. Notice also, that most rich people have incorporated themselves, so they receive full deductions.

The CRFB article continues with additional complaints about tax deductions that “were responsible for significant deterioration of the nation’s medium-term fiscal picture.”

This, of course, is a statement of “the Big Lie.” The U.S. federal government, being Monetarily Sovereign, cannot have a “deterioration” of its “fiscal picture” — not short-term, not medium-term, and not long-term.

In a section titled, “Economics:

Trump Will Face Highest Debt-to-GDP Ratio of Any New President Since Truman

By our estimates, the national debt will total about 77 percent of Gross Domestic Product (GDP) when Trump takes office –higher than at the start of any other presidency, save Truman’s. .

And not only would President-elect Trump begin with higher debt levels than any president other than Truman, but he also faces an unsustainably growing national debt which would rise far more rapidly if he followed through with his costly campaign proposals.

Translation: Trump and the nation benefit from higher debt levels, in that higher debt is a reflection of higher federal deficit spending, i.e. higher stimulus spending.

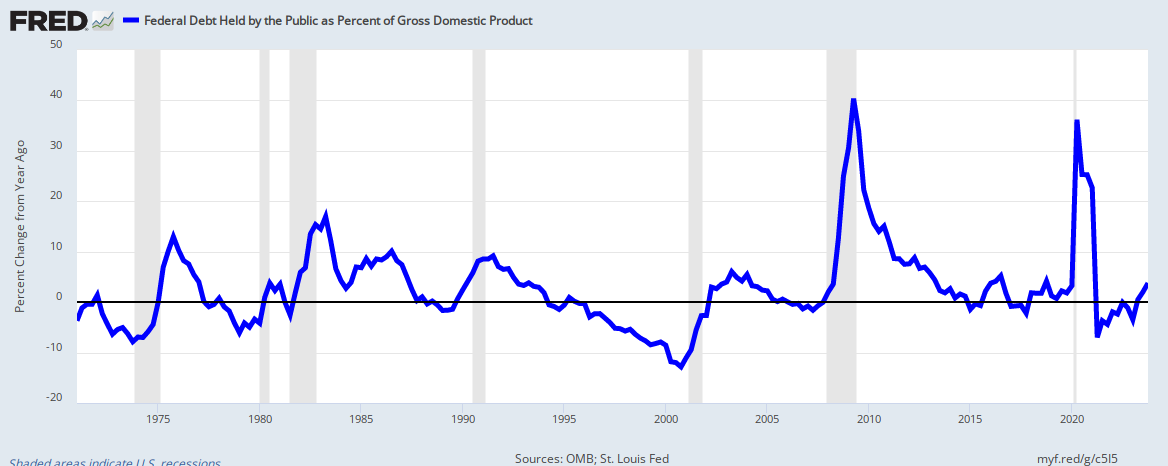

Here is a graph that demonstrates the fact that decreased growth in deficit spending results in recessions, while increased growth cures recessions.

Even before FCRB began, as far back as 1940 and before, debt fighters have been claiming the federal debt is “unsustainable” (their favorite word) or a “ticking time bomb. See here.

The Big Lie is not new. We’ve documented it for at least 76 years — year after year after year, repeatedly telling us, the American public, that the growing debt is “unsustainable.”

And yet here we are today, 76 years later. The debt still is growing and we still are sustaining. How could that be unless the whole thing is a gigantic lie: The Big Lie?

Here is the purpose of the Big Lie: It encourages fewer benefits going to the poor and middle classes, with more tax collections (increases in FICA and “broadening the base.”)

This widens the Gap between the .1% and the rest. Since it is the Gap that makes the .1% rich (Without the gap, no one would be rich; we all would be the same.)

Thus, the primary goal of the rich is not simply to make more money, but more importantly, to widen the Gap. Pushing us down is just as important as pulling themselves up.

And that is what the FCRB is paid to do: Promote programs that will widen the Gap between the .1% and the rest.

And that is what makes Maya MacGuineas America’s second most damaging person — more damaging than any spy, more damaging than any bigot Senator, more damaging than a purveyor of false news, like Breitbart.

She has access to influential people, regularly meets with members of Congress and their staff, hosts several policy briefings, and offers false solutions that can achieve bipartisan support and put the country on a downward fiscal course.

She and the CRFB combine longevity, focus of purpose, access to influential people, a loud “megaphone,” and an agendum that will maximize the damage to the most people.

The most delicious irony would be if fate made Ms. MacGuineas completely dependent on Medicare and Social Security, but because of CFRB, benefits were so reduced, and taxes so high, she would be unable to “sustain.”

Rodger Malcolm Mitchell

Monetary Sovereignty

The single most important problems in economics involve the excessive income/wealth/power Gaps between the rich and the rest.

Wide Gaps negatively affect poverty, health and longevity, education, housing, law and crime, war, leadership, ownership, bigotry, supply and demand, taxation, GDP, international relations, scientific advancement, the environment, human motivation and well-being, and virtually every other issue in economics.

Implementation of The Ten Steps To Prosperity can narrow the Gaps:

Ten Steps To Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich can afford better health care than can the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE AN ANNUAL ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA, AND/OR EVERY STATE, A PER CAPITA ECONOMIC BONUS (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONEFive reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefitting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-transferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be a good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

Here is how the Big Lie kills.

And this is interesting:

Other nations consider healthcare a right. The CRFB considers it a burden.

LikeLike

And to all you coal miners who voted for Trump, so sorry:

When you vote for an obvious liar, you obviously get lies. Are you grateful?

LikeLike

And then there’s this:

All you folks who voted for the “greatest jobs President God ever created,” guess what. He lied. Surprised?

Don’t say you weren’t warned.

LikeLike

And — and then there’s this:

http://www.msnbc.com/rachel-maddow/watch/poll-shows-trump-voter-gap-with-facts-rest-of-americans-s-views-828697155531?cid=eml_mra_20161209

Stupid is as stupid does, and very soon, stupid will pay the price.

LikeLike

https://www.yahoo.com/finance/news/gop-introduces-plan-to-massively-cut-social-security-222200857.html

LikeLike

Johnson knows that his bill has no chance of getting out of committee, let alone passing the house and senate, and being signed by Obama. The current congress ends in 24 days, at which time all pending bills will be wiped clean. Everyone must start over from square one. Johnson’s bill is an empty gesture. That’s why it has no co-sponsors.

Note how RMM’s beloved Democrats push for cutting Social Security every bit as much as Republicans do. Democrats do this by supporting the Big Lie.

An example from the article…

“Democrats prefer strategies like increasing taxes above the Social Security cap—billionaires pay the same amount as someone making less than $118,000—or raising the Social Security tax itself. There has, however, been a bipartisan effort for a payroll tax to help keep Social Security funded.”

And there it is: the lie that FICA taxes fund Social Security. The lie is equally echoed by both evil Republicans and “saintly” Democrats. Both conspire against us. RMM says this makes Democrats “better.”

By the way, there is ALREADY a payroll tax. The article’s author is confused.

Also from the article…

“Congress will deliberate on Johnson’s proposal in 2017.”

No. Johnson’s bill is dead. If he wants to revive it, he will have to re-introduce it anew next year. He only did it this time because he introduced the bill to his own committee, which he chairs.

By the way, Johnson is 86. Alan K. Simpson is 84. Pete Peterson is 81. What is it about some elderly people (I said SOME) that makes them so obsessed with destroying Social Security? Do they think it keeps them young?

LikeLike

OFF TOPIC

Yesterday (10 Dec 2015) the Greek parliament passed a budget of dramatically increased austerity.

Prime Minister Alexis Tsipras said his latest attack on average Greeks will mark Greece’s “final exit” from a crisis from which there can be no exit as long as Greece uses the euro. (It’s always the “final exit.”)

The government will increase taxes by more than 1 billion euros, and will cut spending by over 1 billion euros.

The doubled austerity, plus a mammoth debt load, will further destroy the Greek economy. However Alexis Tsipras claims (as always) that it will spur “robust economic growth” for 2017.

Tsipras said that despite endless austerity, this new doubling of austerity “is the first budget of optimism, growth and recovery.”

Finance minister Euclid Tsakalotos says the IMF is demanding even more austerity worth 4.5 billion euros ($4.75 billion) starting in 2019, plus mass public sector layoffs.

http://abcnews.go.com/International/wireStory/greece-passes-austerity-2017-budget-eyes-27-percent-44111505

LikeLike

Sounds more like the “final solution.”

LikeLike

(Sarcasm alert) – But, but, but, if you oppose the EU you’re RACIST. You’re probably a white woman who despises open borders and wish your country keeps white people as a majority. You white people are a plague***.

In all seriousness now, I am a firm believer that change only comes when the absolute worse happens. When the absolute worse happens is when the “peasants”, as you call them, finally decide to do something to change the situation they’re currently in. Unfortunately, this change only comes through violent means (think Bolshevik Revolution, French Revolution etc.) and ends with the heads of the oligarchy impaled in a stake. That’s why I think that stuff like what is happening in Greece is imperative to bring change; the people will get tired, they will revolt, they will kill the people oppressing them and maybe (just maybe) create a better system.

Hopefully MMT/MS can reach a wider audience so that when change is ready, the peasants build a system modeled after these aforementioned economic philosophies.

***BTW, this is what the ‘regressive left’ thinks of white people:

http://www.washingtontimes.com/news/2016/dec/7/buzzfeed-faces-backlash-over-racial-piece-covering/

LikeLike

I degress..

If what you say comes about (heads getting chopped), then anyone spewing the mmt/ms garbage will also get their heads chopped.

By that time, people will be forced to face reality. Unless, “reality” is what has happened in cuba for the last 60 years.

The irony is, you still have people in cuba, the US and all over that believe in the communist nonsense.

You know what, i will take that back – people never learn. I suggest there are a bunch of free loading cowards amongst us, whom:

1) “feel good” when the government helps people, but they never would

2) have no clue what it really takes to create and grow an economy. Hint, its not money.

I think rmm and liz fall under #1. They are likely the worst of citizens and wouldnt help anyone other than themselves, but acting like they do makes them feel good.

The majority of the citizens have no clue what to do and will believe just about any garbage, including those spewed by the left and those in government.

LikeLike

He “degresses.”

There may be some who wonder why we continue to publish Danny’s comments. In addition to their entertainment value, they provide a good example of “what’s out there.” Sometimes our lives are so insular, we tend to believe that what we say is “obvious.”

But the world is filled with Dannys, and what may seem obvious to you, or obvious to me, is alien to others.

Consider the fact that Donald Trump obviously is a lying egomaniac, mentally and emotionally unfit to be president of a neighborhood bingo club, much less President of the United States, yet millions voted for him.

Who are these people? They are Danny, and that is what we must recognize.

LikeLike

Ummm . . . . what? You talked a lot but said very little Danny boy.

LikeLike