If you enjoy economic fiction and a restatement of The Big Lie, there may be no better place to begin than the Republican 2016 platform.

On page 23, you will find the following:

Balancing the Budget

The federal fiscal burden threatens the security, liberty, and independence of our nation.

The current Administration’s refusal to work with Republicans took our national debt from $10 trillion to nearly $19 trillion today. Left unchecked, it will hit $30 trillion by 2026.

The term “fiscal burden” is a lie. The federal government, being Monetarily Sovereign, can pay any bill of any size at any time. It never can run short of its sovereign dollars to pay its financial obligations. The notion of “burden” simply does not apply.

Even more, the so-called “national debt” is not really a debt as you may understand the term. The misnamed national “debt” is nothing more than the total of deposits in T-security accounts at the Federal Reserve Bank.

In short, the so-called “debt” is bank account deposits. It entirely could be paid off tomorrow, simply by transferring the dollars that exist in those accounts to the checking accounts of T-security holders. No new dollars and no taxes needed.

Thus, the “debt” poses no “burden” on the government and no “threat to security, liberty, and independence of our nation.”

At the same time, the Administration’s policies systematically crippled economic growth and job creation, driving up government costs and driving down revenues.

Oh, the irony. Deficit spending is what brought the nation out of the worst recession in our history. In fact, federal deficit spending is what has cured every recession.

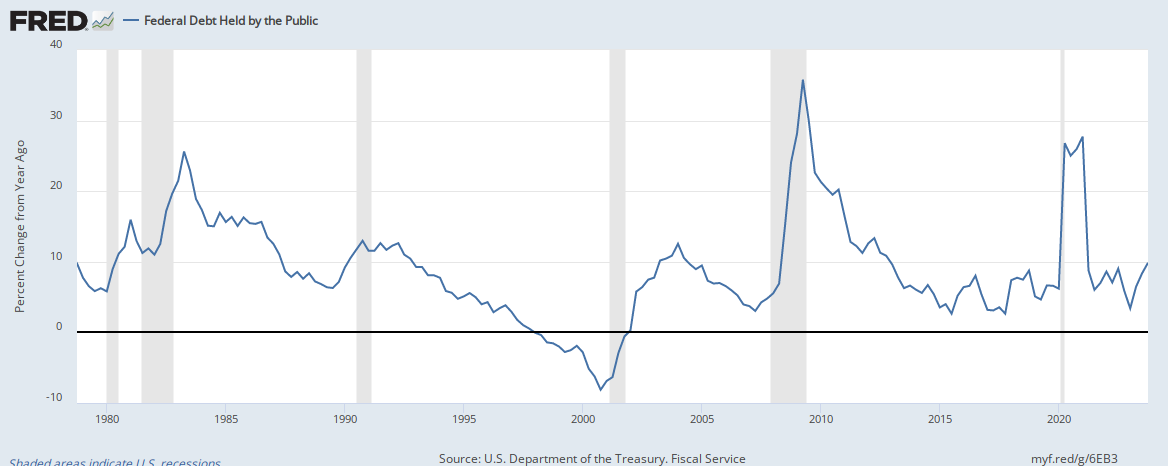

The blue line is the relative change in federal debt. The vertical bars are recessions.

Declines in the blue line have led to recessions, and increases have cured recessions. The reason: A growing economy, by definition, requires a growing supply of money, and federal deficit spending increases the money supply.

When Congressional Republicans tried to reverse course, the Administration manufactured fiscal crises — phony government shutdowns — to demand excessive spending.

The ironies simply don’t end. It was Republican Ted Cruz who threatened to shut down the government unless federal deficit spending (the one factor that grows the economy) was reduced.

The Administration’s demands have focused on significantly expanding government spending and benefits for its preferred groups, paid for through loans that our children and grandchildren will have to pay. This is the path to bankrupting the next generation.

“It’s preferred groups” are the poor, the middle-classes and the children. The “Administration’s demands” included money for health care, education, and retirement.

Our children and grandchildren do not pay for federal spending. As our readers know, The Big Lie in economics can be stated in just five words: “Federal taxes fund federal spending.”

While state and local taxes do fund state and local spending, the federal government, being uniquely Monetarily Sovereign, creates dollars ad hoc, by paying its bills.

That is the fundamental difference between federal financing and state/local government financing. Even if all federal tax collections fell to $0, the government could continue spending, forever.

The Republican path to fiscal sanity and economic expansion begins with a constitutional requirement for a federal balanced budget.

We will fight for Congress to adopt, and for the states to ratify, a Balanced Budget Amendment which imposes a cap limiting spending to the appropriate historical average percentage of our nation’s gross domestic product while requiring a super-majority for any tax increase, with exceptions only for war or legitimate emergencies.

Only a constitutional safeguard such as this can prevent deficits from mounting to government default.

Through wars, recessions, and depressions — through massive increases in federal deficits and federal “debt” — the U.S. government never has defaulted, and never will. It has the unlimited ability to create the dollars to pay its bills.

While the federal deficits and debt pose no threat whatsoever to the government, a reduction in federal deficit spending would destroy the American economy.

Taxes take dollars from your pocket and therefore, are recessive. Reduced federal spending also takes dollars from your pocket and also is recessive.

Money is the lifeblood of an economy. There is no way that reduced deficit spending, i.e. reducing the lifeblood, can grow the economy.

Cutting federal deficit spending to grow the economy would be like applying leeches to cure anemia.

Why then do the Republicans demand deficit reduction? Because most federal deficit spending benefits the lower income groups, and the Republicans are the party of the very rich.

Republicans hate such social benefits as Medicare, Social Security, Medicaid, and aids to education (unless they can privatize these programs for the benefit of Wall Street investors).

By contrast, they love war spending because it already benefits Wall Street — the military/industrial complex.

The Gap is what separates the rich from the rest of us.

Without the Gap, no one would be rich, and the wider the Gap, the richer they are. So the very rich do everything possible to widen the Gap, and that includes cutting social benefits.

A balanced budget amendment would put America into a permanent depression, in which the very rich would rule and the rest of us would have to beg them for sustenance.

A balanced budget amendment would be heaven for the very rich and hell for the rest of us. And the Republicans know it.

But amazingly, the Republican platform gets even worse:

Preserving Medicare and Medicaid

More than 100 million Americans depend on Medicare or Medicaid for their healthcare; with our population aging, that number will increase. To preserve Medicare and Medicaid, the financing of these important programs must be brought under control before they consume most of the federal budget, including national defense.

The above is a restatement of The Big Lie, that somehow the federal government can run short of its own sovereign currency and be unable to pay its bills. This is fear-mongering at its worst, an outright lie.

Medicare’s long-term debt is in the trillions, and it is funded by a workforce that is shrinking relative to the size of future beneficiaries.

Contrary to popular belief, your FICA payments do not fund Medicare. Taxes do not fund federal spending. Even if FICA were eliminated, the federal government could fund Medicare, not just for the elderly, but for every man, woman, and child in America.

FICA is a regressive tax, affecting the poor and middle classes far more than it affects the rich. It can and should be eliminated, while Social Security and Medicare are expanded.

We propose these reforms: Impose no changes for persons 55 or older.

If the proposal were good, why not give it to those 55 or older? The cynical reason: The proposal is terrible, so to get votes from the older people, they are exempted.

Give others the option of traditional Medicare or transition to a premium-support model designed to strengthen patient choice, promote cost-saving competition among providers, and better guard against the fraud and abuse that now diverts billions of dollars every year away from patient care.

You probably don’t know what this means. The confusion is intentional.

It means you will receive less money to pay for medical care than Medicare now spends. For the government to spend less, you will have to spend more.

The problem is that while the federal government has the unlimited ability to pay its bills, you don’t. So you will be impoverished, which will grow the Gap between the very rich and you.

Also note that the proposal has nothing to do with “patient choice,” “cost-saving competition among providers,” or a “guard against the fraud and abuse.” The proposal strictly is: You spend more so the government can spend less.

And finally, the following:

Set a more realistic age for eligibility in light of today’s longer life span.

Translation: Your Social Security and Medicare benefits will begin later. Who benefits from that?

In summary, the above sections of the Republican 2016 platform are a paeon to the very rich, designed at the behest of the rich to widen the Gap between the rich and the rest.

It is designed to fool you who rely on your leaders to aid and protect you. But these leaders have been bribed via campaign contributions and promises of lucrative employment later.

They care nothing for you, and so they lie and hope you believe them.

Do you?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. ELIMINATE FICA (Ten Reasons to Eliminate FICA )

Although the article lists 10 reasons to eliminate FICA, there are two fundamental reasons:

*FICA is the most regressive tax in American history, widening the Gap by punishing the low and middle-income groups, while leaving the rich untouched, and

*The federal government, being Monetarily Sovereign, neither needs nor uses FICA to support Social Security and Medicare.

2. FEDERALLY FUNDED MEDICARE — PARTS A, B & D, PLUS LONG TERM CARE — FOR EVERYONE (H.R. 676, Medicare for All )

This article addresses the questions:

*Does the economy benefit when the rich afford better health care than the rest of Americans?

*Aside from improved health care, what are the other economic effects of “Medicare for everyone?”

*How much would it cost taxpayers?

*Who opposes it?”

3. PROVIDE AN ECONOMIC BONUS TO EVERY MAN, WOMAN AND CHILD IN AMERICA, AND/OR EVERY STATE, A PER CAPITA ECONOMIC BONUS (The JG (Jobs Guarantee) vs the GI (Guaranteed Income) vs the EB) Or institute a reverse income tax.

This article is the fifth in a series about direct financial assistance to Americans:

Why Modern Monetary Theory’s Employer of Last Resort is a bad idea. Sunday, Jan 1 2012

MMT’s Job Guarantee (JG) — “Another crazy, rightwing, Austrian nutjob?” Thursday, Jan 12 2012

Why Modern Monetary Theory’s Jobs Guarantee is like the EU’s euro: A beloved solution to the wrong problem. Tuesday, May 29 2012

“You can’t fire me. I’m on JG” Saturday, Jun 2 2012

Economic growth should include the “bottom” 99.9%, not just the .1%, the only question being, how best to accomplish that. Modern Monetary Theory (MMT) favors giving everyone a job. Monetary Sovereignty (MS) favors giving everyone money. The five articles describe the pros and cons of each approach.

4. FREE EDUCATION (INCLUDING POST-GRAD) FOR EVERYONEFive reasons why we should eliminate school loans

Monetarily non-sovereign State and local governments, despite their limited finances, support grades K-12. That level of education may have been sufficient for a largely agrarian economy, but not for our currently more technical economy that demands greater numbers of highly educated workers.

Because state and local funding is so limited, grades K-12 receive short shrift, especially those schools whose populations come from the lowest economic groups. And college is too costly for most families.

An educated populace benefits a nation, and benefiting the nation is the purpose of the federal government, which has the unlimited ability to pay for K-16 and beyond.

5. SALARY FOR ATTENDING SCHOOL

Even were schooling to be completely free, many young people cannot attend, because they and their families cannot afford to support non-workers. In a foundering boat, everyone needs to bail, and no one can take time off for study.

If a young person’s “job” is to learn and be productive, he/she should be paid to do that job, especially since that job is one of America’s most important.

6. ELIMINATE CORPORATE TAXES

Corporations themselves exist only as legalities. They don’t pay taxes or pay for anything else. They are dollar-tranferring machines. They transfer dollars from customers to employees, suppliers, shareholders and the government (the later having no use for those dollars).

Any tax on corporations reduces the amount going to employees, suppliers and shareholders, which diminishes the economy. Ultimately, all corporate taxes come around and reappear as deductions from your personal income.

7. INCREASE THE STANDARD INCOME TAX DEDUCTION, ANNUALLY. (Refer to this.) Federal taxes punish taxpayers and harm the economy. The federal government has no need for those punishing and harmful tax dollars. There are several ways to reduce taxes, and we should evaluate and choose the most progressive approaches.

Cutting FICA and corporate taxes would be an good early step, as both dramatically affect the 99%. Annual increases in the standard income tax deduction, and a reverse income tax also would provide benefits from the bottom up. Both would narrow the Gap.

8. TAX THE VERY RICH (THE “.1%) MORE, WITH HIGHER PROGRESSIVE TAX RATES ON ALL FORMS OF INCOME. (TROPHIC CASCADE)

There was a time when I argued against increasing anyone’s federal taxes. After all, the federal government has no need for tax dollars, and all taxes reduce Gross Domestic Product, thereby negatively affecting the entire economy, including the 99.9%.

But I have come to realize that narrowing the Gap requires trimming the top. It simply would not be possible to provide the 99.9% with enough benefits to narrow the Gap in any meaningful way. Bill Gates reportedly owns $70 billion. To get to that level, he must have been earning $10 billion a year. Pick any acceptable Gap (1000 to 1?), and the lowest paid American would have to receive $10 million a year. Unreasonable.

9. FEDERAL OWNERSHIP OF ALL BANKS (Click The end of private banking and How should America decide “who-gets-money”?)

Banks have created all the dollars that exist. Even dollars created at the direction of the federal government, actually come into being when banks increase the numbers in checking accounts. This gives the banks enormous financial power, and as we all know, power corrupts — especially when multiplied by a profit motive.

Although the federal government also is powerful and corrupted, it does not suffer from a profit motive, the world’s most corrupting influence.

10. INCREASE FEDERAL SPENDING ON THE MYRIAD INITIATIVES THAT BENEFIT AMERICA’S 99.9% (Federal agencies)Browse the agencies. See how many agencies benefit the lower- and middle-income/wealth/ power groups, by adding dollars to the economy and/or by actions more beneficial to the 99.9% than to the .1%.

Save this reference as your primer to current economics. Sadly, much of the material is not being taught in American schools, which is all the more reason for you to use it.

The Ten Steps will grow the economy, and narrow the income/wealth/power Gap between the rich and you.

MONETARY SOVEREIGNTY

For the “You just can’t make this stuff up” file:

Does the word “unhinged” come to mind?

And then there’s this:

Why don’t Trump’s lies, contradictions, immorality, and incompetence touch him with the voters? Think about it.

LikeLike

Amazingly enough, in a sort of complete role reversal, Trump is the populist in this election cycle (make America great again and no to TPP), while Hillary has embraced the neo-liberal corporatists and Wall Street financiers.

No good choices come November.

It’s crooked Hillary vs. a racist buffoon.

LikeLike

I’m sorry, but this is not one of those “He’s bad; she’s bad” situations.

Donald Trump is the least qualified person to run for President in my lifetime (80+ years). He has neither the knowledge nor the temperament for that office.

He knows nothing and wants to know nothing, because he believes he knows everything — a truly dangerous combination.

Every single day, he expressing outrageous ignorance.

This is not a game. This is the future of America. This is our lives and our children’s lives.

Visualize giving an angry, spoiled brat the nuclear codes.

LikeLike

I stand corrected. Green Party’s Jill Stein is a good choice but she is not going to win.

I’ll vote for her anyway.

LikeLike

Understood. Pray the Green Party doesn’t take enough votes to prevent Hillary from gaining a majority of electoral votes (270).

If that happens, the House of Representatives will pick the President from the 3 highest vote-getters.

Guess who they will pick.

LikeLike

“FISCAL BURDEN”

From fiscal 1998 to current the US govt has redeemed (paid off) a staggering $820 TRILLION of both marketable and non-marketable T-securities.

Fiscal year 2016 alone (with 2 months to go), the figure is just over $75 trillion.

https://www.fms.treas.gov/fmsweb/viewDTSFiles?dir=w&fname=16072600.txt

The federal government has also issued a massive load of debt over the above term. (Didn’t calculate the summary total but it’s a “bit more” than $ 820 trillion.)

These figures prove two main points:

1. an incredible demand for US federal debt (T-securities)

2. an incredible ease in paying the debt off

As stated in the post: The notion of “burden” simply does not apply.

LikeLike