Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

There have been select technological advances in human history that have “changed everything” — the use of fire, the lever, the wheel, the knife, the use of electricity, the computer, the Internet, to name a few, and now . . .

You live at a time of the most important invention since the Internet and you may not yet have heard of it.

It was invented by two women, Jennifer Doudna (UC Berkeley) and Emmanuelle Charpentier (Max Planck Institute).

The invention: CRISPR-Cas9 (pronounced: crisper).

Sound familiar? No? It soon will be all you’ll think about.

Everything You Need to Know About CRISPR, the New Tool that Edits DNA

CRISPR allows scientists to edit genomes with unprecedented precision, efficiency, and flexibility.

The past few years have seen a flurry of “firsts” with CRISPR, from creating monkeys with targeted mutations to preventing HIV infection in human cells.

Earlier this month, Chinese scientists announced they applied the technique to nonviable human embryos, hinting at CRISPR’s potential to cure any genetic disease. And yes, it might even lead to designer babies.

“Designer babies” is the pejorative used to describe human babies that have been “improved” genetically to be faster, taller, smarter, better-looking, stronger, disease-free or in some other ways, to have been changed far more quickly than what breeding by nature accomplishes slowly.

This power is threatening as all power is.

There is an irony to the fact that, for instance, assuring your baby is free of horrible genetic and communicable diseases is an anathema. A distant relation of mine is in a family containing the dreaded Huntington gene. I’m sure they and their afflicted children, would have welcomed a bit of “designing.”

But power corrupts, and CRISPR truly is powerful, so expect the corrupt to use it for corrupt purposes.

CRISPR is actually a naturally-occurring, ancient defense mechanism found in a wide range of bacteria.

CRISPR is one part of bacterias’ immune system, which keeps bits of dangerous viruses around so it can recognize and defend against those viruses next time they attack.

The second part of the defense mechanism is a set of enzymes called Cas (CRISPR-associated proteins), which can precisely snip DNA and slice the hell out of invading viruses.

There are a number Cas enzymes, but the best known is called Cas9. It comes from Streptococcus pyogenes, better known as the bacteria that causes strep throat.

In short, the whole thing is as natural as eating corn on the cob (a human-modified grain). Natural, yes. But that is not where its power lies.

All biologists have to do is feed Cas9 the right sequence, called a guide RNA, and boom, you can cut and paste bits of DNA sequence into the genome wherever you want.

All you have to do is design a target sequence using an online tool and order the guide RNA to match. It takes no longer than few days for the guide sequence to arrive by mail.

You can even repair a faulty gene by cutting out it with CRISPR/Cas9 and injecting a normal copy of it into a cell.

Fast, cheap and powerful, CRISPR will change the world. The question: Will it be a better world?

There already is work being done to apply CRISPR to genetic diseases of the blood, like sickle-cell anemia, where we can repair the mutation that causes it.

CRISPR could, for example, be used to introduce genes that slowly kill off the mosquitos spreading malaria (or the genes for harboring malaria).

Or put the brakes on invasive species like weeds. It could be the next great leap in conserving or enhancing our environment.

CRISPR has been getting a lot of coverage as a future medical treatment. But focusing on medicine alone is narrow-minded.

Precise genome engineering has the potential to alter not just us, but the entire world and all its ecosystems.

Of course, the above-mentioned use of fire, the lever, the wheel, the knife, the use of electricity, the computer, the Internet, etc. all have altered the entire world and its ecosystems. Should we have done without them?

Of course not, but power needs control, and so far, there has been little control over CRISPR.

Easy DNA Editing Will Remake the World. Buckle Up.

Using (CRISPR), researchers have already reversed mutations that cause blindness, stopped cancer cells from multiplying, and made cells impervious to the virus that causes AIDS.

Agronomists have rendered wheat invulnerable to killer fungi like powdery mildew, hinting at engineered staple crops that can feed a population of 9 billion on an ever-warmer planet.

Bioengineers have used Crispr to alter the DNA of yeast so that it consumes plant matter and excretes ethanol, promising an end to reliance on petrochemicals.

With CRISPR, we theoretically could rid the world of every single mosquito, quickly, cheaply and easily (but then, what of the bats and fish that eat mosquitoes and their larvae?)

Over time, we could rid the world of all human diseases. We could extend human life. We could grow more and better foods. We could eliminate any species.

And, of course, this being an economics blog, we should mention money, and as we spoke earlier, corruption:

Just before Doudna’s team published its discovery in Science, Feng Zhang, a molecular biologist at the Broad Institute of MIT and Harvard, applied for a federal grant to study Crispr-Cas9 as a tool for genome editing.

Doudna’s publication shifted him into hyperspeed. He knew it would prompt others to test Crispr on genomes. And Zhang wanted to be first.

Zhang had asked the Broad Institute and MIT, where he holds a joint appointment, to file for a patent on his behalf.

Doudna had filed her patent application—which was public information—seven months earlier. But the attorney filing for Zhang checked a box on the application marked “accelerate” and paid a fee, usually somewhere between $2,000 and $4,000.

A series of emails followed between agents at the US Patent and Trademark Office and the Broad’s patent attorneys, who argued that their claim was distinct.

A little more than a year after those human-cell papers came out, Doudna (learned) that Zhang, the Broad Institute, and MIT had indeed been awarded the patent on Crispr-Cas9 as a method to edit genomes. “I was quite surprised,” she says, “because we had filed our paperwork several months before he had.”

The Broad win started a firefight. The University of California amended Doudna’s original claim to overlap Zhang’s and sent the patent office an 114-page application for an interference proceeding—a hearing to determine who owns Crispr—this past April.

In Europe, several parties are contesting Zhang’s patent on the grounds that it lacks novelty. Zhang points to his grant application as proof that he independently came across the idea.

The stakes here are high. Any company that wants to work with anything other than microbes will have to license Zhang’s patent; royalties could be worth billions of dollars, and the resulting products could be worth billions more.

When the stakes are high, the corrupt move in. And as yet, we don’t even know what “corrupt” means with regard to the use of CRISPR.

This post already has grown too long, but I urge you to use the links referenced above and learn the many biological and ethical implications of CRISPR.

You should make it your mission to learn about the most important invention since the Internet.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

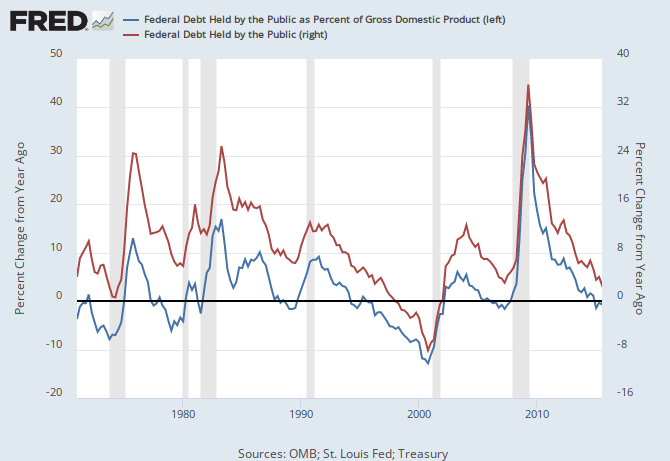

Recessions begin an average of 2 years after the blue line first dips below zero. There was a dip in 2015.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

— OFF TOPIC —

What’s worse: a right-wing liar, or a person who starts by speaking the truth, but ends up defending the Big Lie?

For example, here’s Joseph Stiglitz, who starts out great…

“In early 2010, I warned in my book ‘Freefall’ that without the appropriate responses, the world risked sliding into what I called a Great Malaise. Unfortunately, I was right: We didn’t do what was needed, and we have ended up precisely where I feared we would. Our problem is that the world faces a deficiency of aggregate demand, brought on by a combination of growing inequality and a mindless wave of fiscal austerity. Those at the top spend far less than those at the bottom, so that as money moves up, demand goes down. Meanwhile, because of fiscal austerity, some 500,000 fewer people are employed by the public sector in the US than before the crisis. With normal expansion in government employment since 2008, there would have been two million more. Likewise, most natural-resource-based economies in Africa and Latin America failed to take advantage of the commodity price boom underpinned by China’s rise to create a diversified economy. Now they face the consequences of depressed prices for their main exports. Markets never have been able to make such structural transformations easily on their own.”

So far so good, Mr. Stiglitz. The claim that “markets can do no wrong” is a lie. Without government regulation, markets self-destruct. Greed, fraud, and “too big to fail” become a cancer. We need a balance between government and markets.

Stiglitz again…

“The obstacles the global economy faces are not rooted in economics, but in politics and ideology. The private sector created the inequality and environmental degradation with which we must now reckon. Markets won’t be able to solve these and other critical problems that they have created, or restore prosperity, on their own. Active government policies are needed. That means overcoming deficit fetishism.”

True. But then Stiglitz supports the Big Lie…

“It makes sense for countries like the US and Germany that can borrow at negative real long-term interest rates to borrow to make the investments that are needed. For those countries whose borrowing is constrained, there is a way out, based on the long-established principle of the balanced-budget multiplier: An increase in government spending matched by increased taxes stimulates the economy. Unfortunately, many countries, including France, are engaged in balanced-budget contractions.”

Got that? Tax increases are “stimulative.” And the U.S. government must borrow its spending money. And the presence or absence of Monetary Sovereignty is irrelevant.

I don’t consider Stiglitz to be a huckster like Paul Krugman, but I do wish I could talk to Stiglitz and straighten him out.

LikeLike

Whoops, I forgot to include the source of Stiglitz’ comments…

https://www.project-syndicate.org/commentary/great-malaise-global-economic-stagnation-by-joseph-e–stiglitz-2016-01

LikeLike

Stiglitz has been consistent:

https://mythfighter.com/2011/01/29/will-someone-please-please-explain-monetary-sovereignty-to-stephen-gandel-and-joseph-stigliz-please/

https://mythfighter.com/2013/02/18/income-inequality-the-stilgitz-roubini-buffett-solution/

LikeLike

Thanks Rodger. I re-read those two posts. A few thoughts…

[1] It seems that you can only get a Nobel Prize if you champion austerity and the Big Lie.

Some professors do this by calling for tax increases (e.g. Joseph Stiglitz). Other professors do it by falsely claiming that the U.S. government is “broke” and has a “debt crisis,” and that Social Security is “unsustainable.”

Both kinds of professors falsely claim that economies are stimulated by austerity (i.e. by spending cuts and / or tax increases). They makes these false claims because they work for the rich, and because austerity boosts inequality.

[2] Note how so-called “liberal” or “progressive” economists speak just enough truth to seduce their readers into nodding their heads in agreement. Them, after they have hooked their readers, they include a twist that supports austerity and the Big Lie. Stiglitz does this in his articles by ending on a call for tax increases. Paul Krugman does it by calling himself a “liberal” while he spouts meaningless gibberish.

All of the “New Keynesian” economists do this. They defend Keynes just enough to make you listen to them. Once they have you nodding in agreement, they call for more austerity. It’s all about placating you while inequality continues to worsen.

Politicians in Finland are playing this game in their own way. On one hand they claim to be considering the possibility of all citizens having a basic income (i.e. universal Social Security). On the other hand they cling to the euro, thereby making universal Social Security impossible, since Finland swings wildly back and forth between a trade deficit and a trade surplus from year to year. This trade factor, plus the euro, makes increased austerity inevitable for Finland. Once again the peasants are placated while austerity and inequality become worse each day.

[3] This brings up a side issue…

The average person seeks to widen the Gap below him (by hating the poor, and by demanding cuts in “welfare”) and to narrow the Gap above him (by demanding tax increases).

In both cases the average person cuts his own throat. Austerity (i.e. tax increases and / or spending cuts) hurts everyone except the very rich. And the lower you are on the scale of wealth, power, and prestige, the more you are hurt by austerity. The rich pay little or no taxes anyway.

[4] Some people champion austerity because they have false notions of what “socialism” is. The Big Lie is that the money supply is a zero sum game (i.e. money is physical and limited). If you believe this lie, then you will falsely believe that the higher we raise taxes, the closer we come to “socialism.” This notion is false. Socialism means social ownership and democratic control of the means of production. The more a government has Monetarily Sovereignty, the more taxes are irrelevant to socialism.

Socialist or not, a government with full Monetary Sovereignty has no need or use for tax revenue.

[5] Rodger has noted that tax increases are not necessarily counter-stimulative, It depends on how taxes are imposed. For example, we can use taxes to penalize corporations that invest all their profits in stock buybacks, executive bonuses, and gambling on derivatives. Or we can use tax relief to reward corporations that invest in authentic R&D, and do other things that create jobs. However Stiglitz is not concerned with details. Stiglitz just wants to increase taxes…period.

[6] A MINOR QUIBBLE

Rodger has often noted that the “debt-to-GDP-ratio” is meaningless for nations with full Monetary Sovereignty like the USA. I agree with this. But Rodger also defines the “national debt” as “total of outstanding T-securities issued since the beginning of our nation.”

I don’t know where Rodger gets that from. It seems to me that the “national debt” is simply the amount of money that is currently deposited in Fed savings accounts via the purchase of T-securities.

The U.S. Treasury issues T-securities, and the Fed handles their sale. Over forty percent of T-securities are purchased by the U.S. government itself, or are purchased by the Fed. Since the U.S. government owes itself, it rolls over its T-securities again and again. This is one reason why the “national debt” continues to grow. Another reason is that China gets billions of dollars by selling to the USA. China deposits those dollars at the Fed by purchasing T-securities that pay interest. And China, like the U.S. government, rolls over its T-securities.

Despite this, the “debt-to-GDP-ratio” remains meaningless for the U.S. government.

LikeLike

Outstanding T-securities = deposits in T-security accounts at the FRB.

Did you miss seeing the word “outstanding”? Bet I fooled you with that “beginning of time” phrase.

LikeLike

You’re right. Quibble retracted. 🙂

LikeLike

Speaking of inventions, Rodger, please see this when you have time…

https://monetarysov.wordpress.com/2016/01/05/growth-is-good/

LikeLike

Bhargava is indeed a genius.

For many years there has been a product called NoDoz, It’s a tiny pill containing as much caffeine as in a cup of coffee.

Depending on your susceptibility to caffeine, you could take NoDoz to stay awake and be alert all day for about ten cents a day.

Bhargava invented “Five Hour Energy,” which also contains caffeine plus a vitamin. For more than five dollars a day, it keeps you awake and alert.

The man has my utmost admiration.

By the way, Chicago’s Museum of Science and Industry long has had a bicycle that generates electricity, similar to Bhargava’s.

I’ve tried it.

If I pedal with all my might, I can light one 60-watt bulb for a few seconds.

Possibly the winner of the winner of the Tour de France could keep one lit for ten minutes or so.

The solution is to hire a bunch of people onto MMT’s Jobs Guarantee, and have them light your house. Right? Not too sure about running your TV, though. 🙂

LikeLike

I too have ridden bicycles in museums of science and industry, and I marveled at how much effort it took to simply power a light bulb. However those bicycles were inefficient, and perhaps intentionally so, in order to foster energy awareness in museum-goers.

Bhargava’s design looks more efficient, since it uses leverage and a weighted fly-wheel. If it can energize an average-sized house for 24 hours, based on one hour of pedaling, then I think it’s a good idea. Imagine having one of those as a back-up in case there’s a blackout in your area.

By the way, during the summer I spend almost four hundred dollars a month on electricity, because the air conditioning runs constantly. Maybe one of Bhargava’s special bicycles could help me lower my bills.

Also, I have lived in rural parts of impoverished countries where electricity was such a luxury that local power companies gouged the natives. It was outrageous. If you move into a house or an apartment, or you start renting a commercial property, and the previous tenant did not pay his electrical bills, then YOU must pay the previous tenant’s balance (all of it) before you can get electricity hooked up. It’s outrageous, but the power companies get away with it because people need electricity. So if Bhargava’s bicycles can ease the situation, I’m for it. Here in the USA we take electricity for granted.

LikeLike