Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

If you believe the federal debt and deficit are too high, “unsustainable” and otherwise negative for the economy, here are a few graphs you may find interesting:

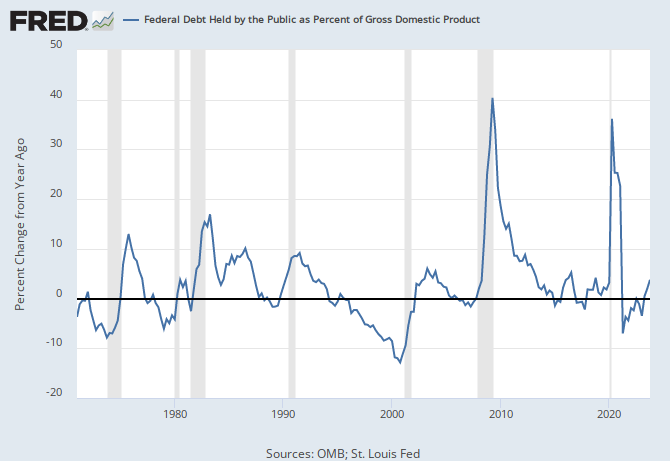

After rebounding from a previous recession, the blue line drops below “0” in 1972. The next recession follows two years later.

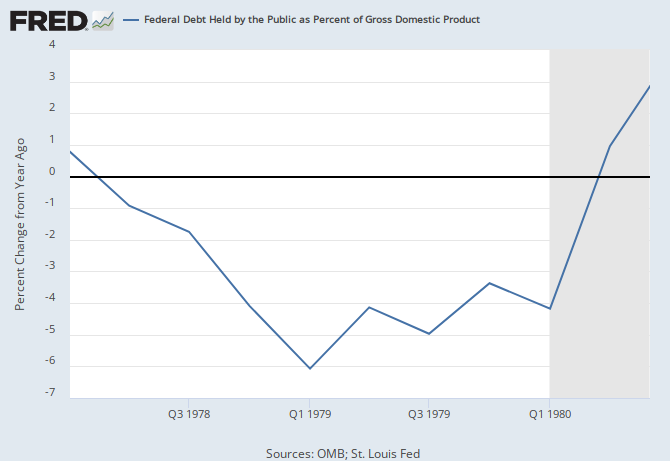

The blue line drops below “0” in 1978. The next recession follows two years later.

The blue line drops below “0” in the 2nd quarter of 1981. The next recession follows one quarter later.

After the blue line first drops below “0” in 1988, the next recession follows two years later.

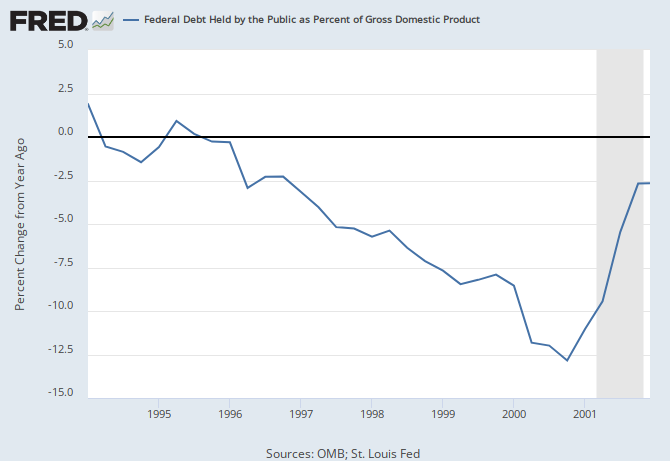

After the blue line first drops below “0” in 1994, the next recession follows six years later.

After the blue line drops below “0” in 2006, the next recession follows two years later.

The blue line fell below “0” in 2015.

——————————————————————————————————————————————————————————————————————————–

Summary: After the Federal Debt Held by the Public as Percent of Gross Domestic Product fell, year-to-year, recessions came:

— Two years later,

— Two years later,

— One quarter later,

— Two years later,

— Six years later, and

— Two years later.

Here is a summary graph, from when the U.S. abandoned all gold standards and became Monetarily Sovereign:

Since the U.S. became Monetarily Sovereign, every recession has been preceeded by a year-to-year reduction in the GDP/Debt ratio.

Cutting the GDP/Debt ratio has been a precursor to recessions. The average length of time between a reduction in the GDP/Debt ratio and a recession: Two years.

Anyone for Debt reduction, please raise your hand.

Then explain why you like recessions.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

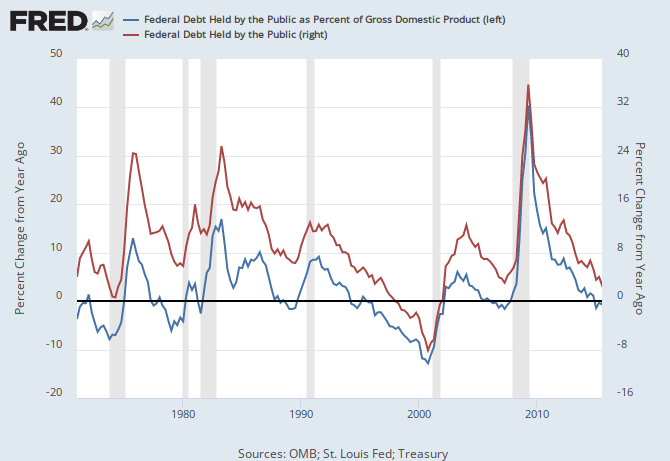

THE RECESSION CLOCK

Recessions begin an average of 2 years after the blue line first dips below zero. There was a dip in 2015. Recessions are cured by a rising red line.

Vertical gray bars mark recessions.

As the federal deficit drops, we approach recession, which will be cured only when the growth rises. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

“Anyone for Debt reduction, please raise your hand. Then explain why you like recessions.” ~ RMM

I like recessions because…

[1] They widen the Gap between the rich and the rest.

[2] They force the lower classes to seek loans, thereby reducing the lower classes to being debt slaves of the upper classes.

[3] They make everyone but very wealthy people more desperate, and therefore more submissive to the rich in a thousand different ways. For example, recessions wipe out jobs, making workers in general more submissive to low wages, awful conditions, and zero benefits.

[4] They free corporate criminals to steal, to pollute, and to defraud, since there is “no money” to fund regulatory agencies.

[5] They validate the Big Lie. Since the U.S. government is “broke,” and since the economy is in a recession (caused by austerity) “common sense” says that the only possible option is more austerity. After all, it’s not like the U.S. government can create money out of thin air.

[6] They make members of the lower classes attack each other. For example, recessions increase racial friction and police brutality.

What’s not to like?

|||||||||||||||||||||||||||||||||||||||||||||||||||

On a different note, I think the reason for today’s massive inequality is that average people have very little empathy for one another. They have no sense of community. They don’t talk to their next door neighbors. Adult siblings rarely talk with each other, or with their parents. Most people don’t care about anyone but themselves, and they don’t care about anything but their petty hatreds.

There’s nothing new in all this, but modern technology, combined with the sheer size of the human population, makes people very insular and isolated, and therefore submissive to inequality. Why unite against our rich overlords when we can indulge our hatred of Blacks, Muslims, refugees, and poor people? Why have courage and compassion when it’s easier to hate? Why work together when it’s easier to blame everything on those who are below us on the scale of wealth, power, and prestige?

LikeLike

Rodger thanks for this insightful overview. I think you mean “cutting the debt/GDP ratio” not “cutting the GDP/debt ratio” will lead to recession.

LikeLike

Great graphs, Rodger.

LikeLike

As an aside, Hillary Clinton claimed terrorists were using videos of Donald Trump ranting against Muslims as recruiting tools.

Trump said she was lying.

Well, uh, er . . .

Who’s lying now? (Speaking of which, shall we talk about Trump University?)

LikeLike

Funds raised by leading presidential candidates:

Hillary Clinton – $112,000,000

Bernie Sanders – $73,000,000

Ben Carson – $55,000,000

Ted Cruz – $45,000,000

And a lonely last:

Donald Trump – $5,800,000

Boy, it sure looks as if Donald Trump is “the candidate of the evil rich” based on these numbers. NOT!

So who really is the candidate of the rich? I put my money on Hillary and Bernie Sanders. I doubt that Trump will be able to beat all this money and the other Republican candidates won’t make it anywhere.

LikeLike

Got it. The richest candidate, who also is an evil bigot and a proven liar, is not “the candidate of the evil rich.”

A perfect demonstration of what the right-wing calls “thinking.”

LikeLike