Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and the rest..

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Let’s begin with a few facts upon which most people agree:

1. Being Monetarily Sovereign (sovereign over its own currency), the federal government can “print” unlimited dollars.

(It doesn’t really “print” the dollars, but the important point is the U.S. government cannot run short of its own sovereign currency — the currency it originally created from thin air 200+ years ago.)

2. It benefits the nation for American business to be strong.

(Strong business hire more people, pay more salaries and provide more goods and services than does weak business.)

3. Reducing cost is a good way to improve profits and to strengthen a business.

(Profits are the difference between sales and costs.)

4. Federal taxes represent a large cost to most businesses.

5. To reduce this cost, a few companies have instituted an “inversion.”

Clinton’s Plan to Complicate Corporate Taxes

BloombergView, December 10, 2015, By Paula DwyerTo Hillary Clinton, corporations are being unpatriotic when they combine with a smaller foreign company and then move their legal addresses overseas, where taxes are lower. (Known as an “inversion.”

This week she released a plan to stop such tax-avoidance trickery, which has been on the rise in recent years.

(Inversion) isn’t good for America.

As Clinton says, mergers should be carried out for business reasons, not to take advantage of tax loopholes.

Inversions also erode the tax base needed to maintain roads, rails and ports, support basic research, enforce trade treaties and perform the million other tasks that allow U.S. companies to conduct business across 50 states with little friction.

See anything wrong with this?

Since the federal government has the unlimited ability to create its own dollars, why does it need to take dollars from business? And why is taking dollars from business, which weakens American business, considered “patriotic”?

And why does the Monetarily Sovereign U.S. need to get dollars from business in order to “maintain roads, rails and ports, support basic research, enforce trade treaties and perform the million other tasks . . . “?

Clinton, though, has a propensity to address problems with complicated five-point plans involving a mix of legislative and executive actions, when a simple solution — lowering U.S. corporate taxes to match what the rest of the developed world charges — would suffice.

And if lowering taxes to match what the rest of the developed world charges is a good idea, wouldn’t lowering taxes below what the rest of the world charges be an even better idea?

Think of the competitive advantage it would give American business. Think of the additional jobs, the additional salaries.

She would require U.S. shareholders to own half or less of the combined company as a condition for avoiding corporate taxes.

(She) would even try to undo numerous completed inversions by making the 50 percent hurdle retroactive to May 2014.

She would also require companies to pay an “exit tax” before inverting.

She would also ask Congress — or the U.S. Treasury Department if Congress fails to act — to crack down on the practice of “earnings stripping.” This happens post-inversion, when a U.S. unit borrows heavily from its new foreign parent. The loan is then repaid from operations in the U.S., where interest on debt is tax deductible.

All this is a complicated, convoluted effort that will cut corporate profits by making business pay more taxes. So what are we talking about, here?

Deferral from taxation of overseas earnings is the very feature of U.S. tax law that’s driving inversions in the first place.

Multinational companies refuse to repatriate more than b><$1 trillion in earnings unless Congress lets them bring the money home at a much lower rate than the existing 35 percent levy. As a result, companies are inverting to get their hands on that cash.

Few corporations actually pay 35%, but shouldn’t business planning rather than tax maneuvering be the prime concern of corporations?

When American companies spend time, effort and money to buy small overseas companies, for the sole purpose of cutting taxes, that is not the best business use of their time, effort an money.

It’s downright inefficient.

Finally, Clinton would apply the $80 billion or so in new revenue over 10 years, which she claims she’d raise by closing inversion loopholes, to provide tax relief for research, community development and manufacturing.

Hmmm . . . “Tax relief for research and manufacturing.” She would tax business more so she could tax business less. Soundsl like a perfect political plan.

Clinton is acting because Donald Trump has politicized corporate inversions, or any attempt by a U.S. company to close plants and send jobs overseas.

Companies “send jobs overseas” to cut costs. One cost is taxes. So cutting taxes would help discourage companies from “sending jobs overseas.”

Clinton’s proposal wouldn’t fix the biggest underlying defect: The U.S.’s corporate tax is higher than what the 34 advanced countries in the Organization for Economic Cooperation and Development charge.

The OECD average is 24 percent. What’s more, the U.S. taxes companies on their global income, unlike most other countries, which tax only profits earned within their borders.

Get it? U.S. companies send jobs overseas to cut costs. Taxes are a cost. U.S. companies pay higher taxes than do foreign companies.

So the Clinton solution? Increase taxes on U.S. companies by eliminating inversions.

It makes no sense, and Clinton knows it. But . . .

As a Democrat fighting for primary votes against the more-liberal Sanders, Clinton can’t afford to favor corporate tax cuts.

You see, the politicians, media and economists have been so effective in convincing voters that federal financing is like state and local government financing (otherwise known as “the Big Lie”), and so federal taxes “must” be necessary, that now Clinton doesn’t dare reveal the truth: Federal taxes do not fund federal spending.

Yes, those tax dollars that businesses send to the U.S. Treasury are unnecessary.

If all business taxes were reduced to $0, the federal government be unaffected (It could continue spending as always), U.S. businesses would prosper, the American public would prosper, and the economy would grow massively.

But liars become enmeshed in their own lies. (“Oh, what a tangled web we weave . . .”) Trapped by “the Big Lie”, the politicans don’t dare do the right things, even if they wanted to.

So they come up with nonsense solutions (raise U.S. business taxes to encourage U.S. business to stay home), in the hope the public will not notice the illogic.

In short, they are betting on the public’s ignorance.

A pretty good bet.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

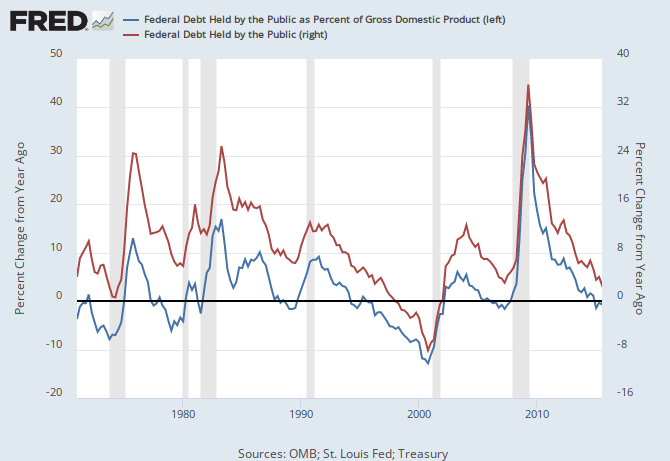

THE RECESSION CLOCK

Recessions come only after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Corporations don’t pay taxes, they collect them.

LikeLike

If you’re saying that corporations get the tax money they spend from their customers, then you also would say, “Corporations don’t have expenses. Customer pay all the expenses.”

The fact is, taxes are a corporate expense, which come right off the bottom line.

Your comment is correct, however, with regard to FICA taxes.

LikeLike

Outstanding post, Rodger. Once again we see that Democrats uphold the Big Lie by falsely claiming that the U.S. government needs tax revenue.

(Republicans uphold the Big Lie by falsely claiming that the U.S. government is “broke.”)

Trump wants corporate federal taxes lowered to 15%. Mike Huckabee and Ted Cruz want taxes lowered to 0%. (I do too.)

Federal taxes are a sick joke. The most powerful corporations pay little or no taxes anyway, since they have armies of accountants to hide everything. Corporate taxes mainly hurt mid-size and smaller corporations.

Instead of saying things like “American workers are overpaid,” Trump should be saying things like, “American business is overtaxed.”

Hillary wants to increase taxes on corporations, because that’s what the peasants like to hear. This will hurt the peasants by eliminating their jobs, but the peasants only care about upholding the Big Lie, since the Big Lie legitimizes their efforts to widen Gap below them, wherever they happen to be on the ladder of wealth and income.

The Big Lie also legitimizes people’s resentment of the Gap above them. Many of the peasants so love the idea of taxing the rich and the corporations that the peasants reject any explanation that federal taxation is useless, pointless, self-defeating, and in many cases a sham. They reject such explanations by clinging to the Big Lie.

Moreover, calls for tax increase can drive some peasants to join the Tea Party, whose members want to eliminate or privatize things like Social Security. (I’m surprised that Trump hasn’t yet said that all Muslim Americans should be denied Medicare and Social Security, since Muslims are making these programs “unsustainable.”)

Democrats call a corporation “disloyal” (i.e. “unpatriotic”) if the corporation uses “inversion” to avoid taxes. An example is Pfizer, a pharmaceutical giant that will merge with Allergan PLC in order to move Pfizer’s headquarters (on paper anyway) from New York City to Dublin Ireland.

(Ireland isn’t even Monetarily Sovereign, and yet its corporate tax rate is half the USA’s tax rate!)

Democrats squawk about this, but Democrats and Republicans both use the Big Lie to make us grovel before them. They both pretend that the U.S. government needs tax revenue. They both depend on the Big Lie so much that they refused to lower Pfizer’s taxes even though Pfizer spent $9,493,000 on lobbyists in 2014, and gave $2,217,066 in direct bribes to politicians. (Pfizer gave twice as much in bribes as its major competitors gave — e.g. Johnson & Johnson).

Ian Read (CEO of Pfizer) says he tried to lobby Congress to reduce the U.S. corporate tax rate (now 35 percent) but he failed. Therefore Pfizer will move its headquarters. I suspect that Ian Read is probably smart enough to know about the Big Lie. Therefore I can imagine his annoyance. “If you want us to create more jobs, then lower our taxes!”

(Pfizer makes Viagra, which stiffens Ian Read’s middle finger as he thrusts it at Congress.)

However Mr. Read’s bribes were not wasted. Politicians, in obedience to Big Pharma, refused to attach a prescription drug benefit to Medicare, refused to make it easier for generics to enter the market, and refused to use Medicare’s bargaining power to reduce drug prices. All of these would have helped the peasants, but the peasants are too busy demanding that corporations pay more taxes. Why? Because the peasants cling to the Big Lie. People at all levels use the Big Lie for their own gain.

For the lower classes the Big Lie is like a drug that makes you feel good for a minute or two, but erodes your health each time you take it. And the damage is cumulative.

There’s another way that the peasants are foolish. The peasants (rightly) believe that state, county, and municipal governments need tax revenue. The peasants also (wrongly) believe that the federal government needs tax revenue. The peasants do not demand higher local taxes on corporations, since the peasants know that corporations will simply move. Instead, the peasants demand higher federal taxes on corporations. Then the peasants scream when corporations respond by moving their headquarters outside the USA. (“Hey, that’s unpatriotic!”)

Federal corporate taxes are a bogeyman for the simple-minded. The peasants can demand that corporations pay more federal taxes, but the peasants say nothing about corporate power over the government. Pfizer, for example, will pay less in taxes, but will continue to bribe state attorneys general in order to get favorable settlements in cases brought against Pfizer. And Pfizer will continue to bribe federal politicians to get protection for Pfizer’s drug patents overseas.

By the way, I wonder how the latest “free trade” agreements will figure into all this. I refer to the Trans-Pacific Partnership, the Trade in Services Agreement, and the Transatlantic Slave and Investment Partnership. (Whoops, that word “Slave” should read “Trade”).

These agreements are a direct attack on national sovereignty, in favor of corporate sovereignty. They will let corporations sue governments for anything that impedes corporate expectations for future profits.

Does that mean that corporations will be able to sue governments for corporate tax relief?

LikeLike

What’s amazing to me is that by admitting MMT/MS reality it would free up Congress to lower business taxation. I can just imagine the relief business would feel if that were understood. However for various reasons, such as the big lie, the ‘gap’ etc. the corporate world and their stooge congress reps cannot afford, in their minds, to own up. So they continue to behave in their classic ways spiting their faces by cutting off their noses. Also they probably imagine that MMT/MS is a left wing idea rather than understanding they live in it already!

Just extraordinary!

John Doyle

LikeLike

For most people, the most important thing in the world is to maintain the Gap between themselves and everyone below them on the ladder of wealth, income, and power. This attitude causes mass poverty. However people validate their poverty via the Big Lie, and they delude themselves that they are not badly in poverty, since people below them are even worse off. They submit to abuse from above as long as they can mete out abuse to everyone below.

People pretend to care about each other, but if they were sincere, they would not believe the Big Lie. They would take the time to understand money, which is important to everyone. They would realize that the following two assertions cannot both be true…

[1] The federal government can “print” all the dollars it wants

[2] The federal government is “broke,” and runs on loans and taxes

It’s like we are living in that 1990 movie “Total Recall,” in which the villain rules by controlling the availability of air. However, instead of being on Mars we are on Earth, where the air is plentiful but rationed for political purposes. And everyone submits to the rationing in order to maintain the Gap below him.

Note that the “Gap dynamics” varies in intensity between civilizations and between historical epochs. Some societies lean toward cooperation and teamwork. Other societies are based on an attitude of “Screw you; I’ve got mine.” The first attitude builds empires. The second attitude kills empires. Most empires begin with the first attitude, and steadily move toward the second attitude, which eventually causes them to collapse, or to be conquered. The U.S. Empire is deep into the second attitude.

For this reason, I doubt the USA could win a conventional war with Russia and China. Average Americans are too enamored with the attitude of “Screw you; I‘ve got mine.” And their rich leaders only care about becoming richer at the expense of everyone below them.

LikeLike

this, “Let’s begin with a few facts upon which MOST PEOPLE AGREE:

1. Being Monetarily Sovereign (sovereign over its own currency), the federal government can “print” unlimited dollars.

(It doesn’t really “print” the dollars, but the important point is the U.S. government cannot run short of its own sovereign currency — the currency it originally created from thin air 200+ years ago.)”

,doesn’t make sense. MOST people do NOT agree with #1, and that is the problem….. although I agree with what you are saying beyond this opening. just a helpful edit, not meant to be published.

LikeLike

It’s published so it can be answered.

Your experience may be different from mine, but in my discussions with the public, we always come to the point where I’m told, “Oh sure, the government can always print money, but that would cause inflation.”

So far as I can tell, the public believes the Treasury can “turn on the presses” and print all the money it wants to.

I can’t imagine how this jibes with the public’s simultaneous belief that the government needs to borrow and tax to pay its bills.

It’s classic DOUBLETHINK

LikeLike

it IS published, because of your decision to publish, so, I suppose, it is open to be answered. that said, your experience is not different than mine, I was more speaking to the wording. you suggest that the public understands monetary sovereignty, when we both know, we (and the delightful ms harris) are in the distinct minority. coming to the conclusion that the federal govt is not revenue constrained is not the same thing as understanding the monetary system (of the US and others).

LikeLike

“I can’t imagine how this jibes with the public’s simultaneous belief that the government needs to borrow and tax to pay its bills.” ~ RMM

Yes. For example, “credit Theory” people (and there are many of them) claim that the U.S. government borrows all its money from banks. When you point out that the U.S. government can create all the dollars it wants, they respond that coins and bills comprise less than three percent of the overall U.S. money supply. When you explain that those are not actual dollars (they are currency bills that represent dollars) and that real dollars only exist in bank accounts, they claim that all dollars in bank accounts are loan dollars. Round and round you go, never getting anywhere.

Frankly (and this is just my opinion) I think the engine of these “credit theory” clowns is concealed anti-Semitism. They hear that “Jews control the money and the banks” and that, “All dollars in circulation are lent by the banks, and therefore by the Jews,” and they cling to this nonsense in order to simplify their world.

“All our money is lent to us by Jews.” How convenient.

Hence I say that the means whereby the human mind maintains doublethink is to sweep mutually contradictory ideas under the rug of hate. (“I don’t know all the details, but I do know the Truth!”)

LikeLike

are you s robot?

LikeLike

Yes I s r0bot. R y0u s troll?

Obviously you never went to school, but we’re here to help.

Lesson #1: In the English language, the first word of every sentence is capitalized.

LikeLike

Speaking of corporate taxes, yesterday Bernie Sanders once again introduced his “Climate Protection Act” bill in the Senate. Sanders has been doing this for the last four years, but the bills all died. (Joseph Biden tried to do it beginning in 1987. Joe Lieberman tried to do it in 2007.)

This time around, Sanders’ “Climate Protection Act” (S. 2399) was filed with the senate Finance Committee. It has no co-sponsors.

The purpose of the bill is to encourage U.S. corporations to transition away from fossil fuels.

That’s fine, but the bill includes a “carbon tax” whose proceeds will (ostensibly) go to households making less than $100,000/year.

That’s right. It’s another bullsh*t gimmick to placate the peasants while maintaining the Big Lie.

Why not just GIVE money to lower-income people? Or give money to corporations that make authentic advances in alternative energy? Oh that’s right. In order to add money to the economy, we must first take money out of the economy. After all, the U.S. government gets all its money from taxes, right? (Or is it loans from China?)

Sander’s latest gimmick is being praised by groups like Friends of the Earth, Environmental Action, and the Center on Race, Poverty and the Environment.

None of these groups are truly sincere about climate change, since none of them question the Big Lie.

Speaking of Bernie Sanders, I’m not a big fan of his. He refers to the late Hugo Chavez of Venezuela as a “dead communist dictator.” In fact, when it comes to making perpetual war and attacking socialism abroad, Bernie Sanders and Hillary Clinton are both as right-wing as the most flaming Republicans. In domestic policy, both of them lean very slightly to the left (at least in some ways). In foreign policy, both of them are radical right-wingers. And they both support the Big Lie.

Still, I’d prefer either of them to Republicans, who are right wing in both foreign and domestic policy.

LikeLike

“It’s another bullsh*t gimmick to placate the peasants while maintaining the Big Lie.”

Exactly true. I suspect if you were in a private setting with Bernie, he would agree, but say, “In order to get anything done, I first have to placate the peasants.”

With Stephanie Kelton as his advisor, he understands MS.

It would be interesting to see what he would do with the power of the Presidency.

LikeLike

The purpose of the bill is to increase the price of fossil fuels relative to renewables thus encouraging people to switch sooner than otherwise.

The purpose of “rebating” all the taxes collected is to prevent economic hardship to those least able to cope with higher fossil fuel prices.

The plan does not take money out of the economy as all of the carbon taxes collected are refunded.

Bernie Sanders economic adviser is Stephanie Kelton. She is more in line with MS by a million miles than whatever kooks are advising the other candidates.

LikeLike

With respect, federal taxation DOES INDEED take money out of the economy. Whether politicians create new dollars to replace the extracted dollars is another matter. Instead of creating new dollars, politicians usually claim that spending must be cut in order to reduce the deficit, since the federal government is “broke” and “in debt.”

Note how the Big Lie, plus the level of ambient hate in American society, causes politicians and the masses to always think of punishing people (i.e. taxing people) instead of rewarding people. This habit legitimizes right-wing types who condemn “big government,” saying, “How dare those politicians claim that they know how to spend my money better than I do?”

Suggestion…

Instead of punishing people (i.e. taxing them) with the questionable promise of “giving money back,” why not just GIVE money to people who switch to non-fossil fuels? Why not try direct rewards instead of punishments and bullshit?

As for Stephanie Kelton, I appreciate your hopes, but I will regard her as relevant when she can get Sanders to stop repeating the Big Lie.

LikeLike

That comment might be misunderstood. By using the term “bullshit,” I was accusing politicians, not you. Apologies.

LikeLike

Rodger, here’s a video that’s infuriating yet funny.

James Zadroga of the NYPD one of the “first responders” at the World Trade Center on 9-11. The air at “ground zero” was so full of asbestos and other toxins that Zadroga died of poisoning in 2006. Many other “first responders” also died, and many more are still dying today. About 33,000 thousand people were poisoned.

In 2006, then-Governor of New York George Pataki signed legislation to expand death benefits to “ground zero” workers who died from 9-11 poisoning.

However Republicans in Washington refused to help the dying workers, even though federal dollars are limitless.

Several bills were introduced, but Republicans staged filibusters to prevent a vote. One bill would have created 7.4 billion dollars out of thin air to help the dying workers and their families. Republicans said there was “no money” available. Eventually the Democrats won, and Obama signed the Zadroga Act into law in Jan 2011. (But it only provided $4.2 billion, not $7.4 billion.)

However the bill expired on 1 Oct 2015. Republicans (e.g. Senate leader Mitch McConell) blocked its renewal, once again claiming that there is “no money.” (The only thing more limitless than U.S. dollars is Republican hate.)

In the video below (eight minutes long), Jon Stewart, former host of “The Daily Show,” returns to the show to discuss this matter. Stewart then travels to the U.S. Senate building in Washington (Russell Senate Office Building, across the street from the U.S. Capitol Bldg.) to try and talk to Senators, but they all hide from him. Finally Jon Stewart manages to meet Sen. Rob Portman (Republican – Ohio) who says, “We’d support it if we had a way to pay for it.”

One of the people in Jon Stewart’s entourage responds, “When you guys want to find money, you know you can find money.”

Funny video…(but you’ll have to sit through a commercial)…

http://www.cc.com/video-clips/4hfvws/the-daily-show-with-trevor-noah-jon-stewart-returns-to-shame-congress

LikeLike

“Shame” requires some sense of morality.

LikeLike

How are people supposed to understand banking when bankers are liars?

Example…

Ecuador’s leftist government is headquartered in the capital city of Quito. The government’s opponents (wealthy right-wing oligarchs) are headquartered in Ecuador’s second largest city, called Guayaquil.

In Guayaquil, César Robalino is president of the Ecuadorian Association of Private Banks, a group of elitist bankers who oppose all government programs to help the poor (since these programs prevent the poor from becoming debt slaves of the bankers).

Also in Guayaquil is a right-wing (anti-government) newspaper titled El Universo. Mr. Robalino opposes all government attempts to rein in his crimes. Recently he told El Universo that, “You can’t create money out of nothing.”

Unless, of course, you are a banker like Mr. Robalino who creates money as loans. Or unless you are a government with Monetary Sovereignty.

Yes indeed folks. The Big Lie is global.

http://panampost.com/belen-marty/2015/05/31/ecuadorian-banks-must-adopt-official-electronic-currency-or-else/

LikeLike

EH001: Guayaquil is actually Ecuador’s largest city, with a population of 3.5 million. It is estimated that 50% of the city’s economy is “informal.” Perhaps this grey area is the only real antidote to the greed-driven tactics of bankers like Rabolino.

LikeLike

Recently he told El Universo that, “You can’t create money out of nothing.”

Sorry Mr. Robalino. You CAN create money out of nothing because it’s not real. You can make up the Easter Bunny but not real and natural rabbits. Humans are naturally real, but titles ( senator and congressman) ARE NOT. They are legally conceptual. Paper and metal are real and represent money, but money isn’t real. Legal isn’t real. Legal can be a pain in the ass and cause a helluva lot of real trouble, but legal is not real. You don’t get existence from nonexistence. You only get existence from existence. You don’t get legal laws from scientific laws. The latter are apriori discoveries. The former are inventions in an attempt to control people with words on paper backed up by punishment, fines and jail.

Natures laws are the only laws that can be enforced, i.e., given force through structural design and control. Legal laws are unenforceable as they have no natural consistency other than a sense of agreed upon morality, though shalt not steal, kill, etc., but we still do anyway, mostly because of the nonreality of money being held up into scarcity.

You can say money is the root of all evil or the conflation of real with unreal, trying to deal with reality on the basis of clinging to the falsehoods of Charles survival-of-the-fittest Darwin and Thomas not-enough-to-go-around Malthus. They were correct in pre-industrial 1810, but their ignorantly clung to tenets are utterly false today.

If and when money gets functional and actually works and is in tune with real human nature, we’ll succeed both internationally and as a plan-it. We don’t have forever. If we keep rolling the dice it’ll be curtains; time and our fantastic luck will run out.

Social and environ-mental problems are multiplying in frequency, intensity and duration mostly due to money as we now know it, that is, as an unreality we wrongly assume to be founded in reality.

LikeLike

“Perhaps I’m being too stupid . . .”

Yes, perhaps.

Nucleus repeatedly changes his/her name so his/her comments will see print.

Not understanding the differences between Monetary Sovereignty and monetary non-sovereignty, plus not understanding the differences between large economies and small economies, means essentially he/she has zero understanding of economics.

I won’t bother to debate his wrongheaded comments, as by publishing them, I allow him/her to demonstrate his/her ignorance, all by him-herself.

Feel free to invent yet another silly pseudonym in your sad, desperate attempt to get published. This one is finished.

LikeLike