Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Noah Smith is an assistant professor of finance at Stony Brook University and a freelance writer for a number of finance and business publications.

Professor Smith wrote an article titled, Japan’s Debt Trap Won’t Fix Itself in which he demonstrates his not understanding the differences between a Monetarily Sovereign government (Japan, the U.S., Canada et al) and a monetarily non-sovereign entity (Illinois, Chicago, businesses, people).

Perhaps because he teaches finance, he may think all finance is the same, so he seems to apply monetarily non-sovereign restrictions to Monetarily Sovereign governments.

Here are some examples:

With low unemployment and high labor force participation, Japan has essentially no idle resources. The scope for boosting the economy with fiscal stimulus or easy money is almost nil.

Its available resource is the yen. Japan, being Monetarily Sovereign, has the unlimited ability to create yen, with which it can buy unlimited resources.

The “scope for boosting the economy” via monetary stimulus is unlimited.

Japan continues to run an enormous budget deficit every year. Things are looking somewhat better for 2015. A hike in the consumption tax in 2014 has swelled revenues.

Here, Professor Smith demonstrates complete misunderstanding of national finances. He thinks “swelled revenues” (i.e. reduced revenues coming into the economy) in some unknown way, will benefit the economy.

No, Professor Smith, sending fewer yen into the Japanese economy, will not help grow the Japanese economy.

Government coffers have also been boosted by increased profits at Japanese companies — which is then subject to the country’s high corporate tax rate. As a result, the primary deficit is projected to be only about 3.3 percent in 2015.

A Monetarily Sovereign government, unlike a monetarily non-sovereign entity, has no “coffers.” It creates its own sovereign money ad hoc, by spending.

And that “high corporate tax rate” and low deficit is guaranteed to depress the economy.

In the long run, any deficit that stays higher than the rate of nominal GDP growth is unsustainable.

Why is it “unsustainable”? No one knows. Professor Smith doesn’t say. I only can surmise that he thinks the formula for GDP (GDP = Federal Spending + Non-federal Spending + Net Exports) is wrong.

Bank of Japan has not managed to increase core inflation to the 2 percent target despite Herculean efforts.

Even if interest rates stay at zero forever, borrowing 3.3 percent of GDP every year is just too much. And if interest rates rise, deficits would explode.

The government, of course, knows this, and has pledged to cut the primary deficit to 1 percent by 2018 and to zero by 2020.

Inflation follows this formula: Value = Demand/Supply. Inflation is a reduction in Value.

The Bank of Japan’s “Herculean efforts” consist of cutting interest rates, which only reduce Demand. But the reason inflation is too low (according to the BOJ) is that Supply is too low.

So what is the government’s “solution” to low Supply? Cut the deficit, which will cut Supply, further. Is it any wonder Japan is in trouble?

The Ministry of Finance, full of sober-minded bureaucrats, projects that under more realistic growth assumptions, the primary deficit will shrink only to 2.2 percent. Even that improvement would require tax hikes, spending cuts or some combination of the two.

So the Japanese government will try to stimulate inflation by cutting the Supply of yen. Hmmm . . . What next? Stimulate obesity by cutting the supply of food? Warm the house by turning down the heat?

A primary deficit of 2.2 percent would be at the very edge of long-term sustainability. If we assume a 1 percent real potential growth rate and 1.5 percent inflation, then a 2.2 percent deficit will be just barely under the maximum sustainable level of 2.5 percent.

If you understand his “sustainability” formula, please explain it to me. And while you’re at it, please explain why a deficit of 2.5% is the maximum sustainable level. Will the Japanese government run short of its own sovereign currency?

The article continues on and on, explaining the unexplainable: Why tax increases benefit the economy while deficits are “unsustainable.” It’s utter nonsense, of course, and unfortunately, a rather common nonsense.

Professor Smith can be forgiven his ignorance about economics. We all are ignorant about many things, and he probably should not be expected to understand Monetary Sovereignty if, as a finance professor, he teaches monetarily non-sovereign finance every day.

But the notion that leaders of major countries don’t understand Monetary Sovereignty is beyond belief, and in fact, I don’t believe it.

Increased deficit spending, especially on benefits for the middle and lower classes, narrows the Gap between the rich and the rest of us. The Gap is what makes them rich; without the Gap, no one would be rich, and the wider the Gap, the richer they are.

It is a fact of life, that the rich run every nation and always have. Because most of the rich want the Gap to widen, they pay the opinion leaders — the politicians, the university professors and the media — to teach the public that federal finances are like personal finances, where deficit spending causes debt and large debt is “unsustainable.”

Whether Finance Professor Smith really believes these things, or whether he has been paid to disseminate the “Big Lie,” is impossible to say.

But add him to the list of those spreading the rich .1%’s false narratives about federal financing.

If you wish to drop him a note to tell him so, his Email is: Noah.Smith@stonybrook.edu

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

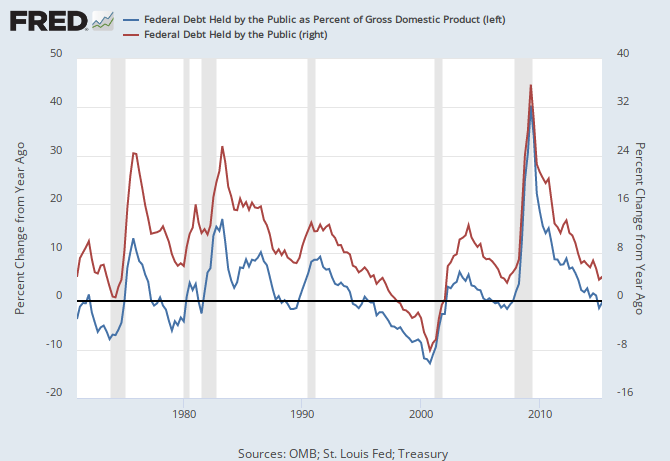

THE RECESSION CLOCK

Vertical gray bars mark recessions. Recessions come after the blue line drops below zero and when deficit growth declines.

As the federal deficit growth lines drop, we approach recessions, each of which has been cured only when the growth lines rose.

Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

So long as the real interest rate on Japan’s debt is less than the real growth rate of GDP their debt is quite sustainable without triggering inflation.

Also Noah’s point about an ageing population is shortsighted. SO long as Japan can produce/import the needed items for its aged population it should be fine.

LikeLike

The rich and the rest of “us”..

Except that “us” dont usually hang out in a country club. Isnt that a “rich” thing?

LikeLike

Although your purpose was to be obnoxious, you inadvertently asked a good question.

When I talk about the “rich,” I am referring to those whose income, wealth and power allow them to bribe the opinion makers.

They bribe the politicians via campaign contributions.

They bribe the media via ownership.

They bribe the economists via contributions to universities and by funding “think tanks.”

That kind of money usually requires being a billionaire and/or being CEO of a many-billion dollar company.

To them, a country club membership is peanuts.

LikeLike

Right…

Bums have country club access and “rich” means whatever you want it to mean. Conviniently you dont fall in it.

LikeLike

Yes, it is very “Convinient” (sic) not to be rich.

LikeLike

So if you have 20 – 100 million and offer a chunk to some politician, that’s not bribing?

Another issue that is very interesting is, are the “bad” rich those on the right (Koch) or those on the left (Soros). And quite honestly, the “media” is mostly run by the left. Just look at Hollywood for an idea.

You should also know that universities are run by left wing groups and economists. The majority are Keynesians..

So if our problem is caused by gaps created by the rich, than our problem is the left, not the right.

LikeLike

“So if you have 20 – 100 million and offer a chunk to some politician, that’s not bribing?”

Huh? That IS bribing. What the hell are you talking about?

“And quite honestly, the ‘media’ is mostly run by the left. Just look at Hollywood for an idea.”

Hollywood stars, not newspapers and TV, are the media??? All those movies are the media?? How much economics did you learn from Star Wars?

Since you now have had your last comment, and you once again will change your name in order to be published, I’ll explain to you: The media are controlled by their rich owners, most of whom are conservative.

LikeLike

I agree. The purpose of austerity is to widen the Gap between the rich and the rest. But who are the “rich”?

I define “the rich” as oligarchs who have power over government and society, irrespective of how much money they have (although they usually have a lot of money). Politicians have some power, but politicians depend on bribes from people like the Koch brothers, who write legislation and pay politicians to ratify it.

Money alone does not bestow power. Money can give you freedom, but money cannot give you power unless you also have connections, like the Koch brothers have. Or like the top executives of the big banks have.

One other thing…we rarely hear of Lloyd Bankfein or Jamie Dimon (for example) demanding more austerity. No, the screamers for austerity are the bankers’ toadies, such as professors, politicians, and media hacks.

LikeLike

Professor Smith is worse than worthless, since he legitimizes austerity. He calls Japan’s recession: “low unemployment and high labor force participation.”

Because of austerity (e.g. a national sales tax), average Japanese are forced to take out mortgages whose repayment periods lasts a century or more. This means that your grandchildren and great-great grandchildren will spend all their lives paying the bankers. (Australia also has multi-generational mortgages.)

During the last six years, Japan’s federal budget deficit has equaled 8.4% of Japan’s GDP (according to the Trading Economics web site), but in 2014, austerity took a sharp upswing, and the Japanese government’s deficit started plunging, just like the U.S. government’s deficit.

It’s all about widening the gap between the rich and the rest.

Austerity always and everywhere increases many of society’s negative factors, including racism, militarism, immigrant-bashing, poor-people-bashing, and so on. Japan is no exception to this rule. The effect of all these vices is to legitimize an ever-widening Gap between the rich and the rest. (For example, weapons makers pay bribes and kickbacks to politicians in return for bigger government contracts. Hence the added militarism, as we now see in Japan, which has de facto abandoned its non-aggression constitution.)

Meanwhile austerity has made the Japanese public so angry that Prime Minister Sinzo Abe is talking about possibly backing off a little, and perhaps raising the minimum wage slightly. (Perhaps.) He is talking about possibly giving a one-time cash handout of $245 to each of Japan’s elderly poor, whose numbers are now at ten million and rising, because of austerity. He is talking about a possible stimulus package of 2.9 trillion yen ($24 billion).

Big deal. The Japanese government traditionally announces year-end gifts for the peasants. Each year the gifts become smaller as austerity becomes fiercer. Last year’s promised stimulus spending was 3.1 trillion yen, the smallest since 2007. This year it is even smaller.

Meanwhile the big Japanese corporations are making record profits, just like in the West.

Here is standard garbage from the Wall Street Journal: “Mr. Abe’s spending plans are limited to what can be paid for by increases in tax revenue or money left over from the year’s primary budget.”

Meanwhile see this bar graph from the Trading Economics web site, which shows the plunging U.S. federal deficit. This is the type of economic terrorism that Professor Smith praises as “fiscal responsibility”…

RODGER WRITES, “The notion that leaders of major countries don’t understand Monetary Sovereignty is beyond belief, and in fact, I don’t believe it.”

MMT people believe it. I do not. When politicians award huge contracts to companies, the politicians see an immediate increase in the companies’ hiring statistics. This is stimulus in action. When politicians cut spending or increase taxes (or both) they see an immediate worsening of the economy. That is austerity in action.

You don’t have to know anything about economics to see that when people have no money, they starve.

LikeLike

Wait,

What is the right approach?

The Japanese government has never, ever, ever implemented austerity, just like the US and Europe. Stop acting like there has been – there hasn’t been.

Now that Japan has proven that increasing government spending doesn’t work, you blame it on the lack of it? Are you kidding? Look at Japan debt growth over the years..

You liberals are annoying.

LikeLike

I assume Chunch and Zero are the same person, since they share the same ignorance and obnoxiousness.

Another austerity victim: Japan falls back into recession

Japan Sees Greece as Proof Austerity Alone Won’t Fix Deficit

Europe can learn from Japan’s austerity endgame

LikeLike

Japan has had no austerity? What is austerity anyway? The formal definition is deficit reduction. However I define austerity as any government program or policy that widens the Gap between the rich and the rest.

Even a deficit INCREASE can be austerity, if all the government money goes only to the rich.

See

https://monetarysov.wordpress.com/2015/11/30/useful-idiots/

LikeLike

did you mean to write this, “The Bank of Japan’s “Herculean efforts” consist of cutting interest rates, which only reduce Demand.”?

or mean to write this, “The Bank of Japan’s “Herculean efforts” consist of cutting interest rates, which only INCREASE Demand.”?

LikeLike

Cutting interest rates reduces the demand for yen. It would be inflationary if spending were higher.

LikeLike

gotcha, you are talking bond buying, I was thinking of domestic investment. even though, as we both know, that just because you have reduced interest rates that fact alone will not compel business owners, potential homebuyers, etc. from taking advantage of the low rates.

LikeLike

Agreed. That fact ALONE will not COMPEL potential borrowers to borrow.

LikeLike

just heard on npr (4oclock est), that yellen was planning on raising interest rates (again), because of the improvements in the economy (really?). ignoring the fact, that inflation has been at 70 year lows. what say you?

LikeLike

Two sides to this. Yes, raising interest rates could lead to deflation, a very serious situation. But raising rates also could pump dollars into the economy, because the federal government would pay more interest on its securities.

What I’d really like to see is a combination of raised rates and increased deficit spending.

It’s unfortunate that Congress believes the Fed is responsible for the economy, and they (Congress) can just stand back and act stupid.

LikeLike