Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

The Gap is the distance between the high earners and the low earners, the rich and the rest, the powerful and the powerless.

If there were no Gap, no one would be rich and no one would be poor, and the wider the Gap, the richer are the rich and the poorer are the poor.

There is not just one Gap, but many Gaps. They exist between all levels of income, wealth and power. Billionaires sneer at mere millionaires, who smirk at “thousandaires,” who deride all those poor below them in the income/wealth/power scales.

And all this sneering, smirking and deriding evolves to scorning and ultimately to despising. The lower middle class despises the poor, and this hatred is the source of racial bigotry, which is strongest among those nearest to the poor.

When we look up, we want the Gap narrowed, because the Gap above us makes us envious. When we look down, we want the Gap widened, because it is the Gap that allows us to feel superior and successful.

So great is our fear of sliding down the income/wealth/power scale, that we are willing to sacrifice our own well-being, so long as the well-being of those below us is sacrificed even more.

The rich intuitively understand this, which is why they have been so successful in making the lower-middle agree to — insist on, actually — reductions in welfare benefits for the poor, reductions in unemployment compensation, and other benefits for the financially lower classes.

(See: Paul Ryan explains why you shouldn’t get paid family leave)

Paul Ryan, who is bribed by rich donors, opposes family leave, which would benefit the poor. He is a member of a party that opposes virtually all benefits to the poor (though not to the rich), a party that has made the word “welfare” a pejorative.

Though seemingly ironic, but perfectly predictable, most members of the Republican party are not rich. Most also are not among the poor. They are in the middle-classes, the very group you might expect to have the strongest bias against helping the poor.

And this bias, like most other forms of bigotry, is self-defeating.

Health inequality kills – and now is the time to close the gap

Overcoming the health gaps that kill and distort lives globally will be tough, but we must try, says the new head of the World Medical Association,

By Michael Marmot. He also directs the UCL Institute of Health Equity and is Lown Professor at Harvard University. His book, The Health Gap, is published by Bloomsbury.IMAGINE the outrage if a newspaper ran a story stating that a million people in the UK had died from a treatable medical condition over the past five years. Health ministers would be interrogated, government enquiries promised – and the public would be left with a terrible feeling of unease.

But those people really did die, and from a preventable condition: health inequality.

I calculated that if everyone in England over 30 had the same low mortality rate as university-educated people, there would be 202,000 fewer deaths each year – almost half the current total.

Last month, the US National Academy of Sciences reported that at the age of 50, life expectancy for a man in the US in the poorest 20 percent of the population had declined slightly in the last 30 years to 26.1 years.

By contrast, life expectancy in the richest 20 percent had improved by 7.1 years to 38.8 years – a difference of 12.7 years.

Health minister Jeremy Hunt recently cited my book as showing an 18-year gap in male life expectancy between the richest and poorest in the London borough of Westminster – one of the richest spots on the planet.

The health gap didn’t widen in the past 30 years in the US and the UK for lack of indoor toilets, but because people are not able to live lives that they value.

A causal thread links health inequalities to life conditions, from the quality of input surrounding early child development, through inequalities in education, employment and working milieu, to the conditions for older people.

There is evidence, though, that improvements at any stage of life can make a difference.

Health inequalities in Brazil have fallen from a very high level, due in part to schemes where poor families receive cash subsidies for meeting conditions such as taking their children to nutrition clinics. This may explain why inequalities in the growth of young children have been sharply reduced.

The problem is that to act on the social determinants of health, governments must get past the assumption that inequalities in health arise from inequalities in healthcare.

Health inequalities aren’t confined to poor health for the poor and good health for everyone else. There is a gradient in health running from top to bottom of the social hierarchy. We should all be calling for action across the whole of society because we are all affected by inequalities in health.

But governments have other priorities. Austerity has caught on like an epidemic, flying in the face of mainstream economists’ views that it damages economic growth.

Even wealthy America is caught up in the austerity craze. We yearn for federal deficit reduction. We deplore our “high” federal debt. We are told that various benefits programs — Social Security, Medicare, Medicaid, all aids to the poor — are “unsustainable” and “unaffordable,” none of which is true, and all of which are austerity.

And there is plenty of evidence that health is damaged by austerity: take Greece, where rising suicide is the most dramatic example.

As president of the World Medical Association for the coming year, I have signalled that my themes will be social justice and health, and health equity.

There is a well of enthusiasm from doctors to make a difference to the social environment in which their patients are born, grow, live, work and age. But enthusiasm from a government, backed by an informed public, is also essential.

As I say at the end of my book, if you live in a country with poorly developed social systems, do something because it will make a difference.

The “difference” he speaks of, is the increase in both the length and quality of life that social benefits make.

Sadly, every day, we see misleading articles like the following two from the Florida Sun Sentinel, articles which purport to show “both sides” of the Social Security funding issue:

Social Security going bankrupt

Mark J. WarshawskyUnder current law and absent reform, Social Security is projected to suffer cash-flow shortfalls — gaps between payroll taxes and spending on benefits — forever.

Second: Social Security’s combined retirement and disability trust funds’ reserves are projected to be exhausted in 2034. Continuing tax revenues would be sufficient to pay only 79 percent of scheduled benefits.

Third: The disability insurance trust fund is expected to be insolvent by the fourth quarter of 2016, when the government must reduce disability payouts to 81 percent of scheduled benefits.

Fourth: The actuarial deficit for the entire program calculated over a 75-year period is 2.68 percent of taxable payroll.

Even an immediate increase in the payroll tax rate of 2.68 percentage points would be insufficient to achieve sustainable or permanent solvency.

The aforementioned are the official facts according to the Social Security Trustees.

The facts according to the Congressional Budget Office are actually much worse, so it’s difficult to understand why so many politicians even demand benefit increases without first proposing how currently scheduled benefits will be paid.

Warshawsky began his piece with the caveat, “Under current law and absent reform . . . ” so technically, he is correct about “Social Security going bankrupt” — under current law.

He implies however that the necessary “reform” is to cut benefits.

He doesn’t mention the real reform: Federal payment for Social Security benefits.

And here is the “other side” of the story:

Strengthen Social Security as key protection against rising economic risks

By: Christian E. Weller, a senior fellow at the Center for American Progress and professor of public policy at the University of Massachusetts Boston.Social Security provides critical income security at a time of rising economic risks to almost every American family. It faces, however, manageable long-term financial challenges that can be addressed through thoughtful updates.

The Center for Retirement Research estimates that more than half of working-age households in 2013 could expect to have less money in retirement than during their working years, compared with 31 percent in 1983. With less money, these households are forced to make substantial and often painful cuts in their spending once they retire.

Many households simply cannot save enough for the future since they are already struggling through the vicissitudes of the present.

However, although Social Security offers basic retirement income to almost everybody, it faces a long-term financial shortfall.

The Social Security trustees estimate that Social Security can pay for all of its promised benefits through 2034. The same projections show that Social Security will receive less income from payroll taxes than it needs to pay all promised benefits.

To improve retirement security for America’s middle class, we need an updated Social Security system.

One such update would be the creation of a minimum benefit that keeps those who worked all their lives out of poverty and keeps pace with overall living standards in the future.

Paying for Social Security updates is rather straightforward.

Congress can do this by lifting the cap on earnings that are subject to Social Security taxes.

Two authors, both of whom admit the necessity of Social Security, provide twp completely different solutions to the perceived financial problems of Social Security: Raise taxes or reduce benefits.

Both solutions would be harmful to the economy and both would increase the Gap between the rich and the rest.

And it is the Gap that reduces the lifespan of Americans.

We spend billions to find cures for life-reducing illnesses, and here is an illness — the Gap — that easily could be cured, or at least alleviated, by the simple expedient of federal financial support for Social Security and other social benefits.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

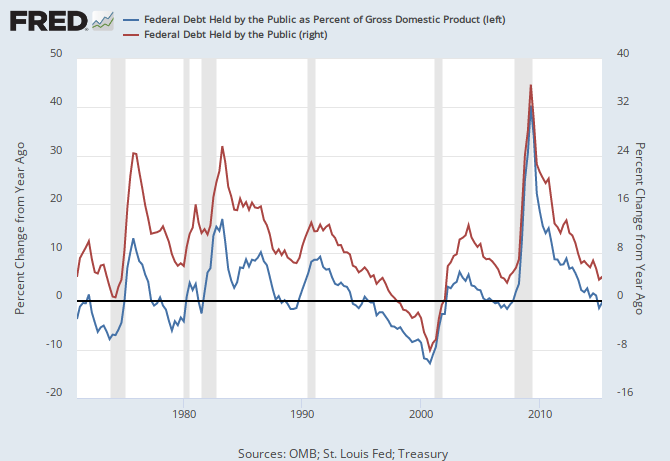

THE RECESSION CLOCK

Vertical gray bars mark recessions. Recessions come after the blue line drops below zero and when deficit growth declines.

As the federal deficit growth lines drop, we approach recessions, each of which has been cured only when the growth lines rose.

Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

How about federal financing of Social Security and Medicare for all?

LikeLike

Republicans want you to grovel to them for a few drops of water from the inexhaustible well.

Democrats want you to grovel to them for a few promises of protection from Republicans.

Both sides depend on the Big Lie that the inexhaustible well is “about to run dry.”

If everyone realized that the well is inexhaustible, then Republicans could not hoard the water, and Democrats could not claim that they are needed to protect us from hoarding.

The basis of social power is artificial scarcity. In business, artificial scarcity is sustained by monopolies, or by collusion between giants. In politics and government, artificial scarcity is sustained by the Big Lie that a money creator is the same as a money user.

Hillary depends on the Big Lie. She wants everyone to grovel to her for a few drops of water. She wants to be worshipped as the divine Keeper of the Well. She wants to be God.

LikeLike

Describe this well Elizabeth..

Is it the money some people get from the government or is it the goods and services they purchase with the money they get from the government?

Do you agree with programs that benefit the poor and are you also with Rodger in that the government should also fund companies like Tesla because the organization is doing something “good” in your eyes (whether it’s a fact or not doesn’t matter – i.e., climate change).

What is more interesting to me is that nobody cares where the stuff comes from. And by stuff, I mean the goods and services that are purchased with these funds… Have you thought that perhaps, just perhaps, if you start giving everyone 10 million dollars – that it just may, just perhaps, cause those producers to stop producing?

Is that even part of your thought process or do you only care about the give me mines now part. I know for sure it’s not of Rodger’s thought process.

LikeLike

Sure,

I guess I missed the part where I supposedly said, “the government should also fund companies like Tesla because the organization is doing something “good.”

Please point out that reference.

Also, reference where anyone (but you) said to “give everyone 10 million dollars.”

But you’re right; it’s not part of Rodger’s thought process.

You do have a vivid imagination.

Finally, please let us know what you think the differences are between Monetary Sovereignty and monetary non-sovereignty. You keep ducking that question.

LikeLike

Q. Is it the money some people get from the government or is it the goods and services they purchase with the money they get from the government?

A. Your question does not compute. Please rephrase.

Q. Do you agree with programs that benefit the poor?

A. Yes. The nature of human society makes stratification inevitable. Even if everyone is equally virtuous and hard-working, society will sooner or later separate into rich and poor. This is unavoidable. (Likewise, communist societies split into party bosses vs. the people. Same thing.) Therefore we need social programs to help people who inevitably lose out and fall to the bottom.

Of course, we can just let them suffer and die, in which case they will be replaced by more people who will suffer and die, who will again be replaced, over and over like rows of shark’s teeth. You may prefer to live in that world. I do not. As I noted before, when I see a homeless beggar, I think, “Today it is him. Tomorrow it will be me.” Perhaps you think something else.

Q. Are you also with Rodger in that the government should also fund companies like Tesla because the organization is doing something “good” in your eyes (whether it’s a fact or not doesn’t matter – i.e., climate change).

A. In principle yes, but with caveats. For example, we may not want politicians giving government money to their personal cronies in selected companies that produce nothing of value to society (although any giveaway of government money is better than having a government budget surplus).

Roger’s point is that the corporate obsession with immediate profits and with Wall Street gambling inhibits risk-taking, and cripples research and development. Since the federal government can create infinite money out of thin air, the government has no profit motive, and can therefore fund things like the Apollo space program, which gave us things like pocket calculators, GPS navigation, etc etc etc. Government funding of DARPA-Net led to the Internet. Or perhaps you prefer government-by-Wall Street, which produces nothing but paper profits.

Q. What is more interesting to me is that nobody cares where the stuff comes from. And by stuff, I mean the goods and services that are purchased with these funds.

A. Your question does not compute. Please rephrase.

Q. Have you thought that perhaps, just perhaps, if you start giving everyone 10 million dollars – that it just may, just perhaps, cause those producers to stop producing?

A. Your resort to extremes indicates that you are not confident in your arguments. As far as giving money to people, the Mincome experiment in Canada proved that when people are given a Basic Income Guarantee (BIG), they work more, not less. A Basic Income Guarantee unleashes people so that they think big. They become enterprising and ambitious. They also enjoy radical decreases in crime, substance abuse, domestic violence, physical ailments, and mental illness. These are facts, not speculation.

As things are now, most people hate their lives and their jobs. They dream of not having to toil for peanuts under idiots who despise them. They cope with their misery by imagining that their suffering is necessary, since (supposedly) no one will work unless he is constantly whipped. Rich people don’t have whips on their backs, yet most rich people are highly motivated to become even richer. Average people would be the same if they had a Basic Income Guarantee (aka Universal Social Security).

Q. Is that even part of your thought process or do you only care about the give me mines now part. I know for sure it’s not of Rodger’s thought process.

A. Your question does not compute. Please rephrase.

Concerning “Rodger’s thought process,” I hope that you can argue for yourself without restoring to schoolyard tactics such as “So-and-so agrees with me, so it’s two against one, ergo you are wrong.”

Please.

Anyway, many thanks for your thoughtful questions.

LikeLike

Freshman GOP senator Ben Sasse made his introductory speech yesterday to his fellow senators as is the tradition for freshman senators upon their arrival to D.C. He was praised by Morning Joe anchors and other senators for his bold “tell it like it is” attitude which included speaking truth to power, stopping all the lies and puppetry, trying to get back on the good side of the public because they “hate us.” No mention however of HOW. No model, nothing. He did seem very sincere and might be open to monetary sovereignty’s philosophy. It would be a great test of just how open-minded he really is to changing the public’s view of the GOP. We/I should write to him and give him the good news about MS. Maybe he should get acquainted with Dr. Kelton.

LikeLike

I have yet to encounter a sociologist who understands “Gap Dynamics.” Sociologists have all kinds of hypotheses, but they ignore the fact that the sensation of “wealth” depends on the Gap. And yes this is a fact, not merely a matter of Rodger’s opinion or perspective.

Some comments if I may…

1. “So great is our fear of sliding down the income/wealth/power scale, that we are willing to sacrifice our own well-being, so long as the well-being of those below us is sacrificed even more.”

>>Precisely. The desire to maintain the Gap is so intense that the middle class will commit suicide, as long as it causes the lower class to die first. Rather than demand equality for all, the average person wants inequality for everyone below him. He more readily calls for a widening of the gap below than for a narrowing of the gap above. (There are exceptions, of course.) For example, the average person complains about “welfare queens” much more than he complains about the rich.

2. “The rich intuitively understand this, which is why they have been so successful in making the lower-middle agree to — insist on, actually — reductions in welfare benefits for the poor, reductions in unemployment compensation, and other benefits for the financially lower classes.”

>>Middle class people cheer attacks on themselves and the poor alike, although they think the attacks will only hurt the bottom class. For example, the middle class cheers when politicians call for a balanced federal budget, and a smaller federal deficit. Likewise, average Greeks cheer the euro that is killing them. It’s all about the desire to punish those below, regardless of where you are on the social ladder.

3. Paul Ryan wants family leave for himself, but not for you.

>> Ryan’s hypocrisy and selfishness appeal to the average middle class person who (like Ryan) wants benefits for himself, but not for those below. The average American wants freedom for himself, and a police state for those below. He wants his entire city to be a gated community that excludes anyone who is below him. He agrees that extreme racism is not a good thing, yet he endorses institutionalized racism, such as the mass incarceration of Blacks and refugees.

4. “Even wealthy America is caught up in the austerity craze.”

>> The middle class is also caught up in the austerity craze. Right-wingers and left-wingers both want more austerity. Right-wingers demand the elimination of social programs that help average people. Left wingers demand higher taxes. Both sides depend on the Big Lie, and both sides righteously defend it. However the bottom class does not defend it, or depend on it. Therefore bottom-dwellers are receptive to the facts of Monetary Sovereignty. (Rich people understand the facts, but they keep quiet, since they depend on mass ignorance.) The average person seeks to punish everyone below him for being “inferior.” Indeed, he wants to increase this “inferiority.” This attack is justified by the Big Lie. (“Money is limited, and those parasites below me want it all!”) Therefore in modern society, “getting ahead” does not mean the advancement of oneself, so much as the impoverishment of everyone below.

5. “It is the Gap that reduces the lifespan of Americans.”

>>Exactly. It is not poverty per se, but the Gap.

5. “We spend billions to find cures for life-reducing illnesses, and here is an illness — the Gap — that easily could be cured, or at least alleviated, by the simple expedient of federal financial support for Social Security and other social benefits.”

>> In human society the one thing that is always in “short supply” is money (which is the one thing that is always infinite). We maintain this artificial scarcity in order to maintain the Gap, which itself is a product of human selfishness. Selfishness is a product of fear. The cure for fear is love, compassion, and the willingness to try and see things from other people’s perspective.

Do you give to beggars on the street? I do. My attitude is, “Today it is him; tomorrow it will be me.”

LikeLike

How often has this happened to you? Too many times to count, I’ll bet.

You’ll be reading an article that seems reasonable, when suddenly the author shows that he or she believes the Big Lie, and rejects the facts of Monetary Sovereignty.

“And you were doing so well,” you think.

Result: you dismiss the entire article.

Just now I was reading a blog post by a guy who described his life’s evolution from a Reagan-worshipper to a Bernie Sanders supporter. The article was okay until this…

“In addition, there was the matter of the gargantuan national debt. Reagan, the avowed fiscal conservative, had created deficits that were absolutely alarming and threatened to swamp my generation’s ability to live decently.”

Whoops.

Such goofs are ubiquitous. Bernie Sanders himself boasts of being a “deficit hawk.” Sanders wants you to suffer more austerity. He wants to increase your taxes, the revenue from which the U.S. government does not need or use. He wants to increase corporate taxes, claiming that it would “generate revenue” to invest in infrastructure and education. In short, Sanders supports the Big Lie.

Right-wingers and “progressives” hate each other, but mostly they hate YOU.

He who speaks the truth about MS is attacked from all sides.

LikeLike

Personalities like myself will analyze everything and will only support theories that work. MS / MMT and Keynsian economics do not work.

I would bet that most progressives are Sensing Feeling types.

LikeLike

Impressive that you analyze everything.

Since this site focuses on Monetary Sovereignty, and you have been reading the site, perhaps you could demonstrate your analytical personality by explaining the differences between Monetary Sovereignty and monetary non-sovereignty.

LikeLike

“I would bet that most progressives are Sensing Feeling types.”

Unlike you, who are heroic, courageous, self-sufficient, and evidently very young.

Out of curiosity, what do you think is the difference between Monetary Sovereignty and monetary non-sovereignty?

Until you can answer that, we will continue talking past each other, getting nowhere.

LikeLike

When interest rates are high, it’s possible for the cost of the loan to

exceed the actual value of the vehicle being covered. Extreme Convenience – Buyers with bad credit car financing problems can finance and buy a car

at the same time, which is time saving as well. Another solution I hear more and more is where car owners are letting someone

take over car payments on their behalf while the loan is still in their name.

LikeLike