Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes..

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

============================================================================================================================================================================================================================================================

Readers of this blog know that federal deficit spending adds dollars to the economy.

–And they know that economic growth relies on increased spending by the federal sector and by the non-federal sector (GDP = Federal Spending + Non-federal Spending + Net Exports)

–And they know that federal deficit spending adds to Non-federal Spending by putting more dollars into the pockets of individuals, corporations and local governments.

–And they know that reduced federal deficit spending leads to recessions (See the Recession Clock at the bottom of this page).

So for all those reasons, the myth that federal deficits, federal debt and the federal debt ceiling should be reduced are wrong-headed and damaging — perhaps the most damaging economic myth in all of economics.

But there is yet another reason why that myth should be consigned to the flat-earth, anti-vaccination, pro-gold dustbin of history, and that reason is: RISK.

What the Steve Jobs Movie Won’t Tell You About Apple’s Success

By Yves Smith, October 27th, 2015Mariana Mazzucato’s recent book, The Entrepreneurial State, makes a bold and well-documented case that government has been the key factor in promoting innovation, largely because private interests lack the risk tolerance and long time horizon needed to create foundational technologies.

I often use the iPhone as an example of how governments shape markets, because what makes the iPhone ‘smart’ and not stupid is what you can do with it.

Everything you can do with an iPhone was government-funded. From the Internet that allows you to surf the Web, to GPS that lets you use Google Maps, to touch screen display and even the SIRI voice activated system —all of these things were funded by Uncle Sam through the Defense Advanced Research Projects Agency (DARPA), NASA, the Navy, and even the CIA!

These agencies are all “mission-driven.”

By contrast, private industry is profit-driven, sales-driven, growth-driven, and the like.

Do you know how much it cost to send men to the moon, or to develop atomic energy or to create GPS? Do you even care?

Without NASA, no private company, would have risked starting from scratch to develop the rocketry, the astronaut training, the launch sites, the computerization and to pay all the thousands of personnel involved in an event that itself produced zero income (though it led to thousands of valuable inventions).

Our government, being Monetarily Sovereign, so is able to create dollars ad hoc, can afford any financial risk.

MM: We pretend that government at best was important for some infrastructure and basic science behind their empires.

We see the new Steve Jobs film, which is based on a 600-page book where not one word mentions any of the public funding behind Apple’s empire. But the real iPhone story — or the story behind biotechnology — reveals a very different narrative in which government-funded research made the most exciting innovations possible.

The same could be said of Elon Musk today —Tesla and Space X not only benefit from government-funded basic research through agencies like the DoE and NASA, but they have also, as companies, received high-risk investments by the public sector.

Just one example is the $465 million guaranteed loan received by Tesla by the DoE. As recently shown by an LA Times article, the entire Musk empire has received close to $5 billion in direct and indirect support.

Why did the DoE guarantee Tesla’s loan? Because they believed electric cars were destined to be energy savers, safer and less pollution creating.

The only question I have is: Why guarantee a loan? Why not simply give the money (with caveats about how the money and resultant profits are used)?

If energy saving, safety and reduced pollution are worthwhile goals for America, why make Tesla think twice about whether developmental costs are worth the risk to the whole corporation?

Sadly, after making the excellent point that the federal government can afford R&D risks that private industry cannot, and were it not for federal spending, much of what we take for granted in modern America would not exist, Ms. Mazzucato falls off the rails.

LP: You make the case that if taxpayers fund research responsible for the success of many private sector enterprises, then we deserve something back. What might a fairer system of the distribution of rewards look like?

MM: When government provided Tesla with that guaranteed loan, it was a success. On the other hand, Solyndra got roughly the same amount ($500 million to Tesla’s $465 million), but it was a failure.

Any venture capitalist will tell you that this is normal: for each success there are many failures. But what the venture capitalist has that the government does not have is the ability to use some of the upside to cover the downside and the next round of investments.

Economists argue that the government gets that upside through taxes paid by the companies benefitting from the investments; and by economic growth, which should generate higher tax receipts more broadly; and also through the spillovers from the investment into other areas, which helps the economy.

Yes, that is what many economists say, but they are dead wrong. The federal government does not benefit from taxes. It neither needs nor uses tax dollars. It creates dollars ad hoc, by spending.

Bottom line: One of the many reasons why federal deficit reduction is so harmful is: It reduces federal financing of the R&D that has brought us modern America. The federal government can afford what private investment cannot. The federal government can afford any financial risk.

If the smartphone and GPS had not been invented, we would feel no sense of loss. We would be perfectly satisfied with dial phones and paper maps. We would live in ignorance of what might have been.

And today, you have no idea what austerity has cost you — the inventions that never were invented, the mortal diseases that have not been cured, your loved ones’ lives that unnecessarily have been lost, the progress that didn’t happen.

We allude to this in the five posts titled, “You never will know what you have lost.”

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

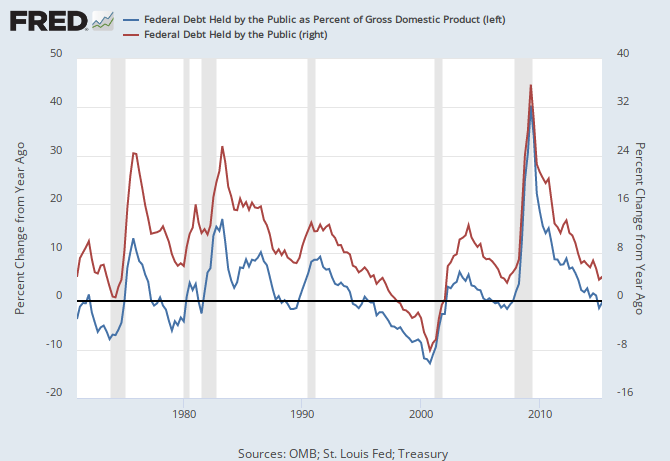

Vertical gray bars mark recessions. Recessions come after the blue line drops below zero and when deficit growth declines.

As the federal deficit growth lines drop, we approach recessions, each of which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

So this “the government can spend all it wants” thing only works in the US? If so, why?

LikeLike

Any Monetarily Sovereign nation has the unlimited ability to create its own sovereign currency. Examples are: Canada, Japan, Australia, the UK and Mexico.

Monetarily non-sovereign governments are unable to do this. Examples are the euro nations, as well as cities, counties and states in the U.S. and elsewhere.

LikeLike

@ Suŕe: Rodger has noted that either a national has Monetary Sovereignty or it does not. Either a nation produces its own currency, or it does not.

That said, Rodger has also noted that – practically speaking – the degree of Monetary Sovereignty varies between nations. Both the USA (pop. 322 million) and Samoa (pop. 187,000) have their own currencies. Therefore both nations have Monetary Sovereignty. However in practical operation the USA has more Monetary Sovereignty, since the U.S. economy is much larger, and since the U.S. dollar is accepted all over the world. This gives the USA more power to influence the value of its own currency. The Samoan government can produce all the “talas” it likes, but foreigners who export to Samoa do not want to be paid in Samoan talas. Foreigners want to be paid in dollars, or euros, or in some other widely accepted currency. Therefore Samoa has Monetary Sovereignty over the tala, but Samoa must also obtain foreign currencies in order to buy imports. The USA does not need foreign currencies. The USA does everything in dollars.

Therefore, in practical, real-world terms, the U.S. government has more sovereignty over the money used in its economy than does the Samoan government, which uses its own currency, plus foreign currencies.

Looked at another way, in order for a nation to have 100 percent Monetary Sovereignty, it must

1. Produce its own currency, and

2. Be totally self-sufficient, or else have its currency accepted world-wide (like the U.S. dollar)

LikeLike

and, ms harris, oil is paid in dollars. you can thank the war criminals, Kissinger and Nixon, for that. when they decided to take the dollar off the gold standard, they also were negotiating with OPEC to have oil paid in dollars (in exchange for the defense of the monarchs, and other considerations). what did this do? it created a demand for US dollars beyond the US borders, supplanting gold as the reserve currency of the world.

LikeLike

The U.S. Empire is in its twilight. It does not manufacture. Its only innovation is in devising new financial scams. Its only concern is widening the gap between the rich and the rest, and between Wall Street and Main Street. Its leaders intentionally keep the real economy in a depression, in order to widen the gap. Its weapons makers deliberately produce non-functional garbage (e.g. the F-35 fighter) in order to milk the U.S. government via endless cost overruns. Its rich people spend all their time in financial casinos, while its non-rich people become poorer by the day. The financial sector is such a crippling parasite that I strongly doubt we could win a conventional war against Russia and / or China.

In April 2012, Rodger wrote a post titled, “I’m a SETI buff, and I don’t know why.” This brings up a question. If suddenly there was absolute proof of intelligent life on some distant planet, what would the U.S. government do? I say it would do nothing. If an item does not widen the gap between the rich and the rest, or between Wall Street and Main Street, then the U.S. government is not interested in it. Therefore the USA will never organize a manned mission to Mars. The Space Shuttle program ended four years ago, and the “New Horizons” probe Pluto was launched nine years ago, before austerity mania became global.

We’re done folks.

LikeLike

I see your points and most people would probably agree with you. However, in my opinion our issues are a little bit different than what you describe and the solution to those issues are different as well.

For one, I can’t understand how this sovereignty thing is not the same across the board. I think I know the answer as to why, for instance, the US is a global powerhouse and nations around the world use it to trade – so it is highly trusted. I think this trust did not happen because the US is a sovereign, I think it happened because the US dollar has proved to be more stable than any other form of currency in the world. So this trust has been earned. If you don’t believe me, than go read articles from a few years ago when the dollar was depreciating – there were many screaming that the dollar would collapse and people started to prefer local currency over the dollar. Of course, the dollar has rallied the last few years and everyone is now back to loving the dollar again. The US economic system is far superior than any other form of government around the world – and it has been proven time and time again. Nations around the world do not have anything close to the solid foundation that the US has been built on – the US constitution.

There are a few regulatory issues that do harm the US, like regulations that result in jobs being exported to other nations as well as regulations that result in an extremely high price for medicine / medical services which drain the population of most of their hard earned money. Americans spend an incredible amount of their incomes in medicine – this is skyrocketed in the last 30 – 40 years.

You fix the regulations that result in jobs being exported and you fix the issue with high cost of medicine and we would be much better off in my opinion.

LikeLike

@ Suŕe: Many thanks for your comments.

From my perspective the basis of U.S. strength is the worldwide acceptance of the U.S. dollar. In any country you can find a local bank that will exchange your U.S. dollars for the local currency.

This occurs because the USA was a manufacturing powerhouse after World War II. The USA sold to the world, and the U.S. dollar became a world habit, so to speak. (I am not speaking of the U.S. dollar as a reserve currency, which is a different matter, and pertains to trade between nations. I am speaking of the dollar being accepted worldwide.) Since the U.S. government can create as many dollars as it likes out of thin air, the U.S. government has a lot of power.

However two things show that this power is waning. One thing is that so many U.S. manufacturing jobs have been sent overseas that the USA is no longer a manufacturing powerhouse. Big American corporations no longer invest in industry. Instead, big corporations focus on boosting their stock prices, so that their senior officers can collect higher bonuses.

The other thing is that foreign currencies are catching up to the U.S. dollar in terms of world acceptance. Right now the most widely used currencies are (in this order) the US dollar, the euro, the British pound, the Japanese yen, and the Chinese yuan. In October 2013, the Chinese yuan was the 12th most-used currency for global payment system transactions. By December 2013, the yuan was the 8th most widely used currency. By January 2015 the Chinese yuan was the fifth most widely used currency. The Chinese yuan is now more widely used than Canadian or Australian dollars, and will soon overtake the Japanese yen. Eventually the Chinese yuan will eclipse the U.S. dollar.

Don’t panic. Only two percent of the world’s transactions are done in Chinese yuan. Seventy-five percent of the world’s transactions are still done in dollars and euros. However the yuan is rising fast. In most of Asia, the Chinese yuan is already used as much as US dollars. Shanghai as a financial center is almost as powerful as London and New York. Last year, Nigeria converted $4.3 billion of its reserves from dollars to Chinese yuan.

All this is happening (in my opinion) because the USA is focused on only one thing: widening the gap between the rich and the rest, and between Wall Street and Main Street. Widening the gap means boosting Wall Street, and crushing average Americans. This crushing may be fun for the rich, but it can’t stop Russia, for example, from taking control of Syria and perhaps more nations in the near future. In simple terms, an Empire cannot continue if it is focused on crushing its own people.

As for the U.S. dollar “collapsing,” this is nonsense is perpetrated by gold traders and other charlatans who want you to buy shares in their “gold exchanges” that have nothing to do with gold.

The only way the U.S. dollar would ever “collapse” is if the U.S. government collapsed. The U.S. dollar is an expression of U.S. government sovereignty, and of the “full faith and credit” of the USA as a whole. The U.S. dollar will continue for as long as there is a USA.

As for the US economic system being “far superior to any other form of government around the world,” I don’t know what you mean. An economic system is one thing; a government is another.

Regarding the U.S. Constitution, with all due respect, this is irrelevant. The U.S. Constitution means whatever the rich and powerful want it to mean. Presidents routinely ignore the Constitution when they make war, and politicians routinely ignore it when they pass laws to widen the gap between the rich and the rest. The US Supreme Court routinely twists the Constitution, as when the Court approved the detention of Japanese-American citizens during WW II, or ruled in the “Citizens United” case (in 2010) that political bribery is “free speech.”

I think that average Americans would be better off if the USA went back to industrial capitalism, as opposed to today’s financial capitalism. But I don’t see that ever happening.

At the very minimum, we need the U.S. government to stop serving the rich by imposing gratuitous austerity on the non-rich.

LikeLike

I’m confused. You think the yuan will soon eclipse the dollar, yet you call out the gold bugs for saying the same thing. You also talk about Russia’s involvement in Syria as if these wars were good a good thing for Americans. Not only do we waste money and military resources, we waste lives for useless causes. Let the Russians keep fighting with the revels, the US shouldn’t even be there.

I disagree, the yuan will not overtake the dollar, at least not in our livetimes. The reason for this is pretty simple, the US values freedom, China doesnt.

You also talk about the US power being connected to manufacturing, yet you yourself agree that the US ceased being such decades ago. Yet, the dollar is still the most widely held and used currency in trade. It is clear the dollar will remain powerful, and the reason has zero to do with manufacturing and sovereignty – there are many others with these characteristics. The US dollar is at the top because of the freedom in the economic, financial and political system we have – we have transparency, they dont. If you don’t believe me, go ask the few financial journalists were forced to go on TV and blamed themselves for “causing market panic” in China. Wow, one single person was able to cause a market crash?

So yes, a constitution that gives you the right to live, freedom of speech and government prosecution is the reason our economic, financial and political systems are far superior to not only China, but also the rest of the world.

LikeLike

@ Suŕe: Thank you for your additional comments. May I please respond?

1. “You think the yuan will soon eclipse the dollar, yet you call out the gold bugs for saying the same thing.”

No, I said the only way the U.S. dollar would “collapse” is if the U.S. government collapsed. The global use or non-use of a currency is an unrelated topic.

2. “You also talk about Russia’s involvement in Syria as if these wars were good a good thing for Americans. Not only do we waste money and military resources, we waste lives for useless causes. Let the Russians keep fighting with the revels, the US shouldn’t even be there.”

Strange. On one hand you want the USA to cease its involvement in Syria. On the other hand, you lament that Russia has become involved, and has thereby ended the USA’s involvement in Syria. I am not supporting or opposing the USA’s involvement. Whether it is a “waste of money” is a matter of perspective, since the U.S. government can create infinite money out of thin air. The USA does not rely on loans or tax revenue to fund its wars.

3. “I disagree. The yuan will not overtake the dollar, at least not in our lifetimes. The reason for this is pretty simple. The US values freedom, China doesn’t.”

That is a totally subjective opinion that (with respect) belongs on some blog other than this one. I am interested in Monetary Sovereignty, which deals in facts.

4. “You also talk about the US power being connected to manufacturing, yet you yourself agree that the US ceased being such decades ago.”

No, I said the USA is not the manufacturing powerhouse it had been between 1945 and 1975. I said that one reason for this is that the U.S. government is more interested in propping up Wall Street than Main Street. It is more interested in paper wealth and the financial casino than in true industrial capitalism.

5. “Yet, the dollar is still the most widely held and used currency in trade. It is clear the dollar will remain powerful, and the reason has zero to do with manufacturing and sovereignty – there are many others with these characteristics.”

And this disagrees with what I said…how?

6. “The US dollar is at the top because of the freedom in the economic, financial and political system we have – we have transparency, they don’t. If you don’t believe me, go ask the few financial journalists were forced to go on TV and blamed themselves for “causing market panic” in China. Wow, one single person was able to cause a market crash?”

The first part of your assertion is, again, a purely subjective opinion. I am interested in facts. The second part is unintelligible (to me anyway).

By the way, regarding stock market fluctuations, Rodger has explained that stock markets are volatile because they are guessing games. Essentially people made wild bets and counter-bets based on their guesses as to (for example) whether the Fed would raise its benchmark interest rates, or not raise them.

https://mythfighter.com/2013/08/19/qe-how-1-trillion-0-and-why-the-stock-market-tanked/

7. “So yes, a constitution that gives you the right to live, freedom of speech and government prosecution is the reason our economic, financial and political systems are far superior to not only China, but also the rest of the world.”

No nation in history has ever fully abided by its own constitution. Perhaps you would understand this if you had been a U.S. citizen of Japanese descent who was forcibly put into a concentration camp during WW II. Or you had been a U.S. citizen of Hispanic descent who was forcibly packed into railway cars (along with two million other U.S. citizens) and deported to southern Mexico during the 1930s. Note that phrase: U.S. CITIZENS. Those are just two of many examples.

In reality the constitution of any nation means whatever the rich and powerful want it to mean.

Thank you again for your kind comments.

LikeLike

So inflation is no concern? If yes, why?

LikeLike

Inflation always is a “concern,” either too much or too little. That said, inflation should not be a fear, because it always is controllable, at least for the U.S.

To prevent inflation, the Fed raises interest rates, which strengthens the dollar (i.e. increases the demand for dollars).

Today, the concern is not too much inflation, but too little, which is one reason the Fed has been reluctant to raise rates.

LikeLike

Sorry I’m a bit confused, just trying to figure this out.

Sure, the Fed can raise interest rates to make the dollar stronger and control inflation – but judging from history, rates are raised post inflationary periods. Inflation occurs first and then the Fed raises rates.

But…. if there is a concern, wouldn’t that mean that this spending is at the expense of potential inflation (whether it materializes of not is another matter)?

And wouldn’t that mean that this spending carries potential risk (inflation / losses) like as any other form of investment?

LikeLike

“Inflation occurs first and then the Fed raises rates.”

What you’re saying is: The Fed has not been pro-active enough, and rather than preventing inflation, it has cured inflation.

Deficit spending is at the “expense” of potential inflation, just like breathing is at the “expense” of potential airborne disease.

The risk of an uncontrollable inflation from deficit spending is much lower than the risk of economic stagnation from not deficit spending.

We have a cure for inflation (which currently is quite low), but what is the cure for economic stagnation (which currently is a problem)?

I’m confused about why people would be more worried about what might be, than about what is.

LikeLike

Rodger said “Why not simply give the money (with caveats about how the money and resultant profits are used)?”

I would agree as long as the money is given to the PEOPLE and not to billionaires like Elon Musk.

For example, give every adult American a GREEN debit card worth $1000/year (or whatever). Similar to how SNAP cards can only be used to purchase food, GREEN cards could only be used to purchase green energy or green transportation.

As it is, only rich people can afford to purchase Tesla cars, so Tesla’s subsidies are effectively a transfer to the wealthy.

LikeLike

Dan, see Step #3 in the Ten Steps to Prosperity

LikeLike

Roger, in your ten steps you also mention that they’d be implemented gradually over time, not all at once. As they are gradually released and as the money supply grows, would it be better in the long run to

a) match price advancement with proportionate increases in economic bonus (step 3), or

b) to match them inversely with decreases in order to make everyone more painfully aware of the consequences of greed, i.e., unnecessary price advances.

On another note, yes, it’s true throughout recent history, the inventor has been the “goose that lays the golden egg” and then the military exploits it for their own concerns after which it’s handed over to the public for further exploitation, e.g., atomic energy (war) to private utility electricity (peacetime), but only AFTER government scientists show how it can be done.

Without that nasty, intrusive, interfering federal government, the private sector would be lost and on its knees begging for help more so than it is now in 2015! There really is no private sector; it’s all public in reality. The demarcation is only a legal one.

LikeLike

The Rubio record grows:

LikeLike

Hooray!

The U.S. government’s 2015 fiscal year ended on September 30. The Treasury Dept. says the federal deficit for FY 2015 was $439 billion, the lowest in seven years. This means the U.S. government created only 439 billion more dollars than the government destroyed via taxes.

Meanwhile the U.S. trade deficit for FY 2015 totaled $965 billion, according to the Trading Economics web site. This means that FY 2015 saw a net loss of $526 billion from the U.S. economy. (439 billion fiscal deficit minus 956 billion trade deficit.) For September 2015 alone, the Treasury recorded a budget surplus of $91 billion, meaning that 91 billion dollars were removed from the U.S. economy and destroyed.

Result: we remain locked in a severe recession. That’s what happens when $526 billion are sucked out of the U.S. economy.

Naturally the corporate media outlets call this a good thing, since recessions widen the gap between the rich and the rest. The outlets call a smaller deficit a “recovery,” when in fact a smaller deficit is economically devastating for average Americans.

On a related note, Rodger has often explained the meaninglessness of comparing the (fake) “national debt” to the US GDP. I say it is likewise meaningless to compare the federal deficit to the US GDP. Time magazine says the U.S. federal deficit for FY2015 fell to 2.5% of GDP. So what? What about the net loss of $526 billion from the overall U.S. economy?

The Congressional Budget Office is “non-partisan,” meaning that all of its 235 employees agree that average Americans need more poverty and austerity. The CBO boasts that the federal deficit will keep falling (which means the U.S. recession will keep worsening). The CBO demands that average Americans have radically increased austerity, because the (fake) “national debt” is “unsustainable.”

If the economic situation for average Americans was not so grim, the CBO’s lies would be hilarious.

http://time.com/money/4075678/federal-deficit-7-year-low/

LikeLike

Well said, Elizabeth.

LikeLike

THE FAKE “U.S. NATIONAL DEBT”

On Friday (October 30th) in Des Moines Iowa, Kentucky Sen. Rand Paul hosted a Halloween-themed fundraiser in which he wore a turtle-necked shirt emblazoned with the words “18 Trillion.”

“I’m the national debt,” Paul said. “That’s very scary.”

No Mr. Paul, what’s very scary is that millions of people believe your lies. You support the private debt that is killing us (for example, student loans), while you lament the so-called “national debt” that is trivial and irrelevant. You perpetrate this fraud in order to make us submit to more austerity, and thereby submit to a wider gap between us and the rich. You know that the well of money is inexhaustible, but you claim that the well has run dry, and it has a “debt crisis.” You do this to make us grovel at your feet for a few drops of money-water from the infinite supply.

Truly you have no shame, and therefore no honor.

As you know, Mr. Paul, the “national debt” is simply the amount of money that various parties have deposited in their Fed savings accounts by purchasing T-securities. It has nothing to do with the U.S. government’s ability to continue creating money out of thin air. Furthermore, most of that deposited money comes from the U.S. government itself. Therefore most of the so-called “national debt” is owed by the U.S. government to itself. Oh the crisis!

As Rodger Mitchell says, if our right hand borrows from your left hand, will your left hand have trouble giving it back?

Pictures of Ran Paul wearing that stupid shirt…

http://www.desmoinesregister.com/story/news/elections/presidential/caucus/2015/10/30/rand-pauls-halloween-costume-national-debt/74907274/

LikeLike

Must say that I find Ms. Harris’ comments to be exceptionally well thought through, on point, and altogether convincing! ………….

LikeLike

“So here’s the plan — no, not developed enough to be called a “plan” — call it a “concept.” Every quarter, the federal government should replace the trade deficit. It should send the amount of the trade deficit to the American consumers, dollar for dollar.”

“It could be in the form of mailed checks — something resembling the very first stimulus attempt in 2008. The result: Consumers would continue to have spending money, businesses would continue to thrive and hire employees, and at long last, Congress could stop blaming China for its own mistakes.”

I like your solution Roger 🙂 Some how we have to trade like all nations are interdependent. That all nations benefit from trade

“It’s also that its state-owned steel mills, which produce as much steel as the rest of the world combined, haven’t slowed down to match demand. Rather, China’s mills have stayed in high gear, which means the rest of the world has been flooded with cheap Chinese steel, with U.S. imports rising 68 percent last year alone.”https://www.washingtonpost.com/news/wonkblog/wp/2015/03/16/u-s-steel-plants-are-on-a-layoff-spree-heres-why/

LikeLike

You have to wonder how it’s possible to maintain such a huge conspiracy (suposedly the government does not borrow) under wraps. I’m sorry, I am not sure I will ever, ever, ever believe you…

http://www.marketwatch.com/story/treasury-raises-quarterly-borrowing-estimate-to-344-billion-2015-11-02?link=MW_home_latest_news

LikeLike

Do you understand the differences between Monetary Sovereignty vs. monetary non-sovereignty?

Which are you?

LikeLike

Bill Gates apparently agrees with you.

http://www.theatlantic.com/magazine/archive/2015/11/we-need-an-energy-miracle/407881/

LikeLike

Roger, Bill Gates agrees with you.

http://www.theatlantic.com/magazine/archive/2015/11/we-need-an-energy-miracle/407881/

LikeLike