Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Sen. Rand Paul, Kentucky Republican and 2016 presidential contender, said he could not support any bill that “continues to add to our nation’s mountain of debt.” (By Tom Howell Jr. – The Washington Times – Thursday, September 24, 2015)

Congress, the media and the economists have been telling you the same Big Lie since — well, forever. What the hell is the problem?

The Big Lie, simply stated is this: “The federal debt should be reduced. Whether its federal debt or personal debt, being in debt is bad.”

But why is federal debt bad?

Will the federal government default? Will the federal debt cause inflation? Will our children have to pay the federal debt?

No, no and no.

So, what exactly is the problem with the federal debt?

Government debt threatens to send U.S. economy into death spiral, CBO warns

Rising federal debt threatens to choke economic growth within a decade, beginning a death spiral that will sap revenue from government programs even as demands grow, forcing the government to borrow even more, Congress‘ budget watchdog said in a frightening report Tuesday.

Budget cuts or tax increases now would help avert that scary scenario, leaving the economy far stronger than it otherwise would be, the Congressional Budget Office said.

The next few years will show solid improvement in the budget as the effects of the stimulus wear off.

So let’s get this straight: Tax increases make the economy stronger by . . . by what? By removing dollars from the economy?

Are we supposed to believe that reducing the money supply increases GDP??

And that federal spending, which adds dollars to the economy, should be decreased?

What branch of economics claims that adding dollars to an economy, particularly at a time of extremely low inflation, depresses the economy?

And finally, do we need the effects of the stimulus, which by definition stimulated the economy — do we need those stimulative effects to wear off?

Earth to CBO, Earth to CBO. Come in please.

And then we come to the infamous “debt ceiling,” the law that says, “Beyond an arbitrary limit, the U.S. government should not pay for what it already has bought.”“

Right. Congress and the President first decide how much to spend and tax, and then the debt ceiling determines which debts they will pay, after all the spending and taxing.

Intelligent?

If that makes sense to you, feel free to join the CBO, drifting somewhere on a distant planet.

Returning to earth, here are the simple facts:

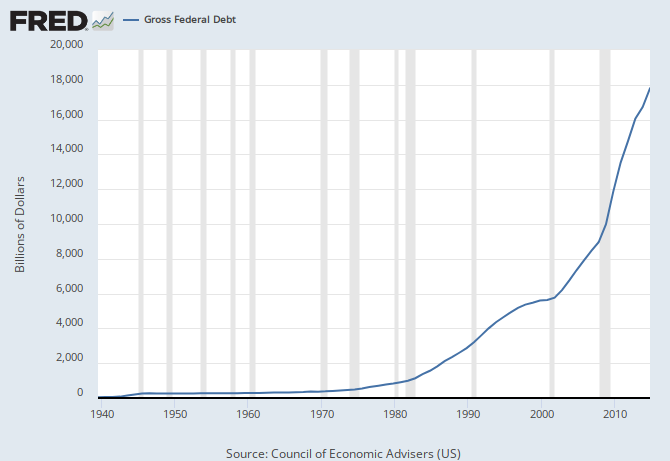

In 1939, the federal debt was $48 billion.

In 1972, the year the U.S. government became Monetarily Sovereign, the federal debt was $436 billion — a 9-fold increase in 33 years.

Last year, the federal debt was $18 trillion — a 41-fold increase in 43 years.

Yet here we are: Despite the CBO’s ludicrous claim about a “death spiral,” the federal government still has no difficulty paying its debts (phony “debt ceiling” notwithstanding).

And despite debt-nuts’ incessant warnings about hyper-inflation, our inflation rate is as low as it ever has been — so low as to concern the Fed.

And with today’s federal tax rates at relatively low levels, nobody’s children are paying for past federal debts.

So again, what the hell is the problem? Why do we see headlines like these?

–Highway trust fund runs out next summer

–Social Security disability payments will run out of money in 2016

–Medicare: Running out of time and money; The crisis is coming—with no easy fix in sight

–The United States Postal Service is in deep financial trouble

And why does the Big Lie continue to be told and believed, year after year:

FEDERAL DEBT, A TICKING TIME BOMB Sept 26, 1940, New York Times: Deficit Financing is Hit by Hanes: ” . . . unless an end is put to deficit financing,to profligate spending and to indifference as to the nature and extent of governmental borrowing, the nation will surely take the road to dictatorship

Our politicians, media and economists long have known that the public is economically ignorant, and will believe the same lies, even when the lies become laughably obvious.

The same warnings, since 1940 and earlier, about federal debt — yet the debt grows, and none of the warnings come true, the “time bomb” keeps ticking, and still the public believes.

Just like in the Peanuts comic strip, where Lucy repeatedly pulls the football away before Charlie Brown can kick it — and Charlie never catches on — the American public never catches on to the fact that the Monetarily Sovereign federal government cannot run short of its own sovereign dollars.

What is the purpose of the Big Lie? Very simple: Federal deficit spending benefits the poor and middle classes far more than the rich.

The rich run the government (via campaign contributions and promises of lucrative employment later), the media (via ownership) and the university economists (via university contributions).

The rich want the Gap between the rich and the rest to be widened, for without the Gap, no one would be rich, and the wider the Gap, the richer they are.

So now, as we enter the silly season of the federal debt ceiling debates, remember this: The federal debt ceiling is a Big Lie, and what the politicians, the media and the university economists tell you will be bullsh*t.

But our Charlie Brown public keeps getting fooled.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

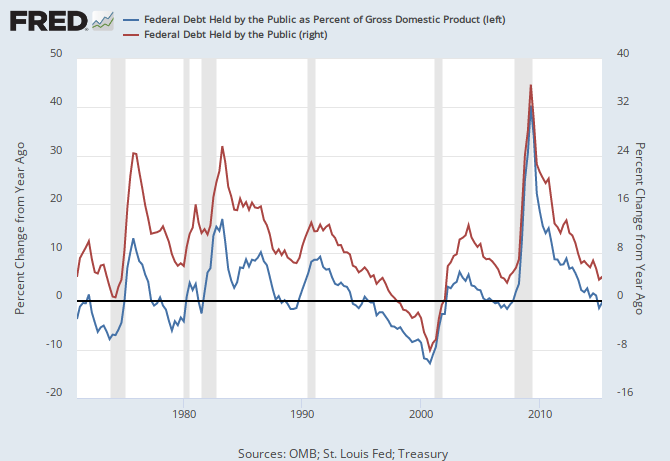

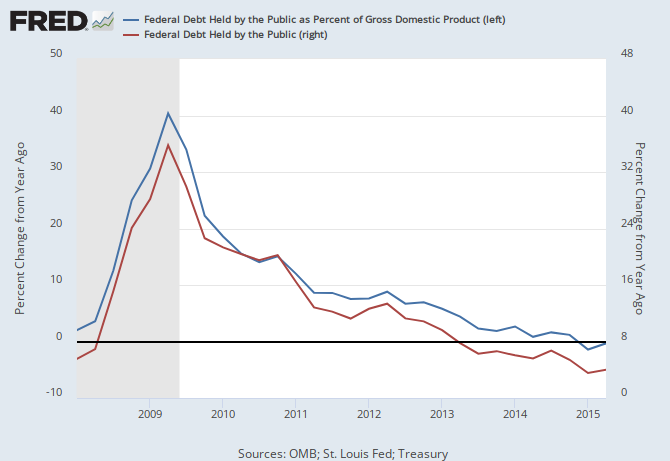

THE RECESSION CLOCK

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

This exactly what pope Francis said we should be afraid of. Simpletons….

I continued to be puzzled as to how counterfeiting helps us. If it does, than why is it illegal for the average Joe to do it.

You should also explain why the US issues treasury bonds. Fyi, when I deposit money in a savings account I’m lending the bank money…

I know you know better Rodger…

LikeLike

As I have noted before, the CBO bases its ridiculous “lower debt means higher growth” assumption entirely, repeat entirely, on the concept that lower public debt means less “crowding out” of private savings and investment – hence higher economic growth. Of course, in reality, the funds used to buy the Treasury securities (a private sector debit) are recycled back into the economy (a private sector credit) – thus there is no “crowding out” of private sector funds. And, the private sector now owns Treasury securities – overall then there is an increase in private savings – which is what the higher “debt” represents. I’ve tried explaining this to some selected CBO economists. No response, of course – the usual copout. All you can do is keep bugging people with the idea that someone someday will show some intellectual curiosity and integrity.

LikeLike

CharlesD

‘the funds used to buy the Treasury securities (a private sector debit) are recycled back into the economy (a private sector credit)’

could you explain this please?

LikeLike

RMM … our core problem can’t be solved by capitulating to the debate opponents on the terms of the argument

Please quit using the term “Federal Debt”

You don’t efficiently recruit people to be pragmatically agnostic by endlessly telling them that there is no Devil, no God, no angels … and that they aren’t going to hell.

That just reinforces the very concepts you’re trying to get them to oppose.

Ditto when introducing J&J Sixpack to fiat currency operations.

http://mikenormaneconomics.blogspot.com/2014/08/deficit-doves-crowded-out-by-semantic.html

LikeLike

Coolslim,

” the funds used to buy the Treasury securities (a private sector debit) are recycled back into the economy (a private sector credit)”. I’ll explain.

I could have been a bit clearer: ” the funds received from the sale of the Treasury securities are recycled back into the economy”. Specifically, these funds become a private sector bank deposit credit. If the recipient of these funds decides to save this payment, it obviously becomes private saving. If the recipient decides to spend this payment it becomes a business revenue. Since the business sector incurred no new costs (at the macro level) these addtional revenues become all profit. Profits are also private savings. Hence, the increase in overall private savings from the “deficit funded payment” is equal to the decrease in private non-Treasury savings used to buy the Treasury securities. Hence, overall, there is no change in non-Treasury private savings and thus no crowding out. And the private sector now owns the bonds – a net add to the financial assets of the private sector.

It may not be totally clear as why deficit funded spending becomes, dollar for dollar, a business profit In this regard, Kalecki’s profit equation defines the sources of profits – with government deficits being one term in the equation. The Levy Forecast.com has an excellent paper in this regard “Where profits come from”. Hope this was helpful. Thanks for the interest..

LikeLike

thanks CharlesD

LikeLike

We have the analogs of the sky is falling and Christ is Coming Again to “Look out! WE are going broke.” They may work fearfully over the short run, but NEVER happen (obviously) in the long term. Just goes to show how short sighted we are and actually willing to remain that way.

I’m of the opinion truth will out. If society can’t accept MS, then it’ll be forced down our throats via mounting pressure to fix everything that is breaking down in terms of infrastructure. Here in Iowa it’s being reported that the 70 year old water delivery system of Des Moines is busting and will continue to do so at high cost to taxpayers. Philadelphia is even worse; that poor town is in real trouble. We’re not even talking about roads, bridges, power grids, etc.

I can see the day of impending doom when some important titled person(s) will have to simply yield to MS with a statement such as ” For God’s sake wake up. We can’t go broke. We can produce all the credit we need without taking a dime from anyone.” That plus unprecedented economic pressure should get a constructive public conversation going.

CharlesD: “.. I’ve tried explaining this to some selected CBO economists….”

It’s been my experience that huge egos when faced with facts that prove them wrong, will not shake your hand and say Thanks. Instead they become overwhelmed by embarrassment and have no choice but to go silent or try a diversion. Remember the TV ad where the wife scolds the hubby for not being careful with money she found in his pants and the hubby says “Those are your pants” to which she looks left and right and silently walks away. It takes guts to admit “check mate.”

LikeLike

coolslim,

Your welcome. It occurred to me that Warren Mosler is much more succinct than I was in terms of explaining the myth of “crowding out”. He notes that a deficit payment (lower taxes or higher spending) increases bank deposits and bank reserves. Hence, Treasury bonds NEED to be sold to sop up these new reserves and avoid a “crowding in” effect, if you will.

LikeLike

Rodger,

When banks clear checks between private entities, the reserves just move around or are balanced out. But when the check involves the Treasury, what happens to bank reserves when:

a) someone other than the Fed buys a Treasury security and,

b) a regular check to the US Treasury (such as for taxes) clears?

In case “b”, I would think that clearing the check would just eliminate the reserves. It might bump dollars into the Treasury’s T & L accounts, but aren’t reserve amounts just reduced by the amount of the check and that is why taxes destroy dollars?

In case “a” my guess is that reserves remain in place and that security accounts at the Fed are pegged to reserves on a 1:1 basis and that is why treasury sales are monetarily neutral.

LikeLike

Are you talking about required reserves?

If you, as a bank customer, write a check payable to anyone, including the Treasury, the banks required reserve amount goes down. Required reserves are determined by deposits, and writing a check reduces that bank’s deposits.

Yes, if the check goes to a private person, that person’s bank’s required reserves go up. If the check is written to the Treasury, total required reserves go down.

Taxes destroy dollars because any dollars held by the Treasury are not part of the money supply.

The reason is that it is meaningless to determine how many dollars the Treasury has, since it creates dollars at will. The Treasury does not spend tax dollars, but rather creates dollars ad hoc, by spending.

LikeLike

Sorry Rodger for my confusion, and this may be more a question for Bill Black or someone of his banking ilk, but what I’m actually not clear on is actual reserve operations that involve the Treasury rather than reserve requirements. So when a check drawn on a bank and payable to the Treasury is cleared, are the paying bank’s reserves debited from that bank’s reserve account in the amount of the check and credited to a Treasury reserve account, or do those reserves just get debited from the bank’s reserve account into the thin air from whence they were originally created by the Fed? Now that I phrase it that way, the question really becomes “Does the Treasury have a reserve account with the Fed as do banks?” Wikipedia says “yes”, but it doesn’t make sense why it would since Treasury reserves seem meaningless. Apparently the Fed creates all reserves and the Fed taketh them away.

LikeLike

“The Treasury tax and loan account system was designed as a mechanism for minimizing the dislocations on bank reserves and the money market arising out of the sizable and irregular transfers between the Government and the public.”

Treasury tax and loan accounts and Federal Reserve open market operations

Click to access v3n2article7.pdf

TTL Note Accounts and the Money Supply Process

Click to access Accounts_Oct1979.pdf

Reply

LikeLike

The hilarious part of the first article is that the Treasury petitioned Congress to allow them to invest its operating cash for a greater return.

The Treasury wants a greater return??? Yikes!!

Completely senseless, which indicates even the Treasury doesn’t understand what it is doing.

LikeLike

Jim, as you note, it makes no sense for the Treasury to have a reserve account with the Fed. It also makes no sense for the Treasury to borrow or for there to be a “debt limit.”

I’m not knowledgeable about the Byzantine accounting rules at the Fed, and you probably would do better asking Warren Mosler than anyone else I know.

That said, I’m curious about why you care. The Fed and the Treasury can create infinite dollars at the touch of a computer key, and how they account for those dollars is meaningless from an economic standpoint.

They could note it on rolls of toilet paper, flush it once a day, and re-create it the next day, and still the facts wouldn’t change. Federal spending creates dollars; federal taxing destroys dollars. The difference between the two (the deficit) is a measure of the dollars created.

LikeLike

Thanks Rodger. I understand entirely and often use that phrase “federal spending creates dollars and federal taxing destroys dollars” myself in disputing my less informed neoliberal friends and my tight-fisted “the taxpayer’s friend” Republican congressman Walter Jones. I just feel the need to be able to explain to them sometimes exactly how the accounting works to help prove my point. Most people instinctively refuse to believe that federal taxes “destroy” money. I don’t know how to make them see it other than by proving it via the accounting. That’s why, because spending by the Treasury initiates new reserve credits from the Fed, I think payments to the Treasury must debit back those reserves, thus shrinking reserve balances and the corresponding monetary base (MB), thereby destroying dollars. That sure seems like proof enough to me. Reserves seem to be a critical component of the monetary/banking system that I want to understand more fully. Thanks again.

LikeLike

Jim, if you think your friends will understand that explanation better, go for it. Whatever works for you.

I just say, “When the federal government buys stuff from the economy, it pays by sending dollars into the economy. When it taxes, it takes dollars out of the economy.” (And that doesn’t work, either.)

LikeLike