Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Bernie Sanders has advocated a form of Medicare for All. It would be a single payer (i.e. federal government) program, that would protect everyone, and with far fewer loopholes than current Medicare has. You should review the brief description here.

Hillary Clinton’s thinking hasn’t gone as far as Bernie’s, but she has come out with a prescription drug “plan” — well, not so much a plan as an amalgam of talking points.

Here are some comments about a summary published by Bloomberg Politics.

Hillary Clinton Drug Plan Would Cap Consumer Costs, Mandate R&D Spending

A day after a tweet about high drug costs from Hillary Clinton sent pharmaceutical and biotechnology stocks plummeting, the Democratic presidential candidate said that if elected, she’d implement programs to force the industry to concede tens of billions of dollars a year in tax breaks, lower prices and increase research spending.

There is nothing like attacking the evil pharmaceutical industry to get the hoi polloi stomping and cheering.

But really, is impoverishing the guys who create our life-saving medicines the best way to create more affordable, life-saving medicines?

“It is time to deal with skyrocketing out-of-pocket costs and runaway prescription drug prices,” Clinton said. Nobody in America “should have to choose between buying the medicine they need and paying their rent.”

Absolutely true. But which is more likely to increase medical research and development: Cutting pharmaceutical industry profits or federal stimulus spending to increase industry profits?

One proposal would limit how much patients could have to spend out of pocket for drugs to $250 a month, or $3,000 a year. It’s an idea that builds on policy in the Affordable Care Act limiting total out-of-pocket medical spending to $6,600 a year for an individual, and $13,200 for a family.

The idea could squeeze health insurers, as well, which provide drug coverage for patients and typically cover a portion of the costs.

Why even charge people $3,000 a year? Under Medicare for All, the federal government would pay for everything.

Another item would make drugmakers spend a minimum amount on research and development, just as Obamacare forces insurers to spend a minimum percentage of their revenue on medical care.

Clinton would also bar pharmaceutical companies from deducting drug ad spending as a business expense, for tax purposes, which she said in a statement announcing the policies would save the government “billions of dollars over the next decade.”

Visualize the complexity of rules necessary to force drugmakers to “spend a minimum amount on research and development.

–A minimum amount of what? Of profits? How are profits defined? Of sales? Of foreign sales?

–What exactly is “research and development”? Which of the myriad corporate expenses, is considered research and development? Whose salary is included?

Yes, just what we need: More complexity (leading to loopholes) in our ridiculous tax code, and Hillary Clinton micromanaging the pharmaceutical industry.

And then there’s the economics ignorance reveal: “Save the government billions of dollars,” while costing a segment of the economy billions of dollars.

Apparently Mrs. Clinton believes our “poor” federal government can run short of dollars, while the pharmaceutical part of our economy has too many dollars, and that federal taxes stimulate the economy.

Clinton criticized Turing Pharmaceuticals AG, which bought a drug in August and soon after raised its price 50-fold. “Price gouging like this in the specialty drug market is outrageous,” Clinton said.

Alex Arfaei, an analyst with BMO Capital Markets, said Monday he doubts Clinton’s proposal will lead to meaningful price controls. “Pharmaceutical companies are easy targets in presidential politics, and extreme examples provide great talking points.”

If Turing is making an exceptionally high profit on a drug, what is the worst — the very worst — that could happen under Medicare for All?

Either the federal government will pay the price, which will add stimulus dollars to the economy. Or the government will set the price it is willing to pay, and Turing will accede, or be out of the program (similar to current price setting of hospital and doctor bills).

The Democratic front-runner’s ideas do have the power to rattle markets, though, as Monday showed. In the hours after she criticized Turing and said she’d soon issue the proposals, the Nasdaq Biotechnology Index lost more than $40 billion in market value as investors sold drug stocks. It was one of the worst days for the index in about a month.

The private sector lost $40 billion, because candidate Clinton merely proposed a bad plan. Now imagine the damage with President Clintion wielding the power to implement a bad plan.

Other proposals in Clinton’s package have been put forth by Democrats before, and gone nowhere. One of the biggest would give low-income people enrolled in Medicare, the U.S. health program for the elderly and disabled, drug coverage under Medicaid, which covers the poor.

Known as “dual eligibles,” these poor, elderly people don’t have access to Medicaid’s highly discounted drug prices. Switching them to Medicaid drug coverage would save taxpayers $103 billion over the next decade, according to the Congressional Budget Office.

The “dual eligibles” idea is a step toward Medicare for all. Why have two programs — Medicare and Medicaid — when one program would do the job better and more efficiently.

Of course, none of this would “save taxpayers” anything, since federal taxes do not pay for federal spending.

Clinton would also have Medicare negotiate prices, using the government’s purchasing power to get additional discounts. Such a proposal could save billions of dollars, though in the past has struggled to gain traction in Congress because of heavy opposition from Republicans and drug companies.

Whose dollars would be saved? Certainly not the public’s. On the contrary, the economy would lose those billions of dollars. And the federal government itself doesn’t need to “save dollars.” It has the unlimited ability to create dollars, at will.

The “saving” of federal dollars is known as “austerity,” which always depresses an economy.

Other proposals target expensive biologic and specialty drugs. One would lower the sales exclusivity for biotechnology drugs to seven years from 12.

Another would have the government study the effectiveness of drugs, in an attempt to pressure pharmaceutical manufacturers to charge prices based on the value the treatments provide.

In short, virtually all of Mrs. Clinton’s proposals punish private industry, i.e. the economy, and reduce the ability and incentive to create new drugs, while doing nothing to help consumers.

In Clinton-world, the federal government will pull more money out of the economy, via increased taxes and/or decreased spending: A sure prescription for recessions and depressions.

Back to the drawing board, Hillary.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually Click here

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

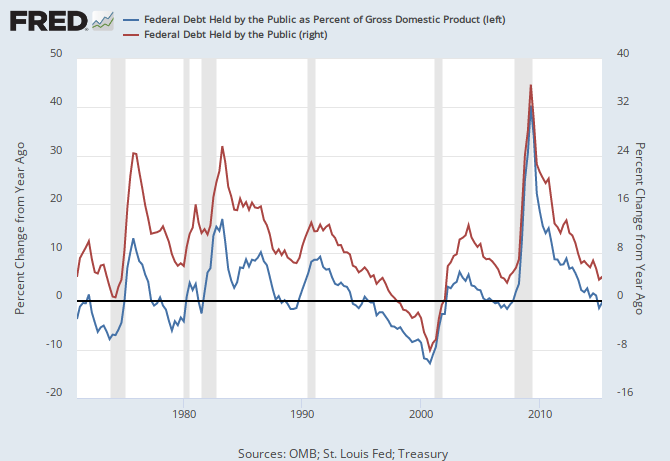

Recessions come after the blue line drops below zero.

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

From: Thornton Parker

To: Rodger Malcolm Mitchell

Sent: Tuesday, September 22, 2015 11:15 AM

Subject: Re: [New post] –Hillary Clinton’s Drug Plan for recession

Hi Rodger,

I’m feeling a bit bruised this morning. Our small company biotech ETFs lost money on paper and we have one of VW’s doctored diesels.

But the issues you raise are complex and I have mixed feelings. There is no question that medical research, including the FDA approval process, is risky and costly. As long as the private sector is expected to pay for this work, there must be substantial rewards. But companies often project the market for their anticipated products on the basis hugely unreasonable prices that could easily absorb most of the patients’ incomes. I invested in this industry because it must be a significant part of the country’s future development. But I am not interested in returns that can drive patients into poverty, and I don’t think the government should encourage this form of scalping.

We are dealing here with the drive to improve human lives and at the same time, companies’ drives to maximize monopolists’ profits or rents. I agree with your point that the government can create dollars to pay these “costs” but in doing so, it can inflate prices in this particular market. We have seen this effect in universities, where the availability of student loans has encouraged them to inflate the cost of college in many ways.

I guess my point is that I am not comfortable that MS/MMT yet provides a way to get things done without risks of major distortions that can weaken the economy and even society. You are right that a complex set of pricing regulations could strangle this industry. I wonder if the type of contracting that the Navy used during WWII to build bases and airfields on captured islands in the Pacific might be useful. The contracts were for costs plus a fixed fee, with an eventual redetermination of both the costs and fee. Guidelines were established for the redetermination process. The contractors trusted the Navy to treat them fairly, and to the best of my knowledge, they were.

Keep up the good work.

Tip

LikeLike

Let’s say you are correct that the government can create dollars to pay these “costs” but in doing so, it can inflate prices.

Why is that a problem, if the government is paying?

The problem with cost-plus, is that research is different from building. In research, no one can estimate the cost, so the “plus” either might be adequate or inadequate.

For instance, would you invest $10 to earn $50? Probably yes. But would you invest $10 million to earn $50? Probably no.

The truth about pharmaceutical industry is: Most drugs lose money, when all expenses are considered, even the ones that make it to market. But no one complains about those prices being too low to pay for the research.

The industry is supported by a few big winners, and that is where the price complaints come in.

LikeLike

So it’s ok for the pharmaceutical industry to have a monopoly but not others. Aren’t monopolies blood suckin devils?

LikeLike

I think it would be nice if you could explain how all this money creation will not result in hyperinflation.

LikeLike

Liesberal,

In all our history, the U.S. never has had a hyperinflation. To create a hyperinflation via money creation, would require orders of magnitude more money creation than we ever have had.

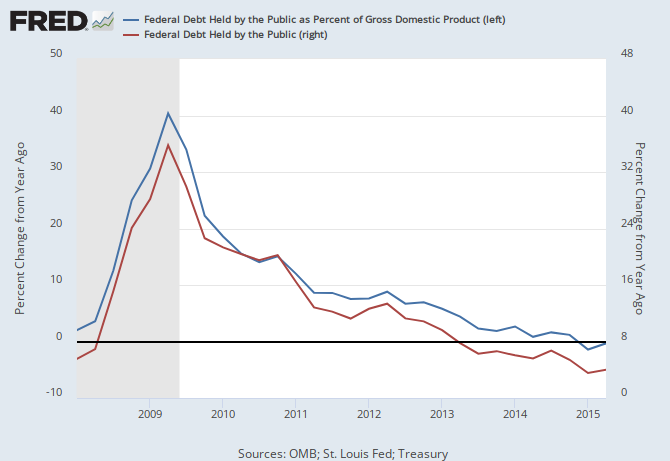

For example, here is a graph showing the massive amount of money creation we have had in just the past 45 years.

And today, the Fed is trying to fight not hyperinflation nor even inflation, but deflation.

LikeLike