Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

The Republicans

The Republicans endlessly wish to privatize Social Security, for one reason and one reason only.

No, it’s not because private investments yield more than Social Security does. That’s the excuse given. The problem with that excuse is it merely restates a simple fact: With greater reward comes greater risk.

If you invest in stocks, you most likely will come out ahead in the long run — the long, long run. Or you could lose. In January 2008, the S&P stock average was above $1,400. By April of 2009, just 16 months later, it had fallen below $800, a drop of 40%.

Is that the kind of risk you think is appropriate for a retirement fund?

Further, if the Republicans were to privatize Social Security, the massive flow of dollars — billions upon billions of dollars — would cause a stock bubble the likes of which we never have experienced, to be followed by a bubble burst of epic proportions.

The Republicans know all this. So why do they keep suggesting privatization? To reward their dear friends, the rich bankers and investment brokers. Imagine the commissions!

The brokers salivate at the thought, and when they finish salivating, they give big campaign contributions.

The Democrats

The Democrats also understand the fallacy of privatization, so they offer other plans, not as ridiculous as the Republicans’ plan, but bad nevertheless.

O’Malley’s plan to expand Social Security draws fire from a Wall Street front

Former Maryland Gov. Martin O’Malley, one of the more overlooked candidates for the Democratic presidential nomination, emerged Friday with an encouraging endorsement of expanding Social Security to make it even more relevant to the lives of working Americans than it is today.

“The economic pressures on millions of families — from stagnant wages and high housing costs, to a lack of affordable childcare and skyrocketing college tuition — have resulted in meager, if any, retirement savings for tomorrow’s retirees.”

He’s right about that, and right that Social Security is the one pillar of retirement security that has remained strong, while employer pensions and retirees’ personal nest eggs wither.

He calls for expanding benefits and requiring wealthier Americans to shoulder their fair share of the program’s cost.

Expanding benefits is good, even necessary if SS is to have much meaning. But no one, neither the rich, nor the poor, nor the benefit recipients, needs to “shoulder any share of SS costs.

People can run short of dollars. The federal government cannot. It is Monetarily Sovereign. It creates its sovereign currency, the dollar, at will.

So why ask people to shoulder the burden, when paying for SS would be no burden at all for the federal government?

O’Malley joins Sen. Bernie Sanders (I-Vt.), and Sen. Elizabeth Warren (D-Mass.), who also are pushing to expand the program.

O’Malley’s move may increase pressure on Hillary Rodham Clinton to endorse Social Security expansion. She’s been silent on the issue.

O’Malley would impose the payroll tax on all earned income over $250,000. Because the higher figure wouldn’t be indexed to inflation, that window would narrow over time.

Sanders would impose the tax on all income, including unearned income such as capital gains, over $250,000.

Aside from guaranteeing massive pushback from those who would have to pay the new tax (i.e. those who are the big contributors to politicians), these plans are based on, and would fortify, the myth that taxes are needed to pay for Social Security.

Rather than simply telling the truth, that the federal government can spend whatever it wishes to spend, on anything it wishes to buy, the Democrats follow the same fact- twisted notion as the Republicans.

Both parties agree that SS payments are too low, and both pretend that the problem is a lack of income. The only difference is that the Republicans want stock market investors to pay for that income, and the Democrats want the people to pay it.

In short, the people pay everything and the government, which can afford anything, pays nothing. That’s every politicians’ plan.

Remember, neither the people at large, nor the people who invest in stocks, actually create any dollars.

Rising stock prices don’t create dollars. In its essence, the stock market is a gigantic Ponzi scheme, in which the same dollars simply move from hand to hand. The same is true of FICA, which also creates no dollars, but rather takes dollars from one hand, while giving dollars to another hand.

The only time dollars are created is via federal deficit spending, in which the government creates more dollars than are destroyed via taxing.

More than half of all married couples in retirement and about three-quarters of singles get 50% of their income or more from Social Security. For a fifth of married seniors and half of the unmarried, the program accounts for 90% of income.

It is sad for our wealthy nation, when half to three-quarters of retired people must credit 50% of their survival to the pittance provided by SS.

O’Malley explicitly states that he wants to give minimum-wage and lower-income workers an especially enhanced benefit and raise the special minimum Social Security benefit to 125% of the federal poverty level.

That benefit, which applies to workers with long histories of very low wages, is currently $804 a month, which is about 82% of the poverty level; O’Malley would raise it to about $1,226 a month.

Ten years ago, we recommended eliminating FICA and exactly six years ago, we published Ten Reasons to Eliminate FICA

The 10 Reasons remain relevant today, but there is an eleventh reason: The existence of FICA lends false credibility to the Big Lie — the lie that federal spending requires funding from federal taxes.

It is the Big Lie that punishes the poor and widens the Gap between the rich and the rest.

At long last, will the Democrats please stop supporting the Big Lie?

Lord, save us from our friends.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

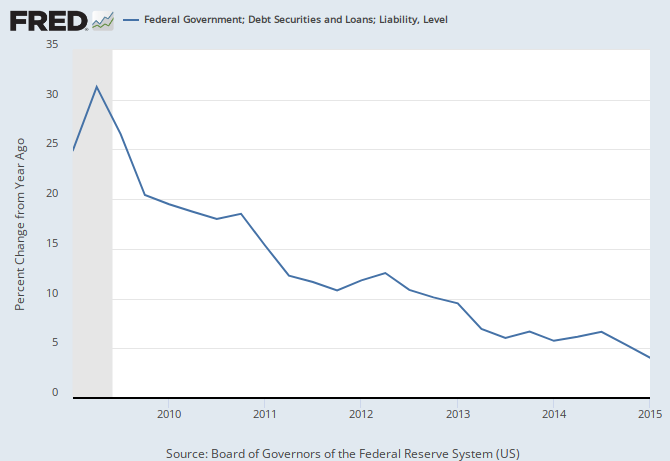

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Disappointed with Sanders. But the more articles i read the less hope i see for anyone actually enacting policy changes based on MS. Everyone acknowledges MS and they even agree that federal spending is fine but they also say that without the illusion of the big lie we will end up like all the other super inflated economies of history

LikeLike

Agree with your main point, Rodger.

But I have to pick knits with this: “neither the people at large, nor the people who invest in stocks, actually create any dollars.”

They do create dollars when they buy stocks with borrowed money.

And this: “the only time dollars are created is via federal deficit spending.” Dollars are created out of thin air every time a bank makes a loan. Or every time a non-bank makes a loan.

LikeLike

Dan, you are correct that it’s borrowing (not private purchasing) that creates dollars.

When I buy stocks I create no dollars. I pay cash. But if I were to borrow to buy stocks (or for any other reason) I help create dollars.

And you are correct that borrowing actually is the largest creator of dollars, far larger even than federal deficit spending. I was trying to draw a contrast between FICA and money creation.

A small note: Federal deficit spending creates “permanent” dollars while borrowing creates “temporary” dollars. (The loans must be paid back.)

LikeLike

Can’t banks just lend/borrow from each other to avoid bankrupcy? I don’t agree that banks create money that way. It’s silly…

LikeLike

OMG!

LikeLike

Can you elaborate??

If banks can simply create money – than why don’t they create money to increase profits. revenues, to avoid bankruptcy, etc? But they don’t and they won’t.. The argument doesn’t pass the smoke test.

Please elighten us and explain how it is that banks create “money”.

LikeLike

When you borrow from a bank, the bank increases the balance in your checking account. Some people believe the limit is a fraction of bank reserves (fractional reserve banking), but in fact, the limit is a fraction of bank capital.

See: Because bank deposits are usually considered money in their own right, and because banks hold reserves that are less than their deposit liabilities, fractional-reserve banking permits the money supply to grow beyond the amount of the underlying reserves of base money originally created by the central bank.

Exactly what are you smoking in your “smoke test”?

LikeLike

I’m not referring to the limits of the system – I’m referring to the process of creating “money” as you and Dan put it.

What you are saying is not a lie – yes – the bank does indead increase the balance on my account. But what you are missing to explain is that before they increase (credit) my account, they must first decrease (debit) their accounts.

By saying that the bank increases my account, you are making it seem as though banks have the power to simply create money out of thin air, without a proof being in place. Isn’t that the same reason we have the FDIC, OCC, The Fed and the Treasury – to audit banks?

Yes, the money supply does indead grow under a fractional reserve system, but it’s not like you explain it here. So again, how do banks create money?

LikeLike

Actually, the explanation of how money is created is on the same link you provided. Look under “Example of deposit multiplication”. LOL…

Money is created when banks lend out 80-90% of DEPOSITS and keep the fraction. The next bank does the same, and so on. Thanks for enlightening me.

The explanation on that link is complete the opposite of what you are explaining here.

LikeLike

You are usually in error, but never in doubt

Banks do not lend deposits. Their LIMIT to lending is a fraction of deposits. See if you can visualize the difference.

The deposits remain in the depositors’ accounts. When a bank lends you dollars, it increases the balance in your account, but it does not decrease the balance in any other depositor’s account.

That is how banks create dollars, and yes, it is out of thin air.

How do you think dollars are created?

LikeLike

You posted a very useful wiki link which explains how money is created – read it. See table I pointed out.

Since you believe banks create money out of thin air by crediting accounts without first debiting their own accounts – than please explain how it’s possible for any bank to go bankrupt.

In the scenario you just posted there is a proof break (sending instruction to credit an account without first debiting internal account) – and banks are audited by government agencies regularly.

So back to square one – what would stop, say, Bank of America from continuously crediting their accounts at JP Morgan Chase for instance?

LikeLike

Sorry to have to keep repeating this very famous quote from Ben Bernanke to Scott Pelley of CBS news several years ago, “As long as we can find enough electrons we can find the money we need.” And from Alan Greenspan during a round table discussion on Sunday Meet The Press also several years ago,

“The United States cannot go broke!”

I almost feel sorry for you, Roger. If those two can’t make a dent in the way we think about the budget then…wtf.

LikeLike

Hey, consider reader Bum, who combines zero knowledge, with endless questions and then disputes the answers.

He (she) is a perfect example of why the population remains ignorant of economics. They know what they know, and by heaven, no one can teach them anything.

LikeLike

I have thought about what the benefit would be if the wealthy were asked to pay higher taxes to pay for increased SS benefits, as opposed to higher Federal deficits? The extra money the wealthy would no longer have, could not be spent, which would be deflationary. But that money would not have been spent on virtually any kind of consumer staple. So there would likely be nothing favorable about taxing the wealthy.

LikeLike

Ian,

Your reasoning is correct, but there is another factor.

The very existence of a too-wide Gap between the rich and the rest is a serious, economic problem. The Gap gives the rich too much power, and enslaves the rest.

So, while you’re correct that taxing the rich does not grow the economy, it narrows the Gap, which is of great importance

By the way, since federal taxes do not fund federal spending, taxing the rich would not pay for increased SS benefits. There is no economic reason to avoid federal deficits, since deficits grow the economy by adding dollars to the economy.

LikeLike

A reader (?) repeatedly asks the same question, in different forms. The latest is: “What would stop, say, Bank of America from continuously crediting their accounts at JP Morgan Chase for instance?”

This reader (?) has refused to understand the explanation, but perhaps other readers will find it helpful.

A bank credits the accounts of borrowers. So, if Bank of America borrowed from JP Morgan Chase, it would be JPMC (not BOA) that would credit BOA’s accounts.

As the lender JPMC, has limits to its loans to BOA:

1. BOA’s credit rating: If, in JPMC’s opinion, BOA would have difficulty paying back its loan, JPMC will stop lending — as with any loan.

2. JPMC’s capital: JPMC legally may lend up to a percentage of its capital. and its reserves. However, since reserves are freely available from the federal government, the real limit is JPMC’s capital.

The reader (?) who asked the question, insists that banks cannot create dollars, even after seeing the link attached to this paragraph:

The money supply grows because:

1. Reserves are deposits

2.Deposits are money

3. Banks lend by increasing deposits in borrowers’ accounts, while not decreasing deposits in other depostors’ accounts.

That is, if you have $1,000 in your savings account, your bank can lend $900 against that deposit, after which you still will have $1,000 in your account, while the borrower will have $900.

The total money supply will have increased by $900.

Not sure if I have dumbed this down sufficiently for the reader (?) who repeatedly asks the same question, but it’s the best I can do.

LikeLike

This is exactly the opposite of what the wiki link says and you are still not answering the question. Perhaps it’s not the answer you want to hear?

I know that fractional reserve does allow the money supply to grow – I stated that in my previous post. What I am trying to clarify is the process by which the money supply grows – and what you are explaining here is completely wrong.

Banks lend every single penny deposited into the their accounts – they DO NOT lend against deposits. If banks lent against deposits while leaving deposits untouched, then that would imply that they are not debiting their accounts first (decreasing the money on their books), before crediting your account at another institution (increasing on the borrower side).

Banks fund your account on an adhoc basis, meaning – the money in your savings and checking is really not there (it’s been lent) – they only fund it when you show up to request the money. Otherwise the money is floating around somewhere.

Back to square one. If banks could simply credit accounts without debiting their internal accounts first (no controls), then what would stop the Bank of America from setting Bank A from which they could “borrow” and can “lend” to. Why would banks even care about ratings if they could simply create the money by lending. Perhaps you can dumb it down just a little more.

LikeLike

If you claim to ” know that fractional reserve does allow the money supply to grow,” describe what you believe the process to be.

Also, are you saying there is no money in your checking account, because your bank has lent it?

LikeLike

There is no money in my accounts and there is no money in your accounts either. It’s common knowledge (I bet you know) that no bank on the planet can honor all their deposits, ever. That should clearly tell you that savings have zero funds in them. Additionally, the Greenspan fed made regulatory changes allowing banks to sweep checking accounts in the 90s. So there is no money in checking accounts either – banks sweep those accounts daily. Banks forecast their withdraw requirements – the rest is invested – it’s how banks make money!

The process by which money is created is outlined in the wiki. If I deposit $100 dollars at Bank of America, BoA will keep $10 and lend $90. The receiving bank, say JPMC, will keep $10 and lend $70, and so on. As you can see – I only deposited $100 which show as a balance on my account – but there are also $90 showing in JPMC and $70 showing in another bank. Stopping there, there is $260 created out of $100.

The difference between this and what you outline is that banks first have to debit internal accounts. Your savings account is debit immediately after you make the deposit and the funds go into a pool account from which the bank will make transfers. The bank will then debit this account and transfer funds to the other banks. In the scenario I just outlined, there is no proof breaks (banks are debiting before crediting another account), but money is created anyway. It’s just not a free for all type of thing like you believe.

LikeLike

Yikes! Aren’t you the guy who said banks can’t create money by lending? Then you said, ” . . . there is $260 created out of $100.”

Yep, that’s how banks create money.

As for “no money in your accounts,” the money in your checking account is known as “M1.” The money in your savings and checking accounts is lumped together as “M2.”

M1, M2, M3, L are shorthand measures of money.

The bank does not debit your account when it makes a loan.

The loan actually goes on the books as an asset, while the accounts are liabilities.

LikeLike

Of course loans are assets while accounts are liabilities – that’s completely in synch with my previous statement. Accounts are liabilities because the bank owes you those funds, while loans are assets as these are receivables to the banks.

I also know that savings and checking accounts are money measures – that doesn’t change anything in my statement. Savings account lock you into an agreement for a reason – the bank borrows from you at a cheap rate of almost 0% and relends those funds for 3%+ for a profit. The money in your savings accounts is not there – it’s somewhere else.

LikeLike

Wrong as always. The money in your savings account is right there in your savings account, listed on the bank’s books and in your passbook and in M2.

Not one thing you have said comports with reality. You keep arguing and then, when shown to be wrong, you say, “That’s what I said.”

Your comments have become so tedious, I won’t be publishing them for a while. I need the vacation.

LikeLike