Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

I admit my mistakes, and back in May of 2012 I made a doozy, when I wrote the post: “Paul Krugman may be starting to get it.”

You can read that post to see why he had me fooled.

Well Krugman, the winner of, not the Nobel Prize, but rather the “Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel” (commonly known as the “Bank of Sweden Prize”), still is fooling people.

Reader “Zen” commented: It looks like Paul Krugman may just be starting to get the MS/MMT idea. “Debt Is Good”

Unfortunately, Krugman has been “just starting,” and “just starting” and “just starting” for all these years, but like the guy who promises to quit being an alcoholic tomorrow, Krugman never seems to get there.

Here are some excerpts from the article:

Rand Paul decried the irresponsibility of American fiscal policy, declaring, “The last time the United States was debt free was 1835.”

Wags quickly noted that the U.S. economy has, on the whole, done pretty well these past 180 years, suggesting that having the government owe the private sector money might not be all that bad a thing.

Actually, having the federal government pay (not just owe) the private sector is a very good thing. Adding dollars to the private sector stimulates economic growth, which is why every recession is cured by increased federal deficit spending.

Can government debt actually be a good thing?

Many economists argue that the economy needs a sufficient amount of public debt out there to function well. And how much is sufficient? Maybe more than we currently have.

That is, there’s a reasonable argument to be made that part of what ails the world economy right now is that governments aren’t deep enough in debt.

The power of the deficit scolds was always a triumph of ideology over evidence, and a growing number of genuinely serious people — most recently Narayana Kocherlakota, the departing president of the Minneapolis Fed — are making the case that we need more, not less, government debt.

Now at this point, you, like reader Zen, might think, “At long last, this guy is beginning to understand a fundamental point in economics: A growing economy requires a growing supply of money.”

After all, the most common measure of economic growth is Gross Domestic Product (GDP), and the formula for GDP is:

GDP = Federal Spending + Non-federal Spending + Net Exports.

All three — Federal Spending, Non-federal Spending and Net Exports — are money measures. When they increase the money supply increases, and when they decrease, the money supply decreases.

That’s why recessions are cured by increased federal deficit spending.

But just when you think Krugman gets it, he writes:

Issuing debt is a way to pay for useful things, and we should do more of that when the price is right.

The United States suffers from obvious deficiencies in roads, rails, water systems and more; meanwhile, the federal government can borrow at historically low interest rates.

So this is a very good time to be borrowing and investing in the future, and a very bad time for what has actually happened: an unprecedented decline in public construction spending adjusted for population growth and inflation.

As grandma used to say, “Oy vey.” The man simply does not understand the differences between the federal government’s finances and private finances.

First, issuing debt does not pay for anything. The federal government, being Monetarily Sovereign, does not need to borrow its own sovereign currency — the currency it created out of thin air more than 230 year ago, and continues to create out of thin air, today.

The federal government creates dollars, ad hoc, by paying bills. It does not need to borrow the dollars it previously created, from anyone.

Second, the price of debt, (i.e. the interest paid on T-bonds) has absolutely, positively nothing to do with the federal government’s ability to pay for “roads, rails, water systems and more.” Zero. Zilch. Nada.

Even were interest rates to rise from their current near-zero to 20% or more, the federal government could continue spending as always.

Third, when Krugman says, “This is a very good time to be borrowing and investing in the future,” perhaps he is talking about you and me and private industry, but he sure as heck could not be talking about the federal government.

For the federal government, NO time either is a good or bad time to be borrowing, and EVERY time is a good time to invest in the future.

O.K., so Krugman remains clueless about federal financing, but why then does the federal government borrow (by selling T-securities)? Amazingly, Krugman supplies an answer:

According to M.I.T.’s Ricardo Caballero and others, is that the debt of stable, reliable governments provides “safe assets” that help investors manage risks, make transactions easier and avoid a destructive scramble for cash.

In this, Krugman (or more accurately, Ricardo Caballero) is correct.

That is one of the two reasons the government “borrows,” the other being that T-securities help the Fed control interest rates, which is how the Fed controls inflation.

Those are the two reasons. Remember, unlike you and me and your state and city, the federal government does not “borrow” to obtain dollars. The federal government creates dollars at will.

So Krugman was right about one function of T-securities (misnamed “borrowing”), but then he goes on to be completely at sea about the function of interest rates).

When interest rates on government debt are very low even when the economy is strong, there’s not much room to cut them when the economy is weak, making it much harder to fight recessions.

Here, he parrots the widely believed myth about low rates being stimulative and high rates being recessive (which is why the stock market tanks when the Fed says it will raise rates).

But it is a myth, and you can see why at: The low interest rate/GDP growth fallacy.

And then, after all the misstatements, misunderstandings and misinformation, Krugman finishes with something that actually is true — sort of:

In other words, the great debt panic that warped the U.S. political scene from 2010 to 2012, and still dominates economic discussion in Britain and the eurozone, was even more wrongheaded than those of us in the anti-austerity camp realized.

Not only were governments that listened to the fiscal scolds kicking the economy when it was down, prolonging the slump; not only were they slashing public investment at the very moment bond investors were practically pleading with them to spend more; they may have been setting us up for future crises.

It’s true, but only sort of, because the great debt panic didn’t end in 2012. It continues today, which is why President Obama brags about how he has reduced deficits (i.e. reduced economic growth).

But Krugman is correct about cutting deficits being wrongheaded and setting us up for future crises.

In short, the guy mixes right with wrong, so you can’t tell whether his bread is made with grain or sand.

Every time I’ve hoped he finally knows what he’s talking about, he’s dashed my hopes with large dollops of ignorance.

At long last I’m convinced: I’ve been way, way wrong about Paul Krugman.

So, reader Zen, I’m sorry to tell you. Krugman is hopeless and I’ve lost hope.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

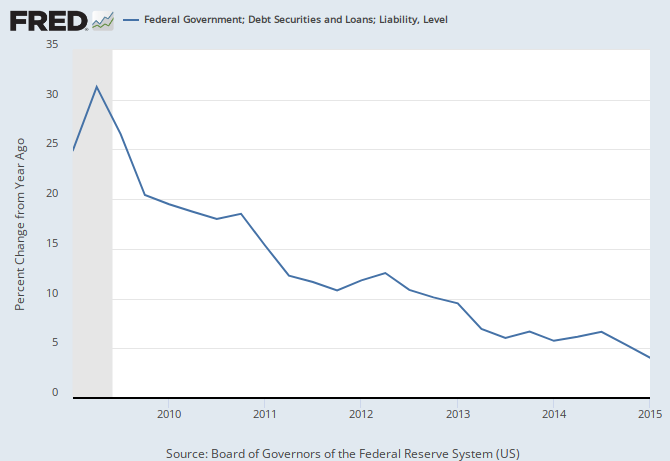

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Rodger,

I follow your posts regularly, and completely subscribe to yours and Mosler’s POV on this subject… although, must say, I’ve had zero success convincing my friends, and most think I am nuts.

But within myself, I honestly struggle with the following:

The primary ingredient for stability of a fiat currency is confidence in the govt. But if, as you suggest, FED and our top economists openly subscribe to and tout a print away as needed policy, the world may not take kindly to USA getting a seemingly free ride. If China realizes US is exploiting their labor and trading keystrokes for their hard work, can they allow that for long? Open disregard for the common myth of fiscal responsibility will completely shake their confidence in our reserve currency, e.g. last week, even a hint that FED may not raise rates caused $ to drop and gold to shoot up.

If every MS country in the world openly prints at will (until inflation, of course), and tries to procure goods for electronic bits, will the world automatically gravitate towards the most fiscally responsible currency, aka net exporting countries, such as Germany, Switzerland… ?? Hence, isn’t it prudent for net importers to quietly continue to pretend they are responsible, and slowly fuel the debt? And yet, if we don’t educate our masses and media, we will all continue to be under the illusion that we are broke… our infrastructure will lag, and our under-privileged will continue to be sick, hungry, and illiterate. Help!

LikeLike

Prakash,

Aha, the old “What if everybody?” question.

Do you plan to vote Democratic? What if everybody voted Democratic. We’d have a 1-party system and a dictatorship.

I root for the Cubs. What if everybody rooted for the Cubs? No more baseball.

So “What if everbody?” not only is hard to answer, but unrealistic as a proposition.

In fact, Monetarily Sovereign countries do spend greatly, but only when they have recessions. During the Great Recession, most MS nations spent lots more — just not enough. Now we are headed for another recession, because of inadequate spending.

But let’s say everyone thought their government could spend limitlessly. What would happen? A few things:

1. The end of poverty, hunger, illiteracy, and a narrowing of the Gap.

2. A great reduction in disease.

3. Humans probably would be walking on the moon and Mars and we would be far more advanced, technologically.

4. Much more good stuff.

I don’t know why lack of spending would be considered “fiscally responsible.” Do you feel austerity is fiscally responsible?

Also, I don’t know why lack of money benefits anyone or any nation.

Maybe you have some thoughts on this.

LikeLike

Krugman is a craven coward and servant of the corrupt 1% oligarchy due to his current employers. He can’t fully attack the status quo matrix because that would upset many powerful people so his analysis is so convoluted. He may be stupid about MMT/Monetary-Sovereignty but he’ll be forever a sideshow keeping most people partially confused, distracted and ignorant. However, hoping that governments will change their policies or do anything for the 99% that might disturb their 1% masters is highly unlikely. Even if politicians in the US and elsewhere figure out that fully using MMT/Monetary-Sovereignty fiscal policies would stop their dependence upon wealthy individuals and corporations (they could pay themselves handsomely for their public service and re-election needs) they are also craven cowards who enjoy their own type of slavery. Trump for all his immigration crapola has mentioned political corruption several times as he’s probably more liberal and pragmatic than most people know – he knows who votes in Republican primaries so the stupid stuff must be stated first and later abandoned in a general election or after being elected. Best wishes and you are cordially invited to visit the WGO website here “http://www.i-globals.org” for a legal, viable and creative alternative to the status quo. PM

LikeLike

What creates demand for globals?

LikeLike

And then there’s Andrew Ross Sorkin, flushing with delight at how accurate Kenneth Rogoff’s prediction was about China.

That’s the same Rogoff, I remember, who teamed up with Reinhart to come up with a dubious study which assert that breaching a certain debt level would be catastrophic for a nation’s economy.

According to Sorkin, China has debt level of something like 282% of its GDP, so I was wondering why its stock market only started to implode now. And I thought the threshold was 90%.

LikeLike

The Chinese government’s debt had nothing to do with it, though the debt of the Chinese people may have had an effect.

As you mentioned, this economist has been thoroughly discredited. Perhaps he can explain this:

U.S. depressions tend to come on the heels of federal surpluses.

1817-1821: U. S. Federal Debt reduced 29%. Depression began 1819.

1823-1836: U. S. Federal Debt reduced 99%. Depression began 1837.

1852-1857: U. S. Federal Debt reduced 59%. Depression began 1857.

1867-1873: U. S. Federal Debt reduced 27%. Depression began 1873.

1880-1893: U. S. Federal Debt reduced 57%. Depression began 1893.

1920-1930: U. S. Federal Debt reduced 36%. Depression began 1929.

In short, depressions were caused by reductions in debt

LikeLike