Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

•Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

•Any monetarily NON-sovereign government — be it city, county, state or nation — that runs an ongoing trade deficit, eventually will run out of money.

•The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

•Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

•The single most important problem in economics is the Gap between rich and poor.

•Austerity is the government’s method for widening the Gap between rich and poor.

•Until the 99% understand the need for federal deficits, the upper 1% will rule.

•Everything in economics devolves to motive, and the motive is the Gap between the rich and the rest..

===================================================================================================================================================================================================================================================================================

Here are excerpts from a 7/31/15 Reuters article. Read them and determine, “What is the Scandal?”

How Pentagon war fund became a budget buster Washington can’t resist

WASHINGTON (Reuters) – The number of U.S. troops deployed in battle zones is at its lowest level since before the 2003 invasion of Iraq. Still, Congress has authorized a 38 percent increase in the war budget over last year.

The contradiction is the legacy of an emergency war fund, started in the aftermath of the Sept. 11, 2001 attacks, that has become a favorite Washington way to sidestep the impact of fiscal constraints on military spending.

The Overseas Contingency Operations account, or OCO, has been tapped to fund tens of billions of dollars in programs with questionable links, or none, to wars, according to current and former U.S. officials, analysts and budget documents.

This spring, Congressional Republicans abandoned any pretense that OCO should be used for its stated purpose – the wars in Iraq and Afghanistan and related operations. In a maneuver to increase defense spending, they simply approved adding $38 billion in other, non-war Pentagon spending to the account, bringing the total to $89 billion.

In doing so, lawmakers tapped OCO’s budget magic: as a contingency fund, it doesn’t count against budget caps on defense and non-defense spending imposed in 2011.

Experts say that a complete accounting of questionable OCO spending may be impossible.

O.K., what is the scandal?

You’re supposed to believe the scandal is the federal government’s use of devious techniques to spend more than it has budgeted. You’re supposed to believe the federal government is spending dollars it doesn’t have in a wasteful and shocking lack of fiscal discipline.

Yes, that is what you’re supposed to believe. But the real scandal is: The federal budget is essentially meaningless — worse than meaningless — it is deceptive, not just in its operation, but more importantly, the federal budget is deceptive in its implied purpose.

For you and me, and for cities, counties, states and businesses, all of which are monetarily NON-sovereign, the purpose of a budget is to find some balance between income and outgo.

If, for instance, you earn $50K per year, you probably can’t afford to buy a $5 million home. So you budget your spending, and perhaps rent an appropriately priced apartment.

The federal government, being Monetarily Sovereign, and able to create dollars at will, suffers from no such restrictions. It can afford anything.

Unlike your budget, the purpose of which is to restrict your spending, the federal budget merely is an accounting procedure, to indicate what spending is proposed.

The real scandal is how both political parties pretend that the federal government’s dollar supply is limited, and so, spending must be limited — especially any spending that benefits the poor and middle classes — while taxes must be increased, especially taxes that impact the poor and middle classes.

Thus, benefits from Social Security, Medicare, Medicaid, food stamps, housing, etc. are under constant scrutiny and pressure, with repeated claims they are “unsustainable,” while FICA is increased, and there are calls to “broaden the tax base” or “institute a flat tax” (which tax the poor more).

There is one, and only one, limit to federal spending, and that limit is not “sustainability” or affordability or availability of funds. The U.S. federal government never, never, never can run short of dollars to pay its bills. Even if all federal taxes, of every type, fell to $0, the federal government could continue deficit spending, forever.

The one, the only, limit to federal deficit spending is excessive inflation. (We use the term “excessive,” because most economists agree that a certain, small amount of inflation is beneficial.)

At some point — a very distant point, a point we never have reached in our history — federal deficit spending theoretically could become so large, even an increase in interest rates might not be able to prevent excessive inflation.

At that never-reached point, we simply would have to cut deficit spending. Until then, the federal government can spend at will.

Yes, the real scandal is the pretense that federal spending is like personal spending, limited by income.

And, until the public understands the differences between Monetary Sovereignty and monetary NON-sovereignty, our economy and the economies of the world, will limp along in fits and starts.

Growth will continue to be interspersed with unnecessary recessions and depressions. Sad situations like the euro and Greece will repeat. And the poor and middle classes will continue to be punished.

The poor and middle classes pay a terrible penalty for their ignorance, and that is the real scandal.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

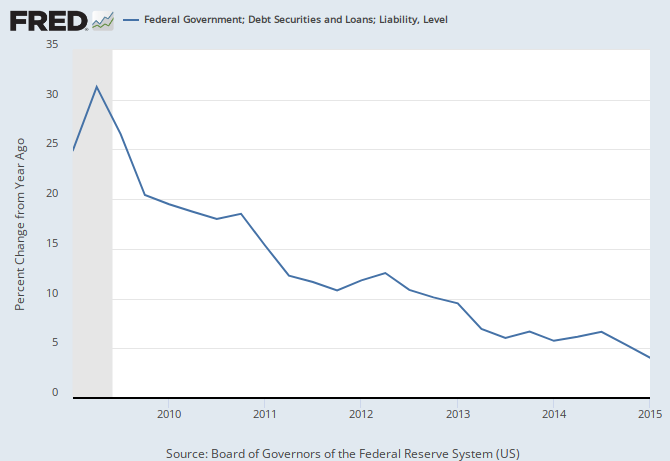

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Too True, and going nowhere. I have been reading a book “Hormegeddon” by Bill Bonner [do you know it?] “too much of a good thing leads to Hormegeddon’

He doesn’t ‘get’ monetary Sovereignty or MMT like you or I do, [he writes about Gov’t borrowing to spend] but aside from that he’s well up with declining marginal utility and how it’s affecting things like defence spending.

You and I know it’s of no consequence that the defence budget is effectively unlimited. The Gov’t can simply keep writing cheques, except the pretence is that it can’t be done and most of the population believes it.

I think the crunch will be a bit different from your contention. It’s not that we can spend until we cannot even pay the interest [the one component of bank debt using real money] It’s that it doesn’t add up to being worth the expense. It doesn’t pay. Nate Hagens says we are in a “Global Deflationary Depression and it’s fuelled by debt.

It will only take a small event to set off a crisis. Credit will stop, then cash restrictions will be enabled, and are already happening.

LikeLike

Depends what kind of debt he’s talking about. Monetarily Sovereign debt isn’t the same as monetarily NON-sovereign debt.

The former doesn’t “fuel” anything. It merely is bank deposits. One could as easily claim that bank savings accounts are a problem.

The latter is, in fact, a serious problem, as witness euro nations’ debts and world-wide personal debts.

LikeLike

Yes, one does have to parse such comments, but I think he writes about sovereign “debt” not non sovereign debt.

It’s amazing how few people get the savings meaning of MS government

Debt. It is a debt instrument because the government “borrows” from the non government side, but then the sums just sit in accounts getting interest.

Can I assume however that municipal and other non ms bonds really do get spent? That real assets have to be paid to the lenders?? That is what you mean by a “serious problem”?

If so My advice is for Greece, Puerto Rico etc to just pay back the interest. The principal is thin air stuff, but the interest is what the bank can use as money and in the end is all the bank actually gets. For Greece etc they pay back the principal with real assets as well as the interest. This is the con the banks play on everyone.

LikeLike

“Can I assume however that municipal and other non ms bonds really do get spent? That real assets have to be paid to the lenders?? That is what you mean by a “serious problem”?”

Yes.

Paying back interest does reduce the immediate burden, but eventually even the interest payments alone could become unaffordable if future deficits require additional borrowing.

LikeLike

Thank you. One question still bugging me and I’ve never seen an answer is to understand what government debt really covers. Since MS governments are made up of sovereign and non sovereign parts, such as component states and municipalities, are their debts part of “Government Debt” such as the $17 trillion we hear about for the Federal Reserve? If the Federal Reserve debt is just the savings accounts of the MS part where are the non sovereign debts counted, or are they ignored, or in another account???

Any idea what each of these three parts amounts to?

LikeLike

John, federal debt is the total of outstanding T-securities (T-bills, T-notes, T-bonds). Holders of such securities have T-security accounts at the Federal Reserve Bank.

LikeLike

Sorry, Rodger, are you saying it doesn’t matter if the T-bonds etc. are federal or municipal? Neither is spent money?

LikeLike

T- bonds are federal, and the money you invest in them IS NOT used by the federal government. The federal government, being Monetarily Sovereign, creates dollars ad hoc, by paying bills.

Municipals are local, and the money you invest IS used by the local government. Local governments are monetarily Non-sovereign, so need to use the money to pay bills.

LikeLike

Thanks!. I also asked Warren Mosler about whether the “Federal debt” figure [$18T] includes non federal debts for the non federal portion of the government. he said he had never seen if it included them, even though they are all considered for the sectoral balances.

LikeLike

China’s economy stagnated so the rich quit expanding goods and services and invested in their stock market.

Is this pattern the result of not enough money for their middle class to create demand for goods and services?

LikeLike

Hopefully Rodger can soon devote a blog post to the present Chinese (economic) situation. I’m pretty confused myself.

LikeLike