Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

Regular readers of this blog have seen these two words — “taxpayer dollars” — discussed often, but in today’s blog, we would like to give you three specific examples of how the words are misused, misleading and mistaken.

Example I:

CNS News

Top 20 Worst Ways the Government Wasted Your Tax Dollars

By Curtis KalinEvery year, Oklahoma Senator Tom Coburn and his staff compile an exhaustive volume of wasteful government spending from that year. The 2014 tome is chock full of government waste ranging from the redundant to the downright absurd.

Oh, and by the way, the U.S. national debt is approaching $18 trillion.

Here is a list of my personal worst of the worst in federal waste:

Swedish massages for rabbits: $387,000

Teaching Mountain Lions to Ride a Treadmill: $856,000

Studying the gambling habits of monkeys: $171,000

Producing the children’s musical: Zombie in Love: $10,000

Funding a “Stoner Symphony”: $15,000

Subsidizing Alpaca Poop: $50,000

Synchronized Swimming for Sea Monkeys: $307,524

Produce a “Hallucinatory” Roosevelt/Elvis show: $10,000

Funding Climate Change Alarmist Video Game: $5.2 million

Teaching Kids to Laugh: $47,000

Developing a real-life Iron Man Suit: $80 million

Tweeting at Terrorists: $3 million

Predicting the End of Humanity: $30,000

Lost electronic devices from NASA: $1.1 million

Studying if Wikipedia is Sexist: $202,000

Asking heavy drinkers not to drink through text message: $194,090

Government Funded Ice Cream: $1.2 million

Funding Kids Dressing Like Fruits and Vegetables: $5 million

Help Parents Counter Kids’ Refusals to Eat Fruits and Veggies: $804,254

Here, Mr. Kalin demonstrates his abysmal ignorance of the military, economics, sociology, climatology and all science.

He has no understanding of the fact that pure research invariably sounds useless at first. That is what makes it “pure research” rather than “development.” If you go to the above link, you may see small hints about why each of those studies was done.

(If you don’t, ask me and I’ll explain it.)

Kalin has no understanding of the fact that federal deficit spending adds dollars to the economy. The approximately $100 million of federal deficit spending he lists and mocks, added $100 million to the economy. Those dollars are peanuts in the world of federal financing, but they did, to that tiny degree, stimulate the economy.

Most importantly, he has no understanding that the federal government does not spend tax dollars. Being Monetarily Sovereign, the federal government creates dollars ad hoc, simply by paying bills.

Federal spending creates dollars and federal taxing destroys dollars, and that is a primary way the federal government manages the dollar supply.

Even if all federal tax collections fell to $0, the federal government could continue spending, forever.

The author is correct, when he says that his examples are the “worst of the worst.” They represent the worst of the worst — in economics reporting.

Example II:

drugpolicy.org

Wasted Tax DollarsOver the past four decades, federal and state governments have poured over $1 trillion into drug war spending and relied on taxpayers to foot the bill. Unfortunately, these tax dollars have gone to waste.

While the author is correct that the so called “war on drugs” is a waste, from the federal standpoint, it is a waste of time, effort and lives, but not a waste of federal taxpayer dollars (for the reasons explained in example I, above).

Here, the authors display an abysmal ignorance of the differences between Monetary Sovereignty (federal government) and monetary non-sovereignty (state and local governments), for indeed, the drug war is a waste of state and local taxpayer dollars.

State and local governments, being monetarily non-sovereign, do not have the unlimited ability to create dollars. You and I and businesses and state and local governments, — we all are monetarily non-sovereign entities. We must have income, in order to pay our bills.

For state and local governments, that income is taxes, without which they would be broke.

So yes, the drug war is a waste of state and local taxpayers’ dollars, but not a waste of federal taxpayers’ dollars.

Example III:

ILLINOIS STATE GOVERNMENT WASTES HUNDREDS OF MILLIONS OF TAXPAYER DOLLARS

Benjamin VanMetreNearly 200 examples of wasteful government spending in Illinois, totaling more than $354 million, is detailed in the “The 2012 Illinois Piglet Book,” a report compiled by the Illinois Policy Institute in a partnership with Washington, D.C.-based Citizens Against Government Waste.

Each item highlights the decisions of politicians who have lost sight of the core services they were put in place to provide.

Piglet 2012 reveals that state and local governments paid for everything from $9,941 for “Speedy-the-Turtle” bobbleheads to $200,000 customized eco-friendly zip lines to a $2,261,009 cable TV bill for prison inmates to get their weekly fill of Seacrest and Snooki.

Here, the author is correct. Illinois’ wasteful spending does indeed waste taxpayer dollars.

The sole problem is that he quotes from a compilation done in partnership with Citizens Against Government Waste, which focuses on federal spending. And from the standpoint of the economy, no federal spending is waste.

Yes, some federal spending is more economically valuable than other federal spending, but it all grows the economy, and no taxpayer dollars are used.

The Treasurer of the United States could go up in the proverbial helicopter and drop billions of dollar bills on the populace, and that would not be waste and it would not be taxpayer dollars.

It would stimulate the economy by putting dollars for spending into the pockets of Americans, and wouldn’t cost taxpayers one cent.

So the next time you see or hear the words “taxpayer dollars,” ask yourself, “Does this article refer to federal spending, in which case it’s not taxpayer dollars, or does it refer to state and local government spending, in which case it is taxpayer dollars.

Simple, isn’t it?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded free Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (the “.1%”) more, with higher, progressive tax rates on all their forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

============================================================================================================================================================================================================

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

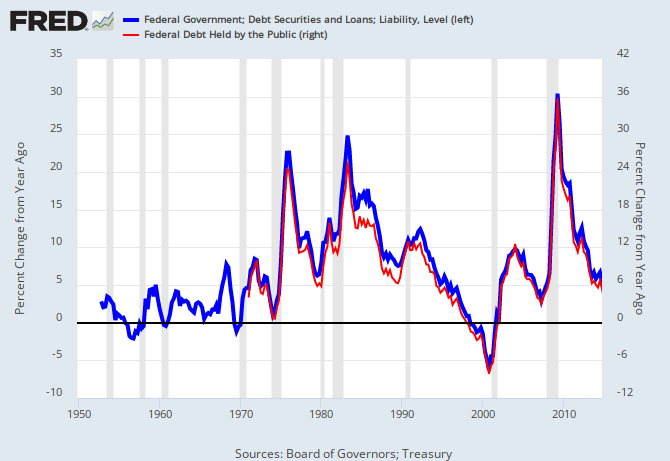

THE RECESSION CLOCK

Long term view:

Recent view:

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

I’m unsure to which post I am making a comment but they are all rather similar. If taxes reduce the money in the pockets of citizens, then there is some “truthiness” to the use of the phrase “taxpayers’ money.” Taxes redistribute currency within a political system from those subject to the currency reduction, to those who benefit from redirected funds from the government. It just ignores who actually creates the money/currency in the first place. Perhaps the approach to explaining monetary sovereignty (MMT) needs some work to get people to understand it better. Clearly delineate the creation of money, currency and income from the taxation aspects of governmental operations. Even the Austrian economists understood that any person, group or organization can create a currency – the “trick” is to get enough people to accept, use, and amass it to make it a popular means of exchange and unit of account. You and your readers are cordially invited to visit this new WGO website here: http://www.i-gobals.org. Best wishes and keep up the good work.

LikeLike

As I understand it, money creation comes from “private” bank lending that must be paid back then, poof disappears except for interest. Also money is created as needed and issued from the “public” federal government by keystrokes but really doesn’t have to be paid back because the Fed isn’t in business to try to make money; it’s an issuer not a user. Money (credit) does not come from an existing account.

An economy grows (bionomy?) from Federal credit issuance not from private banking’s debt clamp production. Real growth is minus debt and taxes–the two things Ben Franklin claimed to be eternal. Of course Ben is wrong in the eyes of MMT/MS which represent the antidote to scarcity modeling.

In a plenitude model, debt is replaced by credit while taxes become unnecessary. In short, society discovers it can better respond and will gladly behave more favorably by the benefits from a model based on Hope-Growth and Giving, while the eternal Ben Franklin model of Taxing and Taking, Dearth, Death and Debt, represents the prospect of eternal struggle and ultimately the system grinding down to unsustainable, cyclic recessions and depressions, sooner or later to be followed by educated citizen Revolt and the voting out of all non-MS representation. A congress of progress.

LikeLike

Federal spending adds net financial assets to the economy but not really net dollars. of course the spending redistributes the dollars creating economic activity. But the net addition of dollars comes from bank lending (or possible Fed loans). Federal government spending does add dollars in aggregate because spending = taxes + bond sales. So, if the government spends $100 million perhaps $50 million is destroyed via taxes and $50 million is used (by law) to but government bonds. Of course the government needs to deficit spend if it has a trade deficit (which the US has) or else the government is sucking economic resources from the private sector.

LikeLike

Federal DEFICIT spending is the difference between dollars added to the economy by the federal government and dollars subtracted from the economy by the federal government.

There are many definitions of “dollars” or “money,” — M1, M2, M3, L — and others more esoteric, the point being that what you may be calling “dollars” is too far limited in our electronic society.

The federal “debt” is the total of T-security accounts at the Federal Reserve Bank. These accounts are essentially identical to bank savings accounts, bank CD accounts, travelers’ checks, etc.

I’m not sure why you don’t consider them to be dollars. Do you not consider CD’s to be dollars? Do you not consider savings deposits to be dollars?

LikeLike

“Most importantly, he has no understanding that the federal government does not spend tax dollars. Being Monetarily Sovereign, the federal government creates dollars ad hoc, simply by paying bills.

Federal spending creates dollars and federal taxing destroys dollars, and that is a primary way the federal government manages the dollar supply.”

Is there any particular reason they do it this way? Is it because when we go way back to the start, a government had to issue money first before it could be taxed (which makes logical sense)?

LikeLike

Dean, you are correct that the government had to create the first dollars out of thin air.

However, the reason tax dollars do not fund spending is because the federal government is Monetarily Sovereign.

Being able to create dollars at will, and not needing tax dollars assures the government cannot run out of dollars.

Compare this with cities, counties and states, which can’t create dollars at will, do use tax dollars and can run out of dollars.

Because the euro nations gave up their Monetary Sovereignty, they can and do need tax money, and they can and do run short of euros.

LikeLike

What it seems you are saying is that if a government (a monetary sovereign one) was to ‘spend’ money towards some project then no ‘tax-payer’ has economic or legal grounds to question it, provided it is not used towards anything that is illegal. Put another way, the tax-payer cannot prove that any spending by a monetary sovereign would adversely affect them because that spending does not come from their tax dollars…correct?

For example, and humour me here, if I see some land not being used, and suggested to the government (which is monetary sovereign) if the government purchases the land, supplies some tools, and allows me to ‘work’ the land, not for commercial purposes, but for the purpose of growing food, harnessing energy, and becoming as self-sufficient as possible, and educating others on the process, and when I die the land and tools etc revert back to the government – then are there any ‘economic’ grounds that would give rise to any ‘tax-payer’ complaining that the use of that money will adversely affect them or would cause them economic loss?

On another note, have you read the story of Con the fruiterer and Smelly Jack the young philosopher?

Con is a great fruit grower, he harnesses his land well and brings a lot of fruit to market every week and makes good money – he averages about $2000 a week in sales.

At the end of each week the tax collector comes along and collects the customary 20% tax which Con was always happy to pay until one day he sees something.

He sees the tax-collector handing out $50 notes to each of the ‘unemployed’. This enrages Con.

What are you doing he yells to the tax collector? This is my job, replies the tax collector – I am required by law to give these people a small sum of money each week on account they are unemployed.

Cons rage grows even worse. He picks out the first of the unemployed he sees and curses him to hell. Why don’t you get off your arse and earn an honest living you scum of the earth?

The young man he picked out happened to be Smelly Jack the young philosopher.

Ok, says Smelly Jack, I will do as you ask. In the not too distant future you will be seeing more of me Smelly Jack explains to Con.

After a few weeks young Smelly Jack turns up with a trailer full of fruit and sets up a stall right next to Con.

By the end of the day, instead of Con making $2000 in sales, both he and Smelly Jack make $1000 each.

At this point Cons face is so red it is redder than his tomatoes (which he didn’t sell), he is trembling with anger, his fists are clenched, and there is steam coming from his nostrils. Obviously making only $1000 is not enough for Con.

Before he could utter a word young Smelly Jack turns to him and says “you told me to get off my arse, you told me to earn an honest living as you see it, and so I did as you told me…it is not my fault I was born with no access to land..it’s not my fault either you have become so used to earning $2000 a week whereas I could support myself with only $50..it is not my fault that the only way to earn an honest living as you see it is to compete – but there you go Mr Con. You and your huge land-holdings – you think you are so smart yet it is because of you feudal lords who have turned into merchants that we simple people have no land to work anymore. And then you think you can trick us into thinking that if we go work in some factory and get paid that you are doing us a favor? I could have got work anywhere but I chose to set up a stall right next to yours to teach you something..if you were honest Mr Con, you would not have me exist at all because you don’t want me competing against you, you don’t want me to occupy any land, and yet you don’t want me receiving unemployment benefits either, and so I am a pest to you. You are not willing to give up some of your land to enable some of us to work it, and so here we are being a pest”

Smelly Jack then throws his $1000 back at Con, and says “here have it – I don’t want your stinking money…Oh and by the way, your tax dollars doesn’t go to paying us unemployed..ahem..us non-land holders…because we have a monetary sovereign government”

LikeLike

Very creative. I’m not sure what laws you are quoting, but you are correct that “spending does not come from their tax dollars.”

Taxpayers can’t question federal spending by virtue of being taxpayers, but they can question federal spending by virtue of being voters, citizens and/or a harmed party.

To my knowledge, paying federal taxes does not provide special legal rights.

LikeLike

Thank you Roger,

I am not quoting any specific law per se, but I am thinking along the lines of seeking a court declaration (as a last resort) to prove that a proposed action I wish to undertake will not be unlawful (i.e. not in breach of any law or contract), cause damage to any persons or property, cause economic loss to anyone, or otherwise be adverse to the interests of anyone.

My proposal seeks to utilize an economic model for my own family and any other who desires to operate under the same model, without it changing the mainstream economic model, and will not only co-exist alongside everyone else, it will actually benefit both government and society.

I have been trying to ‘disprove’ my model for nearly 10 years now from every perspective imaginable, be it law, religion, economics, you name it, I have tried to find a flaw in it, and the more I have tried to prove it ‘can’t’ work or be of benefit to society in general, the more I am finding it will work. I have explained the model to many people from all walks of life be it religious people, economists, lawyers, and so on, and yet not one of them has been able to demonstrate any reason why it cant work – but this is not to say they dont think it might not work, they just stop short of actually providing any reasons because it seems they can’t find any.

The only piece I have been missing for the last year or so seems to have finally been solved thanks to this fact on monetary sovereignty because I have been trying to prove that any “costs or burdens on society” associated with any money the government might spend towards either implementing the model or maintaining it will outweigh the “benefits” the model brings directly and indirectly to both government and society. And if this fact be true that government spending does not breach any law or contract, cause damage to any persons or property, cause economic loss to anyone, or otherwise be adverse to the interests of anyone, then there are no legal grounds upon which anyone could seek to prevent the model being implemented.

As a side note, the model itself is not profit orientated, and in fact does not even use money nor does it legally own any of the property (land, housing, tools, technology, and any other means or resources), it merely acts as usufructuary where the government (Crown) is the legal owner of the property, which in some instances may require the government to purchase some of these resources from the private sector – hence the question to you on government spending vs economic loss.

Here is another question I would like to propose – does society in general benefit when the private sector ‘exports’ goods and services?

LikeLike

Exporting means that goods and services flow to a foreign country and money flows into the “home” country.

So your question can be rephrased: “Does society in general benefit when goods and services flow out, while money flows in.”

The answer depends, in part, on which goods and services. Are we exporting food during a famine? Or are we exporting salt from our endless salt mines?

The other part of the answer relates to the question: Does the United States need more dollars?

The U.S. government can create unlimited dollars. We don’t have to ask any foreign nation for dollars. So what good is exporting?

The answers are massively complex, but in short, exporting sends valuable goods and services out of the country, in exchange for dollars our government creates in unlimited amounts.

So you tell me. Does exporting benefit us?

LikeLike

I completely concur and so my answer to you is no it does not. In fact the whole mercantilist movement was based on this theory that wealth comes from exports converted into gold until a bright spark realized that all it did was make some countries poor. I can only imagine with floating exchange rates being almost a global phenomenon that soon earth will need to find other alien races to convince them they need to buy our products.

I purposely asked you that question to lead into my next one which is ‘does society benefit more if the same exporter sold those same goods and services to the government instead (who in turn uses those goods and services for domestic purposes)?’

I believe the answer to be yes based on your previous response.

LikeLike

Let me again rephrase your question: “Does federal deficit spending benefit the economy?”

The answer is, “Yes.”

LikeLike

It appears based on some of your other posts I have read that the reason they lie, or dont tell the truth, is because it benefits the rich.

Would you be able to point me to any of your posts which addresses this ‘reason’ specifically.

Im assuming the process by which the govt spends if it is not by transfer of money from the consolidated revenue account, which by law is supposed to be where all income goes in and spending goes out, then it must simply credit entities accounts..but do you also have a specific post where you explain this process better?

Many thanks

LikeLike

“Benefits the rich” is explained in many posts on this blog, for instance: https://mythfighter.com/2016/01/11/the-making-of-poverty/

But here’s a quick summary:

1. “Rich” is a comparative term, not an absolute. If you have $100 you are rich, if everyone else has only $1. The Gap between your $100 and everyone else’s $1 is what makes you rich.

2. Federal deficit spending benefits the poor and middle-classes far more than the rich. Think: Social Security, Medicare, Medicaid, aids to education, poverty aids. This list goes on and on. The rich have much less need for, and use of, federal spending.

3. Therefore, federal deficit spending narrows the Gap between the rich and the rest, making the rich much less rich. To the rich, this is like having the homeless camp right outside the mansion. The rich want the Gap to be widened, which requires a reduction in deficit spending.

LikeLike

Thanks Roger

I have gone through a lot of your posts in the last 48 hours but I am still struggling to find actual proof (by proof I mean either legislation or something actually published by a government dept or agency) that specifically states that tax dollars are destroyed and are not used for government spending.

You referred me to a FAQ Fed Reserve page but I couldn’t find anything in there specifically on taxes nor on government spending.

please don’t see this question as undermining what you are saying, on the contrary, it is the first time something regarding this subject has made sense – but – it is one thing for it to make sense, and far better when someone can actually point to something and say ‘here, look, here is the proof!’

LikeLike

“Federal government does not destroy tax dollars” actually is the negative of the statement, “The federal government keeps and stores the dollars taxpayers send it.”

Some proofs — especially proofs of negatives — must be made by omission.

For instance, the only way to prove Mr. Jones did not shoot Mr. Smith might be by showing that Mr. Jones never has had a gun.

If the government does not destroy tax dollars, then it must own a lot of dollars, right?

So tell me this: How many dollars does the federal government own?

You will not find an answer to that question, because the answer would be nonsensical.

Having the unlimited ability to create dollars, ad hoc, by spending, the federal government has no reason collect, borrow or store dollars anywhere. (Think of those big sheets of dollar bills the Treasury prints every day. How many are there?)

So given this unlimited ability to create dollars, what does the federal government do with the dollars it collects?

———————————————————————————————————————————————————————————–

Another way to look at it: A football scoreboard has the unlimited ability to create points ad hoc, as teams score.

Let’s say a team scores a touchdown, and the scoreboard adds 6 points to their game score.

From where does the scoreboard get the points it gives to each team?

Now, let’s say the officials say the touchdown was not scored, and six points must come off the board.

Where does the scoreboard store those points the team no longer has?

Get the picture? When an entity has the unlimited ability to create something, there is no logic to discussing where that entity gets that “something” or where it stores that “something,” or whether it keeps or “destroys” that something.

Because federal tax dollars are not stored anywhere, they are destroyed upon receipt.

LikeLike

I understand your logic, but I am not sure I could use that in a court setting, although using the negative may help.

But am I inspired to do more ‘legal’ research on it.

Interestingly, I did a search for Monetary sovereignty (I will search for similar terms too) in our Australian legal database and found the following:

http://www.austlii.edu.au/cgi-bin/sinosrch.cgi?method=auto&meta=%2Fau&mask_path=&mask_world=&query=%22Monetary+sovereignty%22&results=50&submit=Search&rank=on&callback=off&legisopt=&view=relevance&max=

Claus D Zimmerman,

A Contemporary Concept of Monetary Sovereignty

(Oxford University

Press, 2013) ISBN 9780199680740.

http://www.ejil.org/pdfs/24/3/2425.pdf (*** have you read this yet? I will read it tonight)

These developments are steps forward, taken in order to ensure the efficiency of the Community (…), the forthcoming acquisition of monetary sovereignty, 8

8. Which as Lady Thatcher once remarked is “the core of the core of national soveriegnty”

These came from tax office rulings:

Goods and services tax: the GST implications of transactions involving bitcoin

69. The meaning of ‘money’ in the context of the GST Act was considered in Travelex Limited v. Commissioner of Taxation [48] (Travelex). There Emmett J observed:[49]

Money is any generally accepted medium of exchange for goods and services and for the payment of debts (see Butterworth’s Australian Legal Dictionary at 759). Currency and legal tender are examples of money. However, a thing can be money and can operate as a generally accepted medium and means of exchange, without being legal tender. Therefore, bank notes have historically been treated as money, notwithstanding that they were not legal tender. It is common consent and conduct that gives a thing the character of money (see Miller v. Race (1758) 1 Burrow 452 at 457). Money is that which passes freely from hand to hand throughout the community in final discharge of debts and full payment for commodities, being accepted equally without reference to the character or credit of the person who offers it and without the intention of the person who receives it to consume it or apply it to any other use than in turn to tender it to others in discharge of debts or payment for commodities (see Moss v. Hancock [1899] 2 QB 111 at 116).

70. In Mann on the Legal Aspects of Money, [50] Proctor says that the formulation in Moss, as referred to by Emmett J in Travelex, applied the functional theory to the definition of money. The functional theory of ‘money’ focused on that which was a generally accepted medium of exchange for goods and services and the payment of debts.[51]

71. In the modern era, however, the State theory of ‘money'[52] requires that, in addition to the functional characteristics described, money ‘must exist within some form of legal framework, because it reflects an exercise of sovereignty by the State in question’.[53]

72. It has been argued that bitcoin satisfies the functional theory of money because it serves as a medium of exchange, a unit of account and a store of value. In addition it is argued that bitcoin’s increasing acceptance in the community as a means of discharging debts and a means of exchange for acquiring goods and services has now reached the point that it qualifies as money. In determining whether bitcoin is money for GST purposes, however, it is not necessary to come to a conclusion whether bitcoin satisfies the functional requirements referred to in Moss.

73. Custom alone, whether it be local or international, cannot make something ‘money’ in the absence of an ‘exercise of monetary sovereignty by the State concerned’. Consistent with statutory context,[54] policy and the wider legislative framework governing Australian currency established by the Currency Act, this is the sense in which the word ‘money’ is used in the section 195-1 definition.[55] Bitcoin, therefore, is not ‘money’ for GST purposes.

Income tax: is Bitcoin a ‘foreign currency’ for the purposes of Division 775 of the Income Tax Assessment Act 1997 (ITAA 1997)?

23. In that text, Proctor suggests that the formulation in Moss had tended to adopt a purely functional approach to the definition of money.[22] It is further suggested that although a legal definition of money should reflect at least some of these functional attributes, it must also include an element which recognises the international law requirement that money ‘must exist within some form of legal framework, because it reflects an exercise of sovereignty by the State in question’.[23] Proctor then goes on to state:

For anything which is treated as ‘money’ purely in consequence of local custom or the consent of the parties does not represent or reflect an exercise of monetary sovereignty by the State concerned, and thus cannot be considered as ‘money’ in a legal sense.[24]

…I will keep researching more on similar terms (if you could help me on what some other terms may be used that defines monetary sovereignty that would be appreciated)…but based on this search alone, it proves that some people in our government recognize the term, and therefore must recognize its meaning.

Cheers

LikeLike

All money is a form of debt.

The value of a debt is determined by the value of its collateral.

The collateral for the dollar is the full faith and credit of the United States government.

From what I can see, the collateral for the bitcoin is weak, and for that reason, I’ve predicted the bitcoin will fail.

LikeLike

Roger,

My apologies,

I did not post those rulings on bitcoin for bitcoins sake, but merely because the term monetary sovereign had been mentioned by our tax commissioner in addressing the subject of bitcoin – and therefore bitcoin aside, it is proof at least that our tax commissioner knows of the term monetary sovereign. As a side note though, whether important or not, I did do some study on bitcoin not long ago as a means to understand why governments tax barter exchanges, (exchanges involving bitcoin are deemed to be barter exchanges), and the reason being is because they tax any increase that may occur if one of the items bartered then gets sold for money. The IRS uses a painting as an example on its website – if you barter a painting for some other item, but then later on the painting increases in value and you sell it at a profit (compared to the value of the original item bartered for) the government will tax ‘on the profit made’. Im not saying I agree morally, I am just saying that this is what they have explained as their reasons.

And yes, I did know that all money is debt – the Bank of England published a paper in 2014 (which I am sure you have read). In it they made two points that stood out for me:

– if all debts were paid, there would be no money left

– money is necessary to fill the void for a lack of trust

I also found an interesting definition of ‘credit’ from blacks

http://thelawdictionary.org/credit/

The credit of a government is founded on a belief of its ability to comply with its engagements, and a confidence in its honor, that it will do that voluntarily which it cannot be compelled to do.

LikeLike

“All money is a form of debt. ”

I was thinking about this statement. Is it true that only a monetary sovereign can equitably and truly settle all debts a result of its actions (compared to those who use money issued by some entity other than themselves to pay their debts)?

This question rests on the premise that it costs ‘something’ for money to exist in the first place (unless of course it costs nothing at all for money to exist). And so, whilst I pay my debt ‘with money’, how do I actually settle the debt created by the fact of that money existing in the first place?

LikeLike

to add, I found this in the pdf I posted above

Interestingly, the concept of monetary sovereignty has never been expressly recognized by the international community, either in the Articles of Agreement of the International Monetary Fund (hereinafter ‘IMF’ or ‘Fund’; ‘IMF Agreement’ or

‘Fund’s Articles’), 4 or in any other key instrument of international law. 5 It is a judgment of the former Permanent Court of International Justice (PCIJ) that is commonly cited as the first official recognition of monetary sovereignty in modern international

law. As famously stated by the PCIJ in 1929 in the Serbian Loans Case ‘it is indeed a generally accepted principle that a state is entitled to regulate its own currency’.6 It is on this basis that the state’s sovereignty over its own currency and, by implication,

over both the internal and external aspects of its monetary and financial systems has traditionally been recognized by public international law. 7 In the words of F.A. Mann: To the power granted by municipal law there corresponds an international right, to the exercise of which other states cannot, as a rule, object. … It must follow that, subject to such exceptions as customary international law or treaties have grafted upon this rule, the municipal legislator … enjoys sovereignty over its currency and monetary system.

…just curious – when the IMF was formed, did all those countries that join legally agree to anything that may have impacted their ability to be 100% monetary sovereign, or if not legally impacted, maybe morally impacted?

LikeLike

Any agreement between states impacts the sovereignty of those states, no matter the subject of that agreement.

Loss of sovereignty can be worthwhile, depending on the benefits of the agreement.

All laws imply a loss of sovereignty. You may wish to drive 100 miles per hour, but you agree to give up your sovereignty to do that in exchange for everyone else giving up their sovereignty, and making the roads safer for all.

LikeLike

Just after I asked you that last question I found this:

Click to access gianvi.pdf

Another instrument is of a regulatory rather than financial nature. The Fund

monitors the compliance by its members with certain obligations specified in the Articles of Agreement. These obligations constitute a code of good monetary conduct that Fund members are required to observe.

By becoming members of the Fund, they have accepted these obligations and, to that extent, limited their monetary sovereignty. In exchange they have received certain benefits. One of them is that other members too have agreed to limit their sovereignty for the sake of international cooperation and for the common good of all. Another benefit is that in times of crisis they will have access to financial assistance from the Fund if they meet the required

conditions.

LikeLike

I reckon this is the sealer for me (in support of MS being practiced today), and so correct me if I am wrong:

Click to access gianvi.pdf

from page 4

As a change in the value of a currency is not a breach of international law, a state is not liable

for its consequences on holders of its currency, or on creditors or debtors with respect to

obligations denominated in that currency

*** i am assuming the IMF is speaking in relation to exchange values with other currencies, and if I understand MS correctly, if you possess all the resources necessary for your country, why bother exporting or importing, and therefore what difference does it make how much money the government spends into the economy, and therefore what it does to exchange rates..correct?

LikeLike

As a very general rule, increasing the money supply is stimulative. Government deficit spending and net exports affect GDP.

Exchange rates are market controlled on a daily basis, but government controlled on a long-range basis.

LikeLike

Just going on from several of your posts, I think I have hit the nail on the head, at least from the perspective of the law (please excuse my constant focus on law, but I believe those in power are so not because they understand economics, even though they do, but because they understand law better than most)

All money is debt. This is the key, especially when we understand how equity sees a debt.

Section 170 Equity Jurisprudence, Pomeroy”Even when the executory contract creates what at law would be a debt, and when the recovery at law would be a general pecuniary judgment, the equitable remedy views this debt as an existing fund, and awards its relief in the form of an ownership of or lien upon that fund.”

When a supplier of goods or services agrees to sell to another, at the moment of the agreement, at least in equity, money is created. I say in equity, because although the supplier may provide an invoice payable in say 30 days, which is a debt at law, equity sees a fund on the grounds that equity regards as done that which ought to be done. Not to be confused with some notion of honour (as if to say that equity wants you to keep your promises on grounds you will have to answer to God – even though several centuries ago chancellors were fond of using this tactic) but because if either (or both) party(ies) was to die before payment was made to the supplier, equity regards the supplier and the buyer and their respective assets and liabilities, and the nature and character of those assets and liabilities as if they have already been realized to their end – therefore, although the supplier held an IOU as an asset, upon his death equity says this must be seen as what it intended to be, i.e. money (it does this for several reasons, one of which is to determine which assets of the deceased must go to the heirs, and which must go to the personal representatives). Equity will then compel the buyer (or his representatives if he has also died) to convert assets into money to settle the debt owed to the supplier.

So, what happens when a supplier supplies to a government instead of another private person?

The supplier naturally furnishes to the govt, both the supplies and the invoice. The invoice is an IOU, which in the eyes of equity is seen as a fund, or money. The govt owes this money. However, the government also does not ‘own’ property of its own – as all property it does hold it holds in trust for the people. If we repeat what I mentioned earlier, upon death Equity will then compel the buyer to convert assets into money to settle the debt owed to the supplier. If the govt does not own assets upon which to convert, it stands to reason that it cannot meet its obligations other than from the view point of being able to create that money as a monetary sovereign. It has no other means by which to create that money, which equity says must exist!

Bingo!

LikeLike

I was thinking more about my last post Rodger…

From a trust law perspective, it is both a breach of trust and fraud to sell to a beneficiary that which he already has a beneficial interest in.

If the mainstream economists claim that taxes are collected and used for government spending, then in some cases (such as purchasing physical assets from foreigners), using money collected from the tax payer may not be a breach..

But….if I supplied the government with goods or services and they then ‘paid’ me in tax dollars, they would be in effect be selling me something I already have a beneficial interest in. As most government spending is for services rendered by the private sector (I assume), then it would be a breach of trust to pay for those services rendered in property which those suppliers already own.

Further, my studies into law over the years has demonstrated to me that government follows the law, even if it doesn’t appear so to the layman. And so on these findings, I believe from a law perspective at least, I have proven that what you have been saying about tax dollars and government spending is correct.

However, I am always open to being dis-proven, and if anyone who reads this can factually prove it wrong from this law perspective, I am all ears

LikeLike

Interesting point re. the Monetarily Sovereign federal government.

Most governments in the U.S. are monetarily non-sovereign. The states, counties and cities, being monetarily non-sovereign, do need to collect taxes and they do spend tax money.

The purpose is two-fold:

1. To enforce cooperation in projects that require cooperation (e.e. roads, schools, clean water, etc.)

2. To redistribute funds among the citizens (i.e. poverty aids)

LikeLike

I thought long and hard today about the monetary non-sovereigns, and what stuck out to me is that as they never issue money, they are forced to tax first and spend second, just as a household or business would. Therefore I view any taxes they levy as merely charges for their services. They are nothing more than competing entities competing for the same money. The federal govt on the other hand does not do this, and is the only entity in existence that does not compete (of course this might not be the same for actual politicians or servants of the govt).

LikeLike

I found this article:

Can taxes and bonds finance Government spending?

http://poseidon01.ssrn.com/delivery.php?ID=190081025071013116090002118019075121010037029042091050024126018073010103074090009092028094092018110047014035097085122100008096092095087077083064091119122091064090108086026110097106007020&EXT=pdf

it is probably the best example of a description which not only explains the process well, but proves that taxes are not spent by government…in fact, if anyone was to dispute this, they would have to prove that government spending does not increase bank reserves held at the central bank and that the private sector already held money before the government began taxing it..obviously things that can’t be proven

it also states that taxes are used to create a demand for government money and can thus be conceived as “the means by which real resources are directed out of the private domain and into the public domain”, which is ironic considering that private wealth does the opposite

LikeLike

It was written by a professor (Stephanie Kelton) at UMKC, the university that teaches MMT, i.e. the best economics department in the world.

Note to future students: If you want to learn real economics, don’t go to the University of Chicago, Harvard or Stanford. Go to UMKC.

LikeLike

I also read her paper on Hierarchy of Money which goes hand in hand with the other article, and it seems that those who dispute the theory of how governments spend are also of the metallist (monetarist) camp (correct me if i am wrong)

But what surprises me is that all court cases I have read whether in the US, Australia, UK etc on the subject of money clearly spell out that money is not as the metallists claim, but exactly as it is explained by Charlatists, Wray and others – further the Bank Of England made it public knowledge in 2014.

Unless of course those who believe the metallist theory also assume the Bank of England and all courts/judges are corrupt and liars

Here are but two cases on the subject…and it becomes obvious that facts are facts and there can be NO dispute..the metallist theory of money is clearly wrong, and so too is the notion that govts spend taxes and bond sales, and the proof of all this pudding is in both the legislature and court cases…and if anyone continues to dispute it they are living in denial…

Now, we can spend our energies on other things other than arguing the point to non-believers…!!!

….for those who would like to read extracts of two cases on what money is…here…

http://www.austlii.edu.au/cgi-bin/sinodisp/au/cases/vic/VSC/2004/36.html?stem=0&synonyms=0&query=%22fractional%20reserve%20banking%22

243. • A similar argument based on “credit creation” was advanced in National Australia Bank Ltd v McFarlane.[6] In that case, the defendant mortgagor contended that unless the lender in a security transaction hands over “bullion, banknotes or coin”, the mortgage is invalid. Byrne J stated:

“It is apparent to me that this is arrant nonsense. It has no regard to the legal obligations created by a bank loan; it ignores the reality of modern commerce where it is money, in the broad sense of the term, including choses in action, and not only gold, banknotes and coin, or indeed legal tender, which plays a most important part.”[7]

245. • In Smart v ANZ Banking Group Ltd[10] the appellant, Mr Smart, who gave evidence in the present case, contended that the loan secured by a mortgage was not a real loan but “a paper transaction. Actual money doesn’t change hands, cash money”. Batt JA at p.4 observed that:

“The argument thus seemed to be that no moneys were lent, but only credit was created by book entry, which, it was said, was unlawful because the only mode of payment was by legal tender …. Mr Smart’s argument overlooks banking and credit altogether. Indeed, it seems to take no regard even of an undoubted fact of commercial life, the use of cheques and bills of exchange. It may be that in economic terms, the respondent bank “lends” its credit by way of fractional reserve banking but it cannot be doubted that in point of juristic analysis money was lent. That is so even in the case of the housing loan; some funds advanced to Mr Smart pursuant to it were by his direction paid to the solicitors for the vendors …. Moreover, there can be no doubt that Mr Smart received value in this and the other funding transactions. A legal liability in Mr Smart sounding in money was created for good consideration. What was done was not unlawful, was real and was not devoid of legal effect. Arnold v State Bank of South Australia (1992) 38 FCR 484 at 485 and 486″.

http://www.austlii.edu.au/cgi-bin/sinodisp/au/cases/vic/VSC/2009/429.html?stem=0&synonyms=0&query=%22fractional%20reserve%20banking%22

38 The facts of this case demonstrate the fallacy of Mr Palmer’s assertion that there was no lawful consideration. The moneys advanced by Permanent Custodians were used to pay off an existing mortgage (of about $1.2 million) and other costs associated with the loan and the registration of the mortgage. In addition, Virgin Investments directly received nearly $70,000 by way of bank cheque.[17] Each of these transactions had a value. Virgin Investments was relieved of its indebtedness to the previous mortgagee, creditors were paid out and Virgin received funds which it was able to utilise for its own benefit. Virgin received value as a result of it entering into the loan agreement and the mortgage.

http://www.austlii.edu.au/cgi-bin/sinodisp/au/cases/sa/SASC/2013/27.html?stem=0&synonyms=0&query=%22fractional%20reserve%20banking%22#fnB44

1. The respondent also relied (as did the Magistrate) on the decision in Arnold & Anor v State Bank of South Australia.[43] Again, the decision in Arnold can only be of limited, if any, assistance to the respondent. Arnold concerned quite different facts. The Arnolds had borrowed money from the respondent bank secured by way of mortgage over real property. They argued that no money was due and payable by them under the mortgage. According to the Full Court:[44]

The attacks made in the statement of claim on the mortgage are, with one exception, all based on the notion that the debt secured by the mortgage involved the creation by the State Bank of a book-entry credited at no cost to itself.

In dealing with this argument the court said, inter alia, this.[45]

Notwithstanding the fact, deposed to on behalf of the State Bank and acknowledged in the course of the hearing by Mrs Arnold, that the appellants received the benefit of the original advance (which in fact totalled $200,000), their core argument was that, because the Bank is said to have made this advance available to the appellants by creating credit at no cost to itself out of nothing, that is not proper consideration for the appellants’ obligation to repay. This challenge to the enforceability of the mortgage is identical to that which has been made to bank mortgages, but rejected, in two other actions that have recently come before single judges of this Court: Napier v National Australia Bank Ltd (unreported, Federal Court, Spender J, No 304/92, 16 April 1992) and Fisher v Westpac Banking Corporation (unreported, Federal Court, French J No 624/92, 18 August 1992). In Fisher’s case, French J (at p 13) said:

There is nothing to prevent a bank evidencing a loan by a credit entry. Its obligation under the loan agreement is nevertheless a real one. If the money is advanced by way of electronic transfer or appropriate bookentries there can none the less be real rights and real obligations created which are enforceable at law. Contract documents and securities recording a loan in such cases do not mislead or deceive for want of hard currency backing for it.

This is a correct statement of the position. In A L Tyree’s book on Banking Law in Australia (1990), Ch 1, upon which the appellants rely, the following appears:

[1.3] The characteristic feature of modern banking is that it is ‘ fractional reserve’ banking . In simple terms, the bank ‘lends’ its credit, not its money. The banking system as a whole is capable of creating money.

…

In a system where bank liabilities are used as ‘money’, it is clear that the financial stability of the entire community is closely related to the stability of the banking system.

…

[1.9] One of the characteristics of banking business is that the ratio of debt to equity is extremely high. Since most of the debt is owed to relatively small depositors, it is essential that these depositors be protected from mismanagement and that there is a general level of confidence in the bank. This confidence is for the benefit of the bank and the banking system as much as for the depositors.

The [Banking Act 1959 (Cth)] Act gives the Reserve Bank certain powers which are intended to provide this protection and so to maintain the [sic] confidence.

That there is statutory recognition in the Banking Act, in particular in Divs 1A, 2 and 3 of Pt II of that Act, of that characteristic of Australian banking operations which Tyree refers to as ” fractional reserve banking ” is one answer to the appellants’ contentions that what they refer to as “cost free book-entry credit creation” by the respondent Bank is an illegal and misleading activity which results in the loan being worthless, and renders the security documents void. Another is that the appellants actually received value – even if, according to their argument, it was not money – under the contractual arrangements with the Bank. Prior obligations were paid off; they were enabled to meet fresh ones. This was exactly what they contracted to obtain (no one borrowing thousands of dollars expects, in Australia, to receive the sum in a wheelbarrow) and they must carry out their part of the bargain.

51. • The respondent submits and the Magistrate held, that the present appellants, like the Arnolds, “actually received value (even if not by cash monies)” and that “prior obligations were paid off”, that is, rights were created and in due course obligations were “satisfied”.[46] This may be accepted, subject to the potential qualification raised above.[47] However, again, I do not see how the reasoning or decision in Arnold advances the respondent’s position given the facts of the present case. In Arnold the borrowers received and used the purchasing power that the bank promised to and did provide. In the event that the monies advanced, albeit by way of “book entry” in the bank’s accounts, were not repaid the bank would suffer a loss which would need to be reflected in the bank’s accounts. Ultimately, the bank’s assets would be reduced to that extent. In this sense the bank’s money was lent. The same cannot be said with respect to RCF following the provision of the promissory note to AHM and in circumstances where neither AHM nor Koonara presented it for payment.

LikeLike

Excellent. There probably are many more cases like these. Bottom lie: Money is not a physical thing. It is an accounting notation.

Even gold is just accounting, for the metal itself seldom is shipped back and forth. Rather, during gold standards, the metal resides in a vault, and accounting notations are exchanged.

The accounting notations are based on the full faith and credit of the entity guaranteeing that the gold exists. In short, it is the notations that are money, with gold merely being the collateral..

LikeLike