Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The single most important problem in economics is the gap between rich and poor.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

=========================================================================================================================================================================================================================

Greece Remains Defiant as It Seeks Creditor Deal This Week

Greece’s government said it won’t back down on election pledges to end austerity.

Nikos Filis, spokesman for the parliamentary group of Prime Minister Alexis Tsipras’s Syriza party said, “Our mandate from the Greek people is to reach an agreement where we stay in the euro area without harsh austerity measures.”

Have the Greek leaders caved from “end austerity” to “end harsh austerity”? Does this mean austerity has become O.K., so long as it isn’t “harsh” austerity (whatever that means)?

Tsipras’s so-called red lines include no further cuts to wages and pensions.

That’s all well and good, but what about taxes? Should the impoverished Greek people suffer even more taxes, to pay the EU bankers?

And what about all the other national needs a government is expected to provide for?

Like Chicago, Cook County and Illinois, Greece is monetarily non-sovereign. It has no sovereign currency. Greece uses a currency, the euro, over which it has no control.

Unlike the U.S., Canada, Australia, China and other Monetarily Sovereign nations, monetarily non-sovereign entities can and do run short of money.

Chicago has. Illinois has. Greece has. Greece is broke — more than broke it is deeply, hopelessly in debt.

There is no way Greece can earn enough euros to pay its debts — not this year, not next decade, not next century.

Like all monetarily non-sovereign governments, Greece has but two sources of money: Taxes and net exports.

But its people are too broke to pay more taxes, and Greece is a net importer. Year after year, billions of net euros flow out of Greece.

So, since it’s people are broke and the world doesn’t want to buy what Greece is selling, how will Greece obtain the money to pay its debts?

The EU solution is for Greece to increase its debts by borrowing more.

If that makes sense to you, congratulations. You are well on your way to being an EU economist.

Of course, the EU cares nothing about Greece or the Greek people. The EU cares about two things only:

First, the EU wants to protect the banks. Rich bankers own and run Europe, and the European politicians are their well-paid puppets.

Second, the EU wants to protect the euro. It is the euro that has given the European politicians their well-bribed jobs at the expense of the taxpayers.

German Vice Chancellor Sigmar Gabriel said, “A “third aid package for Athens is only possible if reforms are also implemented. A Greek exit from the euro would pose a political challenge and not an economic one, but “no one would have trust anymore in Europe if, in the first big crisis,” a currency member quits, he said.

Translation: The word “reforms” means that the Greek people must suffer more, so that wealthy European bankers can be paid and the politicians can keep their cushy jobs.

The sole purpose of any Greek government is to benefit Greek citizens, not to benefit foreign bankers and politicians.

Here is what Greece’s politicians should do:

1. Re-adopt the drachma as Greece’s sovereign currency to become Monetarily Sovereign.

2. Pay all debts in drachmas on a 1-to-1 basis. Any creditors refusing drachmas would receive nothing.

3. Convert all Greek bank accounts containing euros to drachmas, on a 1-to-1 basis.

4. Cut Greek taxes. All remaining taxes would be paid only in drachmas.

5. Increase Greece’s spending (in drachmas) on social programs infrastructure, R&D and jobs programs.

6. Raise interest rates, if necessary to control inflation.

7. Cut borrowing. As a Monetarily Sovereign nation, Greece would have no need to borrow drachmas(Someone should tell this to American politicians). Sell bonds only as an interest rate control.

Whether Greece would stay in the EU as a non-euro member (ala the UK) is a question, though a relatively unimportant question. The EU at best, is a trading and travel convenience.

Considering the negative effects (i.e terrorism) that open borders have facilitated, many European nations may now wish they could control their immigration. (Visualize the U.S. having a no-deportations, open border with Mexico, and you’ll get the idea.)

From my vantage point, it seems that the EU wants more from Greece than Greece needs from the EU.

To the Greek people: Grexit just as fast as you can, and a year or two from now, you can thumb your noses at the foreign bankers.

Think about it: What do you have to lose?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

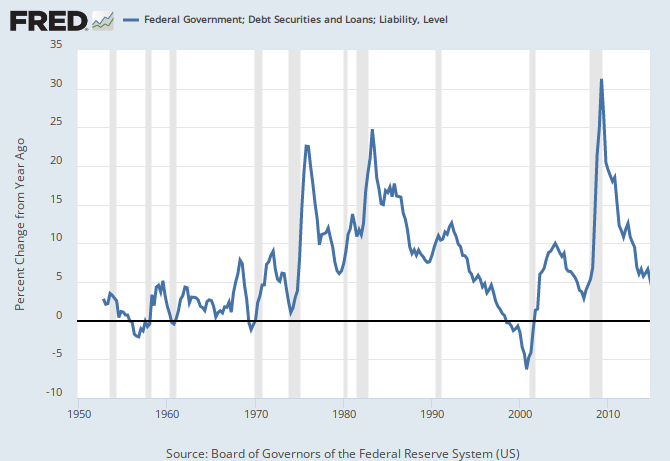

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

I agree Greece should exit the Euro. Two phases of your plan could be done differently, possibly in ways that would cause less ill will from the rest of the Euro nations.

Greece could accept tax payments in Euro, for a time, at parity with the Drachma. Greeks have no Drachmas with which to pay taxes now, and they would be hard to come by, initially. They do have some Euros, though.

There’s no need to forcibly convert bank accounts or debts, either. People could convert if they wished, but need not be forced. The government could sell Drachma to banks or individuals, at parity. Greece could make its Euro debt service payments in Euros, buying them for Drachmas as necessary on the FX markets. As long as Drachmas are scarce and the tax equivalent rate is 1:1, they will trade very near 1:1 everywhere. The government could offer their creditors the option of converting to Drachma, and I think they should do so, possibly with some incentive. It could even be part of an amicable Grexit plan. And Greece would retain the trump card, if the Drachma were to fall precipitously, and they were willing to default on their Euro-denominated debt that was not converted.

All salaries and other government payments should be made only in Drachmas. It will take a while for the supply of Drachmas to build up to a sufficient level. The signal will be that Drachmas trade at a discount to Euros, and for that reason people will pay all taxes in Drachmas. From then, Euros need no longer be acceptable in payment of taxes, and the Drachma will be a truly floating fiat currency.

Another idea has just occurred to me. One objection to a quick Grexit is that there is no design for a paper currency, and no capability to print it or mint coins. Maybe the Drachma could be an electronic-only currency? Is it possible, yet, to do away with coins and paper completely?

LikeLike

“One objection to a quick Grexit is that there is no design for a paper currency . . .”

Perhaps, I should send them my photograph and the address of a printer. 🙂

LikeLike

What a bloody good Idea,Rodger. Full marks for all that!

Greece really has no otner option but to regain its monetary sovereignty.

I also thought a way out, which does not compromise your ideas would be to be like Britain. Be a member, but not a financial member.I.E.,keep its Sovereignty.

LikeLike

I have been hearing this nonsense about Greece leaving the Euro for over 5 years now. Nobody understands this.

Greece ain’t going anywhere. The Euro is a debtors prison for it’s member countries.

The best thing Greece could do is leave the Eurozone. That will never happen.

We keep hearing stories about the Grexit that will never happen. Every time you hear this, just remember it is not going to happen. The EU needs nations in its monetary zone so they can control them. They want to expand, not contract, so behind the scenes, they threaten the leaders with monetary torture to ensure they do what they are told, and this is exactly what happened to Greek leaders. I don’t care who they elect, Greece, and any other EU nation is screwed and prisoners of the European Union.

I’m reminded of a statement in Napoleon’s Think and Grow Rich, one of the most important insights I’ve ever read regarding money and it is at the very core of the problems in Washington and Wall Street.

“Animals prey on each other physically. Man, with his superior intelligence doesn’t prey on his fellow man physically, but rather financially. Man is so avaricious that every conceivable law regarding has to be passed to protect man from his fellow man regarding money!”

LikeLike

Varoufakis has something else in mind than a Grexit: His latest blog post includes his keynote address and slideshow over his reform proposals, and they don’t include monetary sovereignty, sadly. I think he is underestimating how much his “partners” really want to privatize and possess all Greek assets, turning Greece into a vassal state of the Corporations. http://www.opednews.com/Quicklink/A-Blueprint-for-Greece-s-R-in-General_News-European-Central-Bank_European-Debt-Crisis_European-Stability-Mechanism_European-Union-Fiscal-Treaty-150518-335.html

LikeLike

I think Varoufakis is overcomplicating things with his proposal. There’s no middle ground with EU Intitutions, its either total submisson to austerity on german terms or grexit and open conflict with EU. Perhaps Varoufakis is just buying time to sort out what to do next.

LikeLike

Varoufakis doesn’t want Grexit, Tsipras doesn’t want Grexit, and neither do the Greek people, that’s why they’re not doing it or even threatening it. He made that clear from the start. I think he is a poor negotiator, because he has no option other than a negotiated agreement (no BATNA), and that gives the Troika total power to dictate the terms. If Greece will not exit the Euro, it has no choice but to accept austerity. The idea that the Troika would change the rules just for them, and reach some compromise that ends austerity and keeps Greece in the Euro, is naive.

LikeLike

I agree. Varoufakis, Tsipras and the Greek people don’t want grexit. As such, they they have nothing to threat germany. The EU ruling class has invested too much in the austerity ideology. Even a some small sucess by syriza would cause massive defeats of mainstream parties in germany, austria, etc. Therefore, I belive Syriza and the greek people will have to accept austerity and will be humiliated.

LikeLike

And I thought James Galbraith is one of Tsipiras’ advisers. Does he have any influence at all in the calculus of this Greek drama?

LikeLike

Ironically, it may not be the suicidal monetary non-sovereignty that causes Greece or others finally to leave the euro, but rather, terrorism.

Realization of the fact that terrorists have free rein to travel across borders, may turn nations away from one of the two fundamental reasons for the euro: travel convenience and money convenience.

As Islamic extremist terrorism grows (and it will grow), the European populace will demand that their borders be protected — exactly what the euro was supposed to eliminate.

When European nations finally free themselves from the chains of the euro and the European Union, and take control over their own money supplies, they will have the terrorists to thank.

Now wouldn’t that be something.

LikeLike

Again, emerge by means of emergency.

LikeLike