Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

======================================================================================================================================================================================================

As you know, the federal government has run out of dollars — John Boehner told me — so the government needs to cut spending:

In Congress, Income Inequality Comes With Breakfast, Lunch

AP|By CHARLES BABINGTON and LAURIE KELLMAN, Posted: 05/03/2015Many of the Capitol’s food servers, who make the meals, bus the tables and run the cash registers in the restaurants and carryouts that serve lawmakers, earn less than $11 an hour.

Some make nothing at all when Congress is in recess.

You see, it’s important that the federal government not spend the dollars it has the unlimited ability to create, and what better place to save money than on poor people’s salaries?

Members of the House and Senate collect their $174,000 annual salaries whether Congress is making laws, taking a break or causing a partial government shutdown.

Well . . . ahem . . . not all salaries need to be cut. After all, our Congress has been so effective, we need to reward them with big money, in addition to campaign “contributions” (aka “bribes) and many other perks.

But, lest you think Congress doesn’t know how to be generous:

Both Bailey and Tesfahun (two Capitol servers mentioned in the article) said they once received a pay raise of 3 cents an hour.

It’s too bad the whole thing isn’t handled by private industry, which as everyone knows, not only is more efficient than the government, but more concerned about its employees:

All (Capitol food workers) work for Restaurant Associates, a major New York-based contractor that handles food services for the House and Senate.

The House privatized its food operations decades ago. The Senate ran its own operations, at heavy losses, until 2008. That’s when the then-Democratic majority said taxpayer subsidies were unsustainable, and Restaurant Associates won the contract to take over. (Senators approved the 2008 switch in a voice vote, which any dissenter could have blocked).

Well, that’s just a teensy little lie, because:

1. Taxpayers do not fund federal spending. Unlike state and local governments, the federal government creates dollars ad hoc, simply by paying bills (i.e. sending dollars into the private sector).

2. Thus no federal spending is unsustainable.

3. You hand over spending to the private sector, because you want them to cut spending, which means sending fewer dollars to employees and suppliers — all in the private sector. And you don’t want to be blamed for the abysmal salaries. (That is known as the Pontius Pilate defense — Matthew 27:24)

Anyway, as Republican John Boehner said, “We’re broke.” He meant the federal government, which mysteriously seems to have lost its ability to create its own sovereign currency.

So, being “broke,” the government needs to increase taxes.

Repeal of Estate Tax Rewards Billionaires, Punishes Working Americans

Posted: 04/15/2015Recently, the House voted for a budget that would end tax credits for many working families that put $1,000 a year in their pockets, on average.

The Republican budget also would cut $5 trillion in funding for benefits and services that make groceries, health care and college more affordable, pay for road improvements, and invest in scientific research.

Yes, we’re broke, so obviously we have to stop feeding those “takers.”

House conservatives (also) plan to eliminate the estate tax, which is paid only by multi-millionaires and billionaires.

An estate has to be worth at least $5.4 million before a dime in taxes gets paid. If the estate is passed on by a couple, it has to be worth nearly $11 million.

Well . . . we have to reward those “makers,” who give politicians the big political contributions, don’t we?

Abolishing the estate tax — which only affects the wealthiest two-tenths of one percent of families — will cost $269 billion over the next 10 years.

For $269 billion, we could replenish the fund that maintains our highways and transit systems (164 billion), and let every low- to moderate-income 4-year-old attend a good preschool ($75 billion).

Or, for $269 billion we could send 9 million striving Americans to community college tuition-free at a cost of $60 billion; keep college affordable for millions more by reversing proposed budget cuts to Pell Grants ($89 billion), which help pay for tuition for needy kids; and ensure there’s enough food on the table for children, seniors, veterans and their families by restoring $125 billion in cuts to food stamps made in the Republican budget.

Of course, since the government really does not need tax dollars, it simply could (should) reverse those ill-conceived spending cuts, regardless of tax collections.

And here is the important part:

The estate tax (is) the only federal levy that curbs the growth of huge inherited fortunes.

America thinks of itself as a classless society, but the nation’s richest one-tenth of one percent holds as much wealth as the bottom 90 percent combined, according to a recent academic study. Translation: 120,000 households own as much stuff as 110 million families.

We are not a classless society. America actually is closer to India, with its castes ranging from Brahmins to “untouchables,” than to the “all men are created equal” society we claim.

The single biggest financial problem facing America is the widening Gap between the rich and the rest — a Gap purchased the rich via political contributions (bribery) and by promises of lucrative employment later (more bribery).

They call it the “death tax” to imply every family losing a loved one pays it. But, 99.8 percent of American families are untouched by the estate tax.

Opponents claim families are forced to sell farms and small businesses to pay the tax. In fact, no family farm has ever been sold to pay the estate tax. Of the millions of small businesses and small family farms, only 20 paid any estate tax in 2013, according to the Tax Policy Center.

So the need to cut costs is a lie, and the need to cut taxes on the rich is a lie.

And the voting mopes are stupid enough to fall for the same lies, year after year after year.

How stupid? Very stupid.

And sad.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

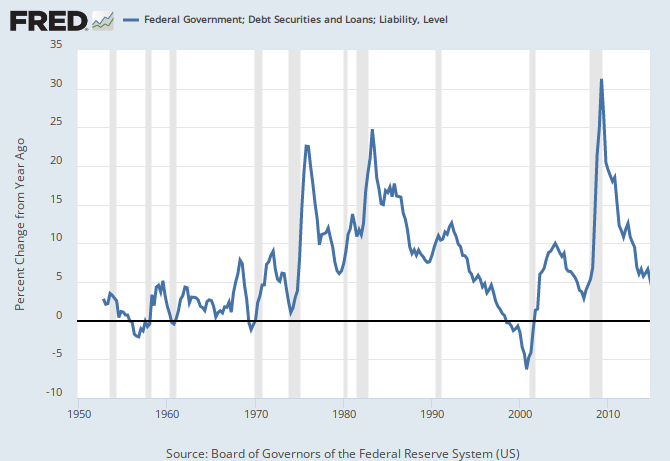

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Meanwhile on today’s Washington Post comment section redneck rubes and stooges are reveling in the Conservative win in the UK election. Wrongly equating that party with Tea/Republicans these cretins are actually pleading for European austerity to be brought here! 25% unemployment, anyone?

LikeLike

August 1997

Alan Greenspan

A Symposium Sponsored By. The Federal Reserve Bank of Kansas City

How about Alan Greenspan? He said [A] government cannot become insolvent with respect to obligations in its own currency. A fiat money system, like the ones we have today, can produce such claims without limit.”

Let me begin with a nation’s sovereign credit rating When there is confidence in the integrity of government, monetary authorities— the central bank and the finance ministry—can issue unlimited claims denominated in their own currencies and can guarantee or stand ready to guarantee the obligations of private issues as they see fit This power has profound implications for both good and ill for our economies .

Central banks can issue currency, a non-interest-bearing claim on the government, effectively without limit They can discount loans and other assets of banks or other private depository institutions, thereby converting potentially illiquid private assets into riskless claims on the government in the form of deposits at the central bank

That all of these claims on government are readily accepted reflects the fact that a government cannot become insolvent with respect to obligations in its own currency A fiat money system, like the ones we have today, can produce such claims without limit .

Alan Greenspan said: (can read entire article see below- Aug1997)

(https://fraser.stlouisfed.org/docs/historical/greenspan/Greenspan_19970800.pdf)

LikeLike

Thanks.

Apparently those who claim the U.S. federal debt and deficit are “unsustainable” weren’t listening.

(Actually, they are paid by the rich, not to listen — or rather to deny.)

LikeLike

Whoa, you been telling us that everyone is lying but now you quote Greenspan acknowledging MS. Things are a lot better than everybody’s lying.

How are you making your 10steps known besides this blog? Do you have meetings with politicians and or economists?

LikeLike

Penny, like everyone else, sometimes Greenspan lies and sometimes he tells the truth.

He undoubtedly knows the truth, so when he doesn’t tell the truth, he lies.

As for the President and Congress, I suspect that the majority know the truth, and since not one of them seems to tell it, they must be lying.

But for those few who do not know the truth, they merely are ignorant, not lying.

O.K.?

I do not have meetings with politicians and economists. I know of a few economists who express the truth. The majority either are ignorant or lying.

Although Monetary Sovereignty is counter-intuitive, it really is quite simple.

So, when it is explained to a person of even moderate intelligence, they easily get it — unless they don’t want to know (a common occurrence).

I rely on folks like you, Randy Wray and Stephanie Kelton to disseminate the truth.

LikeLike

I still remember a segment of Meet The Press several years ago during a round table of notable people, including Greenspan and moderated by David Gregory. They were talking about the national debt and how we are going broke, the national debt clock, etc., when Greenspan blurted out ” We can’t go broke. The USA can create any amount of credit necessary to sustain itself.” David Gregory’s Jaw dropped for 2 seconds and then changed the direction of the conversation.

I can only wonder how many jaws drop and brick walls Kelton and Wray run into every time they try to explain MS to someone with a fancy title, position and high income, i.e., not a member of the choir.

LikeLike