Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

What is your top priority? Getting a better job? Paying off your mortgage and other debts? Sending your kids to college? Better health? Saving for retirement? Being safe from crime?

None of those are top priority for conservatives according to a quick bit of research done by the Washington Times:

Cutting federal spending should be Congress’s top priority: TWT/CPAC poll

Conservatives say reducing federal spending should be the Republican-led Congress’s top priority this session, beating out confrontations with President Obama over his immigration executive actions, Obamacare, and the Keystone XL pipeline, according to The Washington Times/CPAC flash poll at the annual Conservative Political Action Conference.

Thirty-eight percent of the 141 respondents picked reducing federal spending at the top priority, followed by rolling back Mr. Obama’s amnesty plan at 26 percent.

So in addition to cutting federal spending, the other top priority is to get rid of immigrants — the two most worthy goals for the 2015 Congress, in the eyes of conservatives.

Democrats had wanted a bill fully funding the department for the rest of the fiscal year, without language blocking Mr. Obama’s recent actions granting as many as 4 million illegal immigrants legal status and work permits, while conservatives did not like that the immigration language had been stripped.

Twenty-three percent in the poll said Congress’s top priority should be reversing Obamacare, and 13 percent said it should be overriding Mr. Obama’s veto of the Keystone XL oil pipeline.

Did you notice anything about you having a better job, paying off your debts, sending your kids to college, better health, saving for retirement or being safe from crime?

No, all you saw was rich-man’s goals: Getting rid of immigrants, eliminating medical insurance for the poor and giving the Koch brothers their pipeline.

And then, there’s the big one: Cutting spending. Where shall we cut?

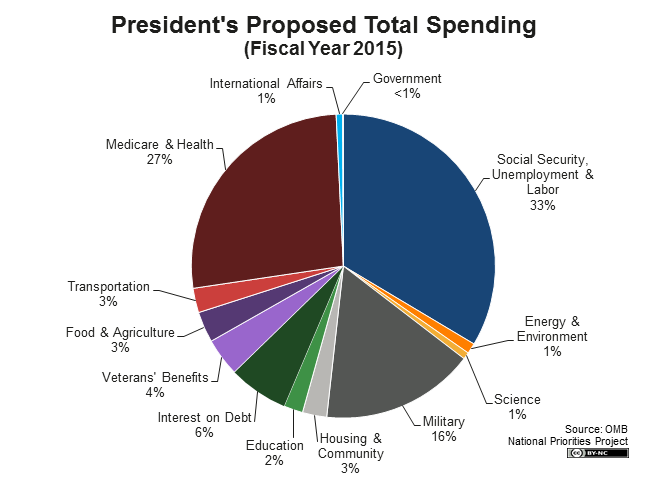

Look at the above graph, and before reading further, you decide what should be cut — and why.

Now, here is what the Koch-supported, right wing Heritage Foundation says:

–65 percent of the cuts proposed are from a single item – capping spending on means-tested programs at 110 percent of pre-recession levels and growing that amount with inflation.

Heritage estimates that this could save $2.7 trillion over the next decade.

Heritage does not provide any details about which programs to cut, leaving it up to “policymakers to direct welfare spending to the areas of greatest priority.”

“Means-tested programs” is the Heritage way of referring to any programs that benefit the lower- and middle-income groups. Conservatives resent dollars given to the poor and middle. (Ironic, since most conservative voters are among the 99% poor and middle income.)

As for dollars to the rich (i.e. Keystone pipe, low tax rates on capital gains, etc.), those are fine and should not be limited — according to the conservatives.

–Limiting Highway Trust Fund spending to existing revenue would result in about $180 billion in savings. Since transportation spending would be reduced, “states or private sector [could] take over the other activities if they value them.“

“If they value” roads?

And of course the monetarily non-sovereign states are so flush with dollars, it’s a great (read, “stupid”) idea to relieve our Monetarily Sovereign federal government from this obligation at lay it on the struggling states.

By the way: As a state and local taxpayer, you do pay for state and local government spending, but as a federal taxpayer, you do not pay for federal government spending.

The federal government creates its sovereign dollars ad hoc, by spending. The state an local governments cannot create dollars.

So every dollar of expense shifted from the federal government to state and local governments, is an extra dollar of taxes you must pay.

–Repealing the Davis-Bacon Act would reduce spending by $86 billion over the next ten years, by Heritage’s estimate. The Act requires federally funded construction projects to pay “prevailing wages” based on the project’s location.

In other words, Heritage wants the federal government to pay you less than private industry does. Why? No one knows. It’s just a way to cut the federal budget and widen the Gap between the rich and the rest.

—Ending Supplementary Security Income (SSI) benefits for children would save $125 billion. Heritage would instead direct SSI toward disabled adults and seniors.

Hmmm . . . let’s see. Seniors vote, but kids don’t. So let’s cut benefits to kids and give those benefits to seniors. What a concept!

-Other proposals would end Head Start, higher education programs, and job training programs, resulting in $170 billion in education and training services cuts.

Yes, that’s another “great” idea: Cut spending for education and training. After all, rich people don’t use those programs. And anyway, America is so special, we don’t need education and training.

Let’s cut to the bottom line:

1. Our Monetarily Sovereign federal government has the unlimited ability to pay debts denominated in its own sovereign currency. Even if all federal taxes fell to $0, the federal government could continue spending forever.

Federal taxes do not pay for federal spending.

Our monetarily non-sovereign state and local governments do not have the unlimited ability to pay their debts. They must use tax or export dollars.

So every dollar of federal expenses transferred to the state and local governments, results in net tax increases for you.

2. The vast majority of federal spending benefits the 99% more than the 1%. So naturally, the 1% wants to cut federal spending. That’s how they increase the Gap between the rich and the rest.

From the standpoint of the average American, there is not a single good reason to cut federal spending, and lot of bad ones.

Is it any wonder that Republicans want to cut federal spending and add to your tax bill?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Ignorance is bliss for politicians. But Democrats also cannot “get” that federal governments don’t tax for revenue. Clearly “bliss” is wilful because some MUST know how mistaken their notions are. How can all the politicians be so in the dark. Clearly this line, as you point out ,is just fine and dandy for them and their sponsors.

We have an identical situation here in Australia, just not quite so extreme.

LikeLike

Lol,

Your situation is actually more extreme, way more. The people there haven’t felt it in years past because of Chinese growth and hunger for your metals. That’s now in the rear view mirror.

I am willing to bet that what you see as our problem and your blessing will quickly become our blessing and your problem.

The US is ready for Rand Paul.

LikeLike

Oops let me take that back. Your government is in trouble, nobody wants austerity and you won’t get anything but…

http://www.couriermail.com.au/news/queensland/surat-basin-towns-are-dying-the-death-of-a-thousand-cuts-as-miners-leave-in-droves/story-fnn8dlfs-1227243110588

LikeLike

Interesting.

There are over 95% of us private industry workers and your reason for defending prevailing wages is that public employees will get paid less than those in the private industry?

So 5% of the population that gets special treatment represents “the poor” to you? How about letting them compete for wages like we do?

LikeLike

Sorry. You’re right. Federal workers should be paid less than private workers because . . . uh . . . .well . . . uh . . . because they’re federal workers.

Makes sense to me.

LikeLike

Wh don’t you say the truth first, that..uhh…welll….uhh… they are getting paid much more and have been for ages.

What will happen is they will get equal pay. Is equal now a dirty word for liberals?

LikeLike

Then what is your objection to the “prevailing wage” law?

LikeLike

It’s the opposite of an open free market, equality, etc… those contractor get paid higher rates than those in the open market. That’s the small part.

The large part is that projects cost a lot more than they should because this law sets a floor. Imagine if you were trying to hire someone and you had to disclose the prevailing wage? Clearly, the employer (gov, aka the people) have the cards all open for the contractors to see. It’s a criminal law.

LikeLike

In what universe is “prevailing wage” special treatment? Thats literally the definition of matching private sector wages. The govt needs to match CA private sector wages for Govt employees in CA and the Govt needs to match AL private sector wages for Govt employees in AL.

What policy could be more sensible?

LikeLike

In what world? Your understanding of this law is wrong.

In the private world a company needing work done puts out details of the projects and contractors bid for it, and they can bid any price, including lower than previously paid wages. The company NEVER discloses what is has paid in the past.

Davis Bacon forces the government to put out the prices previously paid for the project along with the details. It basically sets a floor on what the government pays. This is the main reason it’s extremely costly to repair the infrastructure.

You think this is “sensible”?

LikeLike

There is a direct correlation between wage levels and productivity — well-trained workers produce more value per hour than poorly trained, low-wage workers.

“For example, a study of 10 states where nearly half of all highway and

bridge work in the U.S. is done showed that when high wage workers

were paid double that of low-wage workers, they built 74.4 more miles

of roadbed and 32.8 more miles of bridges for $557 million less”

Click to access DavisBacon%20Q&A.pdf

LikeLike

Taking this one step further, imagine what the reaction would be if a national dividend was a reality. (Step#3) People would not shirk or turn to drugs. They would be very appreciative and want to return the favor somehow according to their ability. Volunteerism would be rampant.

A system that gives will I’d BET succeed far faster than one that takes (taxes/interest/inflation). Malthusian scarcity, phony shortages, and targeted inflation by the FED are all on the wrong track.

If you want to see an unprecedented economic success, self control, and a huge reduction in crime, simply allow a system of “giving” to the disrespected, disconnected masses to become part of the general landscape as much as tax breaks, loopholes and bail outs are for the well-connected, well-respected, well-endowed rich.

LikeLike