Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes. .

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●Austerity is the government’s method for widening the gap between rich and poor.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Everything in economics devolves to motive, and the motive is the Gap.

==================================================================================================================================================================

Can you afford to live? Can the federal government afford you to live? Should America have a “Medicare for Everyone” program?

The following article appeared in the January-February issue of AARP Bulletin:

How Do You Pay for a $1,200 Pill?

Specialty drugs can mean miracles and heartbreak

By Bill HoganSue Trevor (has a) disabling form of psoriasis. “The pharmacist called to let me know my Stelara was ready. She said, ‘I wanted to let you know that you now have a copay.’ It was $1,578 for each injection, four times a year.”

Trevor was able to pay for only one treatment, and that was with financial help from a nonprofit group.

Since then, here share has increased to $2,728 per injection.

Can Sue Trevor afford to live?

By giving new hope to patients with cancer, hepatitis C, multiple sclerosis, Parkinson’s disease, psoriasis and rheumatoid arthritis, to name a few, specialty drugs are the Rolls-Royces of the pharmaceutical industry.

But these drugs come with costs to match. Solaris, for instance, which treats two life-threatening blood diseases, costs $440,000 per year.

Can our Monetarily Sovereign federal government afford to pay for such drugs?

Right wing budget cutters will tell you, “No,” and that people should be self-sufficient, and not be takers, who receive federal help.

Leigh Purvis, director of health services research at the AARP Public Policy Institute says, “There are lots of great new medications out there, but the sad fact is that many of them are so expensive that consumers may not be able to afford them.”

A key factor driving up health care costs (is) specialty drugs. Nineteen of the 28 drugs approved by the FDA were specialty drugs, the third year in a row that specialty drugs accounted for the majority of approvals.

John Rother, president and CEO of the National Coalition on Health Care, warns of “a tsunami of expensive medicines that could literally bankrupt the health care system.”

Really?? Bankrupt the U.S. government, which being Monetarily Sovereign, creates unlimited dollars ad hoc, simply by paying bills?

Sovaldi, a medication that’s been shown to cure about 90% of common cases of hepatitis C, which, if left untreated, can lead to liver damage, cirrhosis, liver cancer and death.

A typical 12-week regimen costs $84,000.

An estimated 3.2 million Americans are infected, 75% of them boomers.

So, debt hawks, what shall we do about these Americans? Tell them to be self-sufficient, because our Monetarily Sovereign government refuses to pay?

How insurance plans arrive at prices for prescription medicine is hugely complicated. Drugmakers set a sticker price and insurers bargain over the price.

Plans organize covered drugs by tiers. A generic drug might require a flat $10 copayment. But a drug in the fourth or fifth tier — the specialty tier — might require patients to pay as much as 33% of the cost.

For Medicare Part D, 95% of all plans had at least one drug in the specialty tier.

Unlike Medicaid and Veterans Affairs, Medicare is forbidden by law from using its strength in numbers to negotiate lower prices. Instead, negotiations are left to private insurance companies, which which drugs to offer and prices and cost sharing rules.

Think about that. The law prevents Medicare even from negotiating. The payers decide what to pay, based on profitability.

If Medicare Part D were a single-payer (government) plan (Part D for everyone), profitability and affordability would not be considerations. More people could have relief from their suffering, plus longer lives.

But it gets even worse:

While Part D enrollees can accept drugs provided at no cost by their manufacturers, Medicare bars manufacturers from offering any kind of co-pay assistance or other financial help.

In the United States, our so-called “1st world country,” being sick, while not being rich, can mean a lifetime of preventable misery or even a death sentence.

Why? Because the debt hawks tell you to be self-sufficient and not to accept help from the government. They tell the Big Lie that our Monetarily Sovereign government could run short of its own sovereign currency, the dollar.

And you believe it!

And its not just medicine. Another AARP article says:

Millions of older Americans rely on community-based programs funded by the Older Americans Act, created 50 years ago to help people live independently as they age.

It funds nutrition services (including Meals on Wheels), caregiver support, transportation and a host of other services for vulnerable older Americans.

But congress has been unable to reach an agreement on reauthorizing this important law.

To the debt hawks, the suffering of actual people is not a problem; the problem is the federal deficit.

Why? No one knows. For a Monetarily Sovereign nation, deficits are absolutely necessary for economic growth. The deficit cutters won’t tell you that. They want to cut what makes the economy grow.

And the beat goes on:

Where’s the War on Alzheimer’s?

As research funding lags, cases are increasing — with staggering costs.

By. T. R. ReidThe most expensive disease in america is devouring federal and state health care budgets, and depleting the life savings of millions of victims and their families.

Recent studies show that the cost of caring for Americans with Alzheimer’s disease and other dementias has surpassed the cost of treatment for cancer patients or victims of heart disease.

“If we don’t get some control over this disease, says Huntington Potter, a neurobiologist at the U. of Colorado School of Medicine, “its going to bankrupt both Medicare and Medicaid.”

No, these federal agencies cannot be bankrupted. But real, live Americans are being bankrupted by Alzheimer’s disease (not to mention the horrors of the disease, itself.)

The disease is costly, and the ignorance about federal financing is even more costly.

Washington has committed some $5.4 billion this fiscal year to cancer research, about $1.2 billion to heart disease and $3 billion to HIV/AIDS. Research funding for Alzheimer’s will reach just $566 million.

The disease can linger for years or decades. That makes the cost, both for government insurance programs and for families, extremely high.

Our Monetarily Sovereign federal government can afford the cost, and never go bankrupt, but doesn’t pay it. The bitter irony: Families cannot afford the cost, and do go bankrupt, while trying to pay it.

Ah, the list goes on and on — things the federal government can and should fund, to improve our lives, but won’t do because of the Big Lie that the federal government “can’t afford it.”

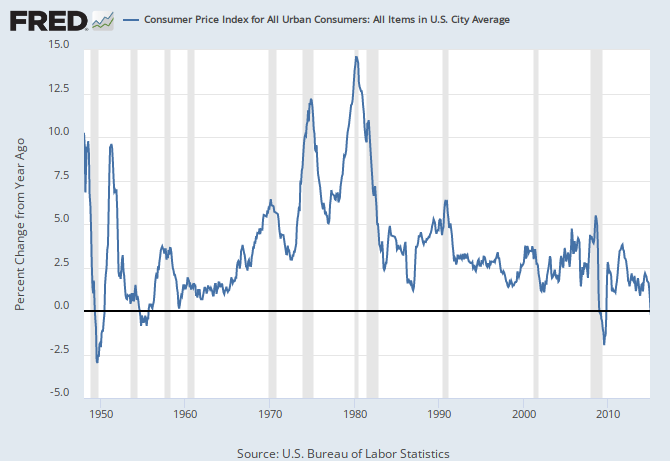

And right about now, I hear the wailing, the crying and the moaning about “inflation,” and not just inflation but “hyper-inflation,” as the names “Weimar, Zimbabwe, Argentina” come spilling out.

Never mind that though people are suffering and dying right now, today, from lack of federal assistance, while America never, in its history has had hyper-inflation.

And never mind that the Fed controls inflation quite well, simply by controlling interest rates.

And never mind that there has been no relationship between federal spending and inflation, but rather the relationship has been with oil prices. See: “Oil causes inflation.”

And never mind that despite those “terrible” deficits, we are sinking into deflation, which most economists say is more devastating than inflation.

The Risk Of Deflation In America Is Rapidly Escalating

WALTER KURTZ, JAN. 11, 2015, 2:10 PMUnlike a number of other nations — especially some countries in Europe — the US is currently not dealing with general price declines. However, the risks of such an occurrence have increased materially.

This for example can be seen in the intermediate-term market-based inflation expectations, which have fallen to 2009 levels — when deflation was a serious concern.

One key data point supporting these rising risks came from last Friday’s jobs report. The report showed wage growth falling from a fairly stable level of 2% per annum. In particular, “production and nonsupervisory employees” saw a sharp decline in wage growth — in spite of robust growth in payrolls.

Translation: There has been a big increase in low pay jobs. The Gap is widening.

Bottom line:

1. The federal government needs to spend more on health R&D and on health care.

2. Federal “affordability” is not an issue. People’s affordability is the issue.

3. The “threat” of possible inflation is way overblown, especially as compared with the reality of human suffering.

4. The “world leader” should provide a federally funded, fully funded (no deductibles) Medicare Parts A, B and D, plus home and nursing care, for all Americans.

It’s not what the rich want, but it’s what the 99% need, if we are to be able to afford to live.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

The Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Federally funded, free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually. (Refer to this.)

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

Initiating The Ten Steps sequentially will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

1. A growing economy requires a growing supply of dollars (GDP=Federal Spending + Non-federal Spending + Net Exports)

2. All deficit spending grows the supply of dollars

3. The limit to federal deficit spending is an inflation that cannot be cured with interest rate control.

4. The limit to non-federal deficit spending is the ability to borrow.

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

No, because there is no such thing as free. In fact, it will probably coat 3 times as much.

LikeLike

It truly is sad that you are completely ignorant of Monetary Sovereignty. But that is O.K. What is not O.K is that you have no desire to learn.

So, goodbye.

LikeLike

I think people that rail against your free lunch idea have way too many negative ideas about government especially when it comes to providing services. The post office and hospitals for veterans etc.

Fox news claims that government regulation of the internet will stifle innovation and service will suffer.

The thought of nationalizing banks is way too much for them to handle.

LikeLike

penny, you make good points.

In most cases, my preference is that the government financially support individuals, who in turn will support private industry. (Check the Ten Steps to Prosperity)

My opinion (emphasis on “opinion”) is that certain industries should be run by the government. Banking is one. Utilities are another. The postal service is another.

Private, for-profit banks and utilities provide no benefits to the public.

The post office could be excellent if it were not hamstrung by a Congress and President who repeatedly cut its funding. The post office accepts assignments at lower cost than can be self-funding — as it should. So it needs far more government funding than it receives.

As for FOX “news,” what can one say? This is the worst news organization since Hearst. To say that FOX habitually lies is to say that rats love garbage.

An unregulated Internet, would charge the “common man” a fortune for use, while the wealthy would pay nothing — exactly what FOX wants.

(The Internet actually has too little government support and direction, which is why the U.S. has the slowest Internet on the planet.)

The people who believe what FOX “news” says will believe Emails that begin, “I am the prince of Nigeria.” FOX, and those who work for FOX, are a disgrace to journalism.

LikeLike

If banks are nationalized and funding the private sector.

how would that work without creating a cronie capitalism?I guess we have that now in the form of lobbies.

LikeLike

Hmmm . . . crony capitalism. Is that when thousand of bankers all over the country make millions or billions lying, cheating and stealing and not one is even prosecuted, let alone convicted of anything?

Is that what you mean by crony capitalism?

LikeLike

I have commented several times on this forum that the Federal Govt should fund all legitimate medical charities (ie, the V-foundation) to the point where they do not need to fundraise. Some criticisms and my responses:

Q) How do you determine that threshhold? It won’t be easy, but would require inspectors.

Q) How will it get paid for? That’s an easy one. Just read this blog.

Q) Would it be inflationary? It is possible that the increased velocity of money would result in competition for labor, higher wages, and inflation. In a country of excess capacity, this is not likely, but it is possible. But think of the deflationary force when for example, cures or prevention of cancer come about. Less doctors, nurses, hospices, etc. As noted in this blog post, diseases have a huge cost. That cost would decline.

Q) Why not extend this concept to non-medical charities, such as one for underprivileged youth. Great idea. There would need to be inspections to determine the threshholds and prevent fraud.

I am aware that this is easier said than done. For example, is there enough labor out there from which to draw from (ie, inspectors)? I believe so. But let’s have the conversation. Perhaps even a vote. Both rich and poor would benefit from increased medical research. Instead, we will continue to see ads for Cancer charities asking for donations. “We could cure cancer, if only we had the dollars” …if only.

LikeLike

Interesting idea. I’d have to think about that one. The IRS provides some criteria for charity legitimacy.

Many business provide matching funds or even double and triple matching funds, when their employees give to charity.

I wonder what would happen if the federal government gave matching funds for donations to charity.

LikeLike

Roger, do you have any comment on this article about Mark Blyth’s book,” Austerity: The History of a Dangerous Idea”, posted on Salon, recently? Sorry I am unable to cut and paste the URL. It appears many of the things we talk about are mentioned in Mr. Blyth’s comments.

LikeLike

…also Paul Krugman has a article in the New York Times today speaking about the subject. Any comment?

LikeLike

Robert, the article is kind of, sort of O.K., but it misses the big point:

Austerity is necessary for monetarily non-sovereign entities (euro nations, businesses, local governments, you and me.)

Austerity is foolish for Monetarily Sovereign governments (U.S., Canada, UK, China, Australia et al).

Because austerity widens the Gap between the rich and the rest (It affects the rich less than the rest), the rich favor it.

The rich control governments. That is why governments favor it. That is why both the Democrats and especially the Republicans favor it.

LikeLike

And the euro is the dumbest idea yet. Why create an entity that never needs to be repaid and then demand repayment plus interest

LikeLike

Yes, indeed. Why would any nation voluntarily surrender the single, most valuable asset any nation could have: Monetary Sovereignty?

If you were Monetarily Sovereign over the dollar, and had the unlimited ability to pay any bill denominated in dollars, would you voluntarily say, “I don’t want that power. I want to be dominated by a bunch of foreigners, who will demand that I live in poverty”?

That’s the euro nations.

LikeLike