Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●Liberals think the purpose of government is to protect the poor and powerless from the rich and powerful. Conservatives think the purpose of government is to protect the rich and powerful from the poor and powerless.

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

The euro nations are dying. There is one word to describe the reason: Austerity.

Actually, there are two words to describe the reason: Monetary non-sovereignty.

Here are some data.

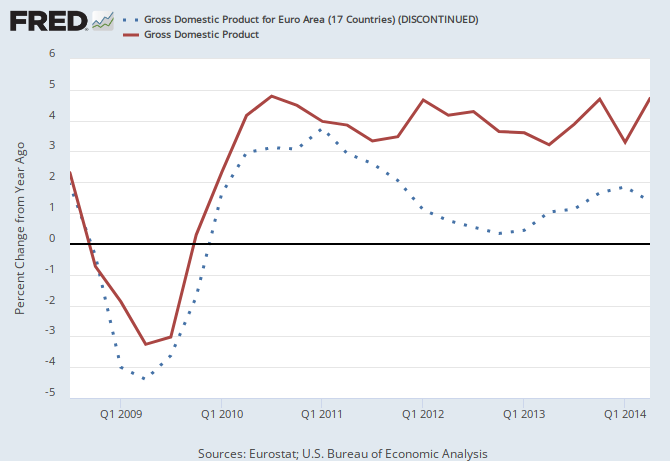

The solid maroon line represents quarterly U.S. growth in Gross Domestic Product (GDP). The dotted blue line represents quarterly euro nation GDP growth.

Every single quarter, since the great recession, the euro nations’ GDP growth rate has been lower than the U.S. growth rate.

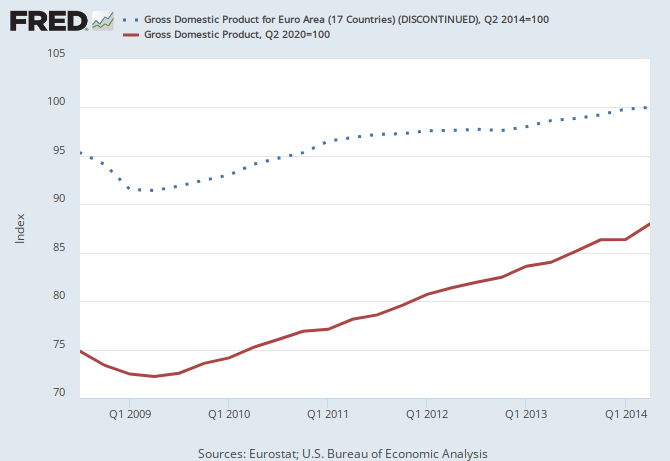

Here is another way to look at the same basic data:

From the recession, through the 2nd quarter ofn 2014, U.S. GDP is up about 18% while the euro area is up only about 6%.

Unfortunately, despite being Monetarily Sovereign and having total control over its own sovereign currency, the U.S. also has been practicing some form of unnecessary and harmful austerity (though thankfully, less so than the euro nations).

The U.S. limited its federal deficit spending via sequestration (i.e. the “fiscal cliff”), partly through tax increases (especially the notorious FICA tax) and reduced federal spending.

Additionally, the so-called “debt ceiling” (which was not a ceiling on debt, but rather a ceiling on payment for already existing debt), forced unnecessary budget reductions.

(In reality, payment for federal debt requires no additional dollars; it merely requires the transfer of existing dollars from T-security accounts to checking accounts. But this fact is ignored by those who welcome austerity.)

Because deficit cutting (austerity) always impacts GDP negatively, you will not be surprised by this article:

Factory Prices Tumble in Europe as German Manufacturing Shrinks Before ECB

Bloomberg By Alessandro SpecialeEuro-area factories cut prices in September by the most in more than a year and German manufacturing shrank, underlining the mounting challenge facing Mario Draghi.

The European Central Bank president is on a mission to avert deflation as the euro region’s economic landscape deteriorates. Purchasing Managers’ Indexes from Markit Economics showed manufacturing also contracted in France, Austria and Greece, with a gauge for the 18-nation region pointing to near-stagnation.

A separate report showed spillover to the U.K., with factory growth there at a 17-month low.

(Though the UK is Monetarily Sovereign, having retained the British pound, it not only acts as though it were monetarily non-sovereign by adopting austerity, but its economy is affected by the economies of its neighbors.)

The euro not only is a disaster, not only a predictable disaster, but a predicted disaster.

(“Because of the Euro, no euro nation can control its own money supply. The Euro is the worst economic idea since the recession-era, Smoot-Hawley Tariff. The economies of European nations are doomed by the euro.” RMM June, 2005)

As the euro area’s economic weakness spreads to countries in the region’s core, the ECB will face increased scrutiny tomorrow when it unveils details of an asset-purchase plan.

The fresh round of stimulus comes against a backdrop of weak inflation and stuttering growth, with geopolitical uncertainty and high unemployment weighing on confidence and demand.

It will be interesting to see who will purchase assets and which assets they will purchase. The EU itself, being Monetarily Sovereign, has the unlimited ability to supply euros to member nations. And it should do so.

Instead, it has be asking for quid pro quo, either by lending (and demanding repayment) or by asset purchases (i.e. asset takeaways), both of which impoverish the nations that are in need of help.

The EU neither needs, nor should ask for, quid pro quo. It merely should give euros to nations as needed.

It is very hard to put any positive spin” on the data, said Howard Archer, chief European economist at IHS Global Insight in London. “Clutching at straws, the best that can be said is that it indicates that the manufacturing sector is still growing.”

Euro-area manufacturing expanded at the slowest pace in 14 months, according to today’s report. The gauge stood at 50.3 in September, just above the 50 mark that divides expansion from contraction, and below a preliminary estimate of 50.5.

Europe is dying, and it either is a murder by Europe’s leaders or a suicide by Europe’s masses.

Europe’s leaders, being owned by the upper .1% income/wealth/power group murder the euro nations with austerity. Because deficit cuts always affect the poor and middle more than the rich, austerity widens the Gap between the rich and the rest.

The rich wish to widen the Gap, for it is the Gap than makes them rich. (If there were no gap, no one would be rich, and the wider the Gap, the richer they are.)

Europe’s masses, having been brainwashed by the rich-owned media, the rich-owned politicians and the rich-owned university economists, commit suicide by accepting the euro as beneficial.

Meanwhile, the euro nations voluntarily have surrendered the single most valuable any nation can have: Monetary sovereignty. They have lost control over their money. So, the euro, by its very nature, requires austerity.

Europe is dying a slow painful death — painful to the lower 99%, while the rich prosper.

The only question: Is it a murder by the rich or is it a suicide by the rest?

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here and here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Addemdum: The beat goes on.

Make that, the beat-DOWN goes on.

LikeLike

The Euro is not a disaster because it prohibits money creation… unless you are a delusional liberal of course. In that case, everything is resolved with more spending. The issue is actually the SPENDING.

In the real world, the reason why the Euro is a disaster and will never work is because the nations under the Euro are different. The people believe in different things. The Germans tend to be much more conservative, with higher savings rates while the French, Italians and Spaniards are a bunch of liberal lunatics.

How can Germans survive next to the French? There is only one single way to the Euro, FORCE. Just like Scottish were forced to remain part of the UK and the Catalans are also being forced to stay within Spain. The only way is for one nation to take over the others. For the sake of innocent people, it would be much better if it is taken over by a nation leaning to the right – the Germans. The French, Spaniards, Italians will destroy whatever little is left of the Euro economies.

There are 2 major kind of philosophies in the world, 1) one that believes that it is hard work that will propel a nation to the next level – the US of the 1940s – 1960s. The US is still leaning to the right when compared to most nations, but far from what it was in those years. Then, there is the other kind, 2) the one that thinks that by simply being born they are entitled to a full live free of worries, no need to work, no need to lift a finger – the government will take care of me.

It is easy to see why the majority of the world will pick number 2. Go look at the nations with the larger poverty rates and most likely they will be full of liberal policies – politicians promising to give everything to the people. Of course, when the people get their wish – everyone stops working and an even bigger poverty will result. France, UK, Italy, Spain – all were once the most powerful (thanks to the labor from conquered nations) in the world and turned to almost third world nations (once they lost the ability to tax conquered nations).

Rodger, the formula to prosperity is not so difficult to figure out. Let’s stop dreaming of unicorns pooping candy and get to work. This nonsense is nauseating.

LikeLike

I agree with your very last sentence. Nothing else.

So, please provide evidence for ” . . . the nations with the larger poverty rates and most likely (are) full of liberal policies . . . “.

On second thought, please provide data to support anything you have written.

The “the US of the 1940s – 1960s” which you so admire, was dominated by the liberal social agenda of liberal Franklin Roosevelt and liberal Harry Truman. Even Republican Eisenhower continued the liberal New Deal and the liberal Fair Deal.

Apparently, you admire those liberal programs.

Anyway, please remember to refuse liberal Social Security and liberal Medicare; do not accept FDIC if your bank goes bust; don’t drive on government built highways; and buy all your prescription drugs from a 3rd world nation. The drugs will be cheaper, though not federally inspected.

Don’t read that nutrition label on your foods; it was demanded by those liberals in the federal government. But do pollute the air and water, because those anti-pollution people are liberals.

When you get fired from you job, absolutely refuse unemployment compensation instigated by liberals.

Finally, be grateful that the rich can spend as much as they wish, to buy politicians. It’s what the conservatives want, isn’t it?

How sad that you believe poor people deserve their poverty, because they are lazy. As you said, “The nonsense is nauseating.”

I agree.

LikeLike

What a bunch of crap…

I should not have made the 1940s – 1960s a topic on this conversation, but the US was alot more conservative in those times than it is today – by a long shot. Yes, there were many social programs introduced by Roosevelt and Truman – but these had nothing to do with those booms. What did cause the booms was the destruction in the region, forcing production capacity to move to the US and also caused a brain drain in Europe. Irrespective of policy, that shift is what caused the boom times here. The liberal policies likely slowed it down.

You talk of social security and medicare as great things – I’d take you on a bet that if we were to remove them tomorrow – the population as a whole would benefit. Simply because the prices sold to government agencies are cooked – while the prices sold to people will not. Everyone pays for those inflated prices. Why do you think an aspirin at a hospital costs $40k? There is your damn proof…

I will refuse unemployment compensation up to the point that I paid into it. All else you can keep it. I have 2 hands and feet and can hold my own – irrespective of how much I’m earning. And I bet I maintain a larger family than most folks reading your blog.

How moronic is this statement: “Finally, be grateful that the rich can spend as much as they wish, to buy politicians. It’s what the conservatives want, isn’t it?”

Isn’t it the majority that put politicians in power? If you are pretending to protect the poor by pushing these liberal ideas, than you are making it easy for politicians to implement policies that benefit the wealthy. Welfare? Social Security? Medicare? Unemployment benefits?

Well, Rodger, who are the people that own the food supply chains? Who owns the medical industry Rodger? Who owns the industry as a whole?

At the end of the day, the savings from the middle class is what is taken to “help” the poor – which in reality is nothing else but a gift to the rich. The middle class gets trashed while the rich get richer.

I will go on a limb and say that you are neither part of the poor nor middle class. Because if you were, you would not be pushing this garbage.

LikeLike

Oh, so your one great example — the 1940s – 1960s — turns out to be, as you so gently put it, “a bunch of crap”?

And, you still have not produced one speck of evidence for your strange ideas?

And then you drift off on a tangent that talks about the wealthy, as though it wasn’t the conservatives who favor the rich.

And according to you, welfare, Social Security, Medicare, Unemployment benefits are “policies that benefit the rich”?

How truly sad, and as always, a confused, crazed “bunch of crap.”

LikeLike

Evidence Rodger?

Who benefits from more people buying in supermarkets? Is it the middle class or the rich? Who benefits from more people buying anything? In today’s world, with welfare, medicare, social security, etc… the rich are the ones driving the businesses making the money from the additional sales. If you still need proof of that, than perhaps you should leave your computer and drive around your neighborhood for a change.

And to you, these programs are “good”. You cannot have a middle class, and have these programs in place – and you know it. This is what has killed and continues to kill the middle class. If you don’t have the opportunity to own a business that caters to the folks on these programs, you are set – of course – unlike me, you have to be rich.

You are past the time where your incomes means eating, clothing, housing and caring for yourself. I am not, and to me and a host of middle class people out there, these programs are not “good”, they destroy us. The “good” and right thing to do is ask the middle class if they want to help the poor by paying taxes. If the proposition passes, than let the taxing begin. Otherwise, ALL these programs should be funded with tax dollars.

The outcome of your “monetary sovereignty” solution is easy to spot, you help the middle class by dissolving the incomes of middle class workers. As I keep repeating, the poor get helped (and many are not even poor and are defrauding the rest) and the rich get richer. Monetary sovereignty is not “free”. Monetary sovereignty does equal fraud at large.

I guess some cannot see fraud even if it was hitting them with a totem pole.

LikeLike

Got it. Helping the middle class with Social Security and Medicare actually hurts the middle class. Also, war is peace, up is down and black is white. Perfectly clear.

LikeLike

That reminds me of a column I read which chronicles how the government improves a person’s life during an ordinary day:

http://governmentisgood.com/articles.php?aid=1

Even the hardcore libertarians are happy with many of these government functions, though they won’t admit it.

LikeLike

Good article, and though it gives many examples of government benefits, it only touches the surface. Of course, the libertarians are clueless about this — except when some service is missing. Then they raise holy hell.

LikeLike

This Week In Crazy

LikeLike

@RMM: Is it a good idea to sell my stock index funds holding european stocks because of the euro problems?

LikeLike

Stock prices are based on guesses about the future. If you know something the rest of the world doesn’t know, and that knowledge will affect the price of the stock, you can act on that knowledge.

But the world knows, and long has known, what is happening to the euro nations.

Further, individual companies react differently to news about nations. For example, bankruptcy attorneys must have done quite well during the great recession.

Bottom line: I have no special, advance knowledge, and I suspect you don’t either. So the shorthand answer to your question is, “I don’t know.”

Personally, I like SCHD, which is described this way: “The investment seeks to track as closely as possible, before fees and expenses, the total return of the Dow Jones U.S. Dividend 100 Index. The fund invests at least 90% of its net assets in stocks that are included in the index. The index is designed to measure the performance of high dividend yielding stocks issued by U.S. companies that have a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.”

Very low expenses and free trading.

But then again, it could drop like a stone. Or not. 🙂

That help?

LikeLike

@RMM: I’m curious to find out what happened to company stocks in foreign countries like Weimar Germany and Argentina when they had currency problems in the past.

LikeLike