Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

There are many arguments, pro and con, regarding an increase in the minimum wage — so many arguments that ’till now, I’ve been reluctant to engage.

Those in favor of raising the minimum wage believe: It’s only logical. If you raise the minimum wage, the Gap between the rich and the rest will narrow; fewer people will require poverty aids, people will spend more, and the entire economy will benefit.

Those opposed to raising the minimum wage believe: It’s only logical. If you raise the minimum wage, employers will be encouraged to find ways to reduce the number of low-wage jobs. These tend to be low-skill jobs, the easiest jobs to replace with automation or by combining multiple jobs. So, raising the minimum wage will cause more unemployment.

There may be no convincing answer — at least no answer that can convince both sides — but here is some interesting data:

Bottom line: Employment decreases may result from many factors, but raising the minimum wage does not seem to be one of them. On balance the states that raised the minimum wage had a higher employment increase than those that did not.

That said, raising the minimum wage may not be the best way to help the lowest-paid group.

Employment decreases generally are associated with a bad economy. But, raising the minimum wage adds no dollars to the economy, so does little to stimulate economic growth.

The best way to help the low-wage worker is to institute the “10 Steps to Prosperity.”

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)The Ten Steps will add dollars to the economy, stimulate the economy, and narrow the income/wealth/power Gap between the rich and the rest.

——————————————————————————————————————————————

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

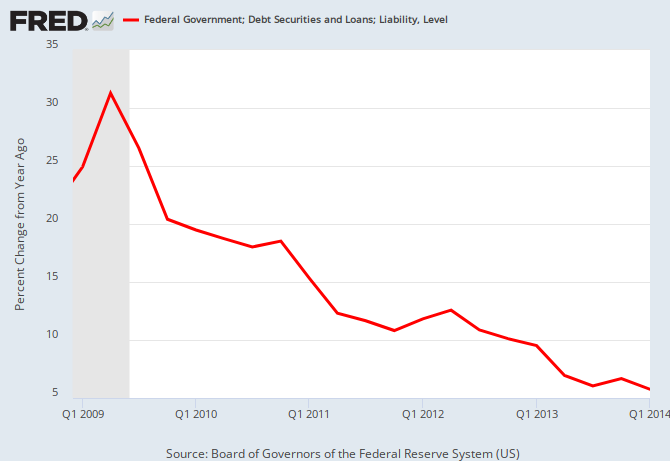

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net ImportsTHE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Without taking sides, I would throw this out there for discussion: those who argue that an increase in the minimum wage will not increase unemployment (with the facts shown here to support that argument) are only demonstrating that it’s true when the MW is increased as it historically has been, i.e., roughly 10-15%. There is no data to support that same argument when a 50%-plus increase in the MW is instituted, because that’s never happened.

I posit that in ultra-low inflationary times, when companies have so little pricing power, the proposed 50% to 100% increase would in fact create more unemployment. The employer must add not only the added per-hour wage, but also extra FICA and Medicare costs to the equation, another 7.65%.

Further, many small company employees, as well as private school school teachers, have base rates of pay based on the minimum wage: say, 3-4 times what the MW currently pays. This forces the employers to raise the base pay from perhaps $24/hr to $36/hr, which would likely discourage new hiring and may, in turn, force layoffs.

Just my own ideas, Rodger, but you often present compelling and convincing arguments to the contrary that I haven’t considered, so I’d welcome your thoughts.

LikeLike

I saw a Venn diagram the other day. The left circle was the set of people who believe a carbon tax will reduce carbon emissions. The right circle was the set of people who believe that raising the minimum wage will have no effect on employment of minimum-wage workers.

The intersection was very large, and was labeled something along the lines of “people who see no need for intellectual consistency”. There was a small dot in it labeled “Paul Krugman”.

There is a strong economic argument that raising the price of (almost) anything will reduce the demand for it. A few things become more desirable to a few people when their price is very high, but for most goods and services that we can take or leave, that have economically viable substitutes, the elasticity of demand is between 0 and 1.

Any other arguments seem to be based on an appeal to morality, rather than science.

You are correct, of course, that the best thing for low-wage workers and no-wage wannabe workers is an increase in aggregate demand.

And, of course, there are unintended consequences. The city of SeaTac raised the minimum wage for some workers to $15 this past January 1. The latest news on the results still says there is no hard economic data to go on, but the anecdotal evidence is that minimum wage workers are disappointed. They have higher cash wages, but they have lost non-cash benefits like free parking, free meals (many of those affected are restaurant workers), overtime hours, 401(k) matching, and health insurance (many are part-timers, and some were reduced to part time).

The 0.1% should not be expected to just take it lying down. A minimum wage increase by itself would reduce the gap. Reactions by the 0.1% may be more than enough to offset that effect.

SeaTac is a small community with easy access to services outside its borders. Businesses who absorb the cost increase and raise prices may find themselves at a disadvantage vis a vis their non-SeaTac nearby competitors. On a national level the price increases may stick, except in industries that have foreign competition.

Seattle just passed a law to raise the minimum to $15 gradually, starting in 2017. That will provide some more data that may be more relevant to judging the effect of a nationwide increase, if we can wait that long.

LikeLike

Rodger I have told my congressman that raising the minimum wage will put more dollars in the economy. You say” raising the minimum wage adds no dollars to the economy.” So I guess I’m missing something so any help appreciated .

My thinking: assume “business” raises wages by X. Assuming these wages are spent, Consumption will increase by X which will increase GDP by X.

Corporate profits will not decline because both their costs and revenues have increased by X, leaving profits unchanged (as the Kalecki equation would indicate).

I realize that increasing the minimum wage does not involve deficit spending nor an increase in lending activity – both of which increase the money supply but, as said, I don’t see what I am missing.

Thanks much for any of your time.

LikeLike

Business and employees are both part of the private sector. Wages represent a transfer of dollars from business checking accounts to personal checking accounts.

Unfortunately, employees must pay income taxes on that transfer, and those tax dollars disappear from the economy.

From a money supply standpoint, a business is no different from an individual. Both spend dollars and both are monetarily non-sovereign

LikeLike

According to S. Kelton at UMKC, the hike in the minimum wage is a currency “usage” that will put more dollars not in the economy but in peoples’ accounts. The Fed on the other hand “issues” (Creates) dollars and therefore net increases the money supply. Usage revolves the dollars and issuance evolves or grows the economy.

LikeLike

. . . put more dollars not in the economy but in people’s accounts.” Peoples accounts ARE the economy. So are business accounts. It’s a simple transfer. But yes, a transfer merely moves dollars while issuance grows the dollar supply.

LikeLike

But businesses also pay taxes on their net profits, usually at a higher rate than their employees. Transfer of net income from employers to employees via a wage increase would tend to reduce total income taxes, not increase them. A single person whose only income is one minimum wage job pays no income taxes, and may even receive net income tax credits. Employment taxes would increase, however. The net, whether positive or negative, is a second order effect and minuscule compared to the normal fluctuations in the economy.

LikeLike

Business do many things with their incomee, mostly at zero or low tax rates.

And don’t forget about FICA.

LikeLike

If the wage increase transfers money from business profits to employee salaries, lowering the gap, business income taxes decrease.

Yes, any money the business spends is generally not taxed as income, only the profits (revenues – costs) are taxed by the income tax.

I didn’t forget about FICA, I mentioned it above. Altogether, the increase in FICA, the increase in personal income taxes, and the decrease in business income taxes net out to something insignificant. The decrease in business income taxes is larger than either of the other two, probably larger than both combined.

But, as seen in SeaTac, business won’t stand still for just the wage increase. It will cut non-wage labor costs to try to maintain profits and competitiveness.

LikeLike

“Consumption will increase by X which will increase GDP by X. Corporate profits will not decline because both their costs and revenues have increased by X”

If you’re saying that business revenue increases by X, the amount of the wage increase, then won’t business costs increase by X + Y, where Y is the cost of other inputs needed to produce the additional goods and services (increased GDP)? Then business profits must drop.

This is totally possible, and reasonable, that increased wages would result in a shift of income from employers to employees, and if the employees have a higher marginal propensity to consume, also likely, that real GDP would also increase.

If, instead, businesses raise prices to recover the $X, then business profits and real GDP remain unchanged.

LikeLike

Got it. Once taxes enter the picture, the horizontal money transfer becomes a net negative. Thanks!

LikeLike

Golfer1John my understanding is that when wages increase, then if they are spent, they become a corporate revenue. Hence, at the macro level, both revenues and costs go up by the same amount, leaving profits unchanged.

(As Rodger points out, taxes complicate the picture so its not quite this simple). However, to your point, the costs of the other inputs are also revenues to those supplying the inputs So, in the absence of taxes, it all washes out. That is, in general, one entity’s cost is another entity’s revenue. So if I buy a shovel at Home Depot with my higher wages, Home Depot makes a profit much smaller than my higher wages.. But all the suppliers and links in the chain down to those supplying the raw materials for the shovel also increase their revenue and make a profit. That is, my higher wages spent flow down further than to just Home Depot. In the end, my higher wages spent result in higher revenues and unchanged profits at the overall level (ex assumptions about taxes). This is all explained by the Kalecki equation. The LevyForecast also has a white paper (available for free) called “Where Profits Come From” – which also explains all this in detail. Hope helpful.

LikeLike

“Raising the minimum wage adds no dollars to the economy.” True enough, but distribution effects are something, aren’t they?

LikeLike

Yes, if they persist. Our tax code has a variety of incentives for employers to offer fringe benefits in lieu of wages. The benefits are deductible to the corporation, but not taxable to the employee. What costs the corporation $100 in wages benefits the low-wage employee only about $75, but $100 in free food or free parking or child care benefits the employee by $100. Maybe more, if the corporation can get a volume discount.

In SeaTac, employers faced with higher wage costs reduced those other benefits, trying to maintain sales and profits, and offsetting the distribution effects of the higher wage.

Employers will offer employees what they need to offer in order to attract the employees they need, and no more. Requiring a higher wage doesn’t change that balance. Only a change of economic conditions can force employers to pay more for the same labor.

LikeLike

Golferjohn, fine, if the employers want to take away x dollars of benefits for y dollars in wage increases, no problem as long as y is greater than x. But what I was really thinking of was economic effects of inequality and how they might be reduced by minimum wage laws. I’m thinking of things like propensity to save and velocity of money. I need to do much more work to really make this point, but I think inequality past a certain point is hurting the economy. We really need a broad based economy for optimal economic health. And then on top of that, there are the social effects that in my view also argue for pushback against economic inequality.

LikeLike

Inequality is not going to go away, no matter what you do. Some are always going to study harder or work harder or smarter and have more income than others, even if you could confiscate all the wealth and distribute it equally. It would stay equal for about a millisecond.

What hurts economic and social health is the absolute level of income of the lowest income workers, including far too many with no income. JG would lift them to, if not a “living wage” at least a level where they could be productive participants in the economy. There would be no need for the current version of minimum wage, the floor would be set by JG.

LikeLike

All those supplying the raw materials increase their revenues, but they also increase their costs. Real goods don’t appear for free.

It seems you’re describing some sort of multiplier, where $1 of wages results in ($1 in this example) of revenue to Home Depot, and 90 cents of costs to HD which is also 90 cents of revenue to the shovel company, which also has 81 cents of cost for steel and wood, which is 81 cents of revenue to the lumber mill and the steel factory, etc., etc until there is a total of $10 of extra spending (or maybe $9, I’m too lazy to do the math now) and the same amount of costs.

But GDP is only final sales. Shovel GDP goes up by one shovel, but the source of the $1 for that shovel loses $1 of profits (which is distributed among HD, the shovel company, the lumber mill, etc.). If that was $1 that the business owner would have spent on a new shovel and he no longer can spend it, then shovel GDP goes down by the 1 shovel that he didn’t buy, offsetting the shovel that the employee bought, and it’s a wash. No extra shovels need to be produced, one is simply sold to a different consumer.

If the business owner who pays the higher wage reduces his savings instead of his spending, then GDP goes up by one shovel, but that can happen without a wage increase. It’s still just a transfer of income from one entity to another in the same sector.

LikeLike

Golfer1John thanks for taking the time to think about and comment. I agree, its just a transfer of income. .Regarding the “shovel, etc” I wasn’t talking about multiplier effects – just the allocation of the higher spending (from the higher wages) to profits among the various entities. Regarding your comment: ” All those supplying the raw materials increase their revenues, but they also increase their costs”. That’s true but, again, these costs (let’s say they were wages for the person chopping down the tree which provided the wood for the handle on the shovel, etc) also become revenues (when the lumberjack spends his wages). So it goes around and around. I may even be confused at this point! But, in general, I think it is correct to say that one business’s costs are another business’s revenues – so that “costs” have little to do with profits at the macro level (obviously not true at the micro level)..

Consider a closed economy where we all work for the same company and buy the company’s products as well. If we spend all of our wages, it should be clear that the company’s revenues are equal to our wages and there is no room for profits. And this will be true regardless of our wages. Consequently, profits come from “outside” dollar flows – investment from borrowing or prior savings and/or deficits of the consumer, government and foreign counties (the latter net exports). As noted previously, the LevyForecast has a paper which explains all this better than I can.

In economics, the “Kalecki identity” provides the specific calculation for after-tax profits. In this identity, spending relative to wages matters – not the level of wages per se. Thanks.

LikeLike

In your closed economy, the factory owner’s income is called “profit”. He’s not a worker, in Kalecki, he is the capitalist. He also cannot save, or else the economy would not consume the full output of the factory, and there would be unemployment. His spending of the profit is necessary for the simple closed economy to remain stable. In fact, the Kalecki equation (one form, at least) specifies that his profit must be equal to his spending. I would add that it cannot be zero, or his family would starve and he’d lose interest in running the factory.

What comes from outside dollar flows is net financial assets, not profits. They are necessary to offset the leakages due to savings, imports, and taxes.

LikeLike

Peter Cooper on why you cannot predict if raising the minimum wage will destroy or create jobs:

http://heteconomist.com/raise-the-minimum-wage/

The partial-equilibrium argument goes something like “If wages increase, firms won’t want to hire as many workers – the ‘marginal’ units of labor – because they’ve become more expensive.”

One flaw in this reasoning is that it ignores the interdependency between wages and demand, or between product markets and labor markets. Firms in aggregate will produce any level of output for which there is effective demand. So the question becomes, will a rise in wages reduce the overall level of effective demand?

Well, on theoretical grounds, there is no way of knowing the effect of an increase in wages on overall demand, and hence production and aggregate employment. Will a redistribution of income away from capitalists towards workers lead to higher overall demand or less? There is no obvious answer. It is likely that consumption demand will increase. Investment demand could go either way. It will be encouraged by the strength in consumption demand, but discouraged by the reduced profit margins implied by the wage increase. Overall, the effect on aggregate demand is ambiguous.

This means that the question of the effect of wage changes on employment becomes an empirical one. Here, as both Krugman and Romer point out, the evidence is overwhelmingly against the story told to students in introductory economics courses. Both cite a recent paper entitled, “Why Does the Minimum Wage Have No Discernible Effect on Employment?”, which pretty much gives the game away.

From the conclusion:

Economists have conducted hundreds of studies of the employment impact of the minimum wage. Summarizing those studies is a daunting task, but two recent meta-studies analyzing the research conducted since the early 1990s concludes that the minimum wage has little or no discernible effect on the employment prospects of low-wage workers.

LikeLike

The problem with “studies” of real-world systems is that too many variables are uncontrolled. As Rodger’s charts shows, if you raise the minimum wage, sometimes the economy goes up and sometimes it goes down, depending on who knows what other factors. And if you don’t change it, sometimes it goes up and sometimes it goes down.

SeaTac may be different, because the increase was so large, and because the city is so small and open. The large wage change is more likely to have a discernible influence among all the uncontrolled changes that may occur, and the effects will not be damped by difficulties of substituting other resources from remote areas.

LikeLike

Bill Mitchell on the effect of raising the minimum wage:

http://bilbo.economicoutlook.net/blog/?p=1010

Many academic studies have sought to establish the empirical veracity of the neoclassical relationship between unemployment and real wages and to evaluate the effectiveness of active labour market program spending. This has been a particularly European and English obsession. There has been a bevy of research material coming out of the OECD itself, the European Central Bank, various national agencies such as the Centraal Planning Bureau in the Netherlands, in addition to academic studies. The overwhelming conclusion to be drawn from this literature is that there is no conclusion. These various econometric studies, which have constructed their analyses in ways that are most favourable to finding the null that the orthodox line of reasoning (that wage rises destroy jobs) is valid, provide no consensus view as Baker et al (2004) show convincingly.

In my view, minimum wage setting has nothing to do with cyclical stimulus policies. It has everything to do with how sophisticated you consider your nation to be. Minimum wages define the lowest standard of wage income that you want to tolerate. In any country it should be the lowest wage you consider acceptable for business to operate at. Capacity to pay considerations then have to be conditioned by these social objectives.

If small businesses or any businesses for that matter consider they do not have the “capacity to pay” that wage, then a sophisticated society will say that these businesses are not suitable to operate in their economy. Firms would have to restructure by investment to raise their productivity levels sufficient to have the capacity to pay or disappear. The outcome is that the economy pushes productivity growth up and increases standards of living.

No worker should be paid below what is considered the lowest tolerable standard of living just because low wage-low productivity operator wants to produce in a country.

LikeLike

“No worker should be paid below what is considered the lowest tolerable standard of living”

That would work if the min wage law could somehow be applied only to “breadwinner” workers.

There are others in the labor force that are working for reasons other than that they need the cash to support their standard of living. The obvious example is teenagers living with their parents and working part-time. There is no need for them to have an income of $30K a year. Some workers are more interested in the non-cash compensation, for which they gladly trade some of the cash compensation.

JG solves the problem. With a “living wage” job available to anyone who wants it, there is no need to prohibit freely entered contracts between workers and employers at any level of cash compensation.

LikeLike

There’s another factor you didn’t consider. The difference between the current minimum wage and a living wage is picked up by the government now. Even leaving aside the idea that the government, being monetarily sovereign, can spend whatever it takes to make up that portion of insufficient wages, this is hardly Free Market capitalism. Without these subsidies, Walmart, McDonald’s and a host of other large companies that pay below living wages, would be exposed as the inefficient operations they truly are. They may SEEM efficient when measured by things like items sold or hamburgers made, but the fact is, they cannot afford their payroll without subsidies, the very definition of inefficiency.

Perhaps some of these chain stores need to close. Perhaps we need more of the supposedly inefficient local stores that actually paid living wages.

In any case, we don’t know, because of the indirect subsidies.

A higher minimum wage would put everyone on the same level, enable competition, and let the market work as it’s supposed to.

LikeLike