Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

The U.S. dollar is both the lifeblood and the measure of our economy. Gross Domestic Product (GDP) is a dollar measure. The equation, GDP = Federal Spending + Non-federal Spending + Net Exports is a dollar measure.

Federal government deficit spending (Spending – Taxing) adds dollars to the economy, which helps grow the economy. The euro nations have had difficulty recovering from the Great Recession, because they practice a more extreme form of austerity (reduced deficits) than does the U.S.

Five years ago, this blog published “The low interest rate/GDP growth fallacy.” Here are a few excerpts:

The Fed raises interest rates to fight inflation. To fight recession, the Fed does the opposite. It cuts interest rates.

This may sound logical except for one, very small detail. The opposite of inflation is not recession. The opposite of inflation is deflation. So doing the opposite of what you would do to counter inflation makes no sense when trying to counter a recession.

We could have a recession with deflation. We could have a recession with inflation, which is called “stagflation.” The history of Fed rate cuts, as a way to stimulate the economy, is not a good one.

Declining interest rates correspond with declining GDP.Why does popular faith hold that cutting interest rates stimulates the economy? Because popular faith views only one side of the equation. But, for each dollar borrowed a dollar is lent. $B = $L.

Cutting interest rates does cost borrowers less. A business might be more likely to borrow if interest rates are low than when they are high. Further, consumers buying on terms are more likely to buy when borrowing is less costly.

But, when interest rates are low, lenders receive less money. And who are the lenders? Businesses and consumers.

You are a lender when you buy a CD or a T-bond, or put money into your savings account. When interest rates are low, you receive less money, which means you have less money to spend on goods and service — which means less stimulus for the economy.

The Fed has not learned from experience, but stubbornly adheres to the popular faith that interest rate cuts stimulate the economy.

I urge you to read that 2009 post before continuing. It serves as background for the article I saw today:

Yellen: Job-Market Shifts Complicate Interest Rate Decision

The Associated PressFederal Reserve Chair Janet Yellen’s remarks to an annual Fed conference in Jackson Hole, Wyoming, offered no signal that she’s altered her view that the economy still needs Fed support from ultra-low interest rates.

Yellen repeated language the Fed has used at its last meeting that record-low short-term rates will likely remain appropriate for a “considerable time” after the Fed stops buying bonds to keep long-term rates down. The Fed’s bond buying is set to end this fall.

The Fed chair noted that while the unemployment rate has steadily declined, other gauges of the job market have been harder to evaluate and may reflect continued weakness. These include high levels of people who have been unemployed for more than six months, many people working part time who would like full-time jobs and weak pay growth.

Translation: The patient has been suffering from anemia since 2008. We’ve been drawing his blood and applying leaches, but still he has anemia. The only solution is to keep bleeding the patient with leeches.

This false belief about low interest rates, along with Congress’s ongoing campaign to reduce federal deficit spending (aka “austerity,”) which also limits money supply growth) has been responsible for our current economic troubles.

The moral of the story, according to the Fed, is: If something does not work, never has worked and never can work, keep doing it, again and again and again. Never admit you were wrong in the first place.

Just keep drawing blood out of the economy, and hoping that in some unknown way, its current anemia magically will cure.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

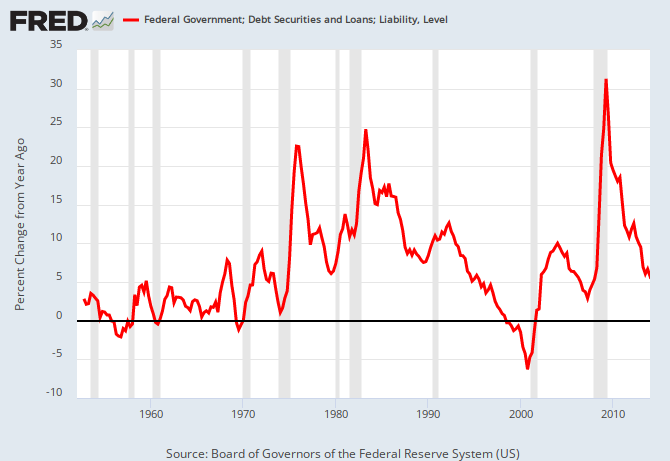

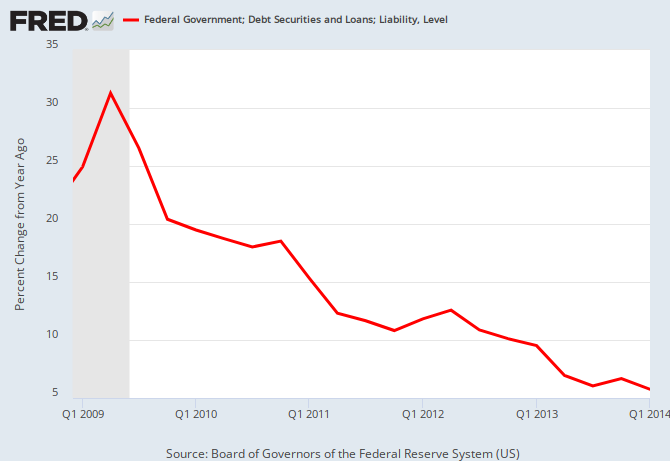

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

Succinct yet brilliant.

LikeLike

Europe is NOT having issues recovering because it’s practicing austerity…. It’s not recovering because it increased taxes to continue to spend on the programs that got politicians elected. The politicians are strangling the same people they profess to help. Where the hell is the austerity Rodger?

Given all the money printing in the US, the US is still pretty much in recession. Are you surprised? The exact reason we are in a recession is because of the same money printing.

Japan went through years and years of the same, they fell into recession, increased taxes to combat the lower revenues, increased money printing, and 30 years later – they are still in the same boat.

Are humans so stupid that they can’t figure this out with years and years of proof in their faces? I mean – come on.. People are becoming so stupid that they are asking the Fed to devalue more of their money away – look at the morons in Jackson Hole. Ridiculous…

Keep your printing going, the more you ask for it, the worst you will be. The more you ask for it, the more poverty we will have. The more destitute, the more sick, the more hungry – to the point that the system WILL again crash like in 2008.

Your analogy is completely backwards – QE, deficit spending, etc.. are the leeches.A growing economy needs CAPITAL – not pieces of paper. You, out of every one out there ought to know that.

LikeLike

” . . . it increased taxes. . . .”

That’s what’s called “austerity.”

Considering our low rate of inflation, it’s difficult to see how, “the more you ask for it, the more poverty we will have.”

But, you’re right. Clearly, some humans are “so stupid that they can’t figure this out.”

LikeLike

I see,

There must be millions of definions, heck, every single person has their own.

Last time i checked, it meant decrease in government spending. But i think i got it, you are ok if the government increases spending by means of fraud and counterfeiting, you are not if the government gets the funds via non fraudalant ways, like taxes.

Thats what i thought you would say…

LikeLike

No, there are not millions of definitions. Better check again.

LikeLike

Hey Rodger,

If the amount of outstanding Tsecurities was 300% of GDP or $50 Trillion, with today’s $17T GDP, do you think that increasing Federal spending by $500B for every 1% increase in the FFR would be anti-inflationary?

In other words which force would be more powerful…

the inflationary force of $500 billion in additional money to the private sector

or

the deflationary force of a 1% increase in interest rates?

LikeLike

Since $500 billions is a relative drop in the bucket, I suppose one might say that a 1% increase might have a greater effect.

But these things don’t operate in a vacuum. Inflation has a wide range of causes, including: Oil pumping and prices, employment, unemployment, wage levels, the Gap, wars, the female work force, party control over Washington, and on and on.

Each one of those causes is touched by interest rates and spending rates differently, in a complex array.

Bottom line: I don’t know the answer to your question.

What I do know however is that interest rates are easily changed, quickly, in small increments and without Congressional endless infighting, as compared with spending changes.

So, to fight inflation, I suggest adjusting interest rates rather than trying to adjust spending levels.

LikeLike

Let me help please.

Any amount of deficit creation is inherently inflationary. The reason we never see inflation is because we have been con’ed into thinking that inflation has to do with prices. It doesnt…

Inflation is equal to the increase in money and credit in the system, it manofests on different ways. Unlike prices, the result of something happening, an increase in the supply of money and credit is the happening.

If you still want to talk prices, if prices go up 2.5% a year and the average salary does not go up that is inflation and its what has been happening. If you compound that 2.5% over 15 years, you’ll see what i mean.

LikeLike

You’re quoting the Austrian “money supply inflation” vs. “price inflation,” definitions.

Anyone using those definitions never should use the word “inflation” alone, but always should say “money supply inflation” or “price inflation,” lest there be confusion.

It is possible to have money supply inflation without price inflation, and it is possible to have price inflation without money supply inflation.

Japan, for instance, has had money supply inflation, but has suffered deflation.

Without that sort of specificity, “inflation” always is understood to mean a general increase in prices.

Your salary example is just plain wrong.

LikeLike

Math is Libertarian – gotcha…

Japan has had credit growth – followed by bouts of inflation and deflation. That’s what should happen in a credit based economy.

“Japan, for instance, has had money supply inflation, but has suffered deflation.”

Money supply inflation = inflation.

Here are the facts: Japan’s debt to GDP is off the charts, Japanese are getting pretty old and the smaller younger Japanese population don’t want kids because they can’t afford them. You go figure out how a tiny part of the population will support an ever larger older population.All this money printing didn’t help Rodger?

The Japanese people have been hollowed out – there are no savings and just wait until inflation gets out of control. Whatever happens in Japan is what we should be looking forward to – and I bet it won’t be pretty. I bet you will immediately distance yourself from Japan.

LikeLike

“Money supply inflation = inflation”

So, when people complain about inflation, they really are complaining about the increase in money supply, not the increase in prices???

There were periods when the money supply increased massively, but inflation increased marginally. So was “inflation” high or low?

“You go figure out how a tiny part of the population will support an ever larger older population.”

If ever you begin to learn Monetary Sovereignty, you will have the answer to your question.

But since you seem to have no desire to learn Monetary Sovereignty, you will have to live in ignorance.

LikeLike

Any amount of deficit creation is inherently inflationary. The reason we never see inflation is because we have been con’ed into thinking that inflation has to do with prices. It doesnt…

Inflation is equal to the increase in money and credit in the system, it manifests on different ways

This is just pointless arguing over definitions. Why on earth would anyone care about what you are calling “inflation”? What people care about is “price inflation”. If you want, I would always use that term. The thing is that MMT people understand where you are coming from – but also that your monetary theory and accounting is just plain wrong, because you are trying to understand things too fast. If you tried to understand money slowwwwlllly and carefully, you would understand that MMT (MS) is obviously correct, and other theories of money are crazy (and cause price-inflation :- ) )..

If any increase in the deficit is inherently inflationary – and inflation is inherently evil and should be prevented. (I have sympathy for this. Inflation is not a good thing)

Then since deficit spending is the only possible source of any money creation, then money itself is evil, and should be banned.

So your view is that the human race should get rid of money. Many on the left including Marx, have had similar utopian ideas. Perhaps they and the libertarian right should rethink their ideas about money from the beginning and do it in a more realistic way? Money is here to stay. Why not try to understand it?

LikeLike

Calgacus,

I’m not trying to understand too fast – I’ve spent years reading and analyzing the subject. The majority of people have no clue about money and I accept that will be the case until I’m no longer around and way beyond.

There is only one single group that has been completely ignored, the Austrians. The Austrians have it right with the exception that some can’t tell the difference between money and credit.

There is no such a thing as MMT, only a bunch of charlatans trying to devise an explanation as to why they are entitled to a “free luch”. When confronted, they are fast to call you names – or change to the topic, because in the end they know there is no free lunch.

What is wrong with this logic? “If any increase in the deficit is inherently inflationary – and inflation is inherently evil and should be prevented. (I have sympathy for this. Inflation is not a good thing) Then since deficit spending is the only possible source of any money creation, then money itself is evil, and should be banned.” Calgacus

Money should not be banned – fractional reserve banking and fiat money should be banned for a simple reason, and you are well aware of it. If the government made counterfeiting illegal, than why are they allowed to counterfeit? You don’t think there is a good reason why they made it illegal, don’t you?

So the issue is not that there shouldn’t be money, the issue is that counterfeiting is illegal, so says the government – and I think we all know why. Just like a counterfeiting is not helping the economy (but stealing from currency holders) when you and I do it, neither does it help the economy when the government does it.

LikeLike

I agree that people should not call you or anybody else names. But there is nothing wrong with my reductio ad absurdum of your logic. Your views do imply that money should be abolished. Money comes from deficit spending. There is no other source of money, and never was. There is no other kind of money than “fiat money” , no kind of money that is not credit, no kind of money that is not “counterfeit”. You are going too fast and not analyzing things in sufficient detail if you think otherwise. MMT thinking is a simpler and more general theory, that contains the baroque but inadequate and incorrect theories of money that you have absorbed. Tell me another kind of money, or another source of money, and I’ll tell you precisely how it is a kind of fiat money deriving from somebody’s deficit spending.

Gold is not money and never was used as money.It is just relatively worthless metal. Thinking it can be money is nuts – it is like thinking that wedding rings can BE “marriages”. Money is like a marriage, an abstract relationship. Gold, paper money whatever is like a marriage certificate or a wedding ring, at best a physical symbol of an abstract social relationship. People here are quite familiar with Austrian economics, which is far from the worst out there. Unlike the Austrians, the mainstream is “not even wrong” – it is just incoherent babble. And MMT is in a way even descended from Austrian economics.

We have gone around this a few times already, all I ask for now is whether you agree that the human mind CAN comprehend abstract interpersonal, social relationships like marriage, like kinship.

Then why not look at money in the same light, and see where the thought leads?

LikeLike

Calgacus,

Your “reductio ad absurdum” is misguided, but I can see where we diverge. We see “money” as different things. Let’s say for a minute that I agree with you in that all money is credit (which I don’t).Now let’s say that in order for there to be money, the government creates it out of thin air and introduce it into the economy by “purchasing” some good and service.

If the government gave you a million bucks for a project – can you clarify who owns this “money”? Do you own that money? Or does the bank (bank A) where you deposit it own it? Or perhaps is bank B who borrow the funds from bank A? Or perhaps me, that borrowed that money from bank B?

Can 10 people have a ownership claim against the same “money”? Is this not fraud? So no – all money is not credit. Most money in our economic system is credit, but not all.

With regards to MMT being “simpler and more general” – MMT’s first focus is how giving money away helps the poor and the economy. This is completely backwards.. Do you start building a home from the top down or from the outside in? Do you make the house look pretty in the outside before you figure what to do with the foundation? Economists could come up with theories that are wrong in the end, that’s understandable if the research is focused on the foundations of the economy, as opposed to an agenda. Start at the foundation and work your way up – nobody knows the foundations of MMT and nobody ever will for the simple reason that it is not a theory – it’s an agenda.

MMT is not remotely close to Austrian economics. You will never see an Austrian advocating for “giving” people money, ever…MMT is more like Keynesian economics, and Keynesian economics is what rules the world today. Keynesians think they can control everything around them from interest rates to the money supply to the stock market to home prices, just name it. MMT, Keynesian economics, Marxism, Socialism, Communism, are all forms of anti-free market theories. They all wan to control the markets. And then they wonder why we are in the dire straights we are currently in.

When you say gold, blah is not a currency – I had to laugh. Seriously. Who are you to decide what money is and is not? Society will decide what is money and what is not money. Why don’t you ask Maduro whether gold is money – I’m sure he could use some just about now. He’s getting a free crash course on why not to mess too much with the free markets.

http://www.bloomberg.com/news/2014-08-28/venezuela-s-black-market-bolivar-slides-to-record-low.html

Finally, you ask for people to look at MMT and see where it leads. Have you not seen Keynesyan economics and where it has led? Here is one for you – why not try something different – something like letting people earn their money and keep it. Why not try letting the market set the value of money (interest rates), and dictate the money supply? That’s what Austrians advocate for, MMT is anti free markets.

LikeLike

If the government gave you a million bucks for a project – can you clarify who owns this “money”? Do you own that money? Or does the bank (bank A) where you deposit it own it? Or perhaps is bank B who borrow the funds from bank A? Or perhaps me, that borrowed that money from bank B?

Can 10 people have a ownership claim against the same “money”? Is this not fraud? So no – all money is not credit. Most money in our economic system is credit, but not all.

As I said, you are going very fast. Answering such a long comment sufficiently would take pages.

Government gives you $1M. You own the money = government credit.When you deposit the $1M at bank A, bank A owns the original 1M, which the government now owes Bank A, while Bank A owes you $1M – you have a bank account = bank money = old-fashioned BankA – notes = bank debt to you. When bank B borrows the original $1M, bank B now owns the government money, while it owes a debt of $1M to bank A. Nobody is claiming ownership of the “same” money. There is always a unique owner of the government money. There is no fraud, and it does not prove that there is non-credit money, an oxymoron. It is ALL credit.

MMT’s first focus is how giving money away helps the poor and the economy. NO. MMT’s focus is on DOING THE ACCOUNTING RIGHT. There is nothing to MMT but accounting. Disagreeing with MMT = disagreeing with accounting. There is nothing but “foundation” to MMT. And its foundation is very clear and simple. Money is credit = debt. Credit/debt is a social relationship. The human mind really can and does understand such “social relationships”. Once you really understand that 3 word foundation / axiom, everything else becomes obvious and simple, like 2+ 2 = 4. Like a fully mature mathematical/scientific/philosophical theory, it is completely and utterly trivial and simple.

To give a merely practical argument – Keynesian economics (= MMT more or less) was spectacularly successful and led to the greatest prosperity the world has ever seen. The more Keynesian the country’s policies was, the more successful. This is just a fact. It is uncomfortable to today’s neoliberal politicians and academic charlatans, but they can only mangle and distort statistics a bit. What they mainly do is just never mention this fact. They hope that people – like you unfortunately, I think – are just too young or forget or don’t have an urge to look at old economic statistics. Unfortunately this fraud basically succeeds.

LikeLike

Yes, the austrian/libertarians use a double definition of “inflation” to confuse. Since “everyone” hates inflation, by defining inflation as an increase in the money supply, they can get everyone to hate an increase in the money supply.

They are about as devious as one can get, and it’s impossible to have a rational argument with libertarians. Fundamentally, they are anarchists, with absolutely zero evidence to back up any claims.

LikeLike

Meanwhile, Jared Bernstein wanted to dethrone the dollar king :

LikeLike

A trade deficit removes dollars from an economy. This is a problem for monetarily non-sovereign governments. It is not a problem for Monetarily Sovereign government, which easily can create more of their own sovereign currency.

Meanwhile, the cheapening of foreign money, which makes imports cheaper, also helps prevent American inflation, despite large deficits.

LikeLike

Can you explain how that works. How do dollars leave the economy via trade deficits?

Can you hold dollars in Euros – while still keeping dollars? Can you hold dollars in Yen while still holding dollars? So where do these dollars go when corporations trade between nations?

LikeLike

When you buy from (for instance) a coat made in China, you send your dollars to China and they send you a coat.

LikeLike

Adding to Rodger’s answer: the Chinese company then holds those US dollars in a US bank, in what’s known as a Reserve Account. It’s exactly like a checking account. From there, they can do one of four things: leave the funds in reserve earning nothing, sell those US dollars for another currency at market rates, buy American goods (our exports), or or shift them to a savings account called a US Treasury. Most often, they choose the Treasury option. They currently are storing about $1.3 trillion (that’s money you and I gave them in return for cheap Chinese products) in their savings accounts in US banks. At such time as they decide they want to get rid of those T-bonds by selling them, the bank will shift those funds from their savings account back into their checking (Reserve) account, along with any accrued interest (which they credit out of thin air via computer keystroke), and await further instructions. “Debt” paid, no problem.

LikeLike

Everyone knows that, where does China deposit the dollars?

LikeLike

See my response above for the answer to your question.

LikeLike

Thanks John,

That’s what I was thinking too – I agree with you on all but one. Here is what you said Chinese companies can do.

1) Hold dollars in US bank.

2) Sell dollars to someone else for local currency. This means the dollars will be sold to someone that will deposit the dollars in a US bank.

3) Buy American goods. This means they will sell the dollars to someone in the US who will deposit the money in a US bank again.

4) Buy US Treasury bonds. This means they will trade the dollars for bonds and the dollars will be transferred to someone else that will deposit the dollars in a US bank.

So in all the cases you outlined, the dollars remain within the US banking system and economy. All the Chinese dollars (and all dollars) are being lent and re-lent as we speak. Dollars never leave the economy!

You end by saying that the Chinese are holding 1.3 trillion in bonds. Guess what – that $1.3 has been lent and re-lent times over and so has all the other money deposited in the banking system. This is what Calgacus and a few others fail to see. It’s why no bank in the world could sustain withdrawals of over 20% without going bankrupt. It’s essentially legalized fraud. And to think some people want even more fraud.

I disagree with you on the keystroke item – but we can leave that for another time.

LikeLike

Understanding that all federal spending is done only via keystroke is vital to knowing how our monetary system works. I suppose you can disagree with me that it’s done that way (if that’s what you were saying) but that doesn’t make it any less true.

I’m not sure what you mean by a “Chinese dollar”…? If you’re referring to dollars that China holds, then you’re incorrect that they’re being “lent and re-lent.” Again, I don’t know what that means. All money that’s held in Treasury accounts remains where it is, untouched and un-lent by anyone. The federal government does not remove the money from your savings account (or mine or China’s or anyone’s) and give it to someone else. They have no need for or use for your money; they make their own.

LikeLike

Sorry,

As usual, you’ve overlooked something: The trillions of dollars held in foreign banks.

Hmmm . . . now how did they get there?

LikeLike