Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Today, Philip Pilkington, one of the chosen few who understands Monetary Sovereignty, published a marvelous article, Taxation, Government Spending, the National Debt and MMT that appeared in the Naked Capitalism blog.

I’ll give you a few excerpts, but I urge you to click the link and read the article in its entirety.

. . . .an absolutely fascinating piece of writing called ‘Taxes For Revenue Are Obsolete,’ was written in 1945 by Beardsley Ruml, the director of the New York Federal Reserve Bank from 1937-1947. He also worked on issues of taxation at the Treasury during the war.

The article lays out the case that taxation should not be focused on revenue generation. Rather, Ruml argues, it should be thought of as serving other purposes entirely. He writes:

The necessity for a government to tax in order to maintain both its independence and its solvency, is true for state and local governments, but it is not true for a national government.

Two changes of the greatest consequence have occurred in the last twenty-five years, which has substantially altered the position of the national state with respect to the financing of its current requirements.

The first of these changes is the gaining of vast new experience in the management of central banks.

The second change is the elimiantion, for domestic purposes, of the convertibility of the currency into gold.

Ruml is making the same case that the Modern Monetary Theorists (MMTers) make: a country that issues its own sovereign currency and is unconstrained by a gold standard does not require tax revenue in order to fund spending.

This is because the central bank always stands by ready and able to buy any sovereign debt issued that might lead to the interest rate rising. Indeed, it does this automatically in the way that it conducts its interest rate policy. Ruml then outlines what taxation is really for in such a country.

What Taxes Are Really For

Federal taxes can be made to serve four principal purposes of a social and economic character:

1. As an instrument of fiscal policy to help stabilize the purchasing power of the dollar;

2. To express public policy in the distribution of wealth and income, as in the case of the progressive income and estate taxes;

3. To express public policy in subsidizing or penalizing various industries and economic groups;

4. To isolate and assess directly the costs of certain national benefits, such as highways and social security.‘ ‘ ‘ taxing is never to be undertaken merely because the govenrment needs to make money payments. . . Taxation should be imposed only when it is desirable that the taxpayers shall have less money to spend, for example, when they would otherwise spend enough to bring about inflation.

The above is the essence, which you who understand Monetary Sovereignty, will find quite familiar. But again, I urge you to to read the article, which has additional informative commentary.

That said, I have one bone to pick with Mr. Ruml and Mr. Pilkington, and it’s a rather large bone. Both gentlemen discuss theoretical, academic effects of taxation, but both ignore the real, political purpose of today’s tax structure, which is: To provide the underpinnings for widening the Gap between the rich and the rest.

Consider Ruml’s point #2: (“To express public policy in the distribution of wealth and income, as in the case of the progressive income and estate taxes”) implies that taxes serve to narrow the Gap, while in fact, the opposite is true — for two reasons:

1. Middle-class salaried people pay FICA, high tax rates on salaries, plus many and various sales taxes and other state taxes, all adding up to an enormous percentage of their income — often approaching 50% when everything is considered.

By contrast, for the wealthy, FICA is collected only on a minuscule part of their income, taxes on capital gains and interest (from which the wealthy receive a majority of their income) are at low rates, and various “loopholes” are available only to the wealthy.

By clever manipulation, it can be realistic for an ultra rich to pay virtually no taxes at all, or very close to it.

2. Collecting taxes fools an uniformed public into believing federal government finances are like personal finances, thereby justifying austerity. Because austerity punishes the lower 99.9% far more than it punishes the upper .1%, austerity widens the Gap between the rich and the rest — and it is the Gap, more than absolute dollars — that the rich treasure most.

Thus, though Ruml and Pilkingon understand the mechanics of Monetary Sovereignty, they seem to believe our government leaders are ignorant of these facts. That is naive.

It is naive to believe that every President, the entire Council of Economic Advisers (composed of scores of professional economists), all 535 members of Congress, all media writers and the hundreds of university economists all are ignorant of the simple fact that federal financing is not like personal financing.

Why then did Rep. Boehner say, “Let’s be honest. We’re broke”? And why did President Obama say, “(My) budget asks Washington to live within its means . . . That’s what families do in hard times. And that’s what our country has to do, too”?

Why do all the media writers and most university economists proclaim that the federal deficit and debt are “unsustainable”?

They are paid by the upper .1% to widen the Gap.

The politicians are bribed by campaign contributions and promises of lucrative employment later. The media are paid by ownership. The universities are bribed by contributions to their various funds. Almost no one is willing to incur the wrath of the upper .1%, and lose precious dollars and jobs, by revealing that federal deficits are necessary, easily supportable, and can be non-inflationary.

No, it isn’t ignorance by our leaders that leads us to austerity, i.e increased taxation and reduced spending. It is greed by the upper .1% and by those whom they bribe, which leads inexorably to a the widening of the Gap.

It’s the Big Lie, and until we understand this, all the “education” in the world will not change things.

We must confront, challenge and accuse. We must throw into their faces, the word “bribery,” until the public grows angry enough to demand change. Nothing good will happen until then.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

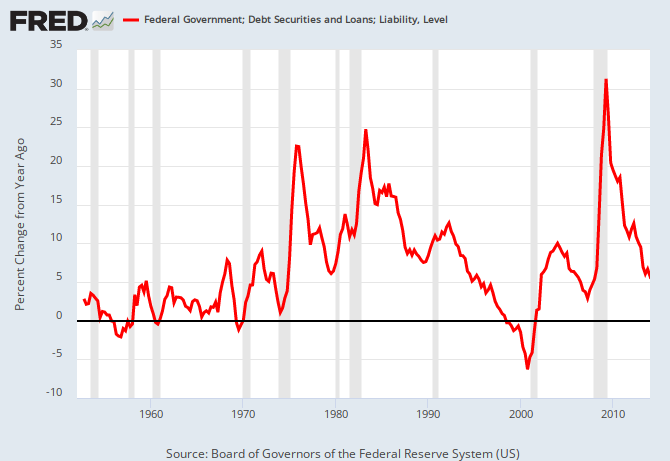

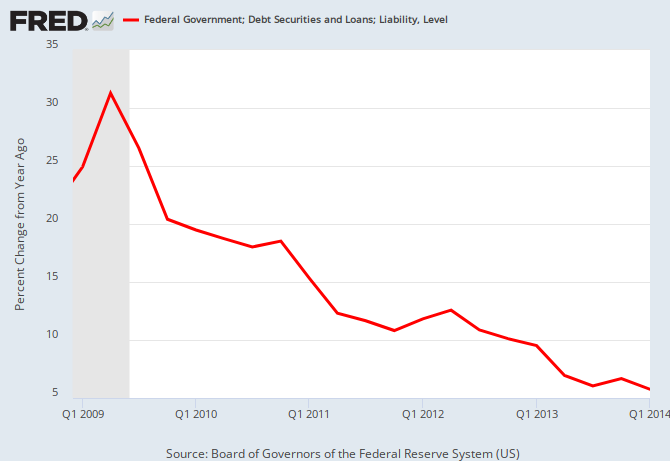

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

In 1945, progressive taxation may actually have served to reduce the gap. Thus Ruml’s point is totally correct.

Unfortunately, “progressive” taxation today is mostly a farce as the upper income group is not progressively taxed on most of their income or wealth.

LikeLike

See step #8 in the “Ten Steps to Prosperity”

LikeLike

I think it’s safe to say the vast majority of all the world’s problems are the result of 1) confusing household finance with national finance, 2) the gap, and 3) the perpetuation of the Malthusian preindustrial scarcity model which ended with the advent of mass production technology.

LikeLike

I’ve recently stumbled upon MMT/MS, etc. & I’ve been interested in the motivation, why haven’t I heard of this. I would tend to apply Occam’s razor to any problem but I’m not sure if a massive conspiracy or massive ignorance is more plausible. China had Fiat money as early as the 11th century but was it really studied? Recently when it is studied we haven’t had much more than 40 years to study the effects of fully fiat currency post bretton-wood, policy takes time. Is widespread ignorance really that implausible given short time and limited focus? If so, what evidence is there of conspiracy?

LikeLike

Wealthy people give billions to politicians. Based on that absolute fact, we have two choices:

1. We can believe wealthy people are stupid investors, who toss their money around, expecting no return, and politicians are honest, moral people who are not influenced by money.

or

2. Wealthy people are smart investors, who expect a return on their investment, and politicians are lying, amoral people, who will do exactly what the money tells them to do.

What does the preponderance of the evidence tell you?

LikeLike

Is it a stretch to link the abandonment of the International gold standard to the Powell Memorandum and the right/left MSM reaction to both events?

The rich-right and the intellectual-left produced a torrent of literature recommending actions to consummate-repel, respectively, Powell’s recommendations. With regard to tax policy, the rich knew that fiat currency issue and spending would no longer be linked to debt and deficits to maintain the dollar’s value relative to gold. They knew that taxes would no longer be needed to fund a fiat money system.

The left having introduced significant regulatory legislation in the 1960’s to constrain business abuses and protect consumers, encouraged higher tax rates in the 1970’s to narrow income gaps. And, railed against all manner of tax breaks for the “rich”

Under the guidance of the Business Round Table and the newly invigorated National Chamber of Commerce their lobbyists began in 1973, their onslaught to reduce corporate income and capital gains tax rates.

Powell wrote, “There are countless examples of rifle shots which undermine confidence and confuse the public. Favorite current targets are proposals for tax incentives through changes in depreciation rates and investment credits. These are usually described in the media as “tax breaks,” “loop holes” or “tax benefits” for the benefit of business. As viewed by a columnist in the Post, such tax measures would benefit “only the rich, the owners of big companies.””8

Powell’s forceful encouragement of the business class to adopt “guerrilla warfare strategies and tactics” was taken to heart in every sphere of corporate interaction with the public and directed by the U.S. Chamber and the Business Roundtable.

8 The Washington Post, Column of William Raspberry, June 28, 1971.

LikeLike

I doubt that leaving the gold standard was a right wing plot. I suggest it was long overdue, from the standpoint of rational economics.

In fact, going off the gold standard should have helped the government narrow the gap between the rich and the rest, because freedom from gold removed pressure on deficit spending.

However, today’s politicians are bribed to pretend the U.S. remains on some sort of mythical “standard” that supposedly makes federal “debt” and deficits unsustainable.

LikeLike

Economist include other factors, such as rents and interest on capital, but isn’t the cost of the goods produced basically equal the wages paid to workers? If so, the price of the goods is then equal to (wages + profit). If the profit is zero, the workers can always purchase all the goods produced or purchase a service and the service economy can purchase the goods.

If taxation removes purchasing power then there are more goods available than can be purchased, and the prices of goods will decrease. Therefore taxation plays no role in diminishing inflation; just the opposite; removing purchasing power by taxation will cause deflation.

However, this does not occur because government spending replaces the lost purchasing power and the goods can then be sold without price changes.

From where cometh the profit? Don’t exports, credit and government deficits supply the profit. When the former two mechanisms are insufficient, then the latter kicks in. The last years show this to be true – government deficits have resulted in huge profits for corporations.

Beardsley Ruml’s propositions may sound inviting but my analysis indicates that taxes cannot be used to properly regulate the economy but are best used to provide services to the public – the public essentially purchases needed services by taxation just as each individual would purchase a needed service by spending.

Government deficits and Fed operations can regulate the economy.

LikeLike

” . . . isn’t the cost of the goods produced basically equal the wages paid to workers?”

No. Businesses have many costs, not just wages.

” . . . taxation plays no role in diminishing inflation; just the opposite; removing purchasing power by taxation will cause deflation.”

Nonsensical. Diminish inflation enough and you get deflation.

“. . . the public essentially purchases needed services by taxation . . . “

Wrong. In a Monetarily Sovereign government, taxes do not fund spending.

LikeLike

Business have many costs but these costs also involve wages.

The cost of machinery is the wages plus profit to produce the machinery.

The cost of advertising is the wages plus profit for the advertising.

All costs when properly analyzed consist mainly of wages plus profit.

If the total price of goods is more than the purchasing power in the system, will not the goods be unsold or be reduced in price. If the government taxes to remove purchasing power, which can never be more than the cost of goods, how can taxation serve to lower inflation? Taxes have been relatively low during the last decade and little inflation. Taxes were moderately high during the 70’s and great inflation.

“Taxes do not fund spending” is a cliche and not a responsible reply. The government keeps books of revenue and spending for each of its organizations and they always balance, either with a deficit or, during the Clinton administration, with a surplus. Is that a coincidence and why do they keep the books?

This brings out the question- why tax at all, just print money? And solicits the reply that taxes regulate the money supply, which is circular reasoning. The government injects money into the system and then removes an equivalent amount. The latter is a zero-sum process that angers everybody. Nothing more distressing to know that the government is printing money and taking it away from you for only that purpose.

LikeLike

Alternative Insight,

“All costs when properly analyzed consist mainly of wages plus profit.”

So Wages + Profits = Costs?

Are you talking about any one business? Any one nation? The world as a whole?

Do the math. Total all wages plus all profits and see if it equals all business costs. And, how do business losses affect your equation?

It was you who originally said, “Therefore taxation plays no role in diminishing inflation” Now you argue the opposite?

Now you say, “If the total price of goods is more than the purchasing power in the system, will not the goods be unsold or be reduced in price. [Yes, reduced in price means reduced inflation}

And then you ask, “If the government taxes to remove purchasing power, which can never be more than the cost of goods, how can taxation serve to lower inflation?” [You have me confused. What do you believe?]

The fact: Inflation has many, many causes, only one of which can be the old “too much money chasing too few goods.” More common causes are:

1. An imbalance between risk and reward (low interest rates) and

2. A shortage of a key product, usually oil.

Taxation never can cause inflation, and it can reduce inflation.

Federal taxes do not fund federal spending. It’s not a cliche. It’s because the federal government is Monetarily Sovereign. You should look it up.

If all federal taxes fell to $0 or rose to $999 trillion, neither event would affect the federal government’s ability to pay its bills.

There are reasons for federal taxation (sin taxes, reducing the gap between the rich and the not-rich) but funding spending is not one of them.

LikeLike

I am not a fan of MMT and try to debate its propositions in a logical and harmonious manner. I honestly want to know if there are valid reasons for its theory but can never find them.

You are correct and I stand corrected. My mind flipped and I did not word it correctly. I was trying to say that the purchasing power in the system from the manufacturing cycle can always purchase the goods produced (if there is no profit) and there is no benefit to use taxation to reduce purchasing power. It can only cause slight deflation. However, as I stated, unless the government runs a surplus, its spending returns the money and purchasing power to the system and it is always a wash. If purchasing power is only transferred, how can taxes halt inflation? Of course, from my understanding, MMT claims revenue and spending are independent. I do not subscribe to that supposition.

Admittedly if borrowing becomes excessive then the increased money supply can cause inflation. However, raising interest rates to discourage borrowing, rather than taxing and have a surplus (done during the Clinton administration) is the preferred method to limit an inflationary trend.

If wages plus profits are not the cost of any item, then what is? What is any manufacturer paying for if not the wages of its own employees and the wages and profits from sub contracts, consultants, whatever? Even the interest on borrowing pays the wages of the creditor’s employees and the creditors profits.To whom and where does the money go, to thin air? I cannot think of anything else — after all even CEOs get wages. Someone has the cost in his/her pocket and the purchasing power must equal the cost. There may be besides profits, depreciation and other small factors that enter the pricing mechanism. That is a problem for clearing the market.

A sovereign country can print money but, as far as I know, since 1963, this sovereign country is limited by law in printing currency. Only the Fed can have currency printed and that is for purchasing debt in open market operations.

The government has been spending $3 trillion a year and borrowing $1.2 trillion. Because it cannot print money, from where does the $1.8 trillion come?

Does not this spending equals its revenue from taxes?

LikeLike

A more complete cost of goods is: Cost = Wages + Rents + Profit. In this equation, Wages represent payment for labor and human produced capital. Rents represent payment for use of land, natural resources, payment of interest and payment of taxes. Profit is the extra going to the owners/shareholders beyond any labor they provide to produce the product or service.

Many decades ago, Major C. Douglas noticed that in most years, the cost of goods and services produced in his nation exceeded the value of wages and dividends with which end consumers could purchase those products and services. He proposed that the government make up the difference by paying a National Dividend to each citizen. The amount per citizen determined by calculating the difference between the cost of all goods and services and the total value of all wages and dividends, then dividing by the total number of citizens. No means testing, no adjustments, just a straight payment on a monthly or annual basis.

LikeLike

Excellent plan, similar to #3 of the “10 Steps to Prosperity” (at the end of the post).

LikeLike

You have misread. I said this.

“Economist include other factors, such as rents and interest on capital, but isn’t the cost of the goods produced basically equal the wages paid to workers? If so, the price of the goods is then equal to (wages + profit). If the profit is zero, the workers can always purchase all the goods produced or purchase a service and the service economy can purchase the goods.”

LikeLike

How do taxes create deflation?

If you earn purchasing power equal to $100 and I take the $100 from you and distribute to people in the economy – how can that cause deflation or inflation? It’s a simple transfer of wealth… is it not?

You should also note that there is far more debt being created than taxes – is there not a deficit? So no, taxes and the creation of money is not a zero sum game – it’s heavily tilted on the money creation side.

But you bring up a REALLY good point here “but isn’t the cost of the goods produced basically equal the wages paid to workers?”..

You are 100% correct there – which should also tell you that creating money out of thin air will do squat for anyone – all you are doing is shifting purchasing power around. It does nothing for the economy and does nothing for regular folks.

LikeLike

You asked “(If I) take the $100 from you and distribute to people in the economy – how can that cause deflation or inflation?”

The answer is: A Monetarily Sovereign does not distribute tax money. In actual fact, it simply destroys tax money.

If all federal taxes fell to $0 or rose to $999 trillion, neither event would have any effect on the federal government’s ability to pay its bills.

I hesitate to suggest that you try to learn the difference between a Monetarily Sovereign government and a monetarily non-sovereign government, because of your “Shoo . . . Peon” comment.

But you really should learn the difference, and if you wish to, I will give you the references.

LikeLike

Unfortunately, the wages paid to workers is usually less, sometimes far less, than the cost of the goods and services produced by those workers. Business owners, landlords, and money lenders tend to add costs far in excess of the value added by their own labor as managers or gate keepers, leaving the workers with wages that are insufficient to purchase the goods and services they produced.

The landlords, lenders, and owners collect the majority of the product or service’s value. Over time, these people use that accumulated wealth to gain more power over others and pass their wealth and power on to their offspring and successors. After a few generations, the economic and associated political power give the “owner” class power equal to the kings and “nobility” of centuries past and the rest of us end up no better off than the peasants or even slaves of those ancient eras.

LikeLike

Sorry,

I believe you misread. I said this.

“However, as I stated, unless the government runs a surplus, its spending returns the money and purchasing power to the system and it is always a wash. If purchasing power is only transferred, how can taxes halt inflation?”

LikeLike

Alternative Insight,

Way too many questions, and most of them show you do not understand the differences between Monetary Sovereignty and monetary non-sovereignty.

If you really wish to learn, I suggest you read these two pages, in the order given. After you have read and understood them, I’ll be glad to answer your questions:

1. https://mythfighter.com/2010/08/13/monetarily-sovereign-the-key-to-understanding-economics/

2. https://mythfighter.com/2013/07/27/i-just-thought-you-should-know-lunch-really-can-be-free/

The pages are short, so don’t skim them. Read them closely and try to understand them.

LikeLike

Wow –

Alternative, consider yourself lucky. Folks that pose those kinds of questions get called nasty names around these neck of the woods. Shoo.. go learn something you peon…

LikeLike

Did you take the trouble to read the links I provided?

LikeLike

I read the links before and much on MMT, including Thomas Palley’s criticisms, with whom I agree. I do not adhere to the opinions in the links and they only raise more questions. Debating in this forum is getting confusing and is not productive. I’ll only make three statements:

(1) Only the Federal Reserve and not the U.S. government can authorize the printing of money and, contrary to what MMT tells the public, the Fed is an independent organization with quasi ties to the government.

(2) The reason that the huge deficits have not caused inflation is because the deficit is financing the trade imbalance and corporate profits and not private spending.

(3) I do not know of any government agency and particular person who can cancel debt by a”keystroke.” if there is why was is there always a fuss about raising the debt limit?

LikeLike

Alternative, you said:

“Only the Federal Reserve and not the U.S. government can authorize the printing of money”

Apparently, you believe the Treasury of the United States has no function. The U.S. government authorizes dollar creation by paying bills. It sends instructions (not dollars) to banks, telling the banks to increase the dollar balances in creditors’ checking accounts. That is what creates dollars.

“the Fed is an independent organization with quasi ties to the government.”

I have no idea what “quasi ties” means. But the Fed itself says, “The Federal Reserve, is an independent government agency but also one that is ultimately accountable to the public and the Congress”. The President of the United States appoints the seven members of the Fed’s Board of Governors

“The reason that the huge deficits have not caused inflation is because the deficit is financing the trade imbalance and corporate profits and not private spending.”

What do you think happens to corporate profits if they don’t go to private spending?

LikeLike

Because you do not answer the questions but only arouse new ones, we can keep this interesting conversation going forever. I am genuinely attempting to find answers but you seem to be trying to win a debate.

Where did I say that the Treasury Department had no function?

From my knowledge the Treasury authorizes payment of bills. Bills are paid by Federal Reserve Banks that collect government revenues and pay the bills by electronic transactions. You can make statements like “by keystrokes,” and “money is created” while “taxes are garbaged,” but at the end of the fiscal year;

Government Spending = Government Revenue + Deficits (Public purchases of credit instruments).

The same amount of money injected into the system is removed from the system.

NO NEW MONEY IS CREATED.

Quasi means “as if.”

Doe the president appoint the Governors or nominate the Governors who are then ratified by the Senate. Because the Governors serve 14 years they are not attached to the influence by any administration or political Party. I note that when the Fed Chairman speaks to Congress, he tells them nothing, nor do they care to understand. He then goes and does what he wants. I also note this has always been true and that no where in history does it seem that Fed decisions resulted from direct intervention from government officials – maybe some advice and pressure but that is natural. As a matter of fact, Fed decisions have sometimes gone against Presidential wants and been catastrophic. Maybe you can help me. We have three arms of the government — Executive, Legislative and Judicial. Where on the chart is the Federal Reserve?

When I wrote “private spending,” I meant “consumer spending.”

Profits have gone to Retained earnings (no spending), Dividends (some new spending), Outsourcing (reverse spending) and Investment (new production that allows new supply to meet new demand).

It would help me if you could answer some of my previous questions plus these new ones that come from your references.

(1) Who in the government “can make the dollar equal to three euros, two pumpkins or one partridge in a pear tree?” If someone in the government can make a dollar = 3 Euros and I go to a German bank, will they give me 3 Euros for one dollar?

(2) Is Argentina a Monetary Sovereign nation?

(3) If someone in the government (who?) can cancel debt by a keystroke and does that with a foreign nation, what happens to the dollars in the foreign nation’s account? It must be reinvested. Is the debt cancelled again and again and again so the person sits there hitting keystrokes forever?

LikeLike

Alternative.

Your question, “Where did I say that the Treasury Department had no function?” is disingenuous. Earlier you had said, “Only the Federal Reserve and not the U.S. government can authorize the printing of money”

I responded, “Apparently, you believe the Treasury of the United States has no function” (if it can’t authorize the “printing of money.”)

I was giving you a shorthand answer, because in truth, the only “printing” is done by the Treasury (although what it prints is not money, but rather debt certificates.) I thought you understood that, but I have thousands of readers, and I don’t know what you understand and what you don’t.

You said (in all-caps yet), “NO NEW MONEY IS CREATED.”

My question of you: How then has the money supply risen massively over the years?

You said, “Bills are paid by Federal Reserve Banks that collect government revenues and pay the bills by electronic transactions.”

Well, sort of, if you consider a mandatory accounting function to be “bill paying.”

Visualize this: I use an online bill-paying service. With my specific ad hoc approvals, this service deducts money from my bank checking account and transfers it to my various creditors’ bank checking accounts.

So, would you say my bill-paying service pays my bills? Would you say my bank pays my bills? Would you say my creditors’ banks pay my bills?

Or would you properly say I pay my bills by telling these services what to do?

Yes, “the Treasury authorizes payment of bills,” or at least is part of the bill-paying process.

But, you would have been on target had you said, “Congress and the President authorize the Treasury and the Fed to effect payment of bills.” After that authorization, it’s all on automatic pilot.

Based on Congress’s and the President’s authorization, federal agencies send instructions to creditors’ banks, telling the banks to increase the balances in creditors’ checking accounts.

At the instant the banks do exactly as they are told (no decision-making by the banks is involved), dollars are created.

The banks then clear through the Fed, which does exactly as Congress and the President has told it (again, no decision-making involved).

The Fed credits the creditors’ banks’ accounts and debits one of the myriad federal agency accounts. All this occurs subsequent to the creation of dollars by the creditors’ banks based on instructions from Congress and the President..

(1) The Fed or Congress or the President, depending on circumstances. The government has the power to devalue the dollar, just as other governments (Britain, Mexico) have devalued their currencies.

Similarly, the government also has the power to revalue the dollar upward. Were our government to revalue the dollar by say +50%, you could get about 3 euros for one dollar, from a German bank.

Typically, though not necessarily, the process would be to issue “new” dollars to replace “old” dollars.

(2) There are various degrees of Monetary Sovereignty. Argentina is at a low degree. See: https://mythfighter.com/2013/07/27/i-just-thought-you-should-know-lunch-really-can-be-free/ Even the U.S. is not as sovereign as it should be, because of austerity laws and debt limit laws.

(3) Example: Our “debt” to China is just the total dollars in China’s T-security accounts. We could cancel that debt by transferring those dollars to China’s checking account. No dollars lost or gained. They are just moved from one bank account to another.

Finally, I don’t like your attitude. You’re not paying me for this education, so don’t be a wise ass. If you disagree, fine, but stop accusing me of not answering your questions — or I really won’t answer your questions.

We are not equals on this blog.

LikeLike

I apologize if I offended you. It was just an interpretation and not an accusation.

Your question of me: How then has the money supply risen massively over the years?

My answer: By Fed quantitative easing and bank loans.

I may be wrong but I do not believe banks purchase government debt. Pension funds, investors and foreign governments from dollar reserves have been purchasing the debt, which only transfers money in the money supply.

Nevertheless, isn’t it correct that the fiscal accounts show that

Government Spending = Government Revenue + Deficits (Public purchases of credit instruments).

Isn’t the dollar the reserve currency of the world, its “quasi standard,” against which other currencies are valued? If so, how can the U.S. government arbitrarily revalue the dollar? Wouldn’t the global system go into shock?

LikeLike

QE is meaningless. It transfers debt ownership from one holder (the public) to another holder (the Fed). It also is relatively recent, and could not account for increases in the past 200 years.

Bank loans do create dollars, in fact the majority of dollars, but this does not account for the dollars created by federal government deficit spending.

Yes, Government Spending = Government Revenue + Deficits

And yes, according to current law, the government cannot run a deficit with the Fed, so T-securities sold essentially = deficits.

If I understand the purpose of your question, I believe you think that no new dollars are created, i.e. every new dollar created by the government goes to the purchase of a T-security, so no dollars are created. Does that describe what you believe?

If so, you misunderstand the definition of a dollar. A T-security is as much a dollar as is a dollar bill. Neither are dollars unto themselves.

Both represent dollars. Whether you own a T-security valued at $1,000, or you have 1,000 dollar bills, or you have $1,000 in your checking or savings account, you have $1,000.

A T-security = a bond = a CD = a savings account = a checking account = a traveler’s check = a money market account. They all represent dollars, with the only difference being liquidity — the ease of spending.

Dollars do not disappear when their representation transfers from one form to another. Thus, when the federal government deficit spends, additional T-securities (i.e. dollars) are created.

LikeLike

None of this agrees with the information I have.

You write:

QE is meaningless. It transfers debt ownership from one holder (the public) to another holder (the Fed). It also is relatively recent, and could not account for increases in the past 200 years.

Does QE just transfer; doesn’t it create money to purchase the debt and is a large part of money creation in the last five years? Where in the Money Supply, as defined by M2, is government debt? And by the way, has not most of the increase in money supply been made in the last 30 years?

You write:

Based on Congress’s and the President’s authorization, federal agencies send instructions to creditors’ banks, telling the banks to increase the balances in creditors’ checking accounts.

Doesn’t the Treasury have an account at the Fed, which pays the bills? Just as any pay billing, doesn’t the Fed transfer funds from the Treasury account to other banks? No new money is originated. if not, what are the weekly Treasury statements of their bank account?

https://www.fms.treas.gov/fmsweb/viewDTSFiles?dir=w&fname=14082100.txt

You write:

A T-security = a bond = a CD = a savings account = a checking account = a traveler’s check = a money market account. They all represent dollars, with the only difference being liquidity — the ease of spending.

Only difference? I can always get 100 cent for a dollar. Can you always get (before maturity) one hundred dollars for a hundred dollar T-bill?

How do you spend a T-bill? Doesn’t it have to be redeemed before spending? And does not redemption only transfer available funds to the seller? Only by QE is new money created from bond transactions and that is theoretically reversed when the Fed sells bonds.

LikeLike

Alternative, the problem is not what you don’t know, but what you know that ain’t so. For instance Rodger explains above how bonds are the same thing as dollar bills. I might word things slightly differently, but he is giving you a good explanation.

In fact, everybody used to know this, say in the 1940s. It was just common sense, and it became incorporated in economic theory, sort of. But there was a lot of junk in economic theory that has unfortunately killed good theories and even worse infected common knowledge, to the point where people make loony distinctions between dollars and bonds, and think in wholly inappropriate terms. People like Palley don’t understand the obscure history, unfortunately, and hence are vulnerable to bad economics.

In the real world, the Fed is part of the government. That is how it always acts, It was created by Congress etc. If you want to torture yourself, you can pretend it is not and make your life pointlessly complicated. In just the same way you could pretend that your right pocket and left pocket are different and do accounting between them. (The pocket comparison goes back to Abba Lerner, and beyond, to Jean-Francois Melon.) If you wanted to pick another branch of government, you could pretend the Forest Service is not part of the government too, and do accounts between it and the true government. But in any case, what you have to do is do the accounts CONSISTENTLY between the government, the Fed, the Forest Service, your left and right pocket or whatever. The usual trick is to pretend that the Fed is independent, different from the Gov in one place, but not in another, hidden place, which is glossed over in silence, where they are identified – but is where the Fed gets its power. So the Fed ends up with magical government-money creation powers that it doesn’t have, and the Gov, its master, is reduced in the fairy tale to a servant. Go very slowly, embarrassingly slowly, think in simple, clear terms one can explain to a child. And then you see the only story that is intelligible, that is not a joke is Rodger’s or MMT or their predecessors through the centuries.

LikeLike

To me these are words and not analysis or economics.

I know well the concepts of MMT, the statements from Beardsley Ruml and the efforts of the Chartists. Don’t be patronizing. I don’t accept anything that is being said here nor do I sense the questions are being properly addressed. You are not talking to an amateur in economics and I think Palley is a sensational economist and got MMT right.

i suggest you carefully read what I wrote and don’t behave egotistical as if you know something others do not know.

Where is the trick that the Fed is an independent arm of the government, which naturally must coordinate its activities with the government. Who is tricking whom and why?

The only people tricking are those proposing MMT, who have no case unless the Fed is under control by…by..by whom?

And MMT fades to obscurity unless debt becomes dollars. Go to your grocer and try giving him a T-note for a lump of sugar. A T-note is a piece of paper until redeemed. If the government rolls over debt, it remains a piece of paper. If it is redeemed, a rare phenomena, then money is transferred from the Treasury account at the Fed and no new money is created.

I value replies but I prefer a direct answer to a question and not the usual silly MMT response: “the problem is not what you don’t know, but what you know that ain’t so.” When you write that, I suspect the writer knows nothing.

LikeLike

“And MMT fades to obscurity unless debt becomes dollars.”

Actually, financial debt is dollars. Please read: Why a dollar bill is not a dollar

By the way, I can go to my grocer and gave him a bank check, a store coupon and a credit card. I might even give him food stamps — and no dollar bills.

So what are dollars? Read the link and think about it.

LikeLike

Alternative,

They aren’t “Chartists. They are “Chartalists.”

Anyway, you are inventing your own definitions for money. I don’t mean to put words in your mouth, but apparently you think money is M2. Why not M0, M1, M3, M4, L or Credit Market Instruments?

Why not coupons, food stamps or credit cards?

Is my bank savings account money? Can I take my savings account passbook to the grocer to buy sugar?

Do read “Why a dollar bill is not a dollar”

LikeLike

We all know that cash money in circulation is small compared to the money supply and transactions are made by electronic transfers. However, the Fed, and not I, defines the money supply by M2.

This repartee started by your group insisting that our sovereign government can print money forever, by a keystroke. And I insist that the Fed controls the money supply and not the government. So, you incorporate the Fed into the government. Well, I and most everyone, do not accept that nor accept that the Fed would allow unlimited printing of money by “keystrokes.”

Somehow the discussion morphed into “what is money?”

The dollar is a medium of exchange that everyone accepts.

If the Fed has a dollar printed or originates a dollar by a “keystroke” during QE, a new dollar is added to the money supply, $4 trillion by last count.

When a Treasury note is sold, no new money is introduced to the money supply.

When the government spends, it is spending from an account at the Fed which contains a record of revenue gained from taxes, the sale of government securities and other transactions. A record of funds is electronically transferred from the government account to the supplier account. No new money is created.

LikeLike

Palley is not a bad guy, but he is making things much more complicated than they really are, and he does not understand what he is talking about when it comes to monetary economics & MMT.

I know well the concepts of MMT

I don’t think you understand them. If you did you would agree with them, the same way people who understand Euclidean geometry agree on Pythagoras’s or Thales’s Theorem.

You are not talking to an amateur in economics

That is the problem. Again, and if it be patronizing, so be it – the problem is what you “know”. Some of it is nonsense. The idea that governments are constrained by their own central banks in the modern era is preposterous. This – the consolidated government+central bank viewpoint – is not an assumption, an “axiom” of MMT but a “theorem”. It can be proven.

And what this “theorem” proves is something perfectly obvious, but since the fraud of central bank “independence” has become a widespread delusion, it is something that most people have doublethink about. Practically speaking, everyone, including you, agrees with MMT. It is just when the truth is actually enunciated that falsehoods about governments being constrained are aired. You show this above when you mention the government debt limit – if there were a real constraint, the debate would be between the Congress and the Fed, not internal to the Congress itself.

The “independent central bank” is a basically recent, post-70s fraud/proposal/delusion. Earlier, everybody knew that the Fed was part of the government. It would not have been so necessary to deprogram people who weirdly believe that the government does not create money when it spends. One way or another, usually with confusing and unnecessary complications, that – MMT/MS is what was taught in the economic textbooks of that era.

A T-note is a piece of paper until redeemed. What do you think a dollar bill is? “A piece of paper until redeemed”. Nothing else. Dollar bills and T-notes are “one and the same thing”, to quote FDR. To quote Seymour Harris of Harvard & the 1st CEA, “government securities are quasi-money” (in a 1947 book). Like I said, everybody used to understand MMT. And any grocer would be very happy to accept a T-bill in return for a lump of sugar.

By far the largest proportion of government money is held in the form of Treasury securities. The National Debt IS the (base) money supply. Sure, you can make distinctions with little or no economic meaning between various types of government money. But MMT / MS is just the name given to people who bother to make the distinctions consistently and do the accounting correctly. Palley and other critics don’t – and I believe at least one former critic has admitted that the MMT accounting is correct.

LikeLike

Alternative,

Bottom line, you are confusing Monetarily Sovereign financing with monetarily non-sovereign financing. They are not the same.

You said, “This repartee started by your group insisting that our sovereign government can print money forever, by a keystroke.”

Actually, the federal government can create (not print) dollars, forever.

You said, “Somehow the discussion morphed into ‘what is money?'”

Why “somehow.” If you deny the federal government can create dollars, it seems appropriate to define “dollars.”

You said, “If the Fed has a dollar printed or originates a dollar by a “keystroke” during QE. . . “

QE does not create dollars. All QE does is transfer the dollars already in T-security accounts at the FRB to checking accounts at the FRB or private banks. No new dollars created. It’s a simple dollar transfer, from one of your accounts to another of your accounts..

If you own a T-security, you have a T-security account at the FRB containing dollars. They are not the FRB’s dollars. They are your dollars. You own them.

A T-security account is very much like a bank savings account. You own those dollars.

You continued . . . ” a new dollar is added to the money supply, $4 trillion by last count.”

Actually, $60 trillion, since that is the total of Credit Market Instruments, Liability. See why we needed to define dollars?

You said, “When the government spends, it is spending from an account at the Fed which contains a record of revenue gained from taxes, the sale of government securities and other transactions.”

Not exactly. Those accounts are records, but in fact, (this is the important point) the federal government owns no dollars. Those balances, to which you refer, are not part of any money supply data.

The only accounts at the FRB, that are included in the money supply, are privately held accounts, like T-security accounts. Government accounts are not considered money, for one simple reason. The government has absolute control over those accounts, and can make those numbers read anything.

It would be like asking a scoreboard how many points it owns. The scoreboard has the unlimited ability to create points, just as the federal government has the unlimited ability to create dollars.

That is the fundamental difference between Monetary Sovereignty and monetary non-sovereignty. (If you don’t believe it, tell me what you think the difference is.)

And that is why those big sheets of dollar bills the Treasury prints are not dollars. Only when they are in private hands do they represent dollars. The money supply only includes dollars that are in private hands.

If you doubt that, try to find the data showing how many dollars the federal government owns. It has none.

By contrast, you easily can learn how many dollars your state and local governments own. (Again, the difference between Monetary Sovereignty and monetary non-sovereignty.)

When the government pays $1,000, one of its agencies sends instructions to your bank, telling your bank to increase the number in your checking account by 1,000. When the bank increases your checking account balance by $1,000 the nation’s money supply is increased by $1,000.

The bank’s books now contain a debit of $1,000 which must be cleared through the FRB, which performs an automatic bookkeeping function, not a dollar-creation function.

You really should ask yourself, at each step of these discussions, “Am I describing Monetary Sovereignty or monetary non-sovereignty?” If you see no difference, that is a red-light signal to rethink your belief.

LikeLike

I thought this would end but I can understand your need to correct vague statements.

You are correct:

When the government pays $1,000, a bank increases the checking account balance by $1,000 and the nation’s money supply is increased by $1,000. The government account is not part of the money supply.

But you are misinterpreting.

The spending equals the funds removed from the system by taxes and purchase of treasury securities, which are in the government account. As I wrote previously: spending = taxes + deficit

From my perspective, the government transactions, which consist of gaining revenue and spending is a wash at the end of the fiscal year and does not create new money.

Yes, the monetary base does not contribute much to the money supply and QE has been ineffective in increasing the money supply due to certain countering factors. I agree only dollars in private hands are included in the money supply. However, I believe private institutions, such as pension funds, and not banks, own the Treasuries, and their accounts are credited by Fed purchase of Treasuries and thus increase the money supply. Maybe I am wrong.

I find engaging in this type of discussion is a preferred way to stimulate thinking and hopefully resolve the differing economic arguments that cloud the mind. I still do not agree with some of what you have said but I am grateful for your taking the time to respond and I value your knowledge.

You can also read my articles on this and other subjects at:

http://www.alternativeinsight.com/ for the latest articles, and

http://www.alternativeinsight.com/main.html for the complete archive.

LikeLike

You said, ” . . . funds removed from the system by taxes and purchase of treasury securities . . . “

This is your point of confusion. The purchase of treasury securities does not “remove funds from the system” any more than funds are “removed from the system” by such acts as:

–Buying a corporate bond

–Buying a bank CD

–Buying travelers’ checks

–Depositing dollars into a bank savings account

etc.

Remember, that when you own a T-security, your dollars are deposited into your personal T-security account at the Federal Reserve Bank. These dollars are no different from any of your bank account dollars.

Your dollars continue to exist and continue to be owned by you, and can be spent simply by transferring owner ship, just as all dollars are spent.

As I said previously, the only difference among the various definitions of money (M0, M1, M2, M3, Credit Market Instruments), is liquidity.

LikeLike