Twitter: @rodgermitchell; Search #monetarysovereignty

Facebook: Rodger Malcolm Mitchell

Mitchell’s laws:

●The more federal budgets are cut and taxes increased, the weaker an economy becomes.

●Austerity is the government’s method for widening the gap between rich and poor, which ultimately leads to civil disorder.

●Until the 99% understand the need for federal deficits, the upper 1% will rule.

●To survive long term, a monetarily non-sovereign government must have a positive balance of payments.

●Those, who do not understand the differences between Monetary Sovereignty and monetary non-sovereignty, do not understand economics.

●The penalty for ignorance is slavery.

●Everything in economics devolves to motive, and the motive is the gap.

===================================================================================

Poor people who receive aid from the government are stupid and don’t know what’s good for them — at least not as well as the government does. Right?

Food Stamps’ $80 Billion Mystery

AUG 19, 2014, By James GreiffImagine a government program that has exploded in size, is the subject of bitter partisan haggling and spends almost $80 billion a year in secret. The program in question is food stamps, the Supplemental Nutrition Assistance Program (SNAP), which now are used by one in six Americans.

The U.S. Department of Agriculture opposed telling the public which businesses get all that money. Taxpayers deserve to know how their money is spent, although fraud is estimated by the Government Accountability Office at about 1 percent.

Ooooh, 1 percent fraud. And what exactly is that “huge” fraud?

. . . an investigation into claims that beneficiaries received cash from retailers instead of food.

Oh, no! Poor people receiving cash? How awful! (Actually, I’m not sure why it’s awful, but it surely must be.)

While it is good governing for the public to know how the government spends, it isn’t taxpayer money the government is spending. The government creates dollars, ad hoc, by spending. No tax dollars involved. Not one SNAP dollar comes out of your or my pocket.

What might the food-stamp information tell us? At a minimum, we would get confirmation that they make up a large part of the sales of some of the country’s biggest retailers, such as Wal-Mart Stores Inc.

Not really vital public information, is it? Are other businesses required to disclose who their customers are or even the categories of their customers?

But wait, we now arrive at the most important part — the nanny-state implications:

If the data were public, watchdogs and the news media could ferret out retailers that do an inordinate amount of food-stamp business, perhaps because they permit misuse of the benefits.

A number of food activists think the Agriculture Department should go further and disclose what products are purchased. Food stamps can be used to buy almost anything, with the exception of tobacco and alcohol and a short list of nonfood goods such as pet food, soap, household supplies and some prepared foods.

Really? The government doesn’t allow poor people to buy soap with SNAP benefits? Well, thank goodness for that!

That leaves the entire universe of junk food, which is responsible in large measure for the U.S. obesity epidemic. Obtaining product information might help public-health officials persuade lawmakers to adopt reasonable prohibitions on food-stamp use.

“Reasonable” prohibitions? Is that like, “You’re poor, so no Coca Cola or potato chips for you. Those kinds of foods are just for people who have earned them”?

The (SNAP) cards could be programmed to help the USDA glean valuable data on what recipients are buying. With that, the government could develop a “do-not-sell” list that retailers could incorporate into the product codes that are scanned at the point of sale.

See, it’s like this: If we, the government, simply banned all the foods we, in our infinite wisdom, felt were bad to eat or drink, there would be riots in the street. But we can do it to you poor people, because . . . well because you have no clout. Your political contributions are next to nothing, which means you are next to nothing.

It might steal some of the rhetorical heat from those who think too many people on food stamps are living high on the taxpayer’s dime.

Oh right, those people with SNAP cards really are living in mansions and driving Mercedes. Out of the 50 million people using SNAP, there must be at least a hundred rich ones.

Bottom line, this is just the tip of the contempt iceberg, in which the poor are viewed with disgust, and every negative label is attached to them: Stupid, lazy, dirty, sneaky, criminal, immature, dangerous — so that they must be controlled on a short leash, as this comment on the article indicates:

People are more willing to help if they feel the person truly needs help. When they are buying lobsters and you’re buying chicken…well, it doesn’t make you feel sorry for them, does it?

When the aid is supposed to only last 3 years, but the government stops enforcing that, well, it makes me care less. When immigrants teach other immigrants how to game the asset rules, you know its become a profession and not a temporary means of helping someone up.

Oh, the hatred. This is the new America, where it’s now cool to find a good excuse for not helping the poor, and what better excuse is there than, “They don’t deserve help.”

In reality, most of the poor are poor because of some failure by the government. For instance, here is a verbatum comment about the article:

“As a dfcs employee i see both sides of the issue, but what troubles me more is the fact that the workers like myself who work for the state and have college degrees are being paid so little that the majority of coworkers receive food stamps!…the system is f-ed up!!!”

These are the working poor, you know, those “lazy” people, many of whom work much harder than the lucky plutocrats. Apparently, these lazy poor are too stupid to know what to eat.

If the government were to institute the “10 Steps to Prosperity” (below), we’d have far fewer poor and far fewer excuses needed for not helping them.

Meanwhile, we all can take comfort in knowing that the government is telling the poor what they can and cannot eat, and even whether they are allowed to bathe.

Rodger Malcolm Mitchell

Monetary Sovereignty

===================================================================================

Ten Steps to Prosperity:

1. Eliminate FICA (Click here)

2. Federally funded Medicare — parts A, B & D plus long term nursing care — for everyone (Click here)

3. Provide an Economic Bonus to every man, woman and child in America, and/or every state a per capita Economic Bonus. (Click here) Or institute a reverse income tax.

4. Free education (including post-grad) for everyone. Click here

5. Salary for attending school (Click here)

6. Eliminate corporate taxes (Click here)

7. Increase the standard income tax deduction annually

8. Tax the very rich (.1%) more, with higher, progressive tax rates on all forms of income. (Click here)

9. Federal ownership of all banks (Click here)

10. Increase federal spending on the myriad initiatives that benefit America’s 99% (Click here)

—–

10 Steps to Economic Misery: (Click here:)

1. Maintain or increase the FICA tax..

2. Spread the myth Social Security, Medicare and the U.S. government are insolvent.

3. Cut federal employment in the military, post office, other federal agencies.

4. Broaden the income tax base so more lower income people will pay.

5. Cut financial assistance to the states.

6. Spread the myth federal taxes pay for federal spending.

7. Allow banks to trade for their own accounts; save them when their investments go sour.

8. Never prosecute any banker for criminal activity.

9. Nominate arch conservatives to the Supreme Court.

10. Reduce the federal deficit and debt

No nation can tax itself into prosperity, nor grow without money growth. Monetary Sovereignty: Cutting federal deficits to grow the economy is like applying leeches to cure anemia.

Two key equations in economics:

1. Federal Deficits – Net Imports = Net Private Savings

2. Gross Domestic Product = Federal Spending + Private Investment and Consumption – Net Imports

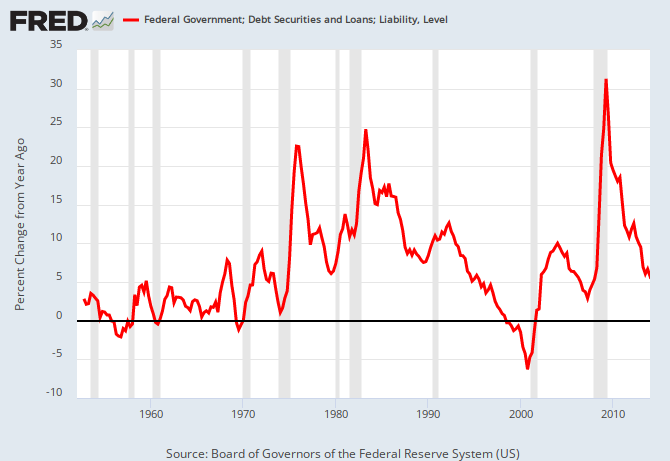

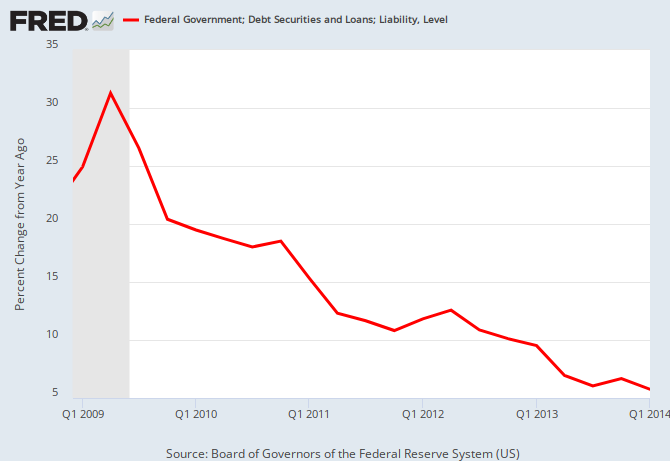

THE RECESSION CLOCK

Vertical gray bars mark recessions.

As the federal deficit growth lines drop, we approach recession, which will be cured only when the growth lines rise. Increasing federal deficit growth (aka “stimulus”) is necessary for long-term economic growth.

#MONETARYSOVEREIGNTY

And regarding Ferguson, this is about far more than race, far more than police brutality and it’s even far more than about poverty, though all are involved.

This is about the Gap:

LikeLike

At least for the Capitalist, Oligarch, Plutocratic classes, they need poor people to keep us minions working, right? I am sure that has been covered on this site in the past. The ‘Just World’ fallacy permeates our culture here in the US, especially in this issue. Rich people are righteous, poor people are unworthy…yada, yada. It’s absurd…and frankly..mean, IMO. Good stuff Rodger, keep at it.

LikeLike

Stuff like this combines the worst parts of conservative and liberal nanny-state big Govt policies. Hatred of the poor by the Cons and overzealous rule-making by liberals.

LikeLike

Yes, that is indeed the sentiment of those who oppose gov’t programs that seek to mitigate the living conditions of the poor – the horrifying thought that those inferior undeserving bastards might be able to actually led happy hedonistic lives without much regard for social responsibility. That the poor will then multiply like crazy, take advantage of the welfare system, and exhaust the finite resources of the planet. That society will no longer operate in Darwinian dynamics (although I don’t understand why that is not, in itself, a desirable outcome).

The difficulty then is how to ensure that those fears are unfounded – how to take away the basis of those fears so that the nature of federal govt’s monetary sovereignty will, in a manner of speaking, be an easier pill to swallow for those conservative plutocrats who are the strongest proponents of a culled government.

LikeLike

“it isn’t taxpayer money the government is spending. The government creates dollars, ad hoc, by spending. No tax dollars involved. Not one SNAP dollar comes out of your or my pocket.”

Not entirely the reality but it sounds nice.

LikeLike

No, entirely the reality. It’s the way it has always worked. There isn’t any other way for things to work. People who think it can work otherwise aren’t doing the accounting correctly and consistently, and invent complicated delusions to obscure the simplicity of reality.

What Rodger should have added is that not only does “Not one SNAP dollar comes out of your or my pocket.” – but many of the dollars in his pocket and yours and mine came from SNAP.

In an economy run as stupidly as the USA’s – which is still less stupid than most of the rest of the developed world – spending on things like SNAP directly enriches everyone. SNAP provides a completely free lunch to everyone.

LikeLike

“What Rodger should have added is that not only does ‘Not one SNAP dollar comes out of your or my pocket.’ – but many of the dollars in his pocket and yours and mine came from SNAP.”

Yes, you’re absolutely correct.

LikeLike

This Week in Crazy

LikeLike